This past month, I initiated a core position in Dino Polska at 410 Pln (Disc: Long). It took a while but I finally mustered up the energy to crank out a blog post! Sorry to my subscribers, the company is up 14% since I initiated.

I promise to all my… 330 free subscribers to be better. You all deserve it because my readers are the best out there. I finally got around to it though, so here’s my breakdown, research, and resources over my newest long core position, Dino Polska!

The Rural Polish Grocery Store

There are five main sections I will be covering for this company analysis, shown below!

Background

Growth Drivers

Bottom Line & Balance Sheet

Valuation & Return Expectations

Summary

Another better and more detailed thesis presentation from Sohra Peak is linked HERE. I’ll be referencing it for a few topics throughout the post that I frankly… just don’t feel like covering or Jon covered so well it wasn’t worth trying to replicate.

Background

Today’s business, Dino Polska, is Poland’s largest grocery store chain, serving 80% of Poland’s population (38 million in total) that live in its rural countryside. Just for a teaser, the company is Poland’s second largest company by market cap, owns nearly all its own real estate, the founder still owns 51% of the company, and its growing like an inflation resistant weed!

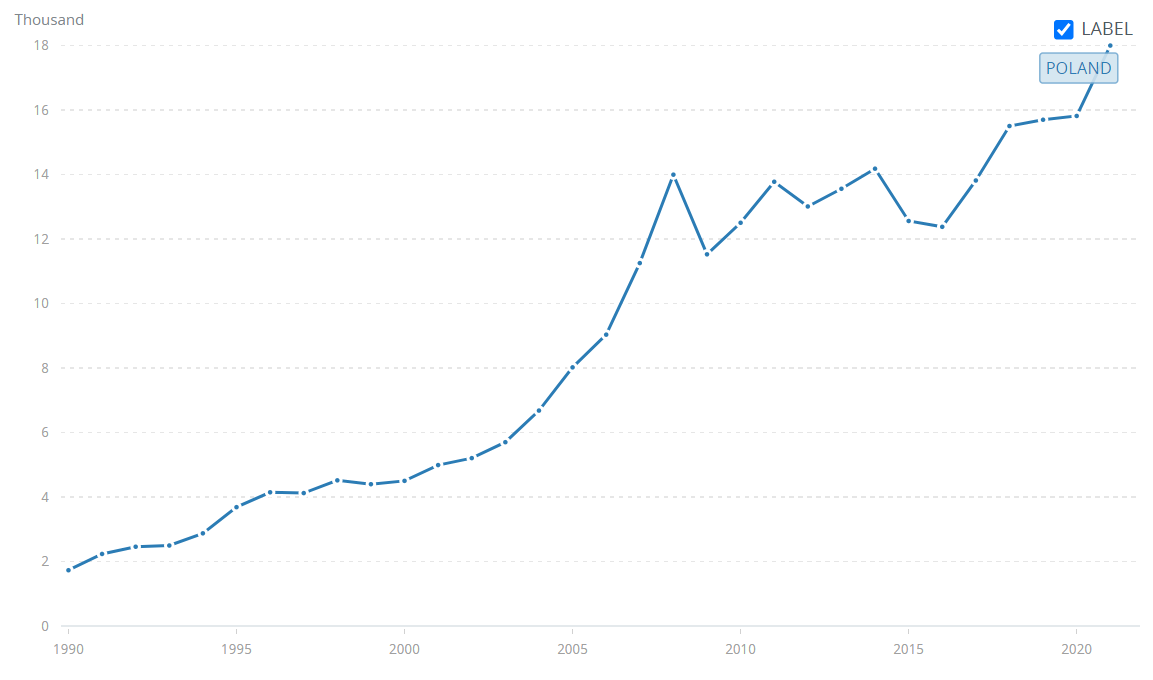

Since the fall of Communism in the 90s, Poland has had a pretty thriving economy with a thriving set of early entrepreneurs. The GDP per capita has had a staggering 10x increase (10.7% cagr) since 1990! After the less than amicable spin-off from the Soviet Union, inflation soared for nearly a decade but did get under control the following decade.

Below are the graphs for the country’s GDP per capita (first graph) and inflation over time (second graph).

Tomasz Biernacki founded Dino Polska in 1999. The first stores were in Western Poland, serving small to medium towns and the edges of larger metropolitan areas. From the beginning Tomasz was laser focused on growth.

By 2010, the company had 111 stores. Tomasz then made an interesting decision. He sold 49% of the company for 200 million PLN to a Private Equity fund. Following the sale, he utilized the proceeds to purchase nearly all of the real estate for all the company’s stores and dramatically expand the company’s store count the following years!

By 2012, the company had 234 stores open, double the count from two years prior! In 2017, the PE firm was looking for an exit so the company IPO’d on the Warsaw stock exchange. Tomasz still owns his 51% of the company to this day.

There were a few aspects to this company’s meteoric success the past two decades:

Meat Processing: Dino purchased a meat manufacturer, Agro-Rydzyna, which allows the company to have quality control for its meat throughout its locations.

Construction: In 2013, Biernacki founded a company, Krot-Invest, for the exclusive purpose to build Dino Polska stores. With this entity, this eliminates many friction negotiation points, speeds up construction, and eliminates potential law-suits from construction workers.

Standardization: The company’s 400 meter squared floorplan is standard across its network. Each store has a standardized format and SKU selection. This allows the company to have a layout before construction and expedites growth and store operations.

With all these aspects put together, you have a business that had the ability to grow quickly and efficiently, producing high returns on capital for a long time.

The key on the right states that per 100k inhabitants in Poland, there are 5.7 stores. With each store needing approximately 1.5k people for its profitability target, the company still has a long runway!

Growth Drivers

The last section was my only “qualitative business analysis” that I will be doing in this post. If you want to know more about the competitors, the company’s value proposition on its pricing, or background on the Polish population landscape, reference the Sohra Peak thesis! I’ll reattach HERE again.

From the company’s own website (love when a company lays out their strategy!!!), it has stated its strategy is as follows:

Continuation of its rapid organic growth of its store footprint

Continued growth in its “Like For Like” (LFL) sales (Same Store Sales - SSS)

Consistent improvement in profitability

This is so simple. I love it. I love even more that the company knows that these are the aspects that are going to drive sustained and increasingly profitable growth! They are simple objectives. On this flip side of simplicity, when many companies have complicated strategies revolving around sustained user acquisitions, reducing churn, improving a platform, or some other qualitative objective, it becomes hard to allocate capital efficiently. This is because the goal or strategy is not concrete. Middle managers or executives alike need to understand what drives growth and how it will be achieved. When middle managers start focusing on how to make the UI more appealing for a sub-set product within a portfolio of products, it becomes harder to trace the real Return On Capital.

In this case though, Dino Polska has a large expansion opportunity to grow its store footprint within Poland for the next few years! I’ve read (Sohra Peak) and verified with quick math on store density within current provinces, and the company does have between a 4-5x store count opportunity domestically alone.

For LFL sales, the company had 27% LFL growth this past quarter on 22% food inflation. From 2014 to 2022, the company averaged an impressive 7.5% LFL growth. I personally love this aspect to the company. With such a high return on assets (more on this later), the pass through revenue dynamic creates an increasing cash printing machine with low maintenance on existing assets.

I only have a few more words of commentary here. I appreciate the company’s strategy points but I’d like to add a bit more color to the growth drivers that go into the broad buckets:

Improving Profitability: Gross Margin Expansion, Procurement: One thing in businesses scale quite well: centralized procurement contracts. I think the company growing its footprint will steadily increase its bargaining power with suppliers. This in turn overtime will increase the company’s ability to earn more for each item sold. Physical-based-procurement is one of those areas where scale of operations can dramatically change what that gross profit margin looks like over time. I think you’ll see this trend continue over time as the standardized footprint grows 15-20% each year. Think the overall trend, minus the Covid supply glut, shows that gross profit margins are trending up over time!

Growing Footprint: International Expansion: In my opinion, the big right-tail alpha on this name is the International expansion. I 100% support the company maturing its footprint in Poland before expanding. However, with neighboring countries like Czech Republic, Slovakia, and Lithuania (maybe Ukraine post war?) enjoying similar rural/metropolitan distributions, these could easily support expansion after Poland has a matured footprint. There’s no telling what happens in this regard, but the company has told us its three pronged strategy. Growing its footprint is one of those. With that in mind, I think going international expansion is an eventual logical next phase, prolonging the potential growth the company can experience.

Bottom Line & Balance Sheet

Two parts to this section: the balance sheet and examining the bottom line a bit further. The balance sheet is pretty boring and simple. The bottom line… could prove to be intriguing over time. Will get into that in a second but first let’s just half ass this analysis on the balance sheet!

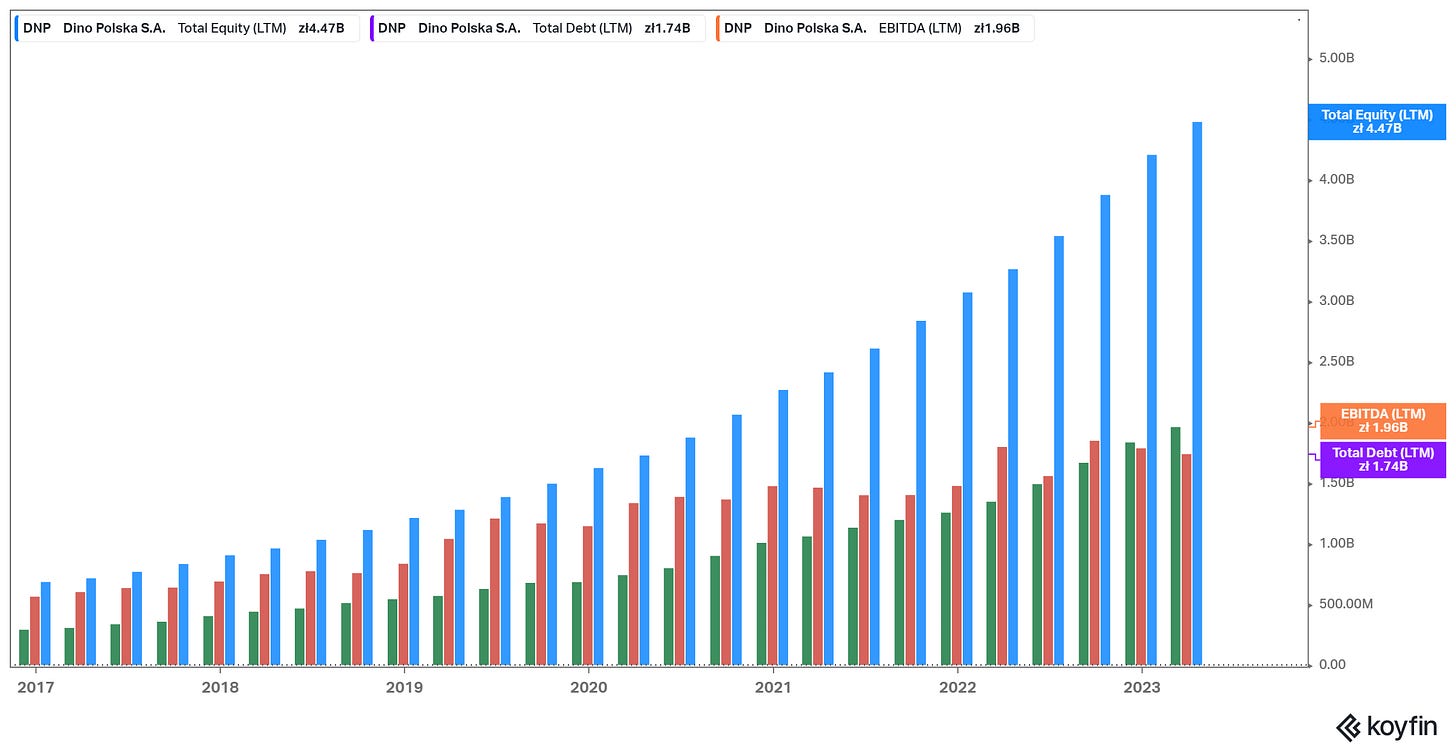

Things to notice:

Deleveraging over time from 2x Debt/EBITDA to < 1x in the last 12 months. Company is utilizing its own cash flow to fund growth and needs less external capital.

My takeaway here is the balance sheet is getting cleaner as the company is simultaneously losing the ability to reinvest as much capital at high rates of return.

In a few years, cash will most definitely start to collect on the BS and I’m curious what management will do at that point. Another accruing item on the BS will be the company’s land assets, as shown below… wild. Having never closed a single store though, I don’t see the land assets being sold.

The balance sheet looks pretty clean and the company has top notch return on assets compared to some of its United States counterparts!

With these comparisons still in mind, Dino Polska is set apart on its efficiency that it operates. To compare the company, the best comp in the US would be Dollar General. Both companies operate in rural areas, have smaller store plans, and have dramatically grown their store footprint over the years.

In Procurement, Dollar General has made a name for finding quality but cheap outsourced goods. Therefore, its Gross Profit margin will most likely be better. Dino Polska is vertically integrated on its meat manufacturing though so I’d expect to see some efficiency gained there on the SG&A side.

On the asset base, Dino Polska owns its stores while Dollar General leases. Dollar General’s current lease expense for the next 12 months is approximately 3.35% of revenues, not a small amount.

In SG&A, Dino Polska is much more efficient. Something I didn’t expect though when I started studying Dino is its ridiculous sales and marketing expense. In the last 12 months, 15% of revenues were tied to Sales and Marketing. Then, I looked a bit further and as a portion of its total SG&A, the sales and marketing expense totaled 96%. So, I dug a bit deeper on how the company classified its S&M expense and it pretty much looks like everything to do with Store Operations. The official description from their last annual report is below.

So looking instead to the total SG&A margin between Dino and Dollar General, Dino is rocking a much lower operating expense than Dollar General and it appears to be continuing to scale to some degree. I think domestically maybe another 100 basis points is possible over the next decade, but it would be difficult to scale further than this.

If the company expands Internationally though, I could actually see SG&A expenses increasing over time. International companies take on a whole new level of complexity in regards to taxation, procurement requirements to different nations, different food standards, banking/invoicing differences in domestic vs international banks, and a whole other string of ongoing issues. I’ll probably model for the company to maintain its current SG&A expense ratio and have domestic/international to even each other out, but feel free to make your own decision in this regard. Now, let’s compare the two’s bottom lines and see what we can find:

The two’s bottom lines experience similar dynamics actually. I do think Dino will close this gap but this relationship does set the bar pretty accurately imo from what is possible from a “mature terminal bottom line”. That 8% peak is probably the most that I would expect, more on this in the valuation section below though!

Cash Flow/EBIT Relationship: This will be quick but just wanted to cover the fact that the company enjoys a working capital advantage and cash from operations is high in comparison to Operating Income (EBIT). Then, all of cash from operations ends up getting spent in CapEx to buildout the store network. Impressive capital management with Free Cash Flow being breakeven each quarter after reinvesting all its cash flow. Then with its ROIC of each store averaging 20-30% though, it would be fiscally irresponsible to return capital to shareholders instead of reinvesting every dime available!

Now with all that in mind, I’m going to go into my typical short hand return calculator that I have built for my portfolio tracker!

Valuation & Return Expectations

As always, feel free to enter your own metrics or assumptions into this framework and see how your own assumptions do! To review, we’re going to use the following inputs for our model:

Timeframe: I use 10 year timeframes. I want to reasonably predict how a return will look 5 years into the future, and that means in my opinion modeling out some numbers 10 years out is necessary.

Foreign Exchange: I’m going to assume a 2% drop in the PLN/USD exchange over the next decade. Over the past 10 years, the PLN has lost 2.3% in comparison to USD on an average growth (decline) rate. The USD is unusually strong right now though and this could be easily be overshooting the next decade.

Averaged Revenue Growth: Combine store count growth expectations and LFL (SSS) metrics.

Assumption #1: In 10 years, I’d expect store count to at least 4x. Sohra Peak was a bit more bullish and expected approximately 5x over a 10 year period. By year 6 or 7, I’d expect International expansion to start occurring after domestic Poland is concentrated. I think this will prolong growth further.

Assumption #2: For SSS growth, I’d expect 6-7% in an inflationary Eastern European environment, plus a maturing store footprint that takes a few years for each store. Even another year of 15%+ inflation bakes in multiple years of SSS growth right there.

INPUT Total revenue CAGR = (4*1.065^10)^.1 = 1.22 → 22%, Geez, wild making that prediction. Adjust as necessary but keep in mind… they’ve averaged 34% the past few years!

Bottom Line Margin: As covered earlier, I think the only bottom-line effects are going to come from centralized procurement decisions.

Assumption #3: I’d expect Gross Profit margins to increase over time steadily to around that 25.50-26.50%. I’ll input 26% gross profit margins that flow to the bottom line. This seems reasonable to me for the company to scale procurement when its store count will grow so substantially. This is around the Covid high gross profit margins, which was a substantial pull forward. With the fresh food offering and domestic sourced items, this will never reach the 30%+ Dollar General margins.

INPUT Net Income Margins: (26% - 23.8%) + 5.64% = 7.84%

SG&A: For now, I’m going to go conservative and input that SG&A margin stays level over the next 10 years. Going International will dramatically increase business complexity, as explained earlier. Any improvement I’ll count as upside!

Capital Return: To date, Dino Polska has returned no capital via dividends or share repurchases. However, we discussed earlier under the Balance Sheet section that the company is in the process of deleveraging and cash might end up building on the balance sheet soon. I don’t see Tomasz Biernacki (49 years old) caring too much about capital return. Instead, I would see the company expanding Internationally. I’ll just input nothing and have the capital return go towards the store count, since that was a bit bullish. If store count disappoints, dividends or repurchases can close the gap.

Terminal Multiple: With this high cash flow business in a staple industry, I’d expect a high multiple!

Assumption #4: I’ll do a Bear/Bull case on multiple, 15x terminal earnings multiple on the bear side (same as Dollar General this past quarter, which isn’t growing at all). Bull side, I’ll do a 20x multiple. Maybe the company can continue prolonging its store count growth or will return capital to shareholders and it will be awarded a high multiple.

Bear/Bull Return Calculator: [ (1.22^10) * (7.84/5.64) * (15 or 20/37) ] ^ .1 - 2% → 13.2% - 16.5% CAGR

Conclusion

I purchased Dino Polska (DNP.WA) at a trailing 32x multiple, where I had nearly a 15% bear case. The stock is now up 14% in the past month, and I have no plans on selling. I think an investment in this company can intrinsically grow at ridiculous rates of return for a number of years to come. Paying taxes on my current gains would not make sense if that capital can continue growing quicker internally, especially when I don’t see many companies of this quality on my watchlist.

Another important aspect to this investment is inflation. Inflation eats away at companies that cannot produce high returns on their assets. This company passes inflation through to the consumer, produces high returns on its asset base, and will outpace inflation by growing its store count over the next decade. This is a safe investment in my mind to outpace the hidden expense. It’s not quite as capital light as something like See’s or Software but with the clear capital allocation policy, I love the path this company is taking.

With these high quality business characteristics, I paid up for the company at a near 3% trailing yield and a modest 15% bear case returns. I think the possibility the company can surprise to the upside is likely. Keeping up store growth or finding SG&A expense leverage can both prolong the growth curve. I just won’t count for them in my return expectations, because I like to see evidence first in past results before accounting for them.

Thanks for reading! If you enjoyed this or found it useful, please like/retweet/subscribe/tell your friends.

Have a great day guys!

I can't remember if I covered this stock in one of my fund holdings posts or Monday links post as maybe another Substack wrote about it. Anyway, I included a link to this post in my latest post:

Emerging Market Links + The Week Ahead (July 10, 2023)

https://emergingmarketskeptic.substack.com/p/emerging-markets-week-july-10-2023

My assumptions (base case):

- TAM in Poland is ~4900 stores, or a double vs today. This is lower than other estimates I've seen (including yours and Jon Cukierwar's) but in line with Shree's 5300 (SVN Capital). My rationale: similar to Jon, I extrapolate from Dino's home town population to the countrywide TAM, but I cut out the population that is living in towns too large or too small for their Dino's strategy. I got my population statistics from this source: https://en.m.wikipedia.org/wiki/Classification_of_localities_and_their_parts_in_Poland)

- This expansion will take 7-8 years. This is quite a bit slower than your (and probably everyone's) estimate. I just based this off their current and planned pace.

- Beyond that, I'm not assuming any further growth pipeline (international, convenience stores at gas stations... the latter looks promising though).