Oscar Health: The New Age Health Insurer

My Research, Assumptions, and IRR over my Newest Core Position

Dear Mr. Fundasy, It has been nearly 4 months since I found a new position to write about since our Nu Holdings article came out on February 26th, 2025. Obviously, I gave a portfolio update since then to you (Paid). However, I have struggled to find "new" ideas in the current environment that clear our hurdle rates of existing positions to enter our portfolio. I don't write unless I have something to say. I know many of our Partners have canceled their subscription due to this absence, but I never want to waste your time. For you, I only want to curate the best. That drought of content is over. For your consideration: Oscar Health Inc. William

The Broken US Health Insurance System

Now, many of you don’t need me to diagnose for you that health insurance companies are not exactly… well regarded in the United States.

With an average Net Promoter Score of a 29 and the US populace being mildly indifferent to a CEO’s murder, it is well documented that health insurers are a disliked (yet sadly necessary) evil. It also doesn’t help that the top 6 health insurance companies have over 60% of the market share (Source: Google AI).

I dove further into the nature of WHY the system was broken in my Hims & Hers article, detailing the misaligned incentive structure between the US Healthcare recipient, the provider, and the health insurer. Worth a read for context.

In summary, the core idea is that the hospitals and insurance firms are both incentivized to keep increasing the prices of the services, creating a system of prices where costs outpace inflation… dramatically.

The Health Insurance Service Options

To be frank with you, I have done many deep dives and lengthy research reports. But I’ve never been a 20k word writeup guy. I like to simplify things down a lot significantly to the “core ideas”. If I were to diagnose every healthcare option, subsidy, relevant legislation, percentage of plans usage, etc. … this would be my longest writeup by an order of magnitude in the 5-10x range. Therefore, I will not be doing that and instead I will be giving you a more condensed history and sector breakdown instead.

1970-1980 Policies:

In 1973 – HMO Act Signed: Nixon launches the managed care era, incentivizing HMO creation. An HMO (Health Maintenance Organization) is a type of health insurance plan that provides healthcare services to members through a network of doctors, hospitals, and other providers. These networks create partnerships with the insurers/providers to create cheaper coverages with system integrations built in place.

Commentary: This setup in the late 20th Century created the dynamic for employer offered coverages and built the initial foundations systems/tech stacks/partnership structures that the nation is largely still built on today.

2000s Government Demand Subsidy:

2003 – Medicare Part D: Created prescription drug coverage for seniors, and also led to growth of Medicare Advantage (private plan option). Medicare Advantage individuals are over 65 or have a disability and choose to get Medicare benefits through a private company and not the government.

2010 – Affordable Care Act (ACA):

Mandated individual coverage, barred pre-existing exclusions, and created health insurance exchanges for individual/ACA market.

Introduced subsidies tied to income and essential health benefits.

Commentary: The United States policy was to generally throw more money at the problem to attempt to solve it, which created the unintended outcome of allowing providers/insurers to increase premiums due to (1) mandated coverages and (2) increased spending on the Federal level.

~2014-Present Personalization Trend:

2014 – ACA “Obamacare” Marketplace Launch:

First open enrollment via Healthcare.gov and state exchanges.

Individual market becomes regulated, subsidized, and standardized.

After this “Obamacare” legislation, insurers were not able to judge individuals by their pre-existing medical history. Therefore, it aggregated risk pools and broadened required coverage. My healthy grandmother at the time reported that her insurance nearly doubled and late into her 50’s, she was required to be covered for maternity care. This effect was obviously reversed for the individuals on the opposite side of the risk pool and they were able to receive much more reasonable coverage at the expense of the healthy individuals with lower payouts.

2017 – ICHRA Rule Proposed:

Expanded Individual Coverage HRAs, allowing employers to fund individual-market premiums instead of offering traditional group plans. Meaning that individuals can CHOOSE their plan and simply be reimbursed, instead of purchasing a broad/un-personalized set of insurance policies for employees.

2020 – COVID-19 Relief (ARPA in 2021):

Temporarily expanded ACA subsidies to higher income levels and reduced cost-sharing.

Triggered record enrollment in ACA plans (Oscar benefitted greatly - 40%+ growth from 2021 to today - risk).

2021 – ICHRA Implementation Begins:

Firms begin shifting to defined-contribution models, growing the personalized employer-funded ACA market.

2023–2024 – ACA Enrollment Surges:

Over 21 million enrolled in ACA plans—tripling since 2014, with ~90% receiving subsidies.

Commentary: Instead of providing specific pockets of information through a deep dive, I want to simply highlight the themes that I was seeing. The government created competitive marketplaces with subsidized funding, allowing a new wave of companies to gain a foothold and offer insurance to customers without gaining traction in a highly sticky employer insurance marketplace where scale dynamics and partnerships created barriers of entry that inhibited competition.

In 2025, there is movement in Congress to both (1) extend Medicare Advantage benefits and (2) provide ACA coverage through ICHRA plans that would both be quite beneficial to Oscar Health by expanding the individual by individual DTC routes.

The US Health Insurance market is complex, regulation intensive, full of entrenched incumbents, and this is not conducive to a competitive free-market that the country has aspires for. The ACA and individual marketplaces has created the possibility for scaled and cost-effective personalization for a new round of US Health Insurance companies that align incentives with consumers.

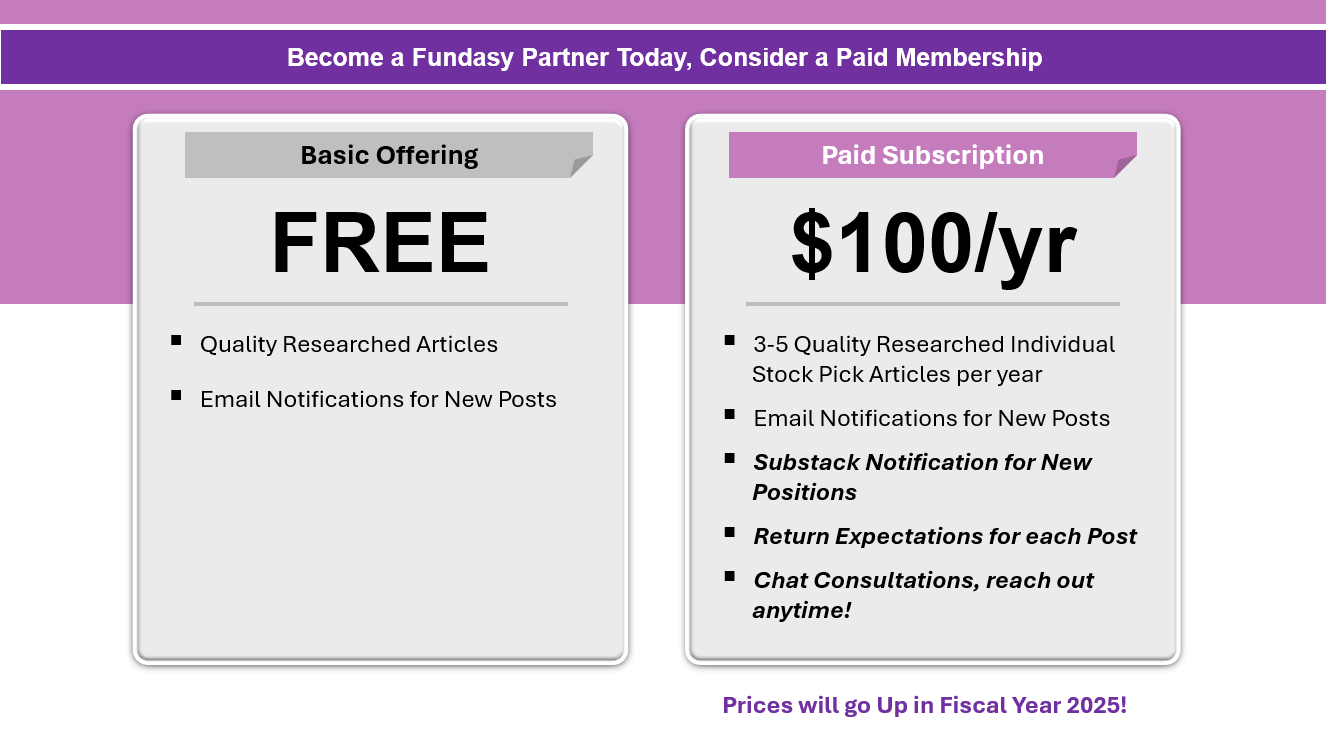

Speaking of aligned incentives, Paid Subs ($100/year) got notified of Oscar Health on June 3rd and the stock is up 30% since then! They received the notification, along with a short pitch. I will be increasing Monthly Paid plans to $25/month to incentivize longer term partnerships with my subscribers, no change to the annual price plan!

Business Analysis: Present Competitive Analysis (Teaser), Management, Business Offering

Present Competitive Analysis

Insurers, at their core, have three main goals:

Underwrite profitably to increase what amounts to Gross Margins:

Manage the Operating Expenses, while still growing at a healthy rate:

Manage the equity effectively and invest the premiums from your working capital advantage to gain outsized equity growth by reasonable low-risk investments:

Those are the three things any insurance company should prioritize. Now… HOW the companies get to these goals or combine them is the secret sauce. The goals are essentially the same though, regardless of insurance line.

I have long held the belief that the critical missing variable in most investors perspective in insurance comes through the lens of distribution. Understanding how the company distributes policies, gains customers, and their strategy on pricing for their market is the combination that I always look for to find that “secret sauce”.

Below, I tried to map out some of the health insurance distribution dynamics. Also, I’m finally getting around to reading Lord of the Rings for the first time right now, and I think it’s fair to say, Frodo’s trek to Mordor is clearly on my mind…

Few facts about how I categorized this breakdown:

I wanted to learn the types of plans offered for US Health Insurance. There are more than these but these are the main types.

I wanted to figure out the percent of health insurance the governments funds vs the citizens of the nation (65% vs 36% roughly from my research). I found it hard to get exact numbers on the real split. I know this doesn’t equal 100% but that’s the healthcare industry for you, nothing adds up.

I wanted to learn the percentage breakdown for HOW health insurance policies are distributed. Brokers, Employer Sponsored Health Insurance, and Government Sponsored Marketplaces (Example: Healthcare.Gov) are the majority of the distribution channels for healthcare insurer’s policies. The largest market segment and the insurers with the largest “moats” operate in the Employer Sponsored Health Insurance market but still do business outside this segment:

Sticky corporate integrations with partners/enterprise large businesses; Employees already on the existing Insurance; Broad Healthcare Partner Network across all US to service Enterprise customers. Tons of scale dynamics in this segment.

It just so happens that Oscar Health having read The Art of War, decided to fight in the area of the market where the opponents weren’t strong. Oscar Health was founded in the Individual Market/SMB market.

Management

Now, I don’t want to give the full history of the company. However, I’ll hit the keynotes:

Mario Schlosser Co-founder : With a Computer Science/AI background, Harvard MBA, decided to build a technology first consumer friendly Health Insurance Company. Mario served as the CEO until 2022.

Josh Kushner – Co-founder : Founder of Thrive Capital, which owns around 15% of Oscar and the stake in Oscar is around 41% of the firms assets.

Mark Bertolini – CEO (2023–Present): Previous CEO and Chairman of Aetna (2010-2018). He also led Aetna through the CVS acquisition and merger. Mark… is one of those guys that I listened to him speak and I don’t know if you come across listening to many of these people in your lifetime. Brilliant. Here’s the link to a YouTube interview I loved with him (Oscar Health CEO Link). The key parts about him that stood out to me:

I don’t know how to put this eloquently, but Mark is someone you want in your corner. He survived a near life ending biking accident, is a stupidly impressive CEO and leader. In constant pain his accident, he is not messing around with his time. When being asked by the founders when they asked him to come on and be CEO at 67 years old after contracting and being on the board a number of years, he asked them one question… “Are we building something to flip for a payout, or are we here to truly change how people interact with healthcare?” (Exact quote).

So with that in mind, what did the team build?

Business Offering

Oscar’s strategy is simple: fix the customer experience and scale effectively

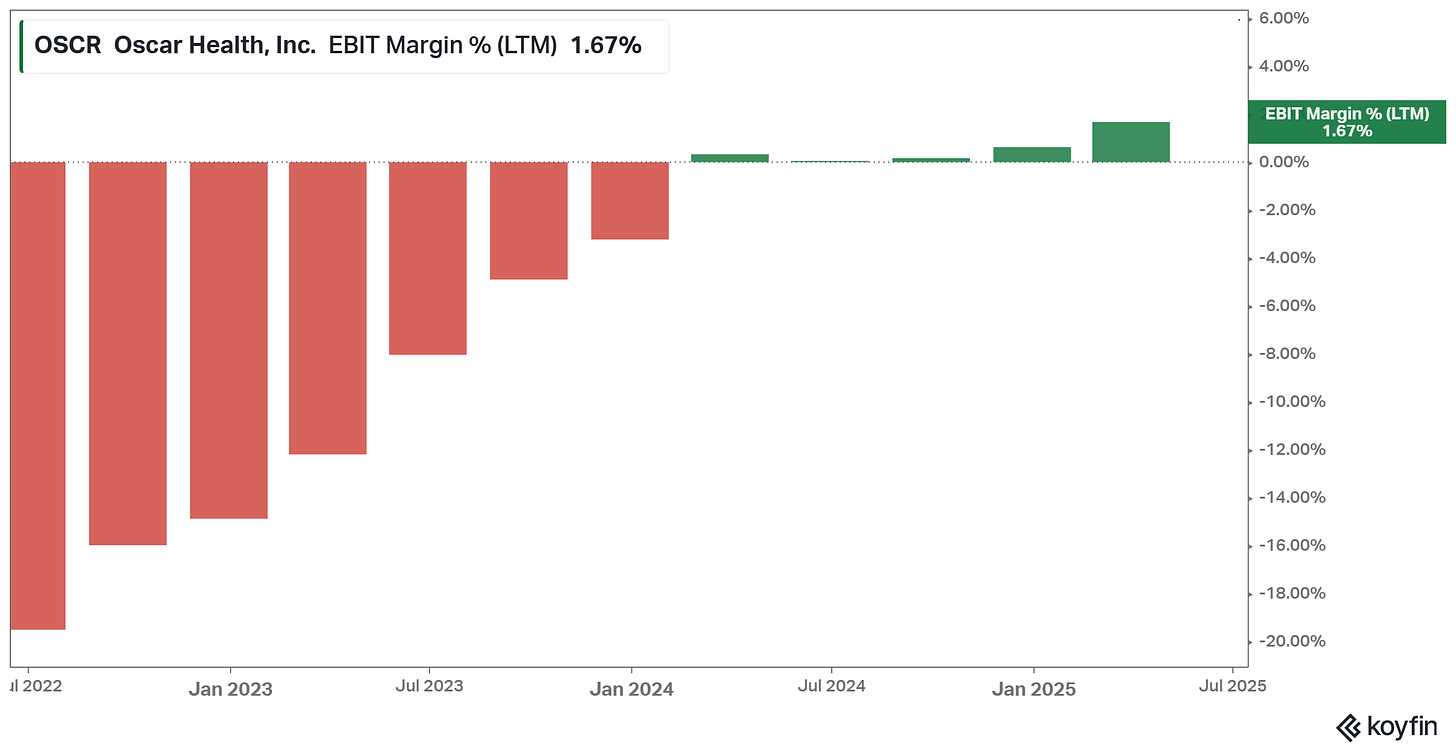

Build Scalable Infrastructure: The company as it has reached more scale has been implementing serious AI/automation across it's SG&A processes. While the company’s Operating Expense Ratio was larger in 2024 than its competitors, (as shown in the image in the section above) the company has managed to grow much faster with the topline at 40%+ rates, while the business has also managed to scale its EBIT margin incrementally quarter over quarter:

Improving unit economics with increased size is one of the key investment criteria I look for in investments. I want businesses that improve and get better over time. The management had this to say on the last earnings call:

“Our tech is playing a big part in driving the performance, and we've been very focused and disciplined about expense management, both on the fixed side and the variable side. Those are the primary drivers of the year-over-year improvement, just to give you some specifics. Fixed cost leverage is about 40% of the improvement. Improvements in our variable cost structure are another, let's call that 15%. And then the remainder is improvements in broker taxes and fees.

We did see some lower fees this year. And then the remainder is our geography. So a very significant portion of the year-over-year improvement is durable. And as I mentioned in the last question, we do expect to see from this point that we will see some quarterly increases in SG&A going forward.”

Richard Blackley Q1 Oscar Earnings Call

Creating a Better Experience: If you were to hear the largest complaints about health insurance, it would be the fact its expensive, coverage and the claims process is terrible for the coverage you paid for, and it’s a complicated experience. Oscar has built its reputation around delivering a smoother customer experience:

United Healthcare’s denies 23% of claims. Oscar denies 12%.

Oscar individual premiums are 10% lower than UHC’s with lower medical loss ratios at the corporate level

How is this possible though that Oscar pays out more, charges less, and is more profitable? Oscar builds customizable coverage plans so customers are able to tailor coverages to their needs, reducing the claims process dramatically by having customers pay upfront for specific conditions/customizations, which also increased retention. They also use narrow provider networks, which gives more price control over doctors. This limits consumer choice but Oscar compensates for this by offering stronger capabilities with in-app for provider discovery.

Now, all of that is in the individual market. However, Oscar Health has made real strides expanding this individual based approach into the ICHRA market:

Oscar’s next growth wave is through ICHRA plans where small business owners and gig economy employers give employees a stipend to buy their own insurance.

Currently today live in 18 states, Oscar has increased its Memberships from 542k in 2021 to 1.5M in 2024 and just under 2M today, a more than 40% CAGR. I would agree with the company that this is a strategic flywheel to keep growing members and the customer experience over time.

Oscar+: The business is also built its out proprietary care coordination service that it offers on its platform called Oscar+.

Own Electronic Health Record (EHR) to be a data source for the individuals health history that is automatically shared with doctors and health providers.

Automates follow up scheduling and many tasks that users don’t enjoy doing and are complicated to do without experienced assistance.

Provides provider care discovery networks for consumers to show their available physicians.

The plan will be for Oscar+ to actually be licensed out to the broader market, aligning with the team’s mission to truly change how consumers interact with healthcare today.

The common theme that I kept finding on this company deep dive was… this really helps the end consumer on every goal the company has. It just so happened that by actually aiding the consumer, the company benefits on large aspects of its SG&A cost, creating additional operating leverage. A better more thoughtful product naturally creates better growth, retention, and experience, which all helps business performance. The key aspect is getting the tech stack and reaching scale in this industry is difficult, borderline impossible. As you saw initially… in those early years the EBIT margins were pretty horrendous.

Market Analysis

I hope I’ve highlight to individuals what Oscar Health is targeting and their value proposition to consumers. However, how large is the market that they’re attacking?

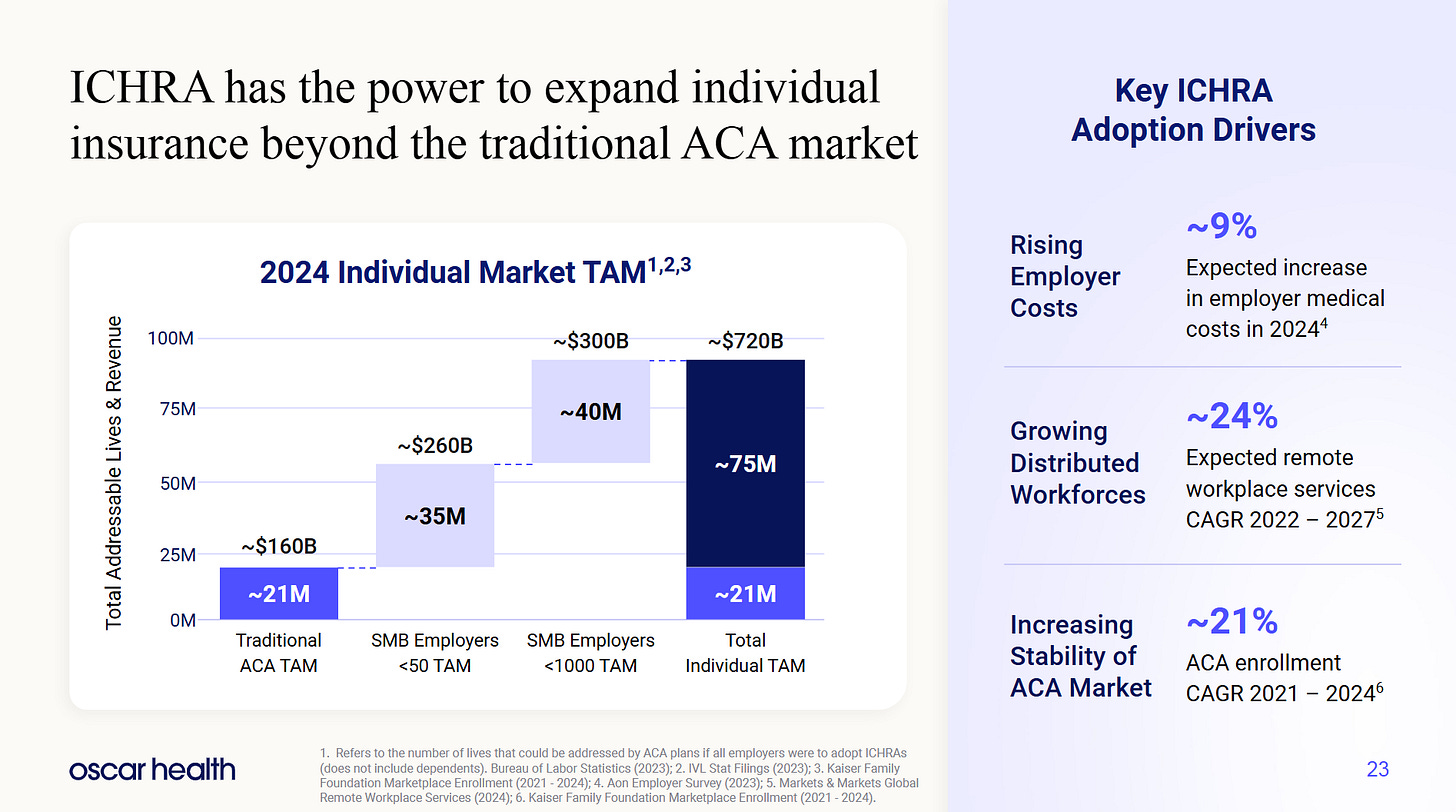

If I were to summarize the markets Oscar is addressing:

The 16M customers if ACA subsidies are fully taken away

The 21M customers if ACA Covid-19 era subsidies stay

35M people under SMB Employers

40M people under SMB less than 1000 for a total TAM of 96M individuals

The company has around 2 million members today. Therefore, the company has much more area for revenue growth and margin expansion under its growth curve.

Financial Analysis: Competition, Unit Economics

Now we’ve covered how the business is growing and I gave a tease of the underlying growth. Let’s breakdown the fundamentals of the company.

Revenues have been growing 50%+ the past few years with both membership growth and premium price increases being the primary two contributors.

Due to the company’s negative Net Working Capital advantage, Oscar has a tremendous stability in its cash flow base to continue growing at scale.

EBIT and margins are increase Quarter over Quarter like clockwork. This indicates that Oscar Health’s business is getting better and better unit economics as the business scales. This is an important aspect of the investment thesis is that as the business grows from here, it will increase in quality over time.

Lastly, the balance sheet is outstanding and is as clean as any that you come around!

Cash was being burned more when the company was in growth mode getting to scale. In the past year though, we can see that Shareholder’s Equity is increasing roughly the same amount as the increase in Operating Income. This surplus of cash that can underwrite 30% of the current float for an insurance company is a huge advantage. United Health for comparison has only 8% of its premiums in force in cash. To make it worse for the incumbent, Oscar also has a much better working capital advantage than United Health. I suspect this is due to Oscar having a larger broker network as a percentage of revenues and is getting paid first.

Finally, an efficiency comparison just to test the more efficient business model just to see if management is lying about the business scaling:

Oscar with a 1.67% EBIT margin is producing a 10.5% ROE

United Healthcare with a 8.1% EBIT margin is producing a 22.7% ROE

Oscar Management has guided for 5% EBIT margins by the end of 2027. That ratio would produce roughly a 30%+ ROE, a much more efficient business than United Healthcare, by roughly 50%. In addition, Oscar will be doing that by offering a cheaper and superior product for members. Most of Oscar’s assets are cash today too. Therefore, the real efficiency gains are likely much larger than that simple analysis indicates.

There is also this. I think it is likely the company will reach its 5% EBIT margin guidance. Nvidia’s revenue per employee is $3.62M by comparison.

Now, I hope you enjoyed this conglomeration of my Free Research!

My Paid Subscribers will see my estimates that I think are the assumptions to consider and the IRR that this will provide, along with an update on portfolio weights. If you enjoyed this article and aren’t subscribed, please let me offer to you my analyst services.

Portfolio returns, which I update subs on trades/allocations/positions/IRRs:

YTD: 91.80%

1Y: 111.76%

Since Inception (5.17.2024): 109.23%