Hims & Hers (Ticker: $HIMS): The DTC Pharmaceutical Company

An Independent Vertically Integrated Distribution Platform within the Healthcare Industry

One stock has been consistently on the mind recently, Hims & Hers Health Inc.HIMS 0.00%↑.

On the surface, this is an exceptionally intriguing stock when looking through a quantitative lense. In a scatterplot of my watchlist, including names such as MELI, NU, EVO.ST, KNSL, CSU, etc., Hims & Hers is consistently lands in the bottom right of my Growth to Valuation graphs, indicating the highest growth for the lowest topline valuation.

Here’s an example that caught my eye:

Scatterplot 1: “X: Expected Revenue CAGR (Forward 1Y) by Y: Price/Gross Profit”.

Scatterplot Description: Forward Revenue CAGR is the expected revenue growth for this next year. Hims & Her’s, highlighted in yellow bellow on the bottom right, has a Price/Gross Profit Trailing valuation at 50-90% cheaper than many stocks on my watchlist and yet is set to grow at 3-4x their expected CAGR’s. This indicates to me that IF Hims & Hers has a quality scalable business model, this could be a fantastic opportunity.

***Conceptually: Farther right on the graph, growing faster; farther down on the graph, cheaper based on Gross Profits. One stock always seems to be in the bottom right, growing the fastest and yet trading the cheapest.

GGP: Growth/Gross Profit.

I decided to go deeper. In the past, I’ve fantasized about how I would fix the US Healthcare System if I had a magic wand, so digging down into this business had me curious. How were they doing it? The more I studied this company… the closer it came to my vision of what it required to get this company where it is. A set of individuals decided to improve the user experience in the health industry and were taking on a terrible inefficient industry. It simply took a long time to put together the pieces and incentive structure.

Something is coming to fix the broken US Health Care System… true Capitalism. It turns out, the answer I was looking for to fix the Healthcare System was relatively simple.

The Broken US Healthcare System

Before we get to Hims & Hers, which was founded in 2017. We need to first think about the US Healthcare Industry as a whole. To anyone paying any attention, the per capita healthcare spend in the US (inflation adjusted is in blue) has ben increasing dramatically and has been outpacing general inflation for a number of years. This has always indicated to me that the main growth driver for the Healthcare industry is Pricing over Volume.

The problem with pricing growth strategies is though, the service has to be a quality one that a consumer is willing to pay more for. However, that is not the pricing incentive structure today. Today, the pricing is increasing for a different reason, the system isn’t designed correctly for the end-consumer.

The question generally boils down to: Why is the cost of US Healthcare per person increasing so dramatically, even with the advancements of modern medicine?

The answer is simple, yet has my caveats. It boils down to… It’s a broken incentive system structure.

Let’s talk first of a “Traditional Business Incentive Structure”. I would classify this business dynamic as a consumer is looking for a good or service and pays for that said service. In exchange, this individual will pay the market value of that service and be on their way. If they choose to purchase this service or good again, they will make their decision based on the quality of said good or service.

That’s not how the current US Healthcare System works…

The “True Customer”: This should not be a surprise for anyone with eyes in the United States on why medical costs keep rising. The actual customer when someone enters the hospital… is not the individual that is sick. The customer is the insurance company. The United States has made it nearly impossible to be a citizen without health insurance, without massive difficulties. You see when a consumer enters a hospital in the United States… a 2 cent Ibuprofen or Advil becomes a $60 charge that will get lost in the lengthy and intentionally technical/vague itemized list. Why is this? Because that bill is for the insurance company to try to negotiate down. The hospital executives figure they might as well rack it up as large as possible, on the “consumer’s” insurance tab. Everyone by practice needs to have insurance so this is the real target for the hospital, which destroys the incentive structure for quality service immediately for the end-consumer.

Non-Standardized Pricing: Now that the consumer is paying for their health insurance out of their paycheck each month and it’s a charge they don’t look at, the hospitals decided to make the services provided to be as opaquely priced as possible. With no strong centralized leadership to implement standardized change across a broad and legally complex nation, the system with no strong governance… began to implement its own rules and jack up prices incrementally:

“Health care price transparency is here, yet nothing has changed” - The Hill

“10 Ridiculously Overpriced Hospital Costs (2016)” - MBA Medical

Tylenol: $15 (again, who knows the pricing?? Opaque)

Plastic Bag: $8

Box Tissues: $8

Gloves: $53

Marking pen: $18

Holding your newborn: $39

Sterile water IV bag: $800

This same article even states that “over two thirds of healthcare dollars are taken by Insurance companies, yet they provide little to zero value”.

Overtreatment & Undertreatment: The current incentive structure is actually built for overtreatment. This means that patient will be upsold for additional items than are required for their treatment, due to the fact these consumers are not the end-entity paying. Many people simply think their insurance company will take care of it though, so why worry? These are the people taking care of you… they wouldn’t take advantage of you, would they? The answer to that… people need to look at the incentive structure and decide for themselves. Is this system working for you or someone else?

Then, there’s the flip side of the issue when a hospital wants to give you a service and your insurance won’t pay for it. Do you not do the procedure? Does the patient pay for it? Also, if you don’t have insurance, it’s not like these hospitals adjust down the bill… they simply send you the entire amount and if you can’t pay it, the bill will go to collections and you’ll have debt collectors coming after you.

This issue is so bad that there are individuals who are giving out advice on how to legally beat these collection agencies, who likely don’t have an itemized bills. Why is it that these agencies don’t have itemized bills? Is the healthcare provider not able to provide transparent pricing? Are there not national data systems for large hospitals to keep these records? Are nurses, doctors, or Hospital Admin recording all the charges correctly? Is it negligence or maybe its simply incompetence? Who’s to say?

Example TikTok in United States on avoiding these charges below. Optional view for influencer provided context.

Not all of these issues are one to one issues that Hims & Hers Health can solve though. However, I’m trying to simply highlight the disconnect of service and monetary compensation that has led these costs to become disconnected from the tangible service or goods provided, allowing for a pricing structure that can outpace inflation growth. Also, I just want to highlight how disorganized this system is. If it seems confusing, you’re with everyone else. I hate our US Healthcare industry because it is simply not efficient, not effectively designed, and it’s not getting better with size.

The industry became a spaghetti dish of messes and friction points: doctor/insurance network dynamics, doctor/nurse insurances, hospitals for profit, a disaggregated hospital provider system, pharmaceutical company’s drug IP and subsequent extraordinary high markup compared to COGs, and the list goes on… and on… and on. Not to mention that legal is up everything’s ass, literally sometimes.

The US Consumer Perspective

Honestly, most people are confused. In general, the talking points from average United States citizens is blaming the problem on the opposing political party of their own personal disdain. Which is par for the course for intelligent discourse in the United States in general.

Most individuals in the United States don’t understand how insurance works, let alone how these companies “make money”. Therefore, it’s easy for this system to continue to raise prices in excess of inflation year on year for decades on end. If you want evidence that this is occurring, I can tell you where partly where our dollars are going:

UnitedHealth Group ( UNH 0.00%↑ ) owns 15% of the United States Health Insurance market and it has a market capitalization of north of $500B. If that tells you anything about the size of just the insurance section of the US Healthcare System.

Additionally, that’s for the insurance market alone, which doesn’t include any of the additional parts of the Healthcare supply chain that are extracting value out of the US Consumer’s pocketbook unnecessarily. The industry simply keeps growing as a percentage of GDP, keeps getting more inefficient, and the end “customer” is being terminally neglected. That is a recipe for capitalism to do its job. That is a recipe for a company to come along to destroy the current paradigm, make a ton of money, and give an enormous amount of value back to the consumer.

Capitalism took its sweet time though. My thesis of this article is this… the Contender that is built to reshape the global healthcare industry through a scalable business structure that will become incrementally more efficient with addition size over time.. has been built. The following writeup will go into my thought process of how I think Hims & Hers can create a better user experience, while simultaneously doing extremely well financially for potential shareholders to the tune of 20%+ a year for 10-years, for my base case.

Late at night, I toss and I turn

And I dream of what I needI need a hero

I'm holding out for a hero 'til the end of the night

He's gotta be strong, and he's gotta be fast

And he's gotta be fresh from the fight

I need a hero

A Brief Intermission

“History Doesn't Repeat Itself, but It Often Rhymes” – Mark Twain.

I have always been fascinated by business models. I love understanding what makes a business model “work”. Usually, there’s some secret sauce in technology, supply chains, or brand. But, it all boils down to efficiency.

Efficiency of a better logistics network

Efficiency of a better niche product

Efficiency of operating a group of products on a platform

Efficiency of getting to a tipping point of scale to achieve operating leverage

Efficiency of eliminating large amounts of fixed costs

Efficiency of decision making even; if the job is easy to make more money, that’s a bonus or an organization has a strong leader with decisive quality decision making to lead an organization more efficiently (Buffett, Nick Saban, Greg Popovich, Jobs, etc.)

Whatever it might be. The “moat” from a business comes from operating better in many circumstances. The US Healthcare industry is bloated, inefficient, and super expensive. It was only natural for a formidable opponent to rise up and eliminate enough friction points, cost, and be efficient enough to achieve scale on a nationally centralized level.

When reading through this article, think about the previous efficient aggregators that built a platform and eliminated enough fixed costs that they destroyed their competition: Amazon, Netflix, Kinsale, and Mercado Libre come to mind.

Amazon: Centralized distribution and end-point shopping to eliminate friction of driving to a retail location and have a wider selection, due to centralized efficiency gains. Retail has high fixed cost structure, creating inefficiencies through the variation in traffic across the nation. Amazon aggregated that demand for more efficient servicing. Furthermore, Amazon was a single product distributor for books for a number of years. This wedge allowed them to build a national distribution system and layer on products as time went on.

Netflix: Centralized distribution for end-point shopping and acquisition for DVDs. Then, they centralized the distribution to an app on your phone or TV for one location that eliminates both Cable and driving to the store to pick up entertainment. In addition, DVD locations and Cable had high fixed cost structures, creating inefficiencies in cost structure.

Hims & Hers: Centralized distribution for end-point consumers so that consumers don’t need to drive to the hospital, deal with insurance, and just pay for service directly. Meanwhile, hospitals are a high fixed cost competitor that are distributing drugs that can cost 2-10x more in total price after insurance, while having a distributed care network, which is much more inefficient than a centralized care network… in addition, Hims & Hers had a wedge with Erectile Dysfunction and Hairloss before layering on additional care and products… sound familiar?

History isn’t repeating. It can’t. Maybe, there’s a bit of a rhyme there though.

Have that idea in the back of your head as we go through this business model. Also subscribe if you’re not already!!!

Hims & Hers Health: HIMS 0.00%↑

Founded in 2017, Andrew Dudem told the following story about when the company went live:

“I remember the night before we launched the company. There was a seven-person team at that point. We went to a restaurant/bar, and at 1 AM I said, 'Listen, tomorrow we are going to launch, and if at some point within the next year we reach 100 sign-ups a day, we'll have built a huge company.' And everyone looked at me and said, 'Oh my God, I don't think we'll ever be able to do that.' We launched that day, and we got 500 sign-ups a day within the first week.

Everything broke — we had one or two doctors and only one person in customer support. I got a call from one of our co-founders at 7 AM saying that our pharmacy partner had decided they didn't think they could fulfill the demand for our business, on the same morning we launched.

It was that moment of incredible energy when we figured out that we had found something people wanted. I give a lot of credit to our team for, since the beginning, spending a lot of time thinking about who is the person we're trying to solve for, what is the pain they're going through, and how we make sure that what we bring to market addresses that head-on.”

- Podcast Appearance, H/T

on Transcribing this.

The product market fit is clearly there from Day 1 but… what does Hims & Hers do?

The Business Model

According to Hims & Hers’ own 10k:

“(1) We believe that the Company has the technical platform, distributed provider network, and access to clinical capabilities to lead the migration of routine office visits to a digital format.

(2) The Hims & Hers platform includes access to a highly-qualified and technologically-capable provider network, (2.a) a clinically-focused electronic medical record system, digital prescriptions, and (2.b) cloud pharmacy fulfillment. Our digital platform enables access to treatments for a broad range of conditions, including those related to (3) sexual health, hair loss, dermatology, mental health, and weight loss.

Hims & Hers connects patients to licensed healthcare professionals who can prescribe medications when appropriate. (3.a) Prescriptions are fulfilled online through licensed pharmacies on a subscription basis. In addition, (3.b) we also offer access to a range of health and wellness products designed to meet individual needs, which can include curated prescription and non-prescription products… enabling greater access to high-quality, convenient, and affordable care for people in all (4) 50 states and the United Kingdom. Hims & Hers products can also be found in tens of thousands of top retail locations in the United States.

That’s a loaded business description. Let’s break it down by the points I wanted to highlight above:

Hims & Hers manages “routine medical visits”. The platform is not built for life endangering situations. This business targets conditions that are recurring in nature, not life threatening, and have highly expensive name brand competition (Viagra, Ozempic, etc.). The consumer simply logs onto an app, instead of a traveling for an in-person doctor’s visit.

Platform Capabilities:

The platform is a clinically focused electronic medical records system. This means that when people come into Hims’ system (the app), the data is all stored. The medical record is stored internally for subscribers, the interaction and prescriptions are inputted to update the medical record, and hypothetically… as the platform gains subscribers, this verticalized medical record database will grow.

The platform is a cloud-fulfillment system, which means that it’s largely software driven. Think like Shopify’s fulfillment network where its via partners, not internal operations. However, Hims & Hers has started to internalize some of these fulfillment functions over the years and has created a network of internal fulfillment pharmacies that connect to Last Mile Delivery partners. As time goes on, Hims & Hers will verticalize the supply chain and manufacturing functions.

Product / Service Description: The company offers services across a broad set of medical functions. The company started in Erectile Dysfunction (E.D.) and men’s hair-loss. After finding success, the company expanded its products and has successfully transitioned to a multiple product platform. I find this wedge similar to Amazon starting in books and expanding to other products. The slide below from the Investor Presentation shows the past and future Product Roadmap.

The services are on a subscription cost model, based on medical examination from the third-party medical partners. This is an important detail, because Hims’ legally needs a third-party to prescribe drugs, else there’s a conflict of interests. The subscription cost structure is on a drug by drug basis with individual pricing for product lines.

The company is personalizing their services. This means that Hims & Hers has the capability to personalize the medium (gummy, pile, spray, etc.), different concentrations, and many other items on a centralized inventory basis to give the consumer more options. Honestly, some of these personalized ideas won’t work out, but the option is always nice. This is largely possible only through a centralized nationally inventory model, such as the one that Hims & Hers operates.

That’s the general basics of the business model.

To get more into the nitty gritty, let’s go a level deeper with my diagram to describe how I see this business model developing.

Key Takeaways:

Hims & Hers (H&H) built their own DTC distribution system that is completely operationally independent of the current healthcare pharmaceutical distribution chain.

H&H is in the process of verticalizing the company across the industry from manufacturing, distribution, medical examination, and handling or partnering to handle the rest.

H&H has dramatically undercut the cost structure from the conventional system, along with reducing many friction points for non-life threatening medical services.

I think conceptually… I consider Hims & Hers independent of the current medical pharmaceutical distribution system. By creating its own distribution channels and verticalizing production and fulfillment, Hims has allowed for its own independent growth trajectory. Where is that future going though?

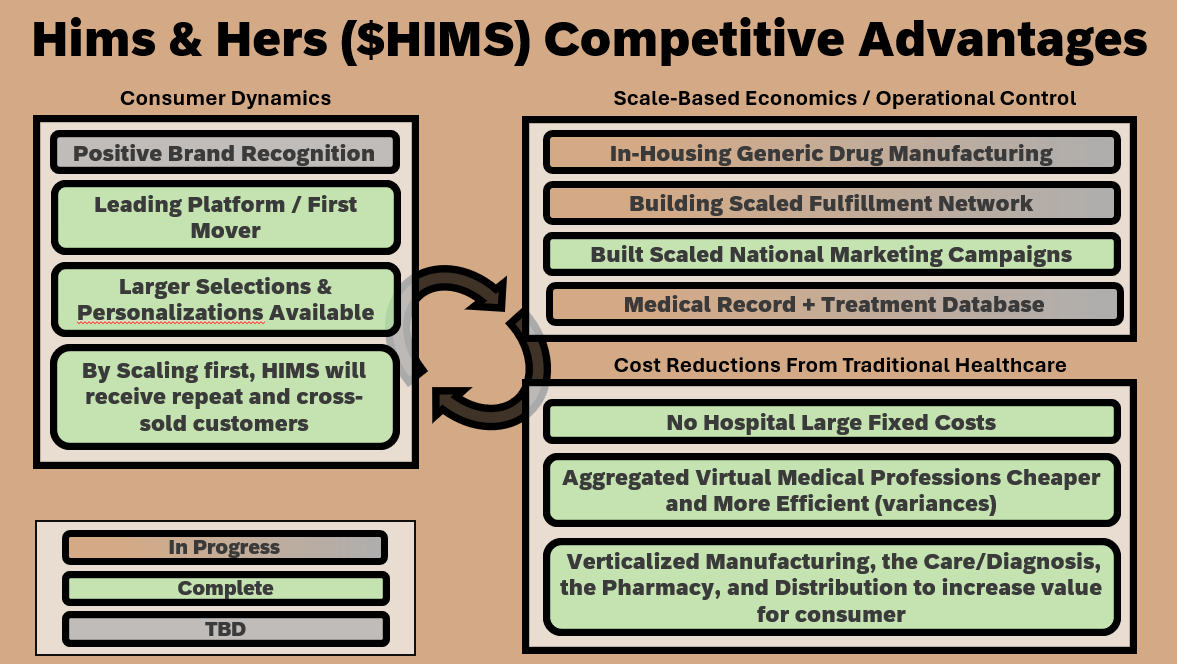

Now I would classify Hims & Hers Competitive Advantages (Potential & Existing) across 3 different categories: Consumer, Platform Competition, and Tradition Healthcare. These loosely translate to the above to distinguish the competitive advantages over existing entrants and new entrants.

Cost Reductions vs Traditional Healthcare: This is likely the simplest bucket. H&H simply eliminated the need to have large fixed cost medical evaluation areas (hospitals), along with the convenience of eliminating the drive to these locations. Also for an analogy on centralization, think about a constant stream of medical care to 1000 hospitals. Imagine meeting a variance of individuals coming in and the amount of hospital personnel at 1000 locations to meet demand at every location. There will be hospitals that have large fluctuations and it cannot be efficient. Now, imagine averaging the variance of those 1000 hospitals via a centralized platform where you can more accurately handle the variances by centralization with more volume. That’s a major OpEx advantage.

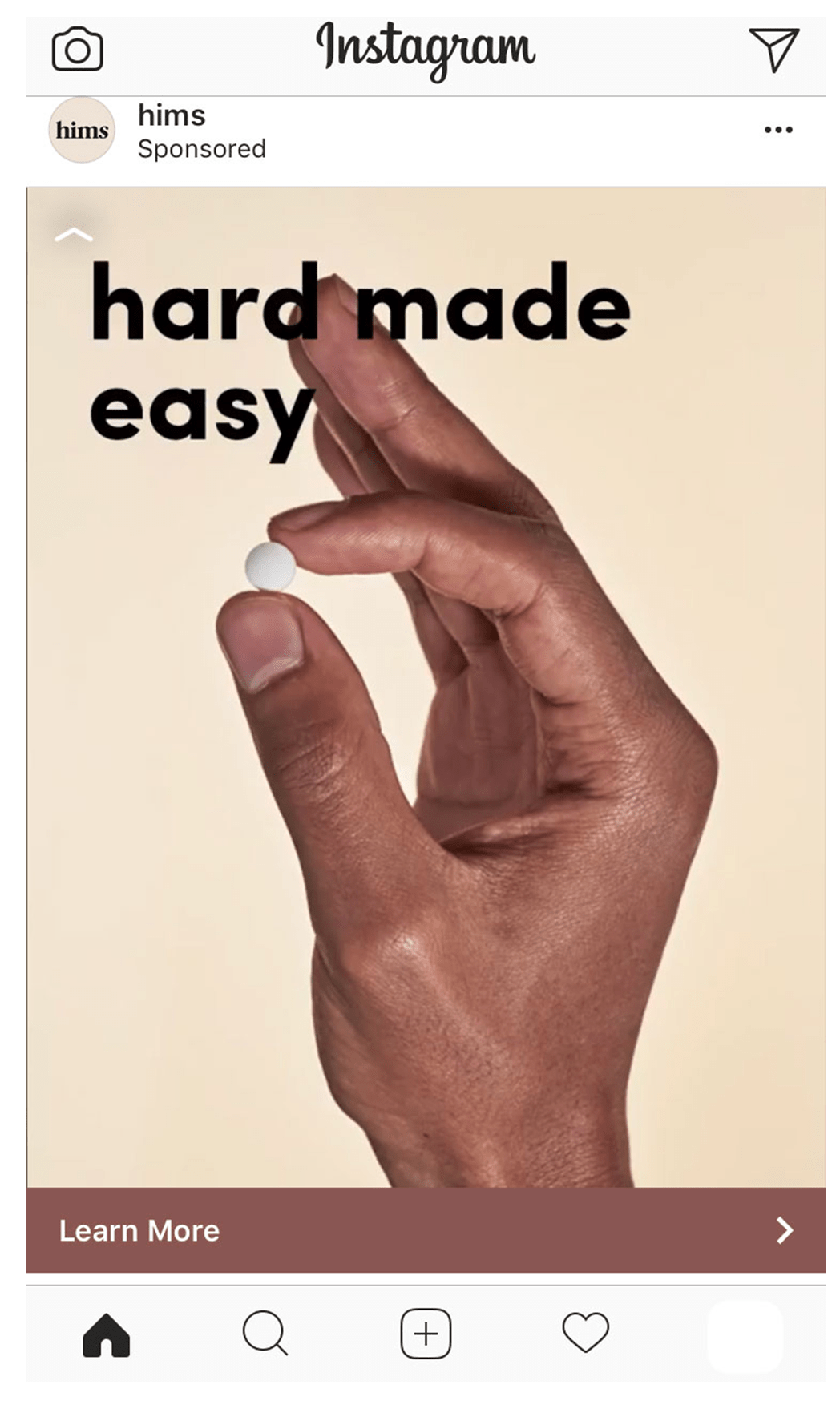

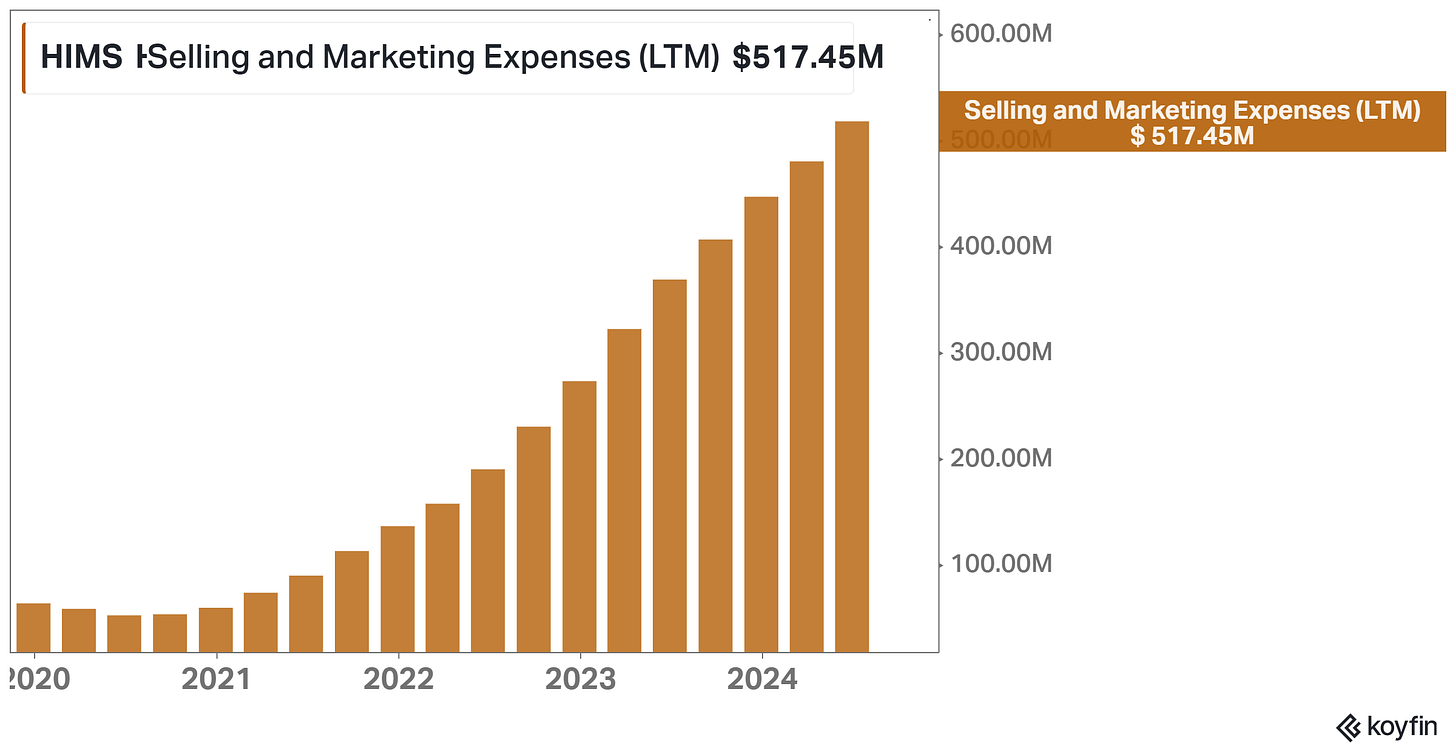

Scale Based & Operational: These advantages are more the category that relate to the advantage over an upcoming DTC platform, whether that be an incumbent switching strategies (Disney+ style vs Netflix, Novo has started this idea) or a new up and comer (tons of options to chose from here). I’ve touched on all of these already. However, I do want to cover the marketing strategy. H&H achieves high gross profit margins distributing small prescriptions and so the company’s strategy has to put incrementally more and more marketing dollars across national scale (Instagram, Radio, FB, TikTok, Snapchat, etc.). These dollars are starting to build NATIONAL BRAND AWARENESS. Anecdotally, people have started recognizing and using H&H more and more in my person life. However, the Apple App Store Ranking also have the Hims and Hers each ranking higher with more reviews each quarter. This makes sense with the incrementally increasing trailing marketing budget though.

Take that data point there too. H&H as a $3.5 billion market cap has a Last-Twelve-Month marketing budget of $500+ million. In response to this budget, the company’s revenue has increased north of 50%+ for the past few years.

Consumer: These competitive advantages are self-explanatory. The leading consumer brand gets a foothold first, can scale additional services, and build more brand awareness. It seems to be trending that direction in my opinion and anecdotally. However, I wouldn’t put it as something I’d use as supporting evidence for my thesis yet. What I will say though is that Hims & Hers is dramatically leading the telehealth market and is receiving 54% of new customers among the telehealth providers, which provides an excellent flywheel to continue rapidly building capabilities and separating from the competition early.

I also want to highlight those two stats: H&M is (1) increasing market share incrementally each year and (2) is adding 54% of new entrants to the telehealth system. This creates a disproportionate advantage for H&H economics wise. Investments are distributed among many more subs and the company can afford to grow much faster, creating a flywheel for increased consumer value via an aggregated national service.

Strategies

Okay, I think that H&H has a set of future strategies or growth objectives that are instrumental in the company achieving its current growth:

New Products: The primary growth driver and increase of value is the company’s product selection. In addition to increased conditions for treatment, the company is also offering new mediums (gummies, spray, pills, etc.) and new combinations (two conditions in one medication) for even further personalization. This is all a net positive for the consumer. Some personalization options will resonate with consumers and some will not. However, having the ability and economics to experiment will build the company an advantage over time.

New Markets: The company already says that it has active operations in the UK, which is a logical next market. Operations have begun there already and the asset-light Platform is now being taken Internationally. As you can also see below, H&H is hiring on LinkedIn to begin operations in Canada. Therefore, in the next few years we can infer that H&H will have increased its addressable market and will be operating globally in the future.

Verticalize Fulfillment/Manufacturing: I think building out the fulfillment and manufacturing capabilities is smart, especially manufacturing. I think that H&H can last another 3-5 years utilizing Partners for Last Mile. However, I think past that… the company might need to invest in its own Last-Mile fulfillment capabilities. I’m seeing too many bad reviews on melted products, poor delivery times, and UPS/FedEx not delivering fast enough. For now, the company is still so far ahead of the traditional healthcare experience that it doesn’t matter. This will long term be a massive scale economics barrier to entry though that will layer on top of a leading Telehealth user count to spread CapEx/OpEx over.

Brand/Incrementally Increased Marketing: I don’t think this can be understated: the US Healthcare system is complicated. People want simple. H&H ads are simple.

It doesn’t need to win you over immediately. The company is not in a rush but it is building the “name recognition” aspect. Everyone when I bring this up says something along the lines of… “That’s like XYZ” and then they proceed to not be able to name the competitor’s brand until I tell them the competitor they’re talking about. H&H simply is going for name recognition and that will create a brand eventually. An incrementally increasing marketing budget that is increasing slower than revenue with attractive payback periods will do that, as you can see below.

New Services: The above advantages are all huge ones. However, I do think the company has more on the horizon. I think that in addition to better supply chain control and delivery time, increased internal manufacturing options, better brand perception, new markets… I think the company has more. I keep thinking about the company’s centralized and structured data, medical records, and treatment histories. In other industries like auto insurance via companies like Verisk VRSK 0.00%↑ this concept of a centralized database has been around for decades. However, this has never been a concept in Healthcare. I think that Hims & Hers has a centralization structure that will allow for ML/AI tools to be created for (1) enhanced medical record analysis vs the current condition (2) cross-human analysis for correlation of conditions (3) genetic mutation tracking from one generation to the next. I think that the H&H structure can create a decade long moat from increased medical examination quality, enhanced by proprietary medical data. I’m not from the medical field, but I’m naively excited by the new opportunities the company has available to it to increase the value for the US Healthcare consumer.

Now, I love talking qualitative. However, I’m a quantitative guy. Let’s get to the numbers.

The Financials “The Numbers”

I’ve already told you. The numbers on this one get me excited. The numbers were actually so good for so long that I thought it was too good to be true. For instance, if you pulled a screener via a Plus Membership from @Koyfin (discount link on Home Page) from the US Small Cap Index, filtered for companies with past and future revenue growth above 20% CAGR(s), and put the valuations on a Scatterplot… you’ll find Hims & Hers on the bottom right of the graph.

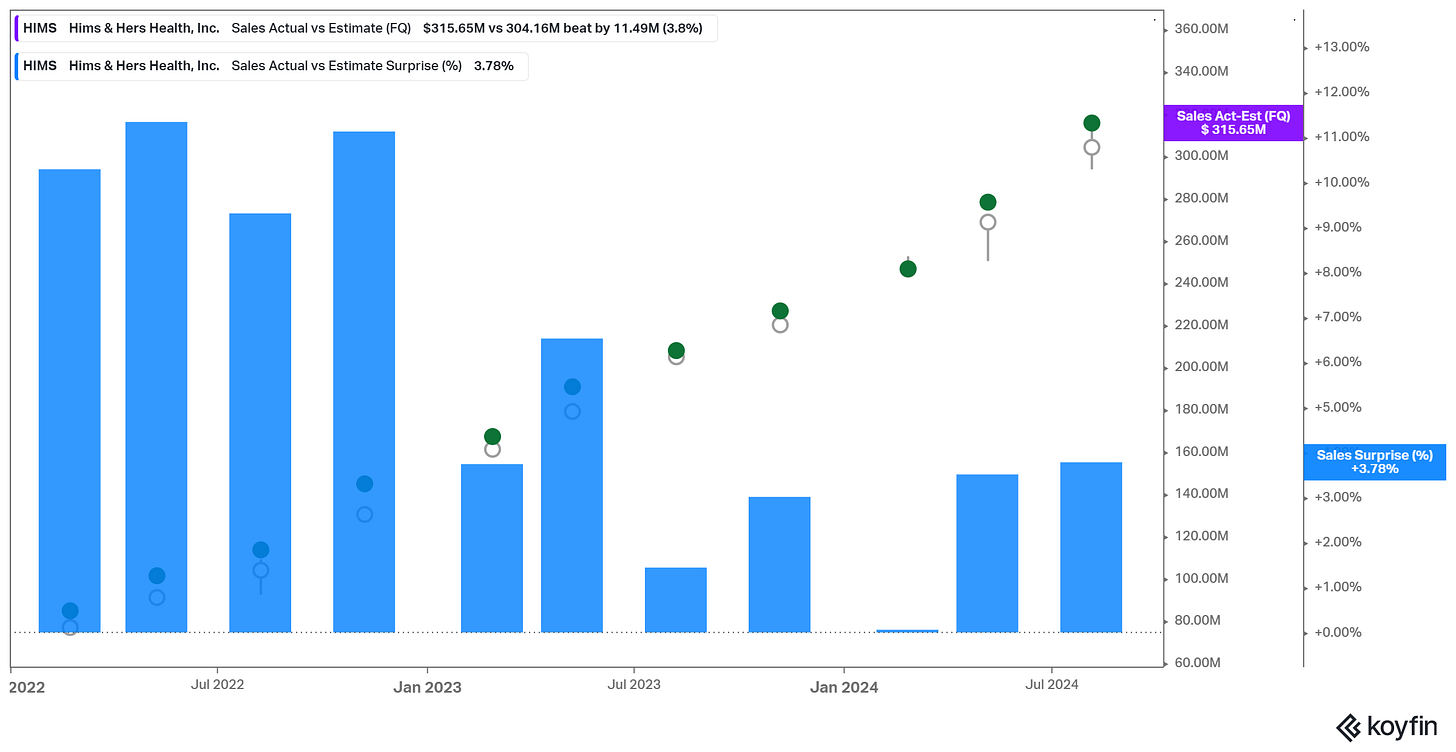

H&H is trading cheap (4x LTM Gross Profit) and has an expected forward 3-Year revenue CAGR of 37% with the company guiding for 65%+ revenue growth Y/Y this next quarter at the mid-point of their guidance. What’s important to note though is that for that all the data I have on Actuals vs Estimates, H&H has beat and raised nearly every quarter with revenue surprises by nearly 4% each quarter for the past year above analyst expectations.

Topline Numbers / Growth Drivers

Obviously the growth drivers for revenue are (1) number of subscribers (2) $ per subscriber. With subscribers growing 40%+ Y/Y and this number only being near 2 million today, I see this as an immature growth driver today. In the future, I think this system is set up to have tens of millions of subscribers on the platform. With an average order today of $55 today per sub, 10 million subs would imply north of $6.6 Billion in revenue (around $5.3 in Gross Profit, NFLX at $16B Gross Profit LTM today). 10 million subscribers would also only be 3% of the United States population. I think that it is likely that H&H can outgrow this target over the long term with expanded product categories, maturing in existing categories, and going internationally. The team has already shown that they can grow very efficiently the past few years!

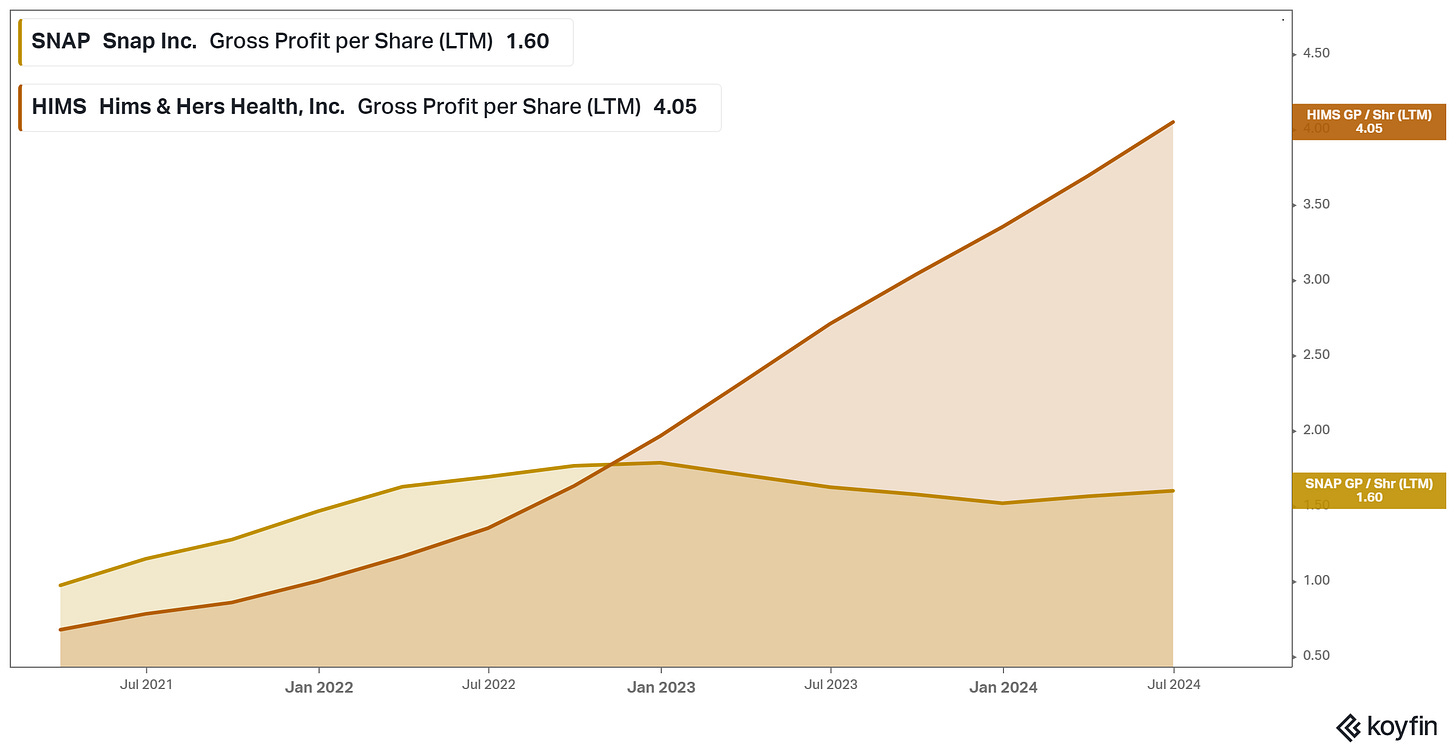

Gross Profit per Share, a good growth company metric, has grown at an astounding 73% CAGR the past three years. The company also trades at a measly 4x Gross Profits today, despite being up over 300% since the lows of the 2022 market action.

Basically, the company has been trading around this 4x GP ratio as its average the past few years. The rapid growth rate is keeping the valuation around this range and it is quite attractive still here today, due to this reason. To show this point, I put a 4x GP line on the chart above to show the reader how the price action is moving around this KPI. For reference, SnapChat SNAP 0.00%↑ trades at a 6x Gross Profit ratio, 50% higher than Hims & Hers.

The company’s stock price indicates that the market doesn’t think the business model will work in the future. It’s as simple as that. However, I think the market is very wrong on this one and it’s not a complicated reason why.

The company is getting more efficient with scale and we already have a baseline comparison to how much more capitally efficient the company is than its legacy competitors.

Margins / Efficiency

I think the biggest problem when I first purchased this company in 2022 at $5 per share was that the company was not in a stable condition with cash not coming into the business. The competition was strong. H&H was cash flow negative. Operating Margins (EBIT margin) was even worse. I wasn’t comfortable. Since then the stock price has nearly 3x’d and I sold at $7 for a 40% gain. However, the stock today is still trading at similar valuations today and is in a much more stable position with a much longer track record. Look at this.

So not only has the company grown its Gross Profit per Share by 70%+ each of the past 3 years but it also has significantly scaled its profitability and efficiency of operational expenses. One of the big operating leverage growth drivers is leverage on the marketing budget each year.

Even after growing its annual marketing budget by approximately 4-5x, H&H has experienced an extra 5% of margin leverage from a percentage of its Gross Profit being brought in each year.

Essentially, the company is getting more efficient with scale. This is definitely shown in the data as well.

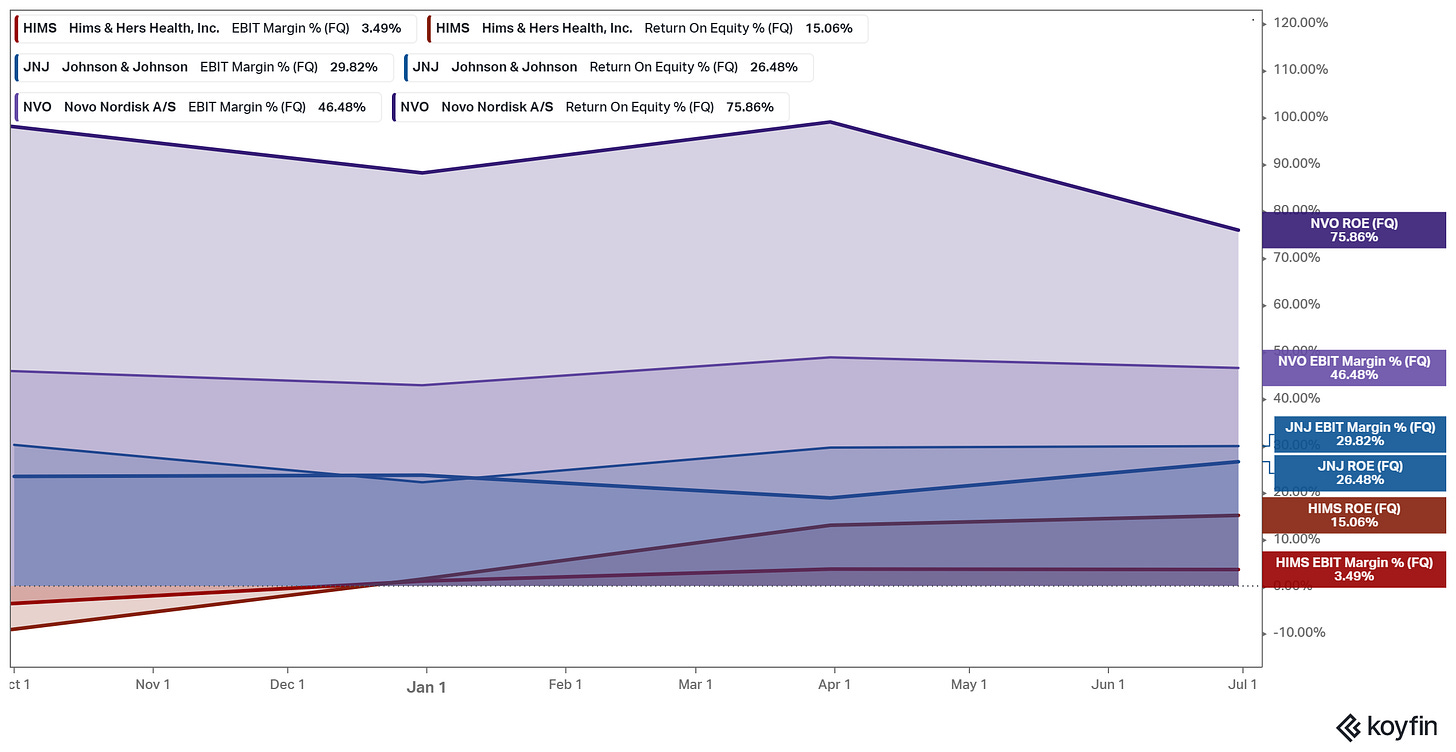

H&H primary competitors today the “OEMs” of the pharmaceutical world who own the majority of the drug IP are vastly less efficient from a business structure perspective.

Johnson & Johnson has an EBIT margin 8.5x higher than HIMS and is producing a Return on Equity only 75% higher than Hims & Hers

Novo Nordisk has an EBIT margin 13x higher than HIMS and is producing a Return on Equity only 5x Hims & Hers

Today, H&H only has a 3.5% trailing EBIT margin as well. I see this number increasing over time with additional operating leverage and the business maturing with its personnel and processes. I simply see that H&H has a more asset efficient business, is scalable by nature, and this business model is extremely value adding for the end-consumer. H&H even with these efficiency gains and undercutting the current cost structure by 80%+ is still putting up 80%+ Gross Profit margins. That’s how broken the current medical cost structure is.

IRR Return Calculator / Conclusion for Free Readers

Hims & Hers is a situation that I have no seen in a long time. There are clearly Risks involving IP infringement, regulation, etc. However, I didn’t want to cover or write about those items. They don’t interest me as much. I like business models and thinking big picture. I hope this writeup showed you how H&H’s new business model could reshape the Healthcare industry, forever.

Now, I’m going to give my baseline assumptions for my napkin math return calculator. I think that I feel comfortable with the Free Materials that I’ve provided thus far. I want to better the knowledge base for this company. However, I think my time and opinions are worth more than $100 per year. I put out 3-5 highly actionable ideas a year and feel like the IRR assumptions are worth much more than $20-33 per idea. If you feel the same based on my research, feel free to become a Paid Sub below.

My thought process on my membership is you get a full-time high quality investment analyst that will give you 3-5 amazing reports a year. In return, you will pay the equivalent of 2 hours of labor for a McDonald’s worker for ideas that can disproportionately win on the upside and take weeks of research and writing. $100 per year is underpriced and will be increased in the future, unlike other promotional analysts no discounts will ever be available. I want partners that understand the value I bring. If you’re a student, shoot me a private ping and I’ll hook you up with a membership.