Before starting, I want to tell you a quick story.

There once were three companies existing in harmony. The first was a large e-commerce platform founded in 1995. The second was an American payments provider founded in 1998. Finally, the third was a Latin American e-commerce company inspired by the first company.

These three existed in harmony. However in 2001-2002, the first company purchased 100% of the payments provider and 19.5% of the small Latin American e-commerce company. The first company sold their stake in both companies in 2016.

Today, (#1) eBay’s market cap is $25B; (#2) PayPal’s market cap is $65B; and (#3) Mercado Libre’s market cap is $82B. In aggregate, eBay’s current market cap is approximately 30% of its previous stake in these two businesses.

Feel free to draw your own conclusions. I just thought it was interesting!

The largest and best business of the three though, Mercado Libre MELI 0.00%↑ and is the one that we will be covering today. This writeup will breakdown the business from a high level and will not include any IRR assumptions.

Format for today’s writeup:

Founding and Background

Business Line Descriptions and KPIs

Business Model Analysis

Building an Empire

Connected Growth

Growth, Margins, & Efficiency

*I will not give any return calculations on this post. This post is to breakdown the business on my Watchlist to get subscribers up to date on the company.

1. Founding and Background

Founded in 1999, Marcos Galperin saw an opportunity in Latin America for an e-commerce platform, one conceptually similar to eBay. This platform would service third-party sellers and buyers as a multi-sided marketplace. Little did Galperin know that his company just 25 years later would end up being one of Latin America’s largest companies with a market capitalization of nearly $80 billion and providing shareholders over a 5600% return since IPO’ing in August 2007.

After seeing the early success of the platform, eBay took a 19.5% stake in Mercado Libre in 2001, right before purchasing all of PayPal later in 2002 for a $1.5 billion all stock deal.

Probably partially inspired by the PayPal/eBay combination created in 2002, Mercado Libre realized that the company needed a payment processor for their own platform to assist in facilitating online transactions, among a largely unbanked population. In 2003, the team added Mercado Pago to its product suite.

By 2006, Mercado Pago made up 8% of on-platform volumes (~$90 million). Following the impressive growth from the previous years, the company IPO’d in 2007 with revenues of $52.2 million in revenue and $1.1 million in net income. An interesting thing to note, Mercado Libre was a profitable underlying business even while in growth mode in those early days. After analyzing the founding, development, and where the business is today, a thesis emerged.

My thesis is as follows.. Mercado Libre’s business model design was and is one of the most impressive I’ve ever analyzed, creating opportunity for synergies that are tangibly creating growth and flowing to the bottom line simultaneously.

That’s easier to say and harder to prove though. So, let’s get into it!

2. Business Line Descriptions and KPIs

Before we get into the WHY behind my thesis, we need to walk through and understand the WHAT(s) that are being examined. What we will what will diagnosing is below. If you are familiar with all the product lines, feel free to skip to section 3:

2.1 Commerce Revenues: Mercado Libre, Mercado Envios, Mercado Ads, + KPIs

2.2 Fintech Revenues: Mercado Pago, Mercado Credito, + KPIs

2.3 Additional Services: Mercado Shops, Mercado Classifieds, Asset Management

2.1 Commerce Revenues: Mercado Libre (Marketplace), Mercado Envios (Logistics), & Mercado Ads (Advertisements)

Mercado Libre (Marketplace): Covered briefly earlier, Marcos Galperin saw an opportunity originally for a third-party marketplace. The 10k describes the Markplace as follows:

“The Marketplace has an ample assortment of products, with a wide range of categories such as consumer electronics, apparel and beauty, home goods, automotive accessories, toys, books and entertainment and consumer packaged goods.” - 2023 10k

The only thing that I would add to this definition is the fact that the Mercado Libre Marketplace is made up of first-party seller items (MELI selling directly) and third-party seller items (other vendors listing products on the platform). From a conceptual standpoint just consider it Amazon but for Latin America. There is even a loyalty program (MELI+) that gives free 2-day shipping among certain geographies.

This multi-sided platform is already already a powerful business model concept. Many strong business model use this concept such as the card networks ( V 0.00%↑ MA 0.00%↑ ) connecting issuers and acquirers, Meta META 0.00%↑ connecting content digestors (that’s us) and advertisers, or Copart CPRT 0.00%↑ connecting salvage buyers with insurance sellers. In essence, as you build both sides of buyers/sellers, the network becomes stronger as whole, creating more additional value for each incremental buyer/sellers that joins the network.

Additionally, similar to the creation of Mercado Pago in 2003, Mercado Libre managed to layer on complimentary products that enhance the company’s ability to retain buyers/sellers on its platform and grow the difference of its capabilities in between competitors, while growing its multi-sided marketplace of buyers and sellers.

The important part of diagnosing this business is understanding (1) WHAT each additional business line is and (2) WHY or IF these make the business stronger. The second part will come later under my “Business Model Analysis” section. For now, let’s dive into these other business lines!

Mercado Envios (Logistics Solution): Described in the 10k, Envios:

“enables sellers on our platform to utilize third-party carriers and other logistics service providers, while also providing them with fulfillment and warehousing services.”

In short, Mercado Envios provides the warehousing and fulfillment services (similar to FBA - Fulfill By Amazon). However, sellers are also able to use Mercado Libre’s logistical services and third-party carriers (3PLs), along with the company’s integrations, to assist in selling products via the Marketplace.

Here’s my key takeaways here:

In the most recently Q4, approximately 50% of the Gross Merchandise Volume (GMV) sold across the platform utilizes Envios. This provides opportunity and runway to deploy capital in the future, bringing up this percent of the total.

Mercado Envios is DIFFERENT than Amazon’s logistics network. Envios offers warehousing storage fees and fulfillment fees to vendors to store the merchandise and set up the fulfillment for vendors, along with utilizing Mercado Air (fleet of planes) to move products between warehouses effectively. However, Mercado Libre does NOT conduct “last mile”. delivery Mercado Libre utilizes a variety of small to mid-sized third-party carriers, including fleets of motorcycles for delivering in urban areas.

Mercado Ads (Advertisements): This business unit is really simple. Vendors can utilize product search, banner ads, or suggested products ads on the Marketplace utilizing Mercado Libre’s first party data to target audiences. This is a great additional product to assist vendors in making sales, create an additional high margin service, and grow the integrated ecosystem.

Commerce KPIs

The most important most important KPIs for the Commerce Revenues are: Gross Merchandise Volume (GMV - amount product sold across the platform) and the Take-Rate (MELI’s % of revenue from those sales).

When multiplied together, these give us the Commerce Revenues:

The most important thing to take from this is that MELI is (1) growing GMV at a fast growth rate (~20% average cagr in USD) and (2) is getting a higher percent of the take rate through expanding Envios and Ads, which are both higher margin offerings.

With that, we have finalized the Commerce Revenues and we will be moving along to the Fintech Revenues section.

2.2 Fintech Revenues: Mercado Pago & Mercado Credito

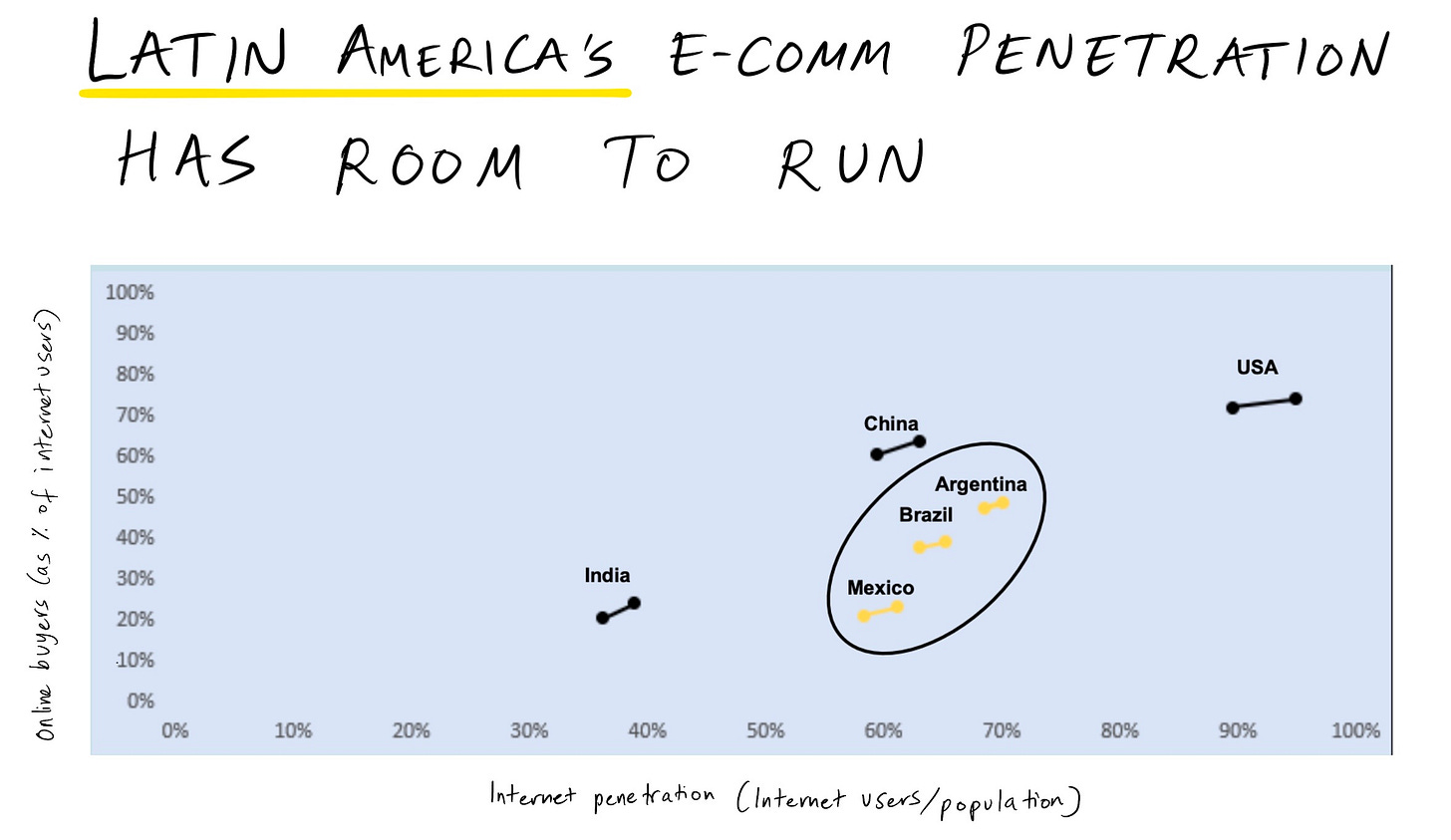

Mercado Pago: According to a Stanford Business Review (Link), “As of 2019, approximately 70 percent of the Latin American population was unbanked or underbanked.” The Mercado Libre team noticed inefficiencies in the system and identified this as a large opportunity.

In 2015, Mercado Pago was expanded into an off-platform payment processing tool. Initially, the service offered low-end Mobile Point of Sales (MPOS) systems so vendors could facilitate transactions via their mobile device. By 2019, the off-platform volumes were the majority of the payments processed via Mercado Pago. Today, Pago is a full functioning service to process in-person or virtual payments and even offers person to person payments.

Mercado Credito: As merchants grew with the platform, Mercado Libre noticed that many vendors did not have the access to credit to invest in their working capital requirements. In 2017, Mercado Credito was built via proprietary credit underwriting models with the company’s access to the vendor’s first-party data.

However, Credito is only available for MPOS/Virtual vendors, because Mercado Libre’s “online merchants’ business flows through Mercado Pago, [they] are able to collect principal and interest payments from their existing sales on Mercado Libre’s Marketplaces, meaningfully reducing the risk of uncollectability on the loans we originate to our merchants.” - 2023 10k.

Fintech KPIs

The most important most important KPIs for the Fintech Revenues are: Total Payment Volume (TPV - total payments processed by Pago), the Take-Rate (MELI’s % of revenue from processing those sales, includes Credito). When multiplied together, these give us Fintech Revenues.

I think the big callout on this chart is in 2015-2016 when the take-rate for Fintech Revenues dropped off significantly but growth seemed to accelerate in the following years. This was when Mercado Pago expanded to off-platform processing and separated itself from purely an on-platform payment solution. I think the rest is pretty self explanatory.

With that, we have finalized the Fintech Revenues and we will be moving along to the Additional Services section.

2.3 Additional Services: Mercado Shops, Mercado Classifieds, & Asset Management

Mercado Libre has also created a number of additional revenue streams. Mercado Shops is the most important in this section but I will briefly cover the other two business lines.

Mercado Shops

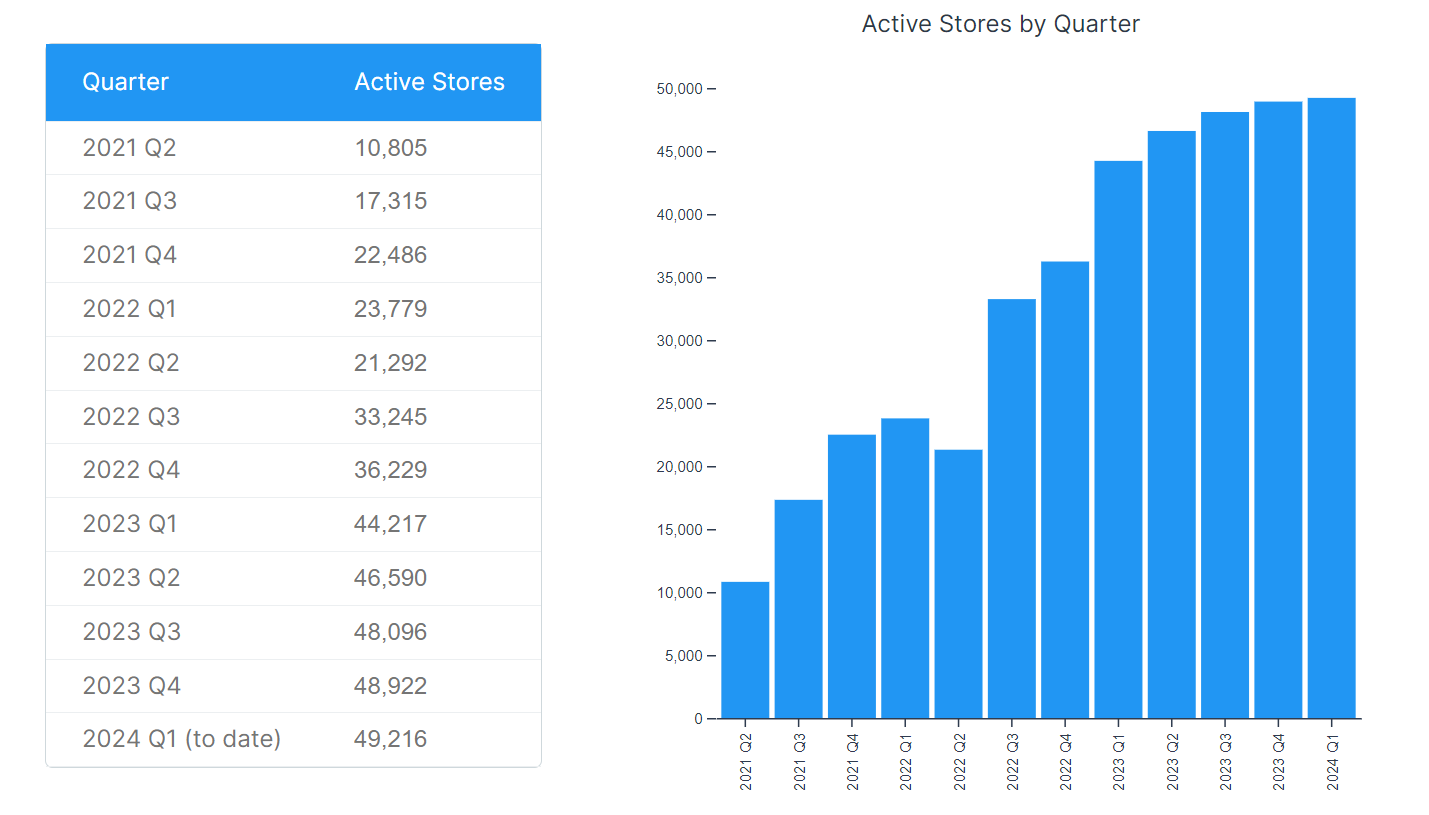

Shops is a digital storefront, similar to Shopify, to allow vendors to create their own website and have integrations into Mercado Libre’s ecosystem. Below, you have the pricing comparisons and the features available.

The integrations with Ads, the Marketplace, and Pago are all powerful. This has led to a significant bump in vendors on the platform. I expect this to an exciting growth opportunity for the company moving forward. More on that later though!

Mercado Classifieds

Per the 10k:

Through Mercado Libre Classifieds, our online classified listing service, our users can also list and purchase motor vehicles, real estate, and services in the countries where we operate. Classifieds listings differ from Marketplace listings as they only charge optional placement fees and not final value fees. Our classifieds pages are also a major source of traffic to our platform, benefiting both the commerce and fintech businesses.

Asset Management

Per the 10k:

“With a seamless onboarding, this product allows users to withdraw and use the value stored in their digital wallets at any given time through QR code in-store payments, pre-paid and debit cards, or cash withdrawn from an ATM, without requiring that their funds be trapped in a money market fund or a certificate of deposit to obtain an equivalent return.”

Finally, not all these business lines are active in all 18 countries Mercado Libre operates in. There is still significant white space for nearly all its product lines today.

With that final piece of the puzzle, let’s move on to the business model analysis!

3. Business Model Analysis

To this point, my writeup has been purely informational and objective, describing WHAT is going on in Mercado Libre’s business. However, on this section I will be entering the subjective territory and describe WHY the business has flourished and provide my own analysis.

3.1 Building an Empire

Empires require mobility. Whether it be Genghis Khan’s mobile horse army, the durable Roman roads, the British Empire’s Naval fleet, or the United States Interstate Highway System, the modern empire requires mobility to combat and grow from the forces of change.

“By 2007, Mercado Libre had grown to be a $50-million-a-year company using the same technology stack for eight-years. But as the company grew and expanded, so did the needs of its customers and the speed with which changes to Mercado Libre’s systems needed to keep up with demand for myriad new features and functions. “After the IPO, when I met with Stanford students and professors, or Wall Street bankers, I was treated like a hero,” Galperin remembered. “Then, I would get in a cab and ask the driver to take me to Mercado Libre’s office. On our way over, I would find out that the driver was one of my customers with a long list of complaints. That’s when I decided to move my office from the executive suite to a cubicle next to the CTO’s office, to learn the issues our technical team was dealing with first hand” - “The Rise of Mercado Libre”, Stanford Business Review.

Technology developments move quickly. If a technology company’s systems aren’t designed to be able to innovate and move rapidly, a company will fail to grow into new product lines and expand their empire. In 2009, Mercado Libre started a technology transition plan codenamed “New World” to completely redesign the technology stack of the company.

After moving his office to be near his technologists, Galperin promoted a young but tough-as-nails engineer, Dani Rabinovich, to take the CTO’s position… Rabinochich’s task was clear as it was insurmountable: to rebuild the company’s systems from the ground up to support speed of innovation, third-party integration, and mobile apps - and all this while the company continued to deliver on the promises made to investors when it went public. Robinovich described the challenge:

“A platform was necessary for us to deliver a product that would survive in the following decade. Even if we never shared our platform with any external developer, a platform was (still) absolutely key for (our) survival. Main reason: speed and innovation. A platform allowed us to decouple a large monolithic system (and team) into many cells. Each cell is like a small company: (with its) own team, own infrastructure, own code, and own data. Only one aspect in common: a strict [adherence to] interface APIs and strong authentication standards.” - “The Rise of Mercado Libre”, Stanford Business Review

As an IT professional, I have no idea how Robinovich completed this project by 2012. A project of “Bet the Company” level importance and three short years later, he built a platform from a custom built tech stack that had been in use for the prior eight years! He did this while the company grew revenues from $52 million at its IPO to near $300 million in 2012.

The importance of this cell-based approach and the decisiveness with which it was conducted cannot be understated. New technologies were on the horizon: Cypto, Mobile devices shopping (iPhone released in 2008), DTC website hosting and payment processing. Mercado Libre was now flexibly designed to tackle them all.

Essentially, each business line within the company is able to operate independently of all the others. This transitioned Mercado Libre from a single company to more of a Platform. Each division having its own Presidents/VPs, own infrastructure, own code, own data. Each division is its own company. This allowed for speed, accountability, and innovation.

“New World” completed in 2012. Review the business development timeline again with fresh eyes, knowing about this behind the scenes project:

2013: Launched Mercado Envios

2015: Transitioned Mercado Pago into its own standalone off-platform payment processing service. Customers could use MPOS. By 2019, quarterly off-platform volumes surpassed on-platform volumes.

2017: Launched Mercado Credito

The team in the following five years had the ability to launch, iterate, and develop each business line with speed and quality. This early platform realization allowed Mercado Libre to put the systems in place for each business to tackle its large addressable market and grow its overall revenue by 39% per year for the next 12 years!

3.2 Connected Growth

Now, many writers cover all the business lines and the growth metrics but I want to also cover some of the key advantages that occurred to me when analyzing this business. There are undoubted more but here are the 7 that I found:

Marketplaces & Classifieds - Mercado Pago: Having your own payment processor for your own platform is extra margin on every item sold. This means as your Marketplace and/or Classifieds grow their business, this in turn provides growth and profits via your payment processor.

Marketplace & Envios: This might seem obvious but as you invest in logistics and create faster/more reliable shipping, you will gain more customers and in turn more sellers. This enhances the multi-sided Marketplace, its competitive positioning, and grows GMV. More GMV in turn provides more payments processed via Mercado Pago on the platform (Synergy #1).

Marketplace/Envios & Ads: As the marketplace grows its customer and seller count, the opportunity for ads (similar to what Amazon did in the US) grows. With investments in Envios growing the customers that want to use Mercado Libre as their go-to order, this in turn builds the customer base that click on high margin ads when making a purchase. This isn’t a complicated one but it still is a powerful add-on high margin product.

Pago & Credito: Credit underwriting has its risks. With Mercado Libre only lending to its vendors though, the company is able to mitigate a large portion of the risk due to being “able to collect principal and interest payments from their existing sales on Mercado Libre’s Marketplaces, meaningfully reducing the risk of uncollectability on the loans we originate to our merchants.” This in turn reduces real delinquencies of loans compared to the actual charge offs, providing a tax advantaged expense compared to a real cash expense.

Mercado Shops & Pago: This one is simple; it’s the Shopify playbook. As you grow your customers on Mercado Shops, these vendors will utilize Pago to process transactions and this will grow the tool’s TPV. This makes Mercado Libre want to assist in helping vendors grow and do well. It allows them to make incremental profits on their growth. This is why Mercado Libre made Shops so cheap compared to competitors. It gets vendors in their ecosystem.

Mercado Shops & Envios: This feature is only in Mexico currently. However, it is going to be a game changer. Merchants will be able to utilize Mercado Libre’s ERP software and integrate with Envios, allowing their customers 24 hour shipping access. This will grow volumes on the Shop Platform, increase the utilization of Envios assets, and in turn increase TPV (helping Pago).

Mercado Shops & Ads: Mercado Shop vendors can also buy ads on the Mercado Libre Marketplace. One day when combined with their streaming service and Envios handling logistics across the board, this will be a more powerful dynamic.

There are undoubtedly other dynamics at play. However, I feel these are the main tangible synergies between the large business lines that all create a connected growth flywheel across the product lines.

4. Growth, Margins, and Efficiency

In this section, I will briefly cover the growth metrics and what are contributing to them, the underlying margin dynamics, and how efficiently the company is growing today.

Growth

There’s no way to tell how long Mercado Libre can grow at its topline at this ridiculous hyper-growth rate. However, after learning about the timeline of Envio’s growth, when Mercado Pago was transitioned to an off-platform tool, and how fast each of these business lines are still growing… I think the company will grow much faster and for much longer than investors expect.

Add to this that Latin America’s internet penetration and online buyers are some of the lowest in the world, Shops inevitable growth, Envios level of reinvestment potential, and I see a much longer runway than most.

Margins

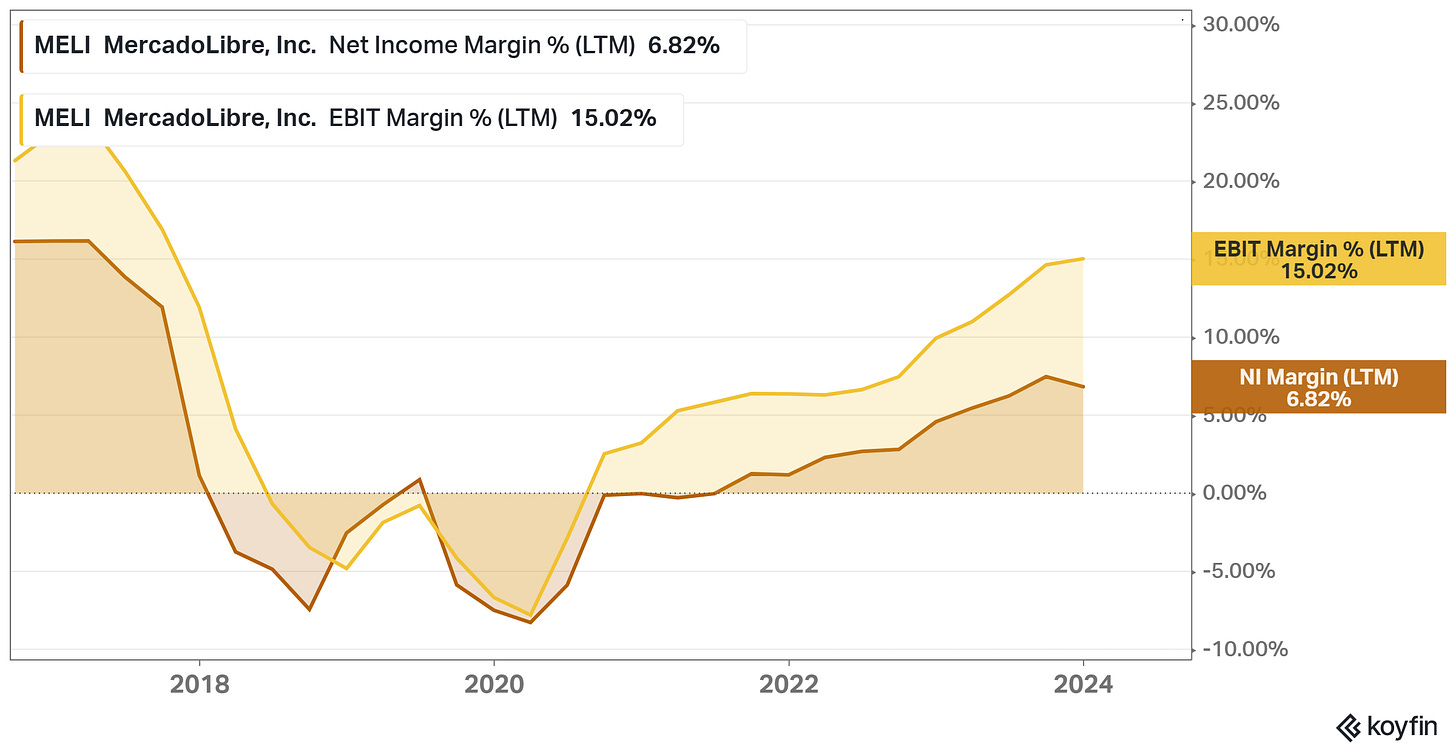

Investors tend to become bifurcated when analyzing Mercado Libre’s bottom line. One group looks at the Cash Flow statement and the other at the Income Statement, and it’s not hard to see why.

The company trades at 17x FCF and 78 PE at the same time.

This is largely due to the company having negative working capital requirements, heavy depreciation and amortization expenses, and contains “charge-offs” (which get added back on the Cash Flow statement).

I’m lazy personally and I just want to see where the operating profits/net income will go over time. I do recognize though that the high free-cash flow/negative working capital dynamic creates a business which in actuality is more profitable than the net income margin suggests. To acknowledge this, I simply create a higher terminal multiple and assume that other investors will recognize this obvious advantage and simply award the company a higher multiple than average.

That being said, I still see the net income margin increasing over time.

Few contributing thoughts on why I see the net income margin increasing over time:

One-Off Expenses: There were a set of large one-off expenses this past quarter with prior year Taxes and Legal fees from some cases in 2014. Operating Profit margins excluding these increased this past quarter. I see it being a minor headwind the next 12 months. I see this as a small opportunity to purchase on perceived weakness.

SG&A Leverage: I see this continuing to have operating leverage over time as the company keeps building higher margin add-on products. I doubt it contributes too much more though, since it already has decreased so much in the past.

Gross Profit Margin: I expect the gross profit margin to continue rising as Mercado Shops, Ads, Pago, Credito, and software products become driving forces in the company. The Commerce take-rate is up. Pago is a high margin service. I’d expect this to continue rising to the mid-60’s, which unlocks significant extra bottom line margin.

Interest: Currently, the interest expense is 2.5% of revenues. I do see this dropping over the long term (7-10 years) as the company builds its logistical infrastructure out to maturity. I’d only expect 1-1.5% of bottom line assistance here though, as the Credito arm still will utilize MELI’s comparatively cheaper capital to loan to higher risk merchants.

Overall, the company is expensive today. However, I do see the bottom line changing over time, which dramatically changes the investment case.

Efficiency

Then, you need to add that the company is putting up stellar trailing numbers on very efficient growth.

Keep in mind that these are trailing metrics. When the bottom line margin expands further, like we discussed in the previous section, these numbers will be even higher (maybe except ROE because of higher debt levels today). Return on Capital could easily go above 25%+ as the net income margin expands to 10%. This is a fast growing and very efficient business from a capital allocation perspective. Below are Amazon and Shopify’s efficiency metrics for comparison:

They’re not even in the same playing field of profitable efficiency. Mercado Libre is built for connected and efficient growth.

Summary

All in all, I hope this writeup was able to justify my thesis that I set out to prove:

Mercado Libre’s business model design was and is one of the most impressive I’ve ever analyzed, creating opportunity for synergies that are tangibly creating growth and flowing to the bottom line simultaneously.

I hope you learned something as well about this fantastic company, its founding, and the opportunity that exists for an investment on the right entry.

If you liked this writeup, subscribe for free for my future writeups or potentially contribute $5/month to help support my writing and keep these blog posts free for everyone. Nothing is expected, everything is appreciated. I also have referral links for Koyfin and Stratosphere that I used to create all the graphs on this post.

Click below for my affiliate discount where I get a proceed of your subscription, supporting my writing and also giving you premium investing tools at a discount:

Thank you if you made it this far. Have a great day guys.

I linked to your post and another one about MELI that the "Invest in Quality" Substack had just done for my links post for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-18-2024

Great work man. The Connected Growth section is really well done. There’s fly wheels and then there’s MELI.