Today for my newest “Long-Ideas” post, I will be covering a company that has an impeccable track record but a potentially uncertain future. Since its IPO on April 11th, 2014, LiveChat has done quite well for itself:

Total Return: 966%, 28.6% cagr

Total Revenue Growth: 18.9M PLN to 315.7M PLN (TTM), 34.9% cagr

Net Income Margins: 49.9% to 54.6% today

Shares Outstanding: 25,750,000 to 25,750,000

However, as is the case with a multitude of software names, the future is uncertain in regard to competition, product pricing power, and AI displacement. Many investors I have mentioned the name to always say, “I just don’t know about its moat/competitive advantage” or something similar. That is why, in today’s post, I will cover more in-depth how I see the unique aspects of this software name that will allow the business to withstand future unknowns and provide investors with a stable return on investment, hence the name in the title, a “Right Tail Diagnosis”.

But first… a word from my sponsor, Koyfin!

Full Transparency: I’m a Koyfin affiliate. However, I did my best to partner with the best for my subscribers. I was utilizing Koyfin free for a few years because as a 24-year-old aspiring blogger, I figured every dollar saved and invested would put me farther ahead! Today though, I’m utilizing the Pro tier and will say I think I have the best product in the game:

Dashboarding/BI: I love Koyfin’s charts. They are by a wide margin the most visually appealing. I can apply statistical measures (average, standard dev, etc.), and can overlap or separate out metrics as I see fit. The statistical measures especially come in handy, as I’ll show you later in the post for my graphs.

Robust Pricing/Valuation Data: Koyfin also has revenue, margins, and valuations at much smaller increments, creating best-in-class valuation charts. This is by far the best differentiator in my opinion.

Other Perks: I also use Koyfin for all my Earnings Transcripts and Screeners now. To be honest, all platforms do Transcripts well but I do appreciate having it all in one place. The screener is actually REALLY good though. Definitely, the best I’ve come across with the best metrics to screen for. I’ve found International microcaps down to $10M microcaps with robust data to help the screening! Being able to screen on Revenue CAGRs as well for 1, 3, 5, 7, and 10-year CAGRs just provides the flexibility you need depending on your investing style, whether it be GARP, Growth, Large-caps, Dividends, or anything in between!

Anyways, there’s my pitch! Use my link to subscribe and I’ll get a portion of your proceeds, you will get 10% off your subscription (Win/Win), and it’ll go a long way to support my writing, while also giving you a quality product in return. All charts will be from Koyfin today, so give them a little closer look and see what you think.

10% OFF Koyfin Affiliate Link below! With all that said, let’s get into this post over LiveChat Software.

Product & Industry

LiveChat, now called Text after the company officially changed its name, is a horizontal software provider that provides the “chat button” plugin on the bottom right of the screen when users log onto websites or applications. This allows users to chat with service reps and get the assistance that they need by clicking the icon, and a chat will open up to contact a service rep team!

Now as you can imagine, the market for this type of plugin has a large number of competitors like Tawk.to, Facebook Messenger Chat, Zendesk, and of course, LiveChat (Text). It’s a crowded market filled with many low-tier solutions with a minor number of premium-product players (Tawk.to/Zendesk/LiveChat).

Many investors would even say it’s a commodity software product. If it is though, let me ask a few questions…

How did a small Polish software company manage to grow its revenues from $1.75M to $73.2M (USD) over the course of 10 years? With over 37,000 customers, what is the product differentiation or market fit?

Furthermore, how did the company over that 10 years, without any dilution, maintain an average profit margin of over 50% and returned over $480 million to shareholders without some sort of competitive advantage? ($1B market cap today)

What is the secret to the company’s efficient growth and is it a scalable method that will continue in the future?

Hopefully, these questions pique some interest in you. One thing that conceptually intrigued me is the fact that Text has managed to rapidly grow its customer base, consistently increase its prices, and return capital all while aggressively managing its sales/marketing and administrative expenses. Furthermore, it hasn’t really slowed down from its steady growth!

I think before I get into the “HOW” explanation of my diagnosis to how the company has managed this, I first need to cover the “WHAT the company’s core products are (LiveChat, ChatBot, HelpDesk, Knowledge Base, and OpenWidget).

Below are some visuals to summarize the product suite from the IR Presentation, the timeline of product development, the ownership structure, and the revenue split by product. After these materials, I’ll go a bit deeper into each product!

LiveChat (developed 2002, 92.9% of revenues): Utilized by customer service reps, this software is a “Customer service platform allowing for a contact with human agent across all channels and asynchronously” (Investor Presentation July 2023). In layman’s terms, this is basically a “Microsoft Teams” style application for reps to monitor open chats, respond to customers, monitor tickets, connect a “Knowledge Base” to provide solutions to common issues, and provide any other integrations for payments, checkouts, or anything else a customer might need.

Below is a screenshot of the clean UI of LiveChat that reps utilize.

This is definitely a premium work management tool for agents. Any company can build a simple plugin for a dummy OpenAI chatbot to occupy and waste a consumer’s time. In contrast, LiveChat is definitely purpose-built and iterated on for two decades to assist agents, save time on interactions, and convert more customers. For $59/month per agent, it’s one of the premium products in this market. However, this still hasn’t stopped the product from growing its user base, with customers growing from 26,000 in Jan 2019 to over 37,000 this past quarter!

Key Takeaways:

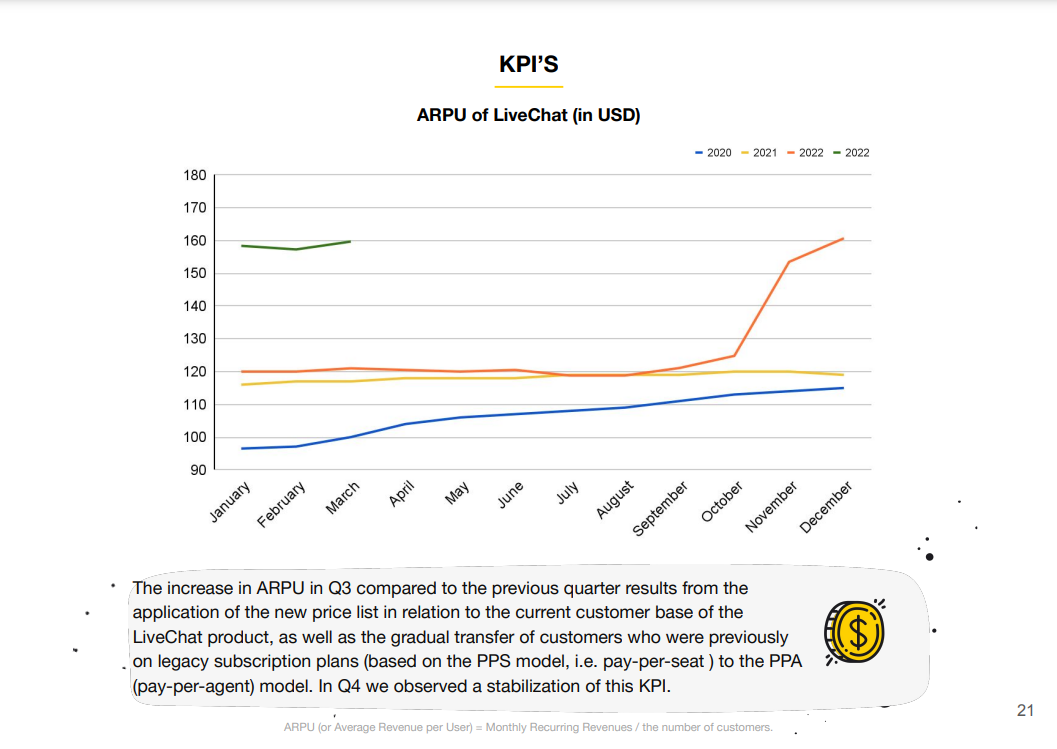

At $160 ARPU ($1,920 per year) and the average customer service rep’s salary ranging from $32-45k, the price of the software to improve these agent’s efficiency is definitely a small percent of the total cost, especially for the primary tool for the team members. With customer service typically being its own separate reporting unit from other operations (Supply Chain/R&D/FP&A/HR/etc), this software wouldn’t get convoluted with other business functions and has a clear effect on its business unit’s efficiency. This is key because it allows the premium software to have a clear cause/effect relationship to KPI(s). In this case, those being (1) time to solve open cases, (2) number of open/closed cases, (3) converted sales, and (4) number of reps required. Basically, this is very clear reporting, unlike many other software products that are more convoluted in their function and end-users. This is a similar dynamic to AutoDesk where the its a tool for end-users that requires training, efficiency, and has simple outputs. This increases retention on the high end of the quality product market fit in small-medium sized businesses (some large), where LiveChat serves.

In addition, this product integrates into all the important areas: social media, payment providers, CRM tools, website hosting (WP, Shopify, Square, etc.), but this isn’t particularly unique among these names so won’t go too much into it. With all that covered, let’s get into the next product, ChatBot!

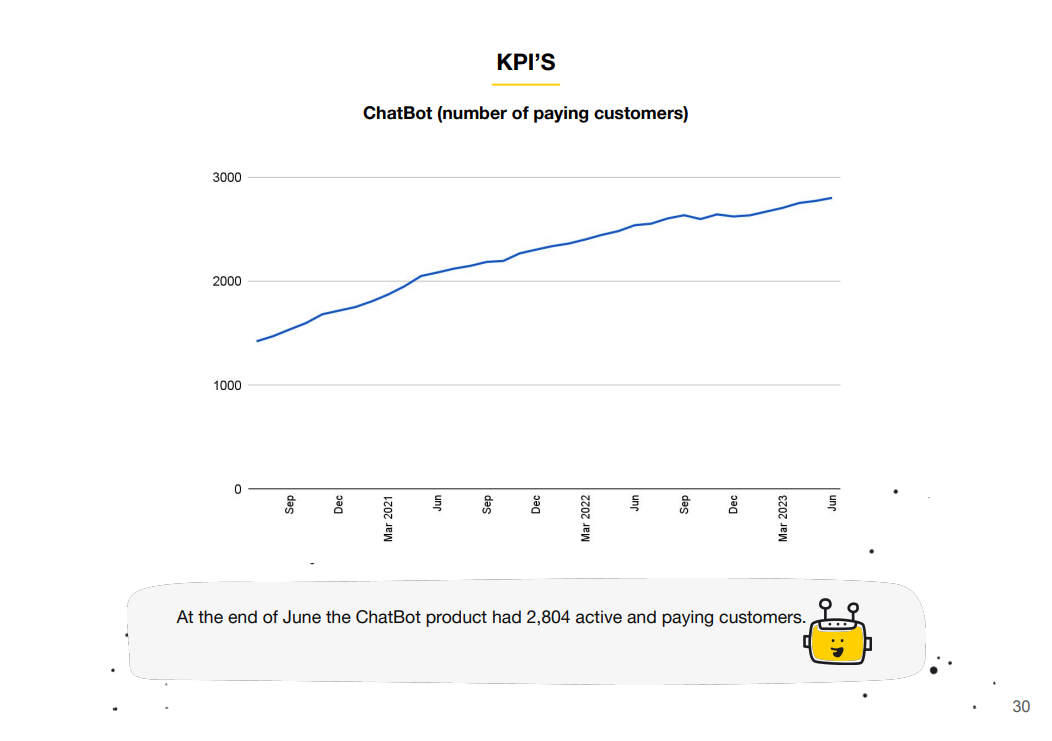

ChatBot (launched 2018, 5.5% of revenues): This product is how it sounds. It’s a tool to create automated chats from a bot that Text launched in 2018 and already has over 2,800 customers and contributes just over 5% of total revenues. Currently, the company is working to integrate AI functions into its ChatBot product for ChatBot 2.0 but below is the interface style for how customers originally designed chats. This product comes with templates for common use cases (Restaurant ordering, Job Applications, Call Scheduling, University Template, etc.).

Key Takeaways:

Pricing: This product has a base tier price then it also has charges for additional interactions when the customer exceeds the number allowed for their plan. Another key interesting takeaway is that ARPU has nearly doubled since Jan 2019. This is interesting because with the usage agreements’ pricing models, this means the tool is getting used more frequently by each existing customer. This product today does not have a LLM attached to it but the company has made clear its developing ChatBot 2.0 right now that will include a LLM option!

Now ChatBot and LiveChat are the most important two products so I’ll be breeze through the next two!

HelpDesk (launched 2019, 1.6% of revenues): This is a ticketing system for teams with functions to automate tasks, send ready-to-go messages, perform bulk actions, and do real-time reporting!

KnowledgeBase (launched 2017, undisclosed % of revenues): This is a tool to gather data on common questions and responses, and provide access to support reps to utilize this to close tickets faster and convert more sales.

Now, I know that that wasn’t super interesting. I appreciate you sticking with it, assuming you’ve made it to this point! Let’s now get into answering those questions:

How has the company over the past 10 years managed to grow its revenues at a 40% CAGR, while keeping its SG&A margin at a 20% average?

What is the secret to the efficient growth, allowing Text to return nearly all FCF to shareholders?

I’ve narrowed it down to these 3 concepts: (1) Aligned product-market fit with its R&D strategy, (2) incentivized-outsourced R&D model, and (3) unique distribution that acts like a small bootstrap style company, instead of a billion-dollar corporation.

Product Market Fit & Outsourcing R&D Model

Now as all software investors know, the real advantage a company needs to build is its distribution. However, with software having near infinite distribution with minimal incremental cost unlike atom-focused businesses, this advantage turns into a disadvantage with competitors being able to launch, scale, and take market share starting from zero.

LiveChat decided to use this disadvantage and build it into a unique strategy, building a Marketplace for developers to develop distinct use cases for customers utilizing LiveChat software!

Marketplace: As stated previously, LiveChat is the premium market tool. How it achieves that is by offering an App Platform for third-party developers to build products for the LiveChat customers. In exchange, these developers get 37,000 potential customers to sell their product to that they can build over a short time frame. This is very similar to how WordPress built a hosting website and a framework for building websites and allowed developers to sell plugins/templates/no-code solutions to customers to make their lives easier. This in turn increases the effectiveness of the hosting platform itself though, in this case, LiveChat.

Furthermore, the company also has a list of integration partners that will build out the product, build any customizations, and provide the selling case for the product. This is the case with many software companies that they build out implementation partners to “sell” the product to customers, get paid to implement, and get referrals from the software company as “official partners”.

Outsourced R&D and Value-Add

In addition to allowing full ownership over custom apps within the Marketplace. Text also created an Incubator program where third-party developers can build a product with the Internal Text team members. In this way, Text accelerated both Knowledge Base and its ChatBot solution, which are both from the Incubator Program! However, in return, Text most likely gets a revenue split agreement, instead of the developer keeping the majority of the revenues.

This R&D model is definitely unique to LiveChat, creating a highly customizable product by allowing its own core product to become a distribution source for developers, instead of creating competitors.

This mindset also helps the customers. LiveChat customers are implementing add-ons to their core product, which makes it incrementally harder for competitors to replace the solution. This is due to the fact reps will want to have access to the tools that they had before (“Well, I could do this with our old software??” - You hear this crap in ERP implementations) If the next competitor doesn’t have the niche use case solutions, then service reps will be more likely to be unhappy with the new implementation and with the total cost being less than $2,000 per year on average per customer, most customers will opt to simply stick with the solution, even if the prices are raised.

Pricing Power

Now all of that analysis may have sounded like “theoretically masturbation” to confirm a positive bias to the moat but the company has proved that it has the ability to raise prices while retaining its existing customers.

From January 2019 to today, the ARPU has increased from less than $100 to around $160. This is due to a shift in payment terms to a (1) Per-agent basis and (2) a 30% price increase in Q4 2022. I personally don’t think that an undifferentiated or sustainable product solution would be able to do price increases like that if the “free-mium” solutions could provide the same value to the Support teams. It also helps that Text focuses on larger corporations that can eat that price increase for breakfast, as long as their support team is happy. However, the company still needs to get new customers!

Unique S&M Distribution

What I’m about to say is not actually too unique. It’s actually familiar to many small software companies. The source of Text’s ability to efficiently manage sales and marketing expenses is… Affiliate Marketing.

In its Partner Program, Text offers 3 ways to Make Money:

Building & Monetizing Apps: We’ve covered this.

Becoming a Solution Provider: We’ve also covered this. This is basically for Consultants, Marketing Agents, or IT Companies that will be “Certified Partners” for implementations for customers looking to use LiveChat. Not going to go too much deeper here. Tons of software companies use this tactic, it’s nothing too unique.

Affiliate Marketing: This is a key one. The business uses affiliate marketing, no doubt alongside its Solution Provider program to grow its customers. The largest customer has made over $4M promoting the product to date (per the company’s website).

Essentially, Text has attempted to make its small horizontal platform into a marketplace/distribution platform, instead of providing a close-sourced software product that would entice competitors to compete rather than join the company in its ambitions of assisting customers.

Affiliate Marketing is an interesting strategic move to be honest. It allows the company to outsource customer acquisition with the cost of revenue splitting then focus on R&D with its cheaper Polish-Development team (compared to US standards). Comparing this strategy to another competitor when they were public, Zendesk was reporting over $1B in revenue a year ($413M in Q3 2022 before going Private) but reported a GAAP net loss of $59M for that same quarter. With Zendesk being on 140k websites vs LiveChats 60k, it’s interesting to compare these two strategies. Zendesk made more but didn’t make money but was growing quite fast as well. LiveChat is still owned by the founder, makes money, and distributes to shareholders every single quarter. Personally, I think LiveChat’s is a more scalable model but will limit its upside in the end. I’m more a fan of sustainable growth though, so this isn’t such a bad thing in my mind.

Now, this writeup is getting a bit long so I’ll start getting to the financials and outline a potential Return on Investment napkin math calculator!

Financials

I’m going to make this short because I think the financials are much more clear-cut in this business, while the qualitative analysis was much more important!

Revenue Growth

Combining price increases, rapid customer growth, a global customer base, and low churn is a delicious combination apparently. Average revenue growth over the last 10 years has been 38%. I have a few thoughts going forward:

Slower customer growth: Text will not be able to grow its customers as rapidly. Having already 6% of the market and competing directly against competitors like Tawk.to and Zendesk now, I think customer grows more slowly. Maybe the company doubles customers to closer to 75k from the 37k today. It’s selling globally and focusing on small to medium-sized companies so its possible to take share from other names. I could see competitors like Zendesk losing long-term vision, unlike Text, which is still run by the Founder today.

Pricing Power: This one is a crap shoot. I have no idea how fast LiveChat will raise prices. I’d estimate 8-10% a year per agent, in-line with service rep raises is probably realistic.

New Products: I think the company keeps developing products internally to its LiveChat solution. ChatBot 2.0 will be integrated with a useable Large Language Model (LLM) and integrated with HelpDesk and KnowledgeBase would be a super useful product to service reps.

New Verticals: This one is not guaranteed. The company has come out with a new product, called OpenWidget. This will allow users to put the code into their website, and the plugin can become any widget integrated into their product. I don’t have too much of an opinion on this today. It is clearly in its infancy, but I appreciate the fact the company is trying to branch out from its core solution. It might also be possible the company is building a “Universal Widget” to attempt to replicate its “Marketplace Approach” for a much broader plugin. This is all hypothetical though.

Revenue Input: I’d estimate revenues compound between 12-14% conservatively going forward. 8-10% of that comes from pricing. 4-6% of that comes from customer growth. This means the company’s customers in 10 years would increase (5% avg cagr) to 60k, which feels conservative.

Margins on Revenue

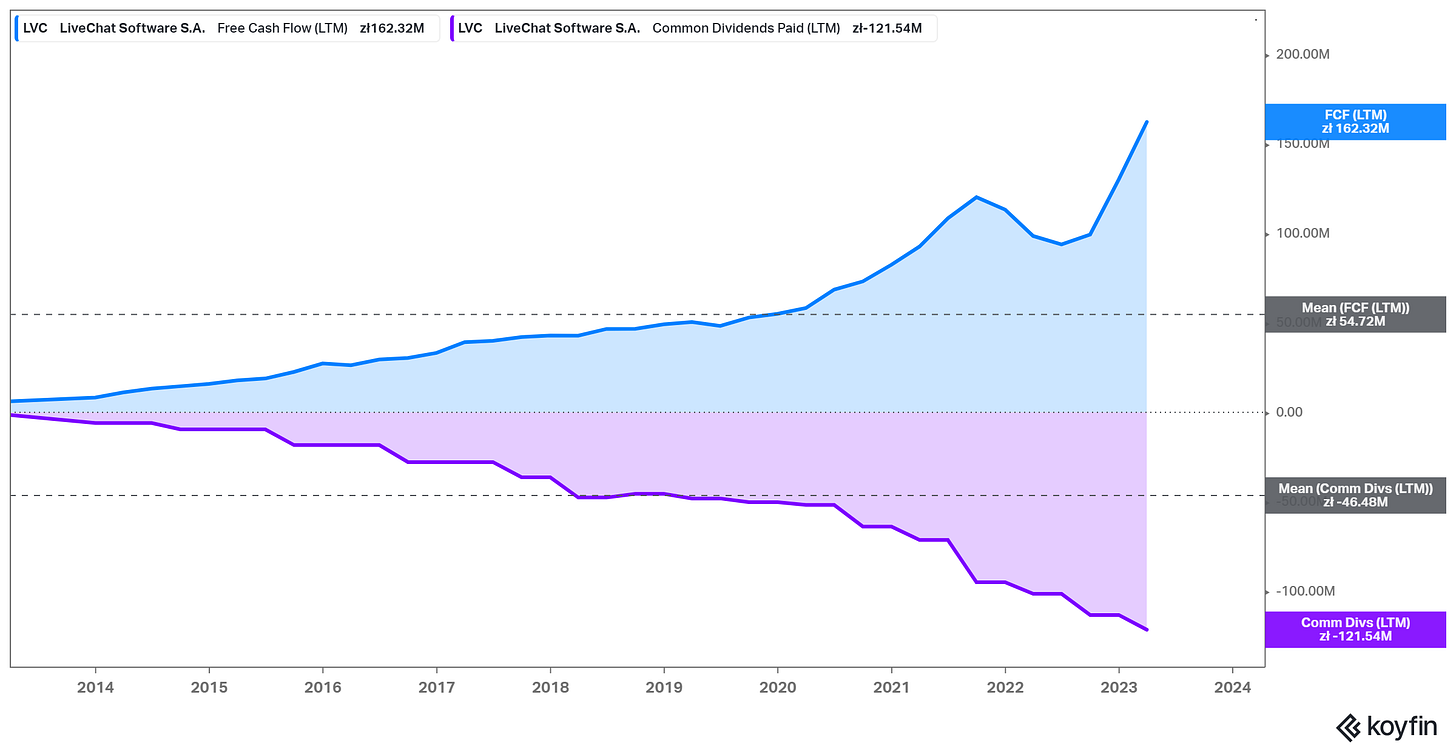

Below are some charts, that show the company’s FCF/Net Income and the net income margins over time. Notice the clean net income to FCF conversion of approximately 90% and net income margins that on average are 54% over the past 10 years.

Stupidly consistent. This makes the inputs for our napkin calculator super easy though!

Conversion Input: Net income to FCF conversion is approximately 90%

Net Income Margin Direction: 1:1 ratio. I don’t expect net income margin to rise over time. I like the company has a balanced future investment and outsourced key functionalities. After the recent hiring splurge, the company sits at 182 people today and envisions a “full team” around 300 people, along with optimizing all the internal processes. 2023 Q1 Earnings Call:

(Again, thank you Koyfin for the Graphs & Transcripts)

Free Cash Flow Returned to Shareholders

This is a cool part. 85% of Free Cash Flow has been returned to shareholders over the past 10 years. I think this is closer to 90% though, due to the dividend being paid out this next quarter for the trailing year. This hasn’t been reported yet in the financials, due to the dividend being just recently approved.

FCF Return Ratio: Due to 0 dilution and all dividend return of profits, this is a solid 90% input.

Balance Sheet

All clean here. A ton of the cash on the balance sheet is about to be paid out via the upcoming dividend but it always helps when you have no debt. Also ridiculous when you can put up Return on Equity (ROE) and Return on Asset (ROA) like this! With no tangible assets, Text can efficiently compound with barely any assets to physically maintain over the coming years.

Napkin Math Return Calculator

With the following inputs over the following 10-years:

Revenue Growth: 12-14%

Net Income/FCF Conversion: 90%

Net Income Margin Direction: 1:1

FCF Return/Diluted: 90%

Trailing PE: 20.3

Currency (FX): Due to the global business and 34% of revenues being in the US, I’m not going to intentionally account for FX within my model but feel free to add it if you think its necessary.

Exit PE Multiple: This sounds stupid, but I’m going to leave the multiple at 20x. I think the company keeps yielding cash and will become a “more stable yield source” over time for investors as they get larger, which academically doesn’t make sense but from a human risk tolerance mindset makes sense in my mind.

Formula: [ (Rev Growth + Capital Return)^10 * Margin Dir * Multiple Change ] ^ .1

Capital Return: (90% * 90%) * (1/20.3) = .0398 -> ~4%

Base (12% rev growth): [ (1.12% + 4%)^10 * (1/1) * (20/20.3) ] ^.1 = 15.8% CAGR

Bull (14% rev growth): [ (1.14% + 4%)^10 * (1/1) * (20/20.3) ] ^.1 = 17.82% CAGR

Summary

I think that these estimates are conservative, potentially even on the bull case. I could see the company being able to go into new verticals effectively, gain a significantly larger than 60k customer base, or grow ChatBot into a significant revenue driver!

However, even with all those options, I think it’s smart to underwrite at reasonable assumptions and then… let the best operators just do their thing and make sure those KPIs are trending in the right direction and are outpacing your initial expectations!

Thanks for reading! If you enjoyed this or found it useful, please like/retweet/subscribe/tell your friends and check out the Koyfin affiliate link below if these charts or transcripts would help your process!

Have a great day guys!

if you go to the marketplace of livechat, you see integrations such as payment or videos or pictures inside the chat window. This kind of stuff makes it really worthwhile like this https://www.livechat.com/marketplace/apps/shopify-live-chat/#description

I think that contextual chat like for cart abandonment and help with payment declines is also a long term potential.

Who are the up and coming competitors - maybe some in india? South east asia? What about generative chat (i dread to use the term "AI") tools that can help accelerate Knowledgebase and other such initiatives - can they still compete with the new tools popping up? will Text's costs go up initially to ramp up their product and service offerings, and eat into margins?