Kinsale Capital: Q1 Review & IRR Expectations

Reviewing the Past & Predicting the Future

Executive Summary

Kinsale Capital Group (Ticker: $KNSL) is a specialty insurer in the Excess and Surplus (E&S) industry. With a straight-forward and uniquely structured data-storage business design, the management team over the past eight years has grown its market share within this industry from nearly 0% to a 2% market share of the E&S Market, which is full of profitable niche sub-segments. For a full business model diagnosis, I highly recommend a new reader visit my original diagnosis over the company, linked below.

Q1 for the company was business as usual. However, the pricing on premium growth came below expectations at 7% when the past 6 years have all seen double digit price increases.

Analysts have seen this deceleration of growth. In response, the stock has dropped 30% from all-time highs (ATHs) and is trading at the cheapest trailing PE multiple since 2016. Analysts expect this to be the start of a “Soft-Market” for the E&S industry. However, the business is still executing on its growth strategy, has pricing power to maintain growth, and can maintain its growth trajectory.

This writeup will diagnose the current state of the insurer, including Operational and Financial updates from the first quarter. The purpose of this diagnosis will be to update existing investors on new developments and provide an expected rate of return for the security at these trading levels.

Hope you all enjoy! The format for the post can be found below.

Table of Contents

Quarter Highlights

Financial Results & Industry Updates

Guidance Updates

IRR Expectations

Conclusion

1. Quarter Highlights

Highlights for the quarter included:

Diluted earnings per share increased by 76.7% to $4.24 compared to the first quarter of 2023

Diluted operating earnings(1) per share increased by 43.4% to $3.50 compared to the first quarter of 2023

Gross written premiums increased by 25.5% to $448.6 million compared to the first quarter of 2023

Net investment income increased by 59.1% to $32.9 million compared to the first quarter of 2023

Underwriting income(2) was $65.1 million in the first quarter of 2024, resulting in a combined ratio(5) of 79.5%

Annualized operating return on equity(7) was 28.9% for the three months ended March 31, 2024

“Our business continues to generate best-in-class returns as we benefit from underwriting and technological competitive advantages and favorable E&S market conditions. We remain confident in our ability to deliver long-term value for stockholders as we execute our strategy to generate consistent and attractive underwriting profits while managing our capital prudently,” said Chairman and Chief Executive Officer, Michael P. Kehoe.

That was the official statement on the earnings release. However, I think the below quote from the Conference Call transcript was the best summary of the quarterly results that could be provided by management:

“Overall, the P&C industry continues to work through challenges around frequency and severity, catastrophies, inflation in general and rising loss cost, in particular, and expanding and at times, unpredictable towards system, litigation financing and loss reserve adequacy, in particular, on longer-tail occurrence lines. All of these challenges and a variety of others should contribute to drive stability and growth opportunity in the market for the foreseeable future.

Beyond the industry-wide challenges noted above, it's our own business strategy here at Kinsale that drives our confidence and prospects for significant future profit and growth. It's the focus on smaller risks within the E&S market, the absolute control we exercised over our underwriting and claims management operations, the best-in-class service level and risk appetite we provide to our brokers and our technology-driven low-cost operation that differentiate Kinsale from competitors across the industry. And in many ways, the competitive advantages we have become even more significant as the market becomes more competitive in the years ahead” - Chairman and Chief Executive Officer, Michael P. Kehoe on Q1 2024 Conference Call.

2. Financial Results & Industry Updates

Overall, these results in a vacuum are fantastic. Similar to my thesis breakdown methodology to determine growth drivers, I think updates should be as simple as talking about the growth drivers. In Kinsale’s case, I think the growth drivers that are relevant to investors are:

Gross Written Premiums (GWP), Net Written Premiums (NWP), Ceded, and Unearned Premiums

Investment Income

Insurance Ratios: Combined, Loss, & Expense

Industry Dynamics

GWP, NWP, Ceded, and Unearned Premiums

Below, I labeled the 10Q topline numbers and wanted to highlight a few key dynamics at play with Kinsale’s growth numbers:

GWP, Ceded, NWP: With growth numbers of 25.5%, 66.7%, and 17.4% respectively, Kinsale’s book of business growth continues being fantastic. The major callout here is that the reinsured or ceded premiums growth was much higher than GWP growth. This change made it so that the policies on Kinsale’s own balance sheet (NWP) grew significantly less at 17.4%.

To provide some commentary on these figures, Kinsale’s management team has significantly grown the topline in previous years and with many unknowns on the horizon (inflation, rate cuts, etc.) the management team is deciding to go forward more cautiously and maintain proper reserves for the company’s growth. The team has decided to reinsure larger portions of collected premiums, holding less policies on Kinsale’s own books, and maintain a more conservative balance sheet position going forward. Below is a quotes from the Conference Call I felt was relevant:

“This had the effect of effectively repricing the reserves for the longer-tailed casualty lines. The uncertainty created by this longer payout pattern in some lines reinforces the wisdom of our conservative approach to reserves that Mike referred to earlier. There are a lot of unknowns in setting reserves, there's a lot that can happen in between the setting of those reserves and the paying of the claims. So it's incumbent on us to err on the side of caution.

And while inflation has moderated somewhat from its highs, it would seem that it will take longer to get back to the Fed's target of 2% that many prognosticators had forecast. And that may continue to cause reserving issues for those of our competitors in a weaker financial position.” - Brian Haney, President & COO, Q1 Kinsale CC.

This quote has important implications for Kinsale’s ability to grow in the future. Essentially, with inflation remaining elevated for longer, insurance companies are needing to maintain higher reserves and be less aggressive with their present underwriting, due to payouts being larger than expected in the future with higher inflation expectations. For a well-capitalized insurer, like Kinsale, this provides opportunity for higher reinvestment income and continued market share growth.

Change in Unearned Premiums: The Change in Unearned Premiums dropped by 33% this quarter. I did not find any commentary on this change but this line item on the Income Statement significantly increased Topline Numbers year over year, due to more revenue being recognized upfront. This line item likely affected the decision to reinsure higher portions of premiums and maintain a more conservative balance sheet going forward. This allows the Net Earned Premiums to still increase 30.5% year over year. In combination with rapid investment growth, the overall revenue growth came in at a blistering 42% year over year.

Investment Income

Investment Income: A big callout to make is that Net Investment Income increased 59.1%. This is largely attributed to Kinsale growing its float rapidly over the past year and new investments yielding higher returns than previous years.

No significant changes in investment strategy

New money yields are averaging in the mid-5% range and an average duration of 2.8 years consistent with year-end.

Current annualized yield on investments is approximately 4.15%. In 2023, the average yield on investments was 3.4%. Meaning investment yields will increase from 3.4% to mid-5% over the next few years if rates stay elevated.

Rating on Portfolio is maintained at AA-.

Investment income should continue increasing rapidly the next few quarters as recently invested capital is yielding much higher rates than previously invested capital in 2021.

Total Revenues (CAGR): Total revenue grew 41.7% Year over Year. Although there were many ins and outs to get to this number. The book of business growth slowed this quarter but Kinsale is still rapidly growing within the E&S space, taking market share, and underwriting profitably. The total revenue CAGR, assisted by investment results, is within the company’s average historical range and shows the company’s strategy can be molded to effectively deal with different market conditions.

Insurance Ratios: Combined, Loss, & Expense

Investors that have already read up on Kinsale Capital should be familiar with Kinsale’s unique combination of growth and profitability.

It is particularly important to highlight in the slide above, Kinsale has a comparable loss rate to the best insurers on this list. However, the Richmond-based insurer also has the best expense ratio by far, even with the highest growth in premiums among its peers.

This quarter followed the trend of the past. Kinsale’s Combined Ratio for the quarter was 79.5%, compared to the 3 month period last year which was 78.8%. I had two major callouts here for investors:

Loss ratio increased slightly from the previous year. This is not entirely surprising given how hard market dynamic that has been present in the previous years. A slight increase in the loss ratio was expected.

The expense ratio actually dropped but this was largely due to the reinsurance trends and Kinsale collecting higher fee revenue that has lower OpEx requirements.

Overall, the combined ratio increased only 1% and with annualized operating ROE at 29%, Kinsale is operating with healthy profitable underwriting.

Investors should expect Combined Ratios to increase over the next few years from their lower ratios today. The Loss Ratio is likely to increase back to a normalized level from here. However, Kinsale’s Expense Ratio should scale as time goes on and will decrease by a few hundred basis points over the next few years.

Industry Dynamics

Investors that are familiar with the E&S industry are aware that the industry as a whole has had a tremendous run the past few years, taking large amounts of share from the admitted market. However, there is likely to a reversion to this trend at some point as Admitted carriers likely start carrying some Specialty underwriting again post 2020-2023 Era.

With the E&S industry increasing at a double digit CAGR the past 6 years, analyst got quite spooked when Kinsale management indicated that pricing grew in the 7% range year over year, indicating slower growth and a reversion on the horizon.

Analysts seem to have felt this was indicative of a macro slow down and a likely start to a soft market. However, it is smart to consider the fact that Kinsale is spread across a variety of business lines and is still in growth mode. I collected the following quotes from the Quarter 1 Kinsale Conference Call to provide some insight on these industry dynamics:

"We continue to see growth in most of our divisions, Casualty and Property continue to grow, and we are seeing particularly strong growth in our small property, entertainment and general category divisions, as well as in some of our newer divisions like High Value Homeowners and Commercial Auto."

"We operate in a wide range of markets, not one monolithic market. And there are some areas where there's much more competition and [ growth ] that's harder to come by, such as our Life Sciences and Management Liability divisions."

"Submission growth continues to be strong in the low 20s for the quarter, consistent with most of 2023. This number is subject to some variability, but in general, we view submissions as a leading indicator of growth. And so we see the submission growth rate as a positive signal."

[Analyst]

“Mike or Brian or Bryan, what do you make of the state E&S data that seem to show a meaningful deceleration, particularly in March? What do you make of that? And did you see anything like that in your own experience? Any kind of volatility at the end of the quarter?”

[Michael Kehoe - Executive]

I don't know what to make of it, Mark. Other than the E&S market has grown at a double-digit clip for 6 years in a row. And so I think the 7% growth in Q1 is not a surprise. [ I don't know how ], if there can be lags in the reporting of some of that data or not. So I don't really have anything additional there.

Our overall growth slowed slightly compared to where it's been. But given the dramatic growth of 40%, give or take, over a 6-year period, it was not unexpected, right? We're still growing at a very rapid rate, and we're still very optimistic about growth prospects looking forward.”

I think the commentary from the call was good regarding the state of the industry, even if the future isn’t quite as attractive as it is in the rearview mirror. The wholesale brokers still have strong submission flow. Some lines are slowing down. Some lines are moving ahead with strong growth.

For a specific callout, Property Values (via the US S&P Shiller Home Price Index below) have been doing well in April, despite near record high mortgage rates. However, these recent rates in combination with a strong Casualty market signal a strong Q2 report rebound for Kinsale’s Gross Written Premiums.

Overall, the industry growth has definitely slowed but to Michael’s point, this wasn’t unexpected. On these results, the stock dropped nearly 20% and is down 16% today from the print of this earnings report. With Property reverting and Casualty continuing its growth, the market reaction is potentially overblown with both of Kinsale’s main divisions in the P&C market signaling much stronger growth going forward.

Investors might appreciate the nuances of dissecting these past results. However, many investors simply want to know one thing though, what does the long-term future look like?

3. Guidance Updates

Kinsale Capital’s management team does not provide formal guidance for investors. I did find a few quotes interesting from the call though. After reading through the transcript notes, I’ll provide some color on my perspective:

[Michael Kahoe] “We don't forecast growth. We won't offer growth guidance, but I think that's an interesting observation, Mark. Tough comp” (Referring to Q2).

[Brian Haney] “Bill, this is Brian Haney. So yes, obviously, what we're trying to do is maximize the wealth building for the investors, and I think that starts with maximizing underwriting profit. And so what we're really trying to solve for is what combination of ROE and growth is the right number to maximize that?

I think you're absolutely correct. We don't have to have a 30-ish ROE to maximize book value. So in certain areas, we are looking at cutting rates to grow faster. In certain areas, in some of the Casualty lines, we don't need to do that because we're growing fast enough as it is. So yes, division by division, we're looking at that exact calculation regularly.

And again, the goal is not to have a certain -- the goal is to drive as much value to the company and the investors as we can. But there is definitely room. And you're right, being a low-cost operator provide us a leeway, I think that our competitors don't have."

[Michael Kehoe - Executive] “And just following up on that. That's why I made the comment earlier about the fact that in a more competitive market, that low-cost feature of our business model becomes even more powerful.”

I know Kehoe and his team don’t provide formal guidance, but I think a few broad pieces of commentary about forward results and the growth drivers that we covered in the past results seem relevant: Growth, Profitability, & Investments.

Growth: Industry & Market Share

It’s no secret that Kinsale has gained significant market share in previous years. With the addition of industry growth and pricing being in the double digit range the previous six years, the company’s premium growth has compounded at a 40% CAGR.

With Market Share growth with GWP nearing 2% of the Market and NWP being 1.25%, Kinsale has taken significant market share in a growing industry.

With Kinsale’s network of large wholesale brokers, the company’s distribution and incentive structure with these brokers is set up so that the insurer can continue growing in the Excess and Surplus industry over time. It’s a good assumption that Kinsale in the coming years (5-10 years) reach a high single digit market share within the E&S market.

Pricing will continue growing in-line with real inflation, which has shown to be higher than the CPI data indicates. With Kinsale’s freedom of rate and form, investors can safely assume pricing growth to continue being in the mid to high single digits range. With Commercial Property being 26.3% of premiums in 2023, the Property segment needs to rebound for Kinsale to return to its previous growth mode.

Recent data with United States Commercial and Industrial Loans appears to indicate that there has been a slight rebound in April, May, and June for loans for this segment. This growth, fueled by likely lower interest rates in H2 2024 or H1 2025 are likely to have an inverse relationship on Commercial/Residential Property prices.

Between pricing growth through Property/Casualty, market share growth, and ability to target mid-20s ROE in certain product lines, and investment income’s rapid growth, Kinsale capital can maintain the company’s 15-20% growth target for many years to come.

Profitability: Loss & Expense Ratio

Let me preface, there is no way to with any reasonable accuracy to predict insurance loss ratios. Insurance companies can only manage risk. However, there are times when insurance companies are in clear hard markets and are over-earning. This is likely one of those times in history.

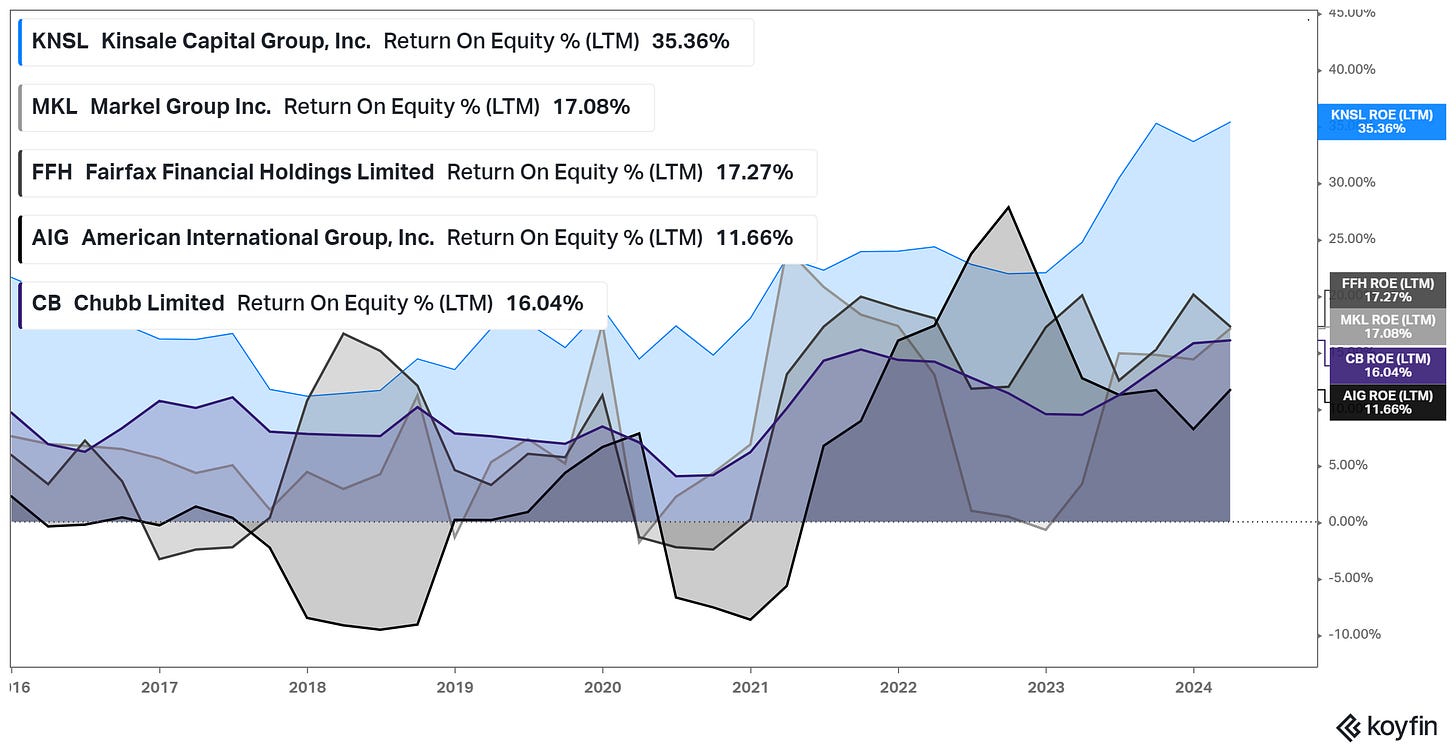

To indicate this, I charted the average ROE’s for the largest publicly traded insurance companies that hold a substantial share within the E&S Market. However, this obviously does not include Berkshire or Lloyd’s of London, due to these not being as valuable for an insight into the E&S Market.

Many of the competitors of Kinsale (Fairfax, Markel, AIG, Chubb) all have historically high return on equity metrics right now and are making more profits from their capital.

That being said, Kinsale has significantly invested in their workforce to scale the company’s ability to underwrite and manage claims, which contains the bulk of their workforce. The insurer is still growing their employee count year over year, while becoming more efficient with higher revenues generated per employee.

With this dramatic efficiency, it is likely that the expense ratio over the long terms scales a few hundred basis points further, down to the 17-19% range. The company long-term has an incrementally scalable business that will likely become more efficient, not less. In the short to medium term, it is likely that loss ratios revert to a more historic 60% experienced in 2017-2019. The expense ratio will likely normalize short-term in the 21-22% range, leading us to a more normalized 80-82% combined ratio. However, long term I would expect for the Expense Ratio to scale to 20%, where it currently resides, assisted by recent over-earning.

Assumption: Long term normalized Combined Ratio of 80%.

That being said, long term loss ratios should fluctuate in this consistent range while the expense ratio continues to scale and allows the company to underwrite more policies while maintaining high profitability, elongating the company’s growth prospects. Now, we’ve covered about some of the expected downsides. However, insurance companies make money two ways: Underwriting & Investments.

Investments

If you remember in the past results, the Net Investment Income grew 59% year over year. This was no accident. See, the length on the company’s bonds is 2.8 years and the investments are being reinvested at a 5.5% rate, instead of a 2% rate indicated at the AA yield rating 3 years ago.

Due to this new reinvestment rate on the maturing premiums now yielding 5.5%, instead of 2%, and more float being added, investments and investment income will likely continue its rapid growth in coming quarters.

Below, I put the company’s Total Investments over time to show the average reader of the company’s rapid growth.

An interesting aspect of this is that Kinsale’s investment income has varied between 20% and 45% between good and bad underwriting years. 20-30% for really good combined-ratio years and then 40-45% for bad years where the combined ratio is above 84. Right now, investment income is already 33% of earnings. Meaning growing 50%+ can easily sustain 15% EPS growth alone, without any underwriting EPS growth in the short term.

Just for context, I pulled together Kinsale and its competitors Investments over time and put this data on a Log Chart so that the reader can see the rate of change difference without the size of the dollars distorting things.

This shows you the trends of growth in the Insurance industry by Kinsale’s main competitors. Their assets are growing. However, Kinsale (shown in blue) has nearly 10x’d their investment portfolio in 9 years.

The dual growth engine of investments and underwriting income that insurance companies utilize is definitely a resilient growth business model, especially when the Insurer can have near unmatched combination of underwriting profit margins and premium growth. With Investments and Premiums growing proportionally in recent years, it is safe to assume Total Investment Growth will be similar, albeit slightly slower than revenues. This makes sense with Premiums being proportional to Investments for an Insurer.

I will admit, this is not on my priorities to model out in a granular fashion and this assumption is more of a placeholder.

Assumption: Total Investments growth of 15% per year with yields staying around the 4% range, assuming AA- 3Y yields drop around 150 bps from the 5.5% reinvestment rates today.

4. IRR Expectations

Now, my napkin math return numbers I usually give are a simplistic mechanism to estimate returns. With Kinsale’s dual earnings growth machine with Investments and Underwriting profit growth, it gets a bit more complicated.

Investments:

Currently sits at 33% of earnings

Can assume long term AA- yields of 4% from today’s reinvested rates of 5.5%. Trailing rates for the Last Twelve Months is sitting at 4.3% though so we will use this number.

Investment Portfolio growth of 15%

Napkin Math: 33% * (4/4.3) * (1.15^10) = 1.25x

Underwriting:

Currently sits at 67% of earnings

With an average 5.5% pricing growth and 5% market share via NWP, we can make an assumption of 20.5% premium growth, ahead of management’s conservative high teens target.

Combined Ratios dropping to 80% from 79% today, assisted by 100-300 long-term Expense Ratio improvement

Napkin Math: 67% * (79/80) * (1.205^10) = 4.27x

Underwriting + Investment Growth: 4.27x + 1.25x = approximately 5.5x topline assumption

Multiple:

Long term the PE ratio should decrease further to the 15-20x range, from the LTM ratio of 25x today

Capital Return:

Management has diluted shareholders on average 1.7% per year for the past 6 years. With 2021-Present averaging .67%. With dividend yields averaging .3% per year, a safe assumption is .5% net dilution per year.

Total Return: (5.5x) * (17.5 / 25) * (99.5% ^ 10) = 3.56 ^ .1 = 13.9% IRR

A near 14% expected return over the next 10 years is not a staggering number. However, you saw how many inputs affect that number. Rates and inflation could remain elevated increasing pricing growth; Securities purchased could amp up investment returns; Kinsale could increase lines of business and Specialty admitted business faster than expected, prolonging its Growth Curve; Multiples could remain elevated with growth lasting longer than expected. I think 14% is a relatively safe Baseline assumption with the company’s business model being resilient and it is likely to outpace this return estimate going forward.

This exercise is still valuable for us to understand what we are potentially underwriting to receive market beating forward returns. It is not meant to be an exact science, more an approximate understanding of forward dynamics. As time goes on, we can mentally adjust our model depending on how the results play out.

5. Conclusion

Hopefully this provides you with a comprehensive update on the company, and if you’re a new investor to the name, I hope that this writeup convinced you to dive a bit deeper.

This is a unique business model that is resilient to many economic conditions, has multiple avenues for book value and EPS growth, and can likely continue to appreciate over the long term.

I hope you enjoyed this article. If you made it this far, please like, subscribe, leave a comment, and share! Also, feel free to become a Paid Subscriber where I will be releasing future Premium Only articles, Portfolio reviews, and you have Access to message me anytime! Nothing is expected, everything is appreciated.

Have a great day y’all!

Hi William, thanks for you great article!

It looks like Kinsale's numbers are too good to be true. I checked their Google reviews and there are a lot of recurring bad reviews. It’s sound like a non ethical practices.

In my opinion, it's a red flag, and I'd love to hear your thoughts.

For any1 interested in Jun CPI numbers, here are my estimates with near-perfect track record so far:

https://open.substack.com/pub/arkominaresearch/p/jun-2024-cpi-estimate?r=1r1n6n&utm_campaign=post&utm_medium=web