Kinsale: Built for Efficiency and Profitability

A Purpose Built E&S Insurance Carrier

On April 25th, 2024, Kinsale Capital group reported some fantastic results for their Q1 2024:

Gross Written Premiums increased 25.5%

Diluted Earnings Per Share (EPS) increased 76.7%

Diluted Operating Earnings Per Share increased 43.4%

Reported a Combined Ratio of 79.5%

If those results don’t make sense to you. Rest assured, I’ll solve that in this article. The stock price and investors did not seem to appreciate these results though. After this drop, I felt that investors do not fully understand the company, its competitive advantages, and why the company is winning business in the first place. So, I set out to write a blog post covering why the business is compelling here!

Disc: I own shares.

With this goal in mind, I am setting out to cover the following topics to provide an in-depth overview for investors learning about this company and industry:

Insurance & Excess and Surplus (E&S)

Insurance Supply Chain

Kinsale’s Business Model

My Explanation

Operations: Underwriting, Claims, IT

Financial Metrics

Risks

Summary

1. Excess and Surplus (E&S) Industry

Everyone knows generally how insurance works. As a customer, you give a company your hard earned money upfront to purchase a policy. This policy then allows you to receive compensation IF something occurs during the time of your coverage.

If you’re reasonably versed in insurance, you know that the insurance companies take all the premiums they collect each period, called the float, and invest them before the coverages are paid out. This allows the insurance firms to make investment income on the premiums they take ownership of.

In addition to investment income, the insurance companies have a few other metrics to determine their underwriting profitability: loss ratio, expense ratio, and combined ratio. To assist with these concepts, I built the cheat sheet below:

Hopefully this makes some conceptual sense. The amount left over after paying out the losses (paying out for the the bad events occurring) is essentially the insurer’s Gross Profit. Then, the expense ratio takes into account the Sales, General, and Administrative (SG&A) costs that includes the underwriting, litigation, and claims management. Both the LOSSES INCURRED and OPERATING EXPENSES are expressed as a percentage of the premiums collected, via the LOSS RATIO and EXPENSE RATIO. It’s not rocket science, right?

The most important concept is that the Insurance companies need to operate with a combined ratio less than 100% to have profitable underwriting. If you subtract the combined ratio from 100, you essentially get the Operating Profit Margin, EBIT margin (EX: 100 - 90 = 10%).

Hopefully this provides a great high-level conceptual look into how to analyze insurance companies! For the sake of this post, I won’t go into more detail but here are some additional resources if you’re needing more clarity:

https://www.investopedia.com/terms/i/insurance.asp

https://www.thestreet.com/how-to/how-do-insurance-companies-make-money-14971728

Purpose of the E&S Industry

For this section, I want to dive further into the E&S market specifically. We’ll discuss the sector’s purpose within the broader insurance industry, and the effects those differences have on insurers and the insured.

As the reader can diagnose, the E&S market lies underneath the broader Property and Casualty (P&C) market, primarily under the Commercial lines. Commercial are lines that serve businesses, while the Personal lines serve individuals.

What is the difference though between E&S and Standardized Insurance (aka Admitted) and frankly and why should we care?

Standardized Insurance: Standardized insurance with what’s called admitted carriers are insurers that deal with easy to underwrite risks. Due to their ease of underwriting (Auto, Home, Life, etc.), regulations have been put in place limiting the amount that insurers are able to charge for these policies.

E&S Insurance: In comparison, Excess and Surplus are filled with hard-to-analyze risks. Let’s clarify though… that’s not riskier by nature. It is simply HARDER to analyze risks. Regulations allow these insurers to have what’s called “freedom of rate and form”. Meaning that these carriers form their policies and can charge whatever they want to underwrite the risks. Examples of these polices are a new axe throwing entertainment venue, cybersecurity data breaches, insuring celebrity body parts, event cancellations, vintage wine collections, rare gemstones and jewelry, the legal cannabis industry, and catastrophe via earthquake or hurricane, etc.

The E&S market can be much more lucrative but does take on unclear and hard to underwrite risks. This can hurt inexperienced firms that don’t know how to underwrite the policies. The key concept of this section is that the E&S Carriers have the freedom of rate and form. What’s interesting too is that the rate of bankruptcy in the E&S Industry is actually lower than the Admitted Carriers!

The E&S market and Standard market has items flow back and forth though, like an accordion. If a policy type moves to E&S or vice versa, it can flow back and forth. That being said, the E&S market has grown substantially faster the past few years and is already around $100B in size.

*SPOILER: Kinsale Capital is a 100% E&S Insurer and has one of the lowest loss ratios and expense ratios consistently in the industry. But how?? Keep reading to find out!

Also, if you like this breakdown and want more free business and industry breakdowns like this, please subscribe or pledge a donation subscription to keep this channel free! Nothing is expected and everything is appreciated.

2. Insurance Supply Chain

The insurance supply chain was the area that I knew the least about before researching this post, and I’m happy that I dug down deeper. This context is essential for the reader to understand why Kinsale is able to grow so effectively and be so profitable. Below is a diagram I created, mapping out the high-level supply chain of the Insurance Industry:

Few key concepts I want to touch on:

Customers: Not too much to touch on here. Customers buying insurance can be individuals, families, small or medium businesses, and large corporations. The size of the policy and ease of underwriting typically decides the level of competition to sell these entities business.

Distribution: This is the fun layer!

Captive Agents: This is just a fun fact. These are agents that sell insurance but only for one carrier (EX: State Farm, Allstate). They sell only that carrier’s products and do not always give the best deal for customers. However for customers, they are a friendly person to talk to with expertise in insurance. In exchange for commission sharing with the larger insurance firm, they get the insurer’s pooled brand, marketing budget, administrative benefits, and an actual salary/benefits!

Independent Agents/Brokers: These are similar to Captive Agents. However, these individuals can sell to whatever insurance products they want or have access to. They are independent. These brokers can work by themselves or as part of a larger firm. According to the Insurance Journal, “In 2022, the estimated total number of independent property-casualty agents and brokers in the U.S. stands at 40,000.”

Wholesale Brokers: True to their name, Wholesale Brokers are distributors of policies that they receive from Independent Brokers to the Carriers that they do business with.

The wholesale brokers are a distributor in the traditional sense. However, they do not have physical inventory. They have policies. The independent brokers source deals and utilize the Wholesale Brokers, who make money from primarily commissions and fees. The commissions coming from selling the policies to an insurer. The incentive for Wholesale Brokers is to earn the most commission and fees as possible, selling the most business as possible either through volume or commission rate. This is a dangerous concept in insurance for insurers, but since the Brokers don’t carry the policies to maturity, they do not take on any of this risk, only potential loss of future business.

MGAs: In essence, these are broker businesses that source deals, gather policy information, and do large portions of the insurer’s job with underwriting policy risks. For this blog post, they are a little less relevant though since Kinsale sells primarily through Wholesale Brokers.

Insurers: Insurers are the insurance companies that operate with a float, which we covered earlier. These are the companies in the insurance industry that individuals usually think of. Think GEICO, Progressive, National Indemnity, State Farm, etc. The only real nuance to this section is how the insurers source their deals.

Direct Insurers: These insurance companies go directly to the customers to source deals through online channels or whatever means they decide. These will usually be Admitted Carriers (Standardized), such as GEICO, Progressive, or other Carriers that directly go to customers to source business. This is typically a B2C relationship from the examples I found while researching.

Insurance Carrier: Direct Insurers are still insurance carriers. However, they are a special type. There’s no real name for a carrier that doesn’t do direct distribution to customers. For this type of carrier, they will be sourcing deals primarily through brokers (MGAs, Wholesale, or Independents).

Reinsurance: The concept of reinsurance distribution is a little less pertinent to this article. The concept is that insurers might not be able to handle the amount of risk on their Balance Sheet for the policies they’re carrying. Therefore, they will reinsure to another Carrier those policies for a commission, almost acting as a broker of sorts. The deal structures are unique though for each situation, whether that be risk above a certain dollar amount lost, pure commission based reselling, or whatever the terms may be. Reinsurance is an important concept in the industry for risk management and retaining business.

Now, I know that was dry. I did feel though that understanding (1) the specifics about E&S insurance and (2) the distribution of policies will help give contextual evidence as to why Kinsale is operating so effectively.

3. Kinsale’s Business Model

Theoretical question here… have you ever worked in a business and said something along the lines of, “If we could create this entirely from scratch with what we know now, it would be so much better”?

Well, Michael Kahoe (CEO) and Brian Haney (COO) must have had that same thought in 2008-2009, because they both left James River, a large E&S Carrier, to found Kinsale Capital together from the ground up with all the lessons they had from the previous 7 years of operating in the C-Suite together.

Their approach for their new insurance carrier was relatively simple in concept:

The high level ideas I take from this slide are below:

Focus on E&S on Small Accounts: Smaller accounts have less competition than larger accounts and Kinsale has “rate and form” freedom to charge larger premiums to smaller customers, allowing for effective profitable underwriting. However, small accounts take both expertise in underwriting nuanced areas and a cost-effective distribution network to insure these policies.

Broad Spectrum of Hard-to-Underwrite Risk, 100% In-House Underwriting: By focusing on a variety of business lines, Kinsale does not have any one business line with significant “blow up risk” and it allows Kinsale to grow its business over time by adding new lines to insure additional areas. A key part is that Kinsale also does not delegate ANY underwriting to brokers. This means the business controls the policies that it insurers, the premium amounts required, and it can maintain its quality of underwriting over time! It can also get better at insuring these “hard-to-place” risks over time as it collects the proprietary data on how their policies perform.

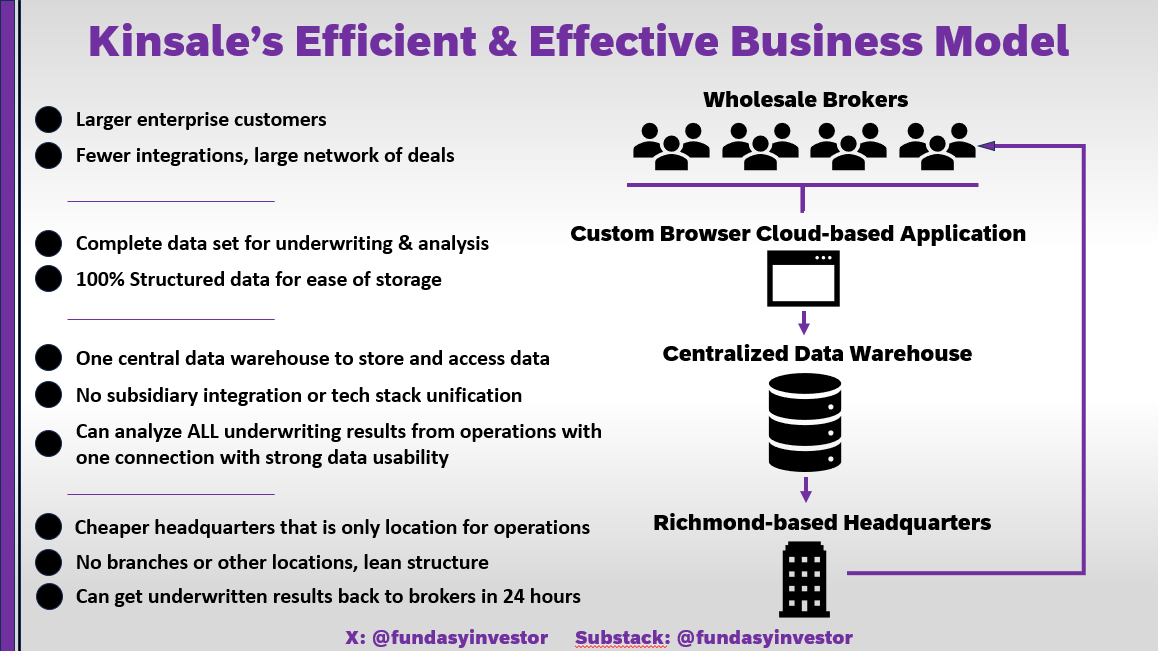

Technology/Analytics: Every company says this but few implement it effectively. More on this in a second but here are the company materials. If they don’t make much sense, no worries. I plan on deep diving on this slide to add more context but give it a read through!

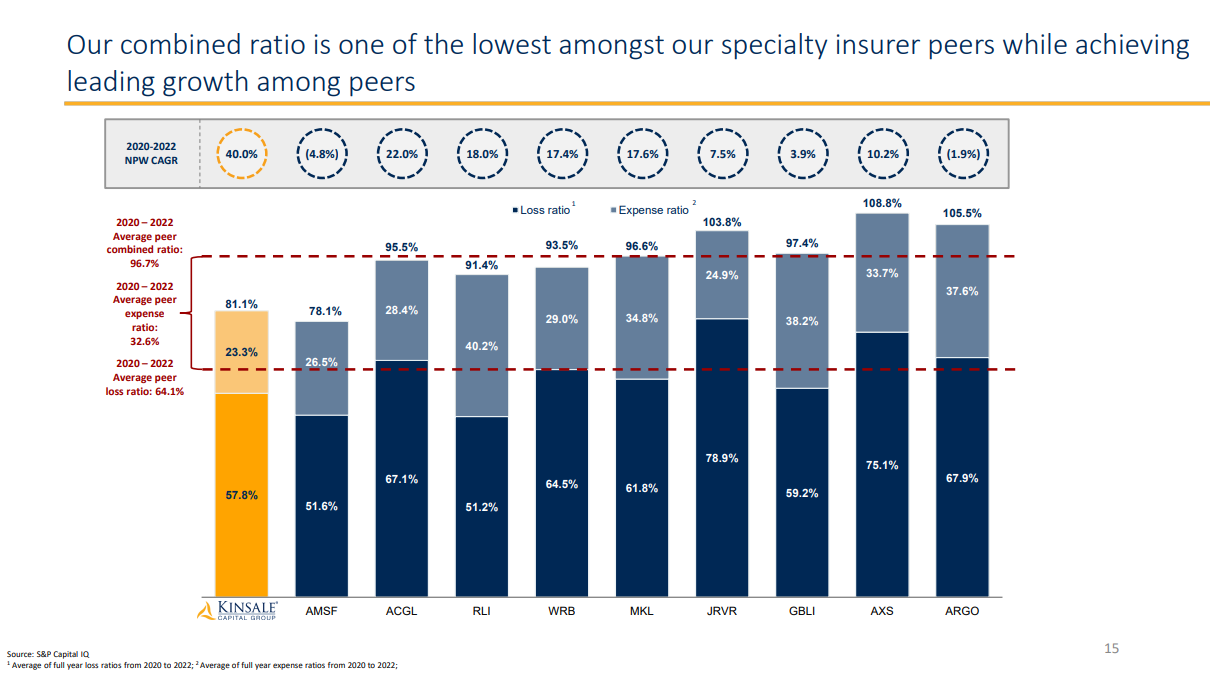

Best combination of High Growth and Low Combined Ratio: They’re not wrong. Check the slide below for evidence.

While growing significantly faster than peers, with a 40% CAGR of net premiums written (NPW) collected, Kinsale has managed to underwrite with a lower loss ratio and a significantly lower expense ratio than any of its peers. A callout here is that Kinsale does not have the lowest loss ratio. However, the expense ratio for their growth is best in class. Meaning that their underwriting is effective but its process is also highly efficient!

In my opinion, Kinsale’s business presentation materials are good but they’re not great for a nuanced view of why their business has succeeded. Looking through the materials I kept trying to figure out what Technological Advantages Kinsale had that made their Analytics better and their business more scalable!

It took digging down through the 10k and my analytics background with mapping data structures when it clicked.

My Explanation

Kinsale’s business has a high degree of control, efficiency, and overall simplicity in its design. At a high level, brokers input the policy information into Kinsale’s browser application, the data is stored in Kinsale’s data warehouse, Kinsale underwriters decide whether to underwrite the policy, and then Kinsale gets back to the broker on the decision and quote, if applicable. Simple design!

From the 10k, the company had the follow points made:

“Utilize browser based platform approach to develop applications…

When broker makes submission, information processes through browser-based intake and underwriting systems. Eliminates costly data entry steps in underwriting process and permits underwriter to focus on underwriting the account accurately and rapidly…

Since inception, we have been capturing and analyzing our data and building, over time, a robust repository of information to improve decision making. This it the data warehouse. The design permits us to capture an array of statistical data, collected by the policy management system at Kinsale.

Data warehouse is easily searchable, collects and labels information in a consistent format and contains key underwriting and claims information we collect at every level”

2023 Kinsale 10k

Kinsale controls all aspects of the information flow. The inputs from the brokers are all electronic-based on one platform. This means that there’s no offline submissions from brokers, incomplete data sets, or different structures of data from different databases. It’s all controlled within Kinsale’s process creating efficient system architecture design with no subsidiaries or M&A complicating the process to underwrite and the effectiveness. Everything can be managed and analyzed centrally, creating a strong competitive advantage.

As the 10k mentions, the underwriters at Kinsale are not wasting time entering in data and are entirely focused on underwriting, increasing efficiency further. In addition, Kinsale has accurate and structured data coming from one source. This means that the company can focus more efforts on building quality analytics and predictive decisions on its one database of archived underwriting data.

Many conglomerates now a days have different databases for each subsidiary, continent, and country. These are complicated to integrate and are nearly impossible to create centralized solutions for!

Shree Viswanathan, founder of SVN Capital, had some unique insights here:

“Most of them, like Markel, Berkeley, AIG, have been around for a while and have made numerous acquisitions. The legacy systems within these companies can be extensive, having 20, 30, 40 legacy systems. For example, I mentioned that Mike Kehoe (Kinsale CEO) used to be at Colony, and even today, without specifying the company, there is at least one company I know of that uses the same enterprise system that Mike Kehoe used when he was at Colony in the nineties. These are outdated systems, and transitioning to a new platform isn't straightforward. In contrast, Kinsale, being a relatively new start, has developed a unified enterprise system that everyone within the company uses.

This structure allows for an incredibly quick turnaround. What do I mean by that? A submission comes into Kinsale, and they respond within 2 to 24 hours, unlike Markel and others, where it might take up to a week to even reach the specific underwriter. These advantages might not translate into tangible numbers on financial statements, but they're the unique edges that Kinsale has cultivated over time.”

- LONGRIVER Podcast: Shree Viswanathan LINK

Shree covered this concept perfectly, but I hope his information now hits your ears differently with the context applied above. Due to this business design, Kinsale can turn around quotes to their Wholesale Broker network much faster and effectively than their competition.

Wholesale Brokers are trying to maximize their volume of policies written and the commission rate they receive on each policy. Kinsale by being so efficient though and doing 100% of the underwriting in-house is actually the low-cost provider in the industry. The company said the following in their 10k:

“In 2023, we paid an average 14.5% of GWP to the brokers, we believe this is slightly lower than the average commission paid by our competitors. Believe specialization in E&S, combined with high degree of service, including rapid response times, permits us to manage our commission expense as part of our overall management of the underwriting process. Also, do not contract our underwriting to program managers or general agents, which typically requires a higher commission level to compensate work on behalf of the carrier.” - Kinsale 2023 10k

Kinsale does business with some of the largest Wholesale Brokers in the industry and does have a concentration with a number of large brokers that it does business with:

For year end 2023, largest brokers:

RSG Specialty $316.5M (20.2% of Kinsale’s GWP) - $2B in revenue

AmWINS Brokerage $286.8M (18.3% of Kinsale’s GWP) - $2.4B in revenue

CRC Commercial Solutions $178.7M (11.4% of Kinsale’s GWP) - $40B in annual premiums across all lines of business

No other broker accounted for more than 10%

This is a risk having such concentration with a few set of wholesale brokers. However, wholesale brokers have no risk of carrying policies so are not at a large risk for bankruptcy. Also, I personally like the fact that Kinsale deals primarily with Wholesale Brokers because it’s a mutually benefitting relationship. Kinsale provides volumes via quick turnaround to the brokers, and the brokers provide good deal flow to Kinsale who does all the work with underwriting, along with getting them a quick response. This allows the brokers to process more policies and earn more in total commission over time.

Everything about Kinsale is efficient and meant to maximize profitability.

Simple system architecture design - no subsidiaries, all centralized, allowing for lower expense ratio.

100% underwriting in-house, lower commission rates and more profitable underwriting.

Small/Medium accounts to have less competition - average policy in 2023 was only $15,000, while being efficient due to only dealing directly with Wholesale Brokers.

100% in the E&S market where the company has rate and form freedom.

Located in a cheap metropolitan area with only one location, no branch network.

Props to Shree from SVN Capital for inspiration for the list above. With all that being covered and hopefully a burning passion for the insurance industry in your belly, let’s get to the numbers to see how Kinsale has done from a financial perspective!

4. Financial Metrics

This will be a shorter section today. I plan to cover the topline growth, margins, and efficiency!

Topline

Kinsale has grown at an amazing clip with an average revenue CAGR in the high 30 % since going public in 2016.

Kinsale’s rapid growth in premiums has led to the company stealing market share hand over fist the past few years. I expect this trend to continue. However, with Kinsale’s focus on small/medium policies, it is unclear how much market share Kinsale can take with still maintaining effective underwriting. Kinsale today via its Gross Written Premiums (GWP) owns about 2% of the $100 billion and growing E&S market.

The below graph utilizes NWP of which GWP is about 25-30% higher most years.

Margins

The company has also underwritten fantastically, with an net income margin routinely above 20%, combined ratios 86% and below every year (14% EBIT margins), loss ratios never exceeding 64%, and expense ratios routinely in the low 20s and continuing to drop as the business scales.

The graphs below show these dynamics over time:

Efficiency

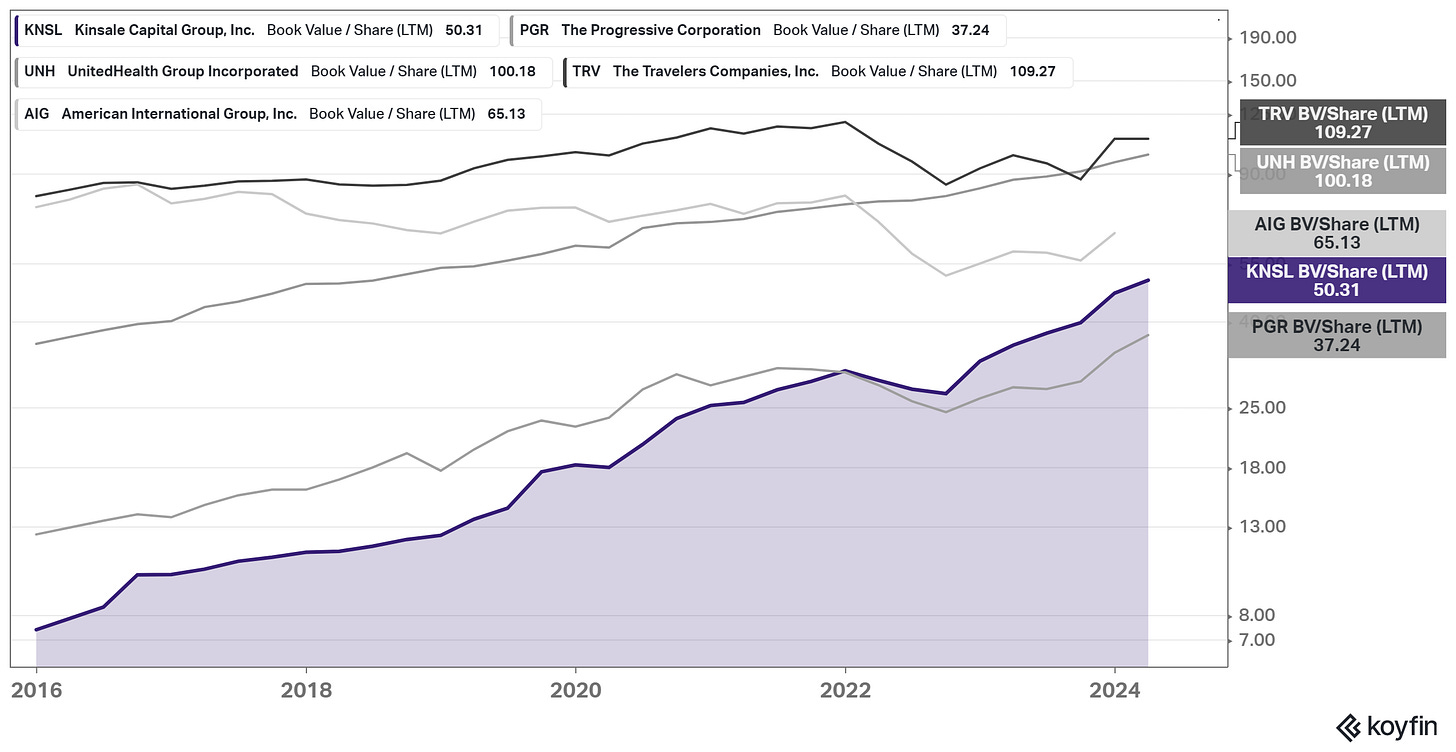

The margins for this carrier are best in class. This combination of growth and profitability does not exist in the insurance industry today. This definitely shows up in the numbers as you compare Kinsale’s Return on Equity (ROE) to all the public insurers, while simultaneously utilizing less leverage.

Kehoe has gone on record to say that through the company’s use of leverage, premiums it chooses not to underwrite, investment style, and reinsurance policies, it leaves business on the table every year. However, the company wants to grow safely and avoid excess risks.

In addition to managing the balance sheet more effectively with less leverage (not less risk though, due to insured areas), Kinsale is also the most efficient with their revenue per employee by a long shot. This being largely due to the efficient structure described above!

In summary, Kinsale is:

Growing faster than its peers

Growing more efficiently than its peers

Utilizing less leverage than its peers

Scaling better than its peers

All of these factors contribute to Kinsale growing its Book Value per Share much faster than any of its peers and providing much better returns! [NOTICE: Logarithmic graph, not linear, to show rate of change]

With that though, let’s get into the risks!

Risks

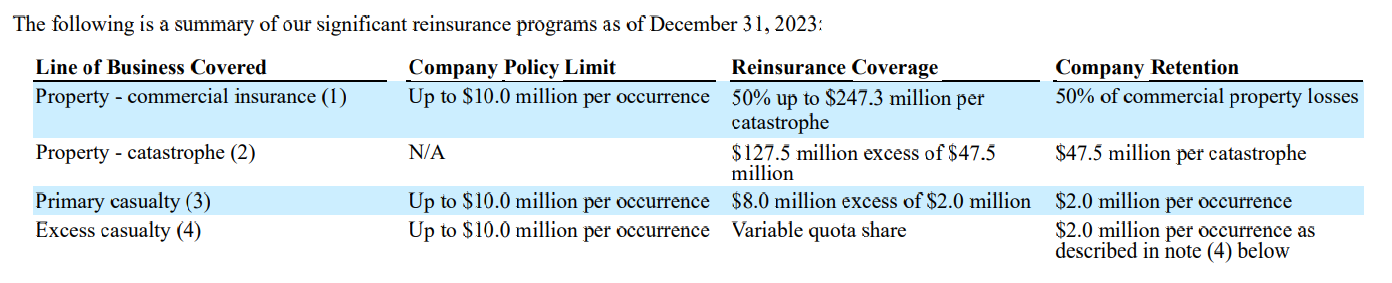

Underwriting Risks: Kinsale is in a riskier area of insurance, being the E&S market. The risks include catastrophe, which includes Hurricanes in Florida that affects the company’s property division. These will be larger events that will inevitable occur some years and definitely hurt margins. However, these are definitely one-off events, and assuming the insurer doesn’t blow up, the company will be fine. The 10k gives adequate detail on the policy to ensure for 100 and 200 year events and avoid concentration in any given Property segment to avoid outlier blowup events.

In addition, the 10k goes through the in-depth reinsurance policy to manage outlier events above a certain threshold of losses. In return, Kinsale loses margin each year via commissions and reinsuring a portion of its profitable premiums.

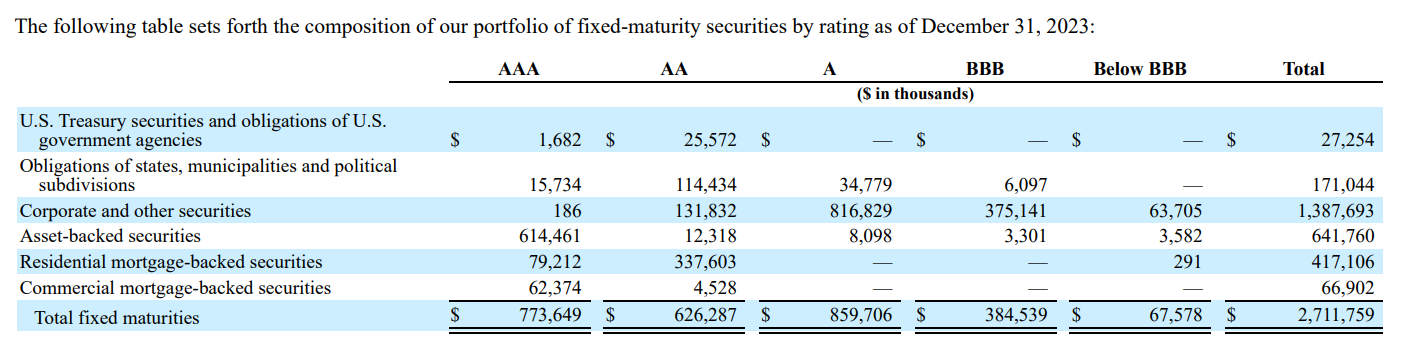

In addition, Kinsale also has a collection of highly rated reinsuring companies and an extremely conservative investment portfolio, due to growing its business is more accreditive than extra margins via riskier investments.

The average credit rating on Kinsale’s investments is an AA- and has an average duration of 2.8 years.

Competition: Every investor I bring this name up to brings up competition. I hear phrases like, “Well insurance is a commodity. Someone will just underbid them.” I hope that via the business process analysis and analyzing HOW Kinsale is winning business in this article, I have covered this risk. However, the large drop in earnings on April 26th, 2024 is largely due to investors believing that the “Hard-Market” is over in insurance and a “Soft-Market” is approaching. A Soft Market is when rates are high, new competition enters the industry, and established insurers are not able to win business as easily. I have hard from my network that Kinsale chooses to underwrites only 10-15% of the policies it receives though. Although I couldn’t manage to confirm this information. It sound reasonable though and would allow Kinsale to continue growing, even through a soft market.

Regulation: Regulation in the E&S market can change on a state by state basis but Federally there’s not many blanket policies that occur. This section within the Kinsale 10k is lengthy. I’d recommend going to read it directly.

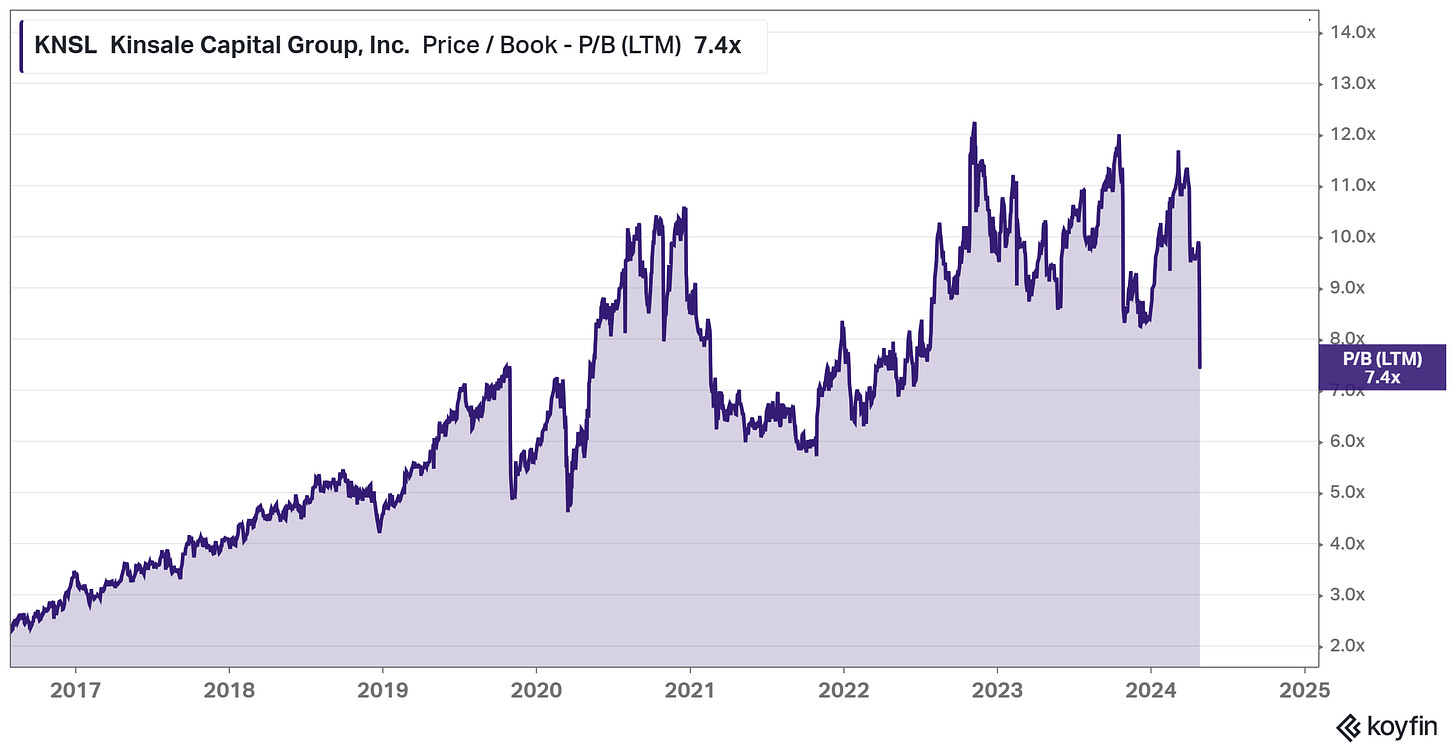

Valuation: Valuation is definitely a concern with this name. However, with this recent pull back on the Q1 earnings with the soft-market expectations, the valuation is much more reasonable. It is likely that bottom-line margins do not hold as high as they are currently though. This will affect the valuation, due to Kinsale over-earning this past few years.

Summary

In summary, I think Kinsale is a long term winner that is systemically taking market share in a profitable area of insurance to be underwriting, when done effectively. The management team is best in class and they have created a business that will continue to win over the long term.

I will be along with them on the journey, as Kinsale is one of my largest positions. DISC: I own a ton of shares.

If you like this breakdown and want more free business and industry breakdowns like this, please subscribe or pledge a donation subscription to keep this channel free! Nothing is expected and everything is appreciated.

Great write-up! I’m definitely hooked to learn more about the company now :)

Really well done writeup, Will!