I’ve always considered this blog a form of public documentation of my own investment process. In many cases, I write my blog posts so that I myself can understand what I am writing about more thoroughly.

With that in mind today, this blog post will be about my large addition to an existing holding that I made on Friday, Dino Polska. My original post from May of 2023 is linked below:

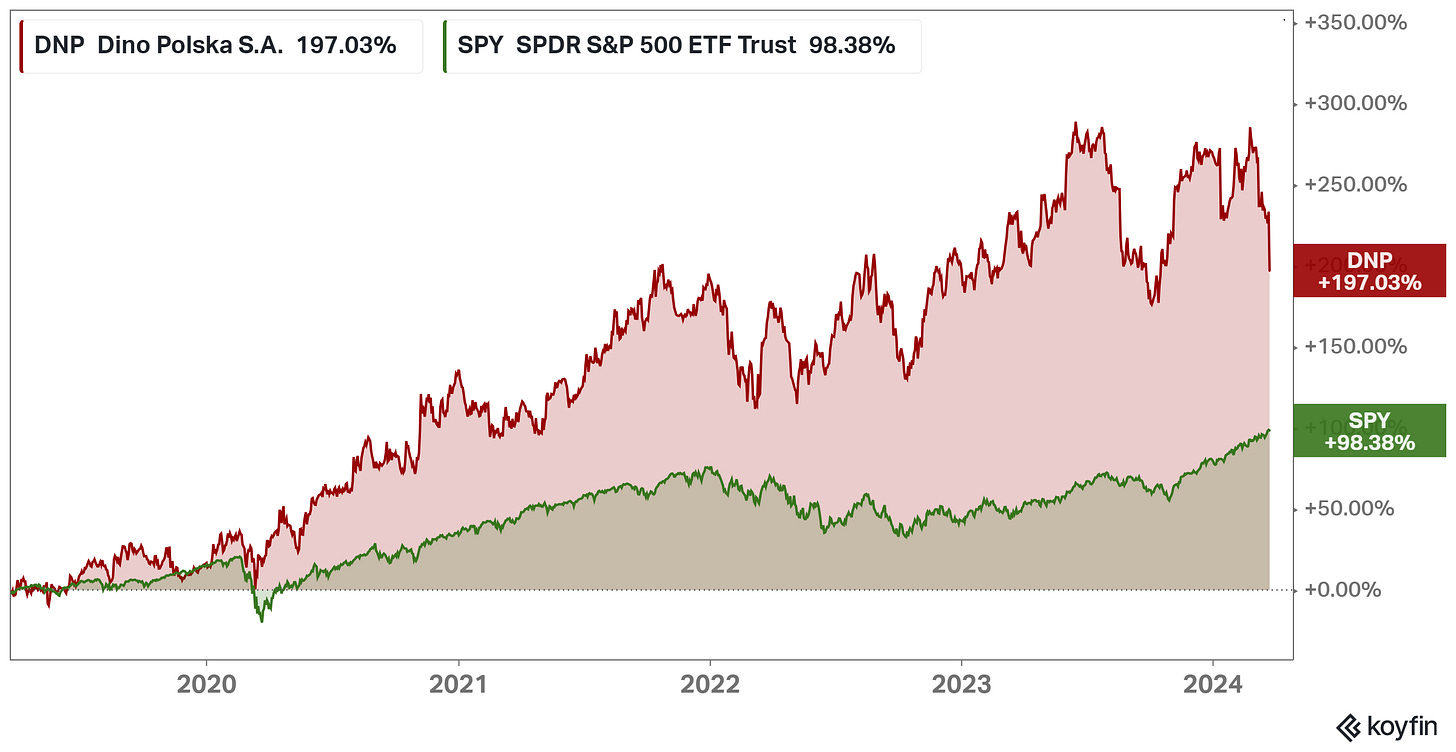

Since I added my initial position last year, my holding has not exactly done fantastically in all objective metrics, especially against the S&P500. With a yearly underperformance of -8% vs +28% for owning a freaking Index!

Although the initial results are not exactly inspiring, I am writing this to you intentionally after the stock dropped 11% on Friday after a solid, although not spectacular, earnings report to document the process.

This post will cover this idea: Why I added to my Dino Polska holding on Friday.

A Long Term Winner

Although the stock this past year has not done exceptionally well, the business over the past 5 years has been a major winner. What has contributed to this growth though and can it continue?

However even with the outperformance, there has been another factor occurring over the past 5 years… multiple compression. Dino’s LTM PE ratio has decreased from 39x to 26x (-33.4%) vs the S&P 500’s LTM PE expansion from 20.5x to 27x (+32%).

In all objectivity, the business was (1) expensive but apparently warranted 5 years ago and (2) the business does deserve a lower multiple today with more growth already baked into the results and operations.

Over the past 5 years, the business has executed on the strategy set out by management:

continuation of rapid organic growth in the number of stores,

continued growth in LFL sales revenue in the existing store network,

consistent improvement in profitability.

LFL sales have increased at a 11% or greater rate every year for the past 8 years, assisted by organic growth and higher polish inflation. However over the same timeframe from 2016 to today, the Polish Złoty has remained relatively similar in value to the USD, only decreasing 1% in its total exchange rate.

The store network over the past 5 years has increased from 977 to 2406. In combination with the strong LFL Sales, Dino Polska has increased revenue at an average CAGR of 35% for the past 5 years, along with increasing its store density in all the areas of existing operation.

After increasing LFL sales and the density of stores in its operating regions, the company’s profitability and efficiency have improved dramatically.

ROA has increased

Operating profits as a percent of gross profit margins have increased from 30% to 32%, even with gross profit margins dropping from 24.50% to 23.1%.

All in all, Dino Polska has had a fantastic past five years. Even with the PE ratio shrinking by 33%, the stock has outpaced the index the past few years by a sizable margin.

However 5 years ago, the opportunity was much larger; the store network is much larger; the opportunity much smaller. Where is the opportunity today though? What does a reasonable IRR calculation look like?

Opportunity Today

Investors can never look only in the rear view mirror when making investment decisions. So today, let’s put some assumptions to paper to see how the long-term returns look even with the returns the past year not being super stellar.

Let’s talk (1) topline growth (2) margins and (3) capital allocation.

Topline

There’s no “best” way to estimate the total store count estimate the business can grow to. I would say that an average “mature” density for each province will be at least 18 stores per 100k people. The most mature province today being 15.4 (14.2 last year) per 100k population. With all of Poland with this density, the total store footprint would be approximately 6,700 stores, which is 2.8x the current count.

With these additions over the next 10 years (2.8x) and the LFL sales increasing 6%, the total revenue CAGR should come in at a minimum of 17.5%. This is obviously without any additions of (1) gas stations to existing properties [Patent Link Here] (2) pharmacy sales going forward and (3) international expansion, which is highly likely to occur in the next 7-10 years.

Margins

Net income margins in the past few years have increased slightly, with an obvious Covid pull forward. However, with the growth drivers of more stores increasing purchasing power, increasing density in stores, and owning all the land for its locations, I’d expect net income margins to increase to at least 6.50-7% meaning Operating Margins would be north of 8-8.5%.

Capital Allocation

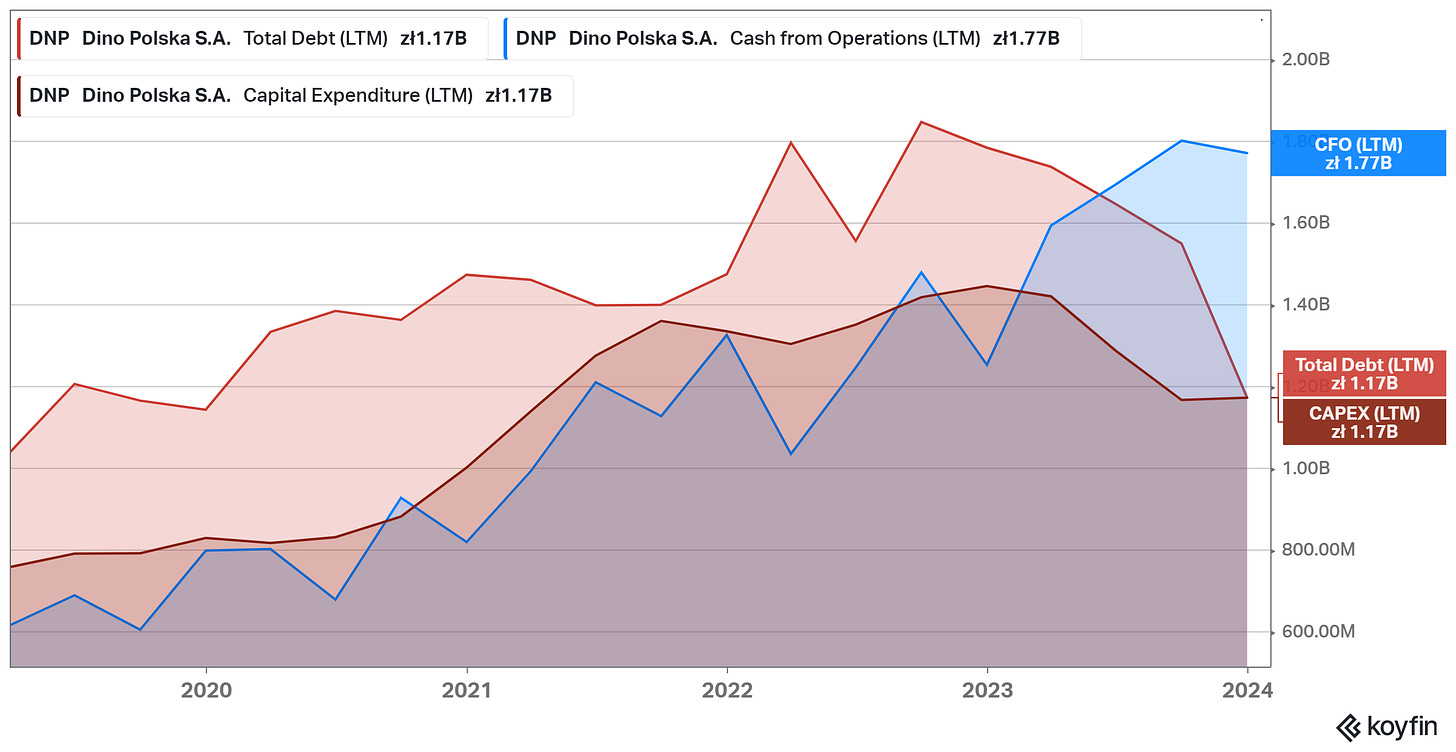

I think the biggest change over the next few years will be in regards to the balance sheet and capital allocation. There are a few things on my mind with this item:

Thus far, the company has NEVER returned cash to shareholder via dividends or repurchases. However, the shares outstanding haven’t increased a single share since going public, meaning shareholders are valued.

The company’s Balance Sheet has dramatically improved in comparison to Cash From Operations (CFO) growth and CapEx requirements.

The question is… what will the business do with the extra cash in the next few years once CFO increases further in comparison to CapEx/Debt? In my mind, you have a few opportunities:

Growth Internationally

Growth in LFL sales through product expansion: pharmacies, gas stations, or any other avenue management thinks of

Dividends or Repurchases

However think on this… Tomasz Biernacki founded Dino Polska in 1999. Since then, he has increased his store count systematically and only let up once Polish Interest Rates have gone to levels not seen since 2010. In all this time though, the company has had the peddle to the meddle for store growth, until recently.

A big hiccup for new store growth is the fact that stores from Planning to Opening day take approximately 2 years to complete. This means that for stores to open today, the Planning had to have started in early 2022, when the macro background looked much less certain.

I think with the following assumptions, it becomes very easy to underwrite Dino Polska for a good long-term investment at today’s 4% earnings yield:

(17.50%) Conservative topline growth of 17.5%

Net Income margins of 6.50% from today’s 5.48%

A High PE Multiple at a 5% yield (20 PE) from today’s 25.8 PE, contributed by likely either (1) International Expansion or (2) Capital return to shareholders

ForEx: With a conservative annual 1% loss in PLN value, resulting in 90% of total’s exchange value

UNKNOWN: The kicker for returns in the future will be what the company does with the cash on the Balance Sheet. Even without this though, the napkin math returns looks as follows:

[ (1.175^10)*(6.50/5.48)*(20/25.8)*(90%) ] ^ .1 = 1.156 (15.6% Annualized CAGR)

Summary

In summary, I believe today’s prices offer a very compelling long-term investment opportunity. Insert your own assumptions if you feel like I have been either too bullish or too bearish in my underwriting. However, I feel like with realistic assumptions that provide a margin of safety, today Dino Polska offers a great long-term investment that can beat the Indexes.

That is why I added to my position on Friday after the 11% drop on short term margin worries.

If you liked this article, please consider sharing, subscribing, or donating a $5/month subscription to keep these articles free for everyone! Nothing is expected but everything is appreciated. I write these article for my own benefit and love that investors from around the world care enough to read my work!

Thank you guys. Have a great day!

I think Dino is interesting and has been on my watch list but as it matures it's multiple will come down further. Jeronimo, Carrefour, Tesco and Koninklijke all trade at much lower multiples. So it's more likely to trade down to low teens than 20x PE. So valuation can still offset the growth and result in a lower return.

I linked to your post in my post for today - Emerging Market Links + The Week Ahead (April 1, 2024) https://emergingmarketskeptic.substack.com/p/emerging-markets-week-april-1-2024

My concerns would be:

1) The funds got into Dino Polska early and lately they have been profit taking...

2) Alot of podcasters and Substackers etc have been talking about the stock compared to other so-called EM stocks just as the "smart money" is getting out or taking profits...

3) Its not clear where future growth will come from. At some point, they will have Poland saturated - if not already as they already have one store for every so many Poles (sorry, can't remember the figures I have seen...). Expansion eastward to Russia and Belarus is probably out along with Ukraine given its a war zone rapidly loosing population.... Germany, Czech, Slovakia etc would be completely new markets with probably different retail laws even though they are EU...

4) At some point, the stores will need to be remodelled by somebody e.g. landlord, tenant or Dino if they are the owner... Same with any refrigeration etc equipment as it will need to be replaced - not sure the lifespan of such equipment...

With that said, they do have the right business model when it comes to format size. Here in Malaysia, Speedmart and K.K. no frills smaller format chain stores have saturated every neighbourhood and housing estate selling mostly the shelf stable basics (and it seems like at higher prices than supermarkets!) while Indomaret and Alphamart have done the same in Indonesia (albeit there is still room for growth there given Indonesia's size and they have multiple formats + the latter expanded into the Philippines)... And of course, the USA has its dollar store chains...