1. Introduction

Domino’s: Shareholders Have Made Dough

If you haven’t heard, Domino’s Pizza is one of the best performing stocks of our time. The last 10 years the stock has trounced the indexes, and it hasn’t been close.

Furthermore, with dividends being reinvested, Domino’s actually returned 2,435.59% over a 10 year time frame. That’s a 37.65% compounded annual rate of return.

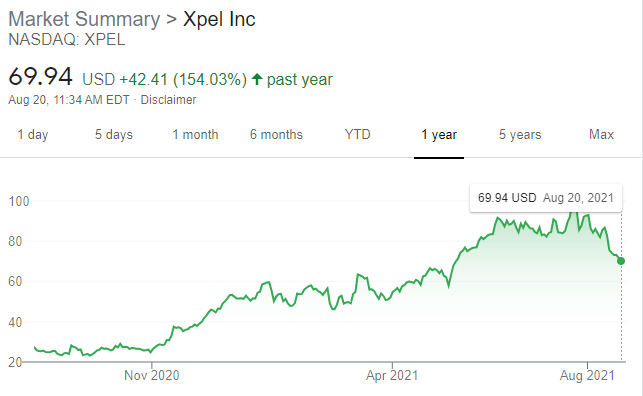

So, when a Twitter friend asked me, “What stock will be the next Domino’s?” I was intrigued. I set out on my quest and found my best culprit: Xpel Inc ($XPEL).

First, we need to go into an in-depth analysis over how Domino’s stock performance managed to even outpace the best performing FAANGs.

Article Layout

This will be a long post, so get ready your coffee/bourbon/beer/psychedelics ready and let’s get this ball rolling.

Introduction

How Domino’s Did It

Business style

Operational Excellence

*How Stock Buybacks Work

Management’s Share Strategy

Putting it all Together

XPEL, the next Contender?

The Business

Business Style Similarities

Operational Excellence

Management’s Present/Future Share Strategy

Conclusion

*This part is purely for people that are unfamiliar.

2. How Domino’s Did It

Business Style

Everyone knows Domino’s Pizza. They are undisputedly the best pizza fast food chain! If you disagree, comment your favorite alternate fast food pizza, and I’ll tell you why you’re wrong.

No one believes it though when you tell them that the company has outperformed Amazon in the last 10 years. It’s just such a simple business! That’s the point.

The franchise model allows Domino’s to focus on supplying product to their franchises, reinvest capital to operate and advertise, and the rest can be returned to shareholders. They don’t have to hyper focus on the ins and outs of everyday operations with the franchise operators taking care of a lot of the work.

Also, Domino’s sells a physical product. When it comes to digital products, software engineers will usually be able to redesign a new look, rack up advertising, and can make an effort to compete. I would argue it’s harder to dislodge Domino’s though. A physical product is much harder to reach with the scale Domino’s has than a digital one. This is definitely an added security and allows for extremely stable cash flows.

In short:

Physical product at scale

Franchise model, high return on capital

Domino’s Pizza is the most *well-rounded* pizza brand

Operational Excellence

This section will be focused on a lot of numbers. Here’s a chart over the last 10 years of Domino’s financials.

Things to note:

Revenue is stable, and it increases every year. It’s compounded annual growth rate (CAGR) was 10%.

Gross margins trend upwards. They increase around 10 percentage points. 2011 was coming off the Financial Crisis but still. This is extremely efficient operations.

Net income went up at a CAGR of 16.5% for the entire 10 years.

This probably won’t be repeated over the next 10 years, because increasing gross margins another 10 percentage points would be near impossible.

Between increasing margins and selling more pizza, the company had a *recipe* for success. The share price compounding at 37.65% is much more than the net income increasing at 16.5% though. So, how did the management do it?

*How Stock Buybacks Work

Many new investors don’t understand how issuing and buying back stock works and more importantly how it affects the value of each share. Due to this, I’m going to go into this to provide background for investors unfamiliar. If you know this already, feel free to skip on to the next section.

It’s a simple concept though, a stock/share is a piece of a business. If you add all the pieces together, you get the sum or the value of the business.

Market Cap (Value of the Business) = # of Shares * Price of Each Share

EX: $100 Million Market Cap = 10 million shares * $10 per share

Now… what happens if you decrease the number of shares but the value of the business stays the same? The share price will theoretically go up, as long as the business isn’t affected and is stable.

EX: $100 million market cap = 5 million shares * $20 per share

The problem is… the opposite also occurs. If you increase the number of shares through executive compensation, bad acquisitions, or being very unprofitable, the price will go down.

EX: $100 million market cap = 20 million shares * $5 per share

This in its simplest form is how issuing and buying back shares works. There is a lot more to it, but this is the fundamental idea behind buybacks. If you decrease the number of pieces of a great business, each piece/stock needs to go up in price since the value has increased.

Management’s Share Strategy

Now, how does this affect Dominos?? If you were astute, you would have noticed this line within the table from above.

The company has systematically cut the number of shares from 62 million to 39 million over 10 years through buying back their stock. Another thing to notice, the company bought back a large number in 2015 and 2016. They went from 56 million to 48 million. This is because their stock was cheap and they could buy back more shares at a lower price.

In essence, the company buys back shares consistently, has a stable growing business, and massively increased profitability.

Putting It All Together

Now, do you remember from the first table when I told you that the company increased its profit (net income) 16.5% a year? What do you think happens to profit per share as you decrease the number of shares?

Domino’s increased their earnings per share (EPS) by 7.25 times, while net income only went up 4.6 times. Once you combine this increase with dividends being reinvested and the company going from 21 times earnings in 2011 to 41 times earnings in 2021, you get the 37% per year.

(7.25 times EPS)*(2 times 2011 valuation)*(~1.3 times from reinvesting dividends) = 19x share price.

The rest probably comes from how they utilized their debt and just general market variance. That’s a high level estimate though for how they managed to achieve those returns. The recipe for success: grow revenue, increase margins, buy at a low multiple and decreases shares or keep share count reasonable.

Now, onto our third section! I will ask though… if you’ve made it this far and you like the content, consider subscribing for emails when I post. I’ve only posted 10 times this last year so you’ll never get spammed… because I would need to write more for that to happen. Hope you’re enjoying it so far though! You’re halfway there!! Sorry for the terrible WordPress subscription process too.

Type your email…

subscribe

Join 3,296 other subscribers

3. Xpel, the next Contender?

Xpel might not be the next Domino’s over the next 10 years. However, I’m going to go over a few of the aspects which make this business very similar to Domino’s and give my future projections.

The Business Model

According to the company’s 10k:

“Founded in 1997 and incorporated in Nevada in 2003, XPEL has grown from an automotive product design software company to a global provider of after-market automotive products, including automotive surface and paint protection, headlight protection, and automotive window films, as well as a provider of complementary proprietary software. In 2018, we expanded our product offerings to include architectural window film (both commercial and residential) and security film protection for commercial and residential uses, and in 2019 we further expanded our product line to include automotive ceramic coatings.” – 2020 10k

In short, Xpel makes money four ways:

Selling to Independent Installers/New Car Dealerships: This is a full “direct” package. They sell everything from the product, software for application, training and even marketing support. This channel accounts for 54% of revenues for the year ended December 31st 2020.

Distributors: In this “indirect” method, Xpel sells the right for companies to use Xpel’s brand “to develop a market or a region under [the company’s] supervision and direction. These distributors may sell to other distributors or customers who ultimately install the product on an end customer’s vehicle.” – 2020 10k

“In China, [the company] operate through a sole distributor under a distribution agreement, Shanghai Xing Ting Trading Co., Ltd., which we refer to as the China Distributor. Approximately 20.6% of our consolidated revenue for the year ended December 31, 2020, was derived from sales to the China Distributor.” -2020 10k

I personally see this as a medium risk. That’s a lot of revenue from one partner, which was shown in 2020 when sales slumped in China. In addition, selling anything in China is a bit shady, due to their “unique” business practices with technology they want.

Company Owned Instillation Centers: “XPEL operates nine Company-owned installation centers: six in the United States, two in Canada and one in the United Kingdom. These locations serve wholesale and retail customers in their respective markets. This channel represented approximately 10% of the Company’s consolidated revenue for the year ended December 31, 2020.” – 2020 10k

Protex Canada: The company owns a Canadian franchise, Protex Canada, which are authorized to sell the company’s automotive paint film and window film products. This subsidiary operates as a normal franchise model with franchise fees and royalty revenue.

Xpel has done a terrific job in expanding their distribution of their key products but also widening their product mix in a logical progression! Check out all the acquisitions and the progression of their business!

1998-2007: DAP: The software for instillation. They do charge a service fee for this software.

2007: Introduced Paint Protection Film (PPF) products.

2011: Expanded their line of films (their “premium” brand)

2016: Window film and expanding to Europe

2017: Bought the franchise, Protex, continued internationally, and expanded into office window film, which was a logical next progression

2019: Started trading on Nasdaq on July 19th, 2019, their stock is up 1100% since then

2021: Continuing their international expansion and product lines. PermaPlate Film will expand their window film to middle market dealerships and is expected to do $25 million in revenue and $6 million in EBITDA a year starting in Q4 of this fiscal year.

The company is expanding internationally and is increasing its reach from its humble San Antonio, Texas headquarters. As a Texan myself, I can’t help but root for them! There’s lots of room for the company to expand, add good products to their lines, extend their reach in marine/aviation protection, and continue to sell/market their current products!

Similarly to Domino’s, this is a stable business that deals in physical products. I think the company has a long way to build out this international distribution network and they can make some good product extensions along the way to increase their runway. This is a great business.

Operational Excellence

I think that similarly to Domino’s Pizza, this company has an efficient business structure. Their home office is essentially selling to franchises/dealerships that take care of the direct labor and they expand that channel to get more repeat customers. You combine that with adding more products on top of that channel and you have a compounding machine.

Now, let’s go to the financials!

Things to note here:

Revenue is growing nicely. They have a CAGR of 39% from the end of 2017 to now. The company just reported their Q2 for 2021, and they reported $68 million in revenue. To me, this means you can expect this trend to continue in the near term.

Massively increased gross margins. Management had this to say on the last earnings report:

“Gross margin for the quarter, grew 115.1% to $25.2 million and our gross margin percentage finished at 36.7% compared with 32.8% in Q2 2020. The gross margin in Q2 2020 was heavily impacted by lower direct sales due to COVID, but still we’re very pleased with our margin performance in the quarter and absent any extenuating macro factors, we expect to continue to improve our margin performance in the coming quarters.”

Expect higher gross margins in the future, check.

Their operating income margin is continuing to expand. This is a combination of gross margins improvement and operating expenses being a lower percentage of revenue.

The gross margins increasing and operating expenses dropping as a percentage are leading to massive net income growth, check.

The company has had the same number of outstanding shares for the past four years. This is good because it shows a shareholder friendly company. More on this in the next section.

Cash flows look very healthy.

In conclusion, you have a terrific business growing their distribution, product mix, and are growing revenue at a much higher rate than Domino’s 10% over the past 10 years.

Management’s Present/Future Share Strategy

This will be a short section! The company has the same number of shares outstanding, 27.6 million, since 2017. This is a massive plus. In addition, I actually like that the company isn’t buying shares back! You might be wondering why that is? I loved it when Domino’s bought their shares back so why would I not like Xpel buying back shares? To explain this point, let’s look at numbers.

Xpel right now is utilizing all of their cash to grow the business. They are growing revenue and profit at a very quick rate and their shares have traded at a expensive valuation. It would not make sense for the company to be utilizing their cash on buybacks at this point in their company’s life, especially with their expensive share valuation.

Domino’s on the other hand has much lower growth at this point in the company’s life. Their shares also trade at a lower valuation so the company can purchase their shares back at a much cheaper price. At a certain point, the world has a lot of pizza places. It makes more sense for them to return capital and make sure their stores are operating well.

Both companies are at different stages in their progression. Domino’s is a mature business and Xpel is in growth mode. However, it’s promising that Xpel, even in growth mode, is treating their shares like gold and not growing their share count. To me, this is promising. It shows that the company values their shareholders.This means that once Xpel matures, they can start buying back shares or start paying a dividend. This formula will probably lead to very long-term compounding.

The management will most likely maintain this vision too, given the fact that insiders own around 38% of the shares. This is great for alignment, and its promising for long-term growth.

Conclusion

Currently, Xpel stock is trading at an expensive 65 times earnings. This is a lot lower than the multiple a few months ago once the stock was trading around $100 per share, but it’s still expensive.

I need the share price to drop… 25 more cents for the PERFECT entry.

I think Xpel definitely has promise to be a very good investment over the next decade! I don’t think the stock will outperform Domino’s this past decade though. There were too many factors going perfectly for Domino’s. They had a very low starting valuation and a low comparative valuation for 10 years for cheap buybacks.

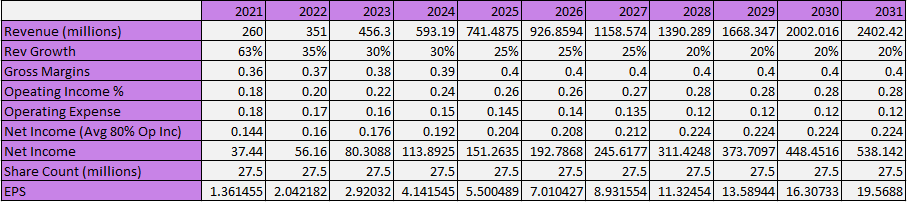

From a back of hand valuation standpoint, if earnings for the next 10 years compound at 30% and the valuation comes down to a more reasonable 30 times PE:

Valuation Shrinking (30/65) * Earnings Compounding (1.3^10) = 6.36 –> 536% increase

Even at earnings compounding at 30 percent, Xpel mathematically would have trouble reaching Domino’s 1900% increase. That being said, Xpel’s management has done very well at growing EPS. If the next 10 years has a big stock market pull back and Xpel’s management buys a lot of shares back at a cheap price, it could be possible. I’ll attach my own rough projections. I think this is a reasonably conservative projection. These are all my own opinions, so definitely don’t take these as gospel.

At a 25 times EPS in 10 years, you end up with around $500 per share though. That’s not terrible considering the shares today sit at $69. This leaves tons of room for error. Given the fact management has consistently outperformed in the past though, I wouldn’t underestimate them.

To wrap all this up all this analysis:

Revenue growing faster than 30% Y/Y, no signs of slowing

Gross Margins going north of 36.5%, this has a long way to go

My 10 year target is 40% gross margins, minimum

I made 40% the highest in my model. I think this margin will probably go higher though

Operating expenses are decreasing as a percent of revenue

Net income percent the latest quarter was already 15% of revenue. With GM increasing and OpEx slowing, you might have net income margins at 22% in 10 years

**Reasonable medium-term risk associated with their Chinese distributor

Domino’s > Pizza Hut > Papa John’s

I think you have the making of a good investment here.

If you enjoyed this article and made it this far, firstly I’m sorry. You must have been really bored. Secondly, please consider subscribing. Thirdly, maybe share us on twitter below. Maybe all of your friends would like to know about pizza, buybacks, and protective film companies.

Type your email…

subscribe

Join 3,296 other subscribers

***Do your own DD peeps. This is purely for entertainment, don’t sue me, other legal jargon, etc.

The post XPEL: Finding the next Domino’s appeared first on Fundasy Investor.