Spyrosoft S.A. ($SPR.WA): Consolidating A Large Boring Industry

My Long Thesis: A Boring IT Consolidator

WARNING: This is a boring Long-Idea over my most recent New Position. Disc: I own shares.

I like to be candid with my readers. This company is not flashy or exciting. It does boring work and is not trying to innovate. However, companies doing the boring work with a scalable growth strategy can perform exceptionally well given time, patience, and the right management team.

In the past four years, Spyrosoft S.A. has delivered nearly a 666% gain for shareholders. In that timeframe, the business has done exceptionally well:

Revenue has increased 1190% (98% cagr)

Shares Outstanding up 4.1% (1.1% cagr)

Book Value / Share is up 2100% (128% cagr)

EPS (Pln) is up 513% (62% cagr)

Hopefully that’s enough for a good teaser. With the historical share price moving at the hip with the consolidated underlying profits… it’s all about seeing that profit growth continue into the future!

*Speaking of the future, Paid Subscribers received this post in their email box on December 29th, 2023. I want to continue to provide free content to grow my audience and increase awareness of quality companies. However, I felt it important to also support myself as a writer, without alienating my readers. If you want to support my work and read my research earlier than the rest of my free subscribers, subscribe below for early access!

Thank you to all my 11 Paid and 950 Free Subscribers today though! I appreciate y’all and am working to give back to your generosity. Let’s have a great 2024!

IT Consulting & Development Industry: The White Collar Tradesmen

Now, I had to provide the hook on the company, but I do want to cover the Industry dynamics before analyzing the company. For the reader’s background, I work in IT Consulting, specifically in implementing SAP ERP Software. Therefore, I have a good general background on the industry, what drives growth, what advantages incumbents hold, and how these businesses ideally should be structured.

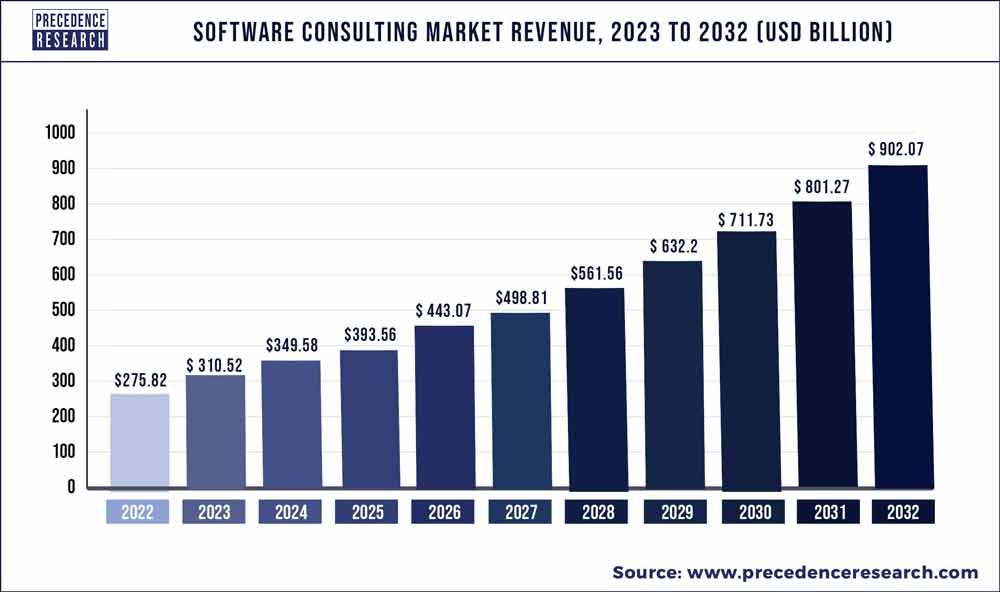

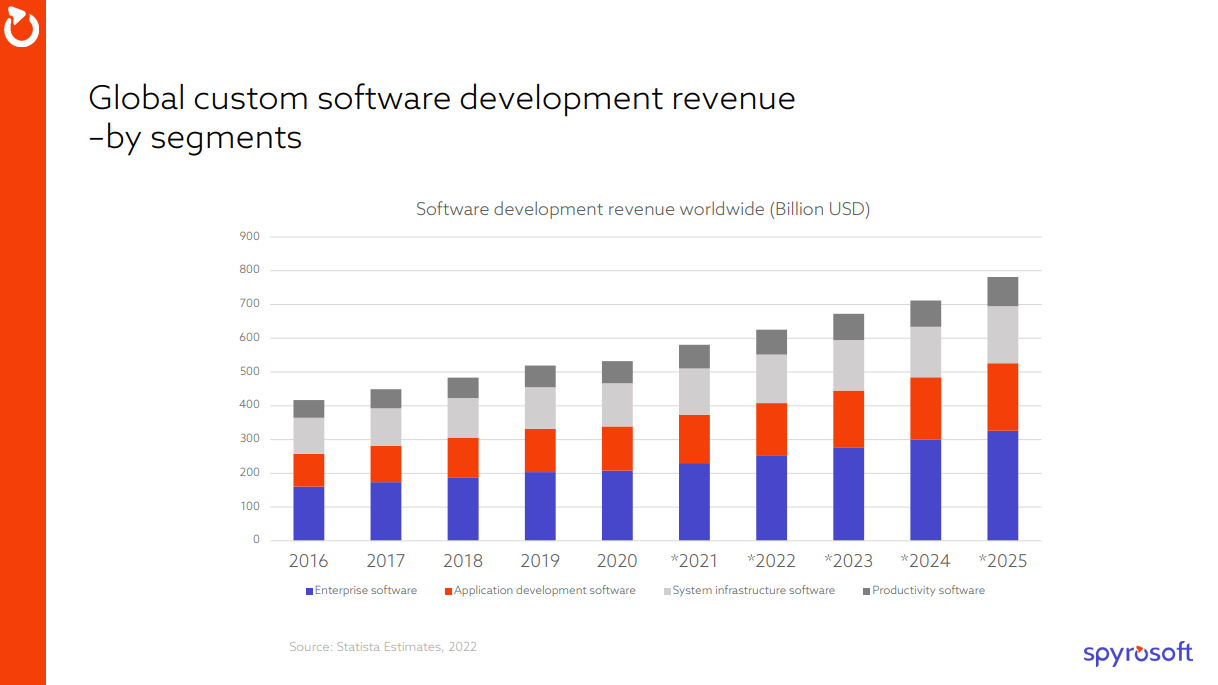

The IT Consulting & Software Development Industry is ridiculously large. All the “classifications” on types of work being done get a bit convoluted. To give you a conceptual idea though, here’s some charts over how large this market is:

Now, the goals of doing a “digital transformation” are very different than the process actually completing a digital transformation. The goals are usually:

Upgrade/change/adding software to gain new functionalities that you need for your business. To name a few IT areas that businesses want to upgrade or change:

E-commerce/Marketing

Payments

Supply Chain

Workforce Management (HR)

Tax

Finance (Reporting)

Security

Vertical Specific Solutions

Migrating existing On-Premise Software to a Cloud solution

Accomplish a more Operational Goal:

Increase automation capabilities

Change data analysis reporting tools

Create a more flexible or scalable solution for global requirements

Manage costs or budget

Meet compliance requirements, etc.

Now, none of the above information should be too surprising to Operational folks. This is simple in concept. Change software to meet the business needs, easy. However, this is a difficult task to actually execute on.

Digital Transformations: The Problems

To update a software tech-stack or “architecture” takes a lot of work that is referred to as a Digital Transformation. Officially defined as “the integration of digital technology into all areas of a business, fundamentally changing how you operate and deliver value to customers. It's also a cultural change that requires organizations to continually challenge the status quo, experiment, and get comfortable with failure” (The Enterprisers Project: A community helping CIOs and IT leaders solve problems).

In my own layman’s definition, it’s the process of transforming the digital infrastructure of a business and all the processes that go along with those activities. This seems simple in concept. Get a new software. Move the data from the old software product to the new one. Discontinue the old software product. Easy peasy, right?

Sadly, it’s not that simple. There are a number of factors that cause issues with Digital Transformations, and IT Consulting/Development Contractors are usually brought in to help assist clients through the process:

Audits - Finding the Right Tools

There’s thousands of software options for each business function. Which tools are right for the business and industry? What tools work well with the current tech stack? Is the current tech stack even right for the business? What’s the “industry standard”?

Consulting/Dev Companies: Have experts in specific areas. They’re not always right but they are dealing with the software systems in a hands-on role so clients trust them, sometimes too much. Essentially, it’s always nice to get a professional opinion/analysis, especially when someone’s job is on the line to get an implementation done well.

DevOps Process - How does a company start?

Consultants/Dev Companies: Picture starting an implementation from scratch and having no idea where to start. The Consultants and Developers are there to guide the implementation through the DevOps process, all the way from workshops, building the development environment, migrating to QA (Quality Assurance), conducting testing, and then going live in Production (Live Environment). If none of that sounds familiar… you’d probably be hiring a consultant too as a VP that has his ass on the line.

Custom Software - You’re running what???

Many companies have a combination of software, whether it be “out of the box” functionality, modified original software to meet business requirements, or fully customized solutions.

Consulting/Dev Companies: Maintaining customized software and integrating new solutions, that usually aren’t backwards compatible, is a difficult task. Developers are brought in to assist firms that don’t have the expertise to upgrade or maintain a tech stack.

There are many other reasons IT Consultants and Developers are hired. However, I think you as a reader understand the general thought process. Hire an expert to help get the system upgraded or back to working normally. If you want to discuss other nuances, feel free to leave a comment and I’ll get back to you! Now, let’s talk about the company I gathered you here for today, Spyrosoft S.A.

Spyrosoft S.A: A Unique Consolidator

What’s interesting in the IT Consulting/Development industry is that there’s not real really any solid competitive advantages enjoyed by the larger players, besides scaled overhead costs. There are definitely outsourcing advantages from hiring lower cost individuals to bill at higher rates or lower your contracts to take market share.

Essentially, this is not a one player take all industry and does not have significant scale-based economics factors at play. This means a small player with a good strategy and a good team can consolidate a small portion of market share and grow quite large.

Management

Spyrosoft S.A. was founded in 2016 when Konrad Weiske, a well seasoned IT professional at this point, had a vision for an IT business. He wanted to create a business for IT professionals after their stressful corporate years, in which they could have ownership of their business and create something.

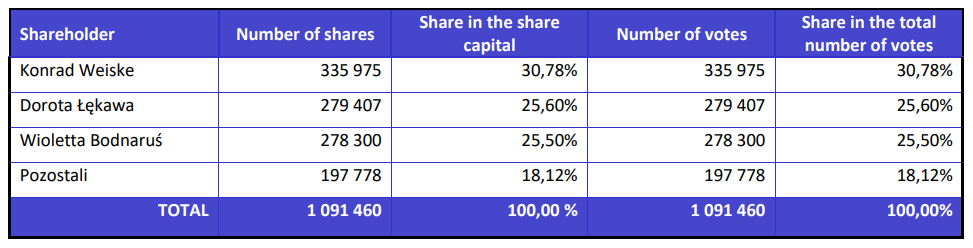

With this idea, Konrad and the three co-founders, Wojciech Bodnarus (CFO), Sebastian Lekawa (Board of Directors), and Andrew Radcliffe (CEO of Spyrosoft UK), came together and founded the company. 7 years later, the business is worth over $140 million USD. The founders have remained aligned with shareholders and still own nearly 80% of the company today.

An interesting thing to note here, Wojciech and Sebastian both own shares in their wives' names. In my opinion, that’s great confirmation bias. These are individuals that trust their personal partnerships and are required to have a high degree of integrity in their lives. That’s someone that I would trust to run a business honorably and be a good partner to shareholders over the long-term. Honestly, I might be reading into that too much though. I just feel like someone willing to put their wives’ names on something, would make them think twice about fucking over their entire shareholder base.

Below, I’m attaching an interview with Konrad Weiske for you to watch to understand his management style and vision for the business. Sincere and smart guy!

Microcap Club Leadership Summit:

In the following sections, I will be pulling direct quotes from this presentation to support my thesis. Thank you for the team over at MCC for pulling this together!

Business & Structure

To first quote Konrad on how he describes Spyrosoft:

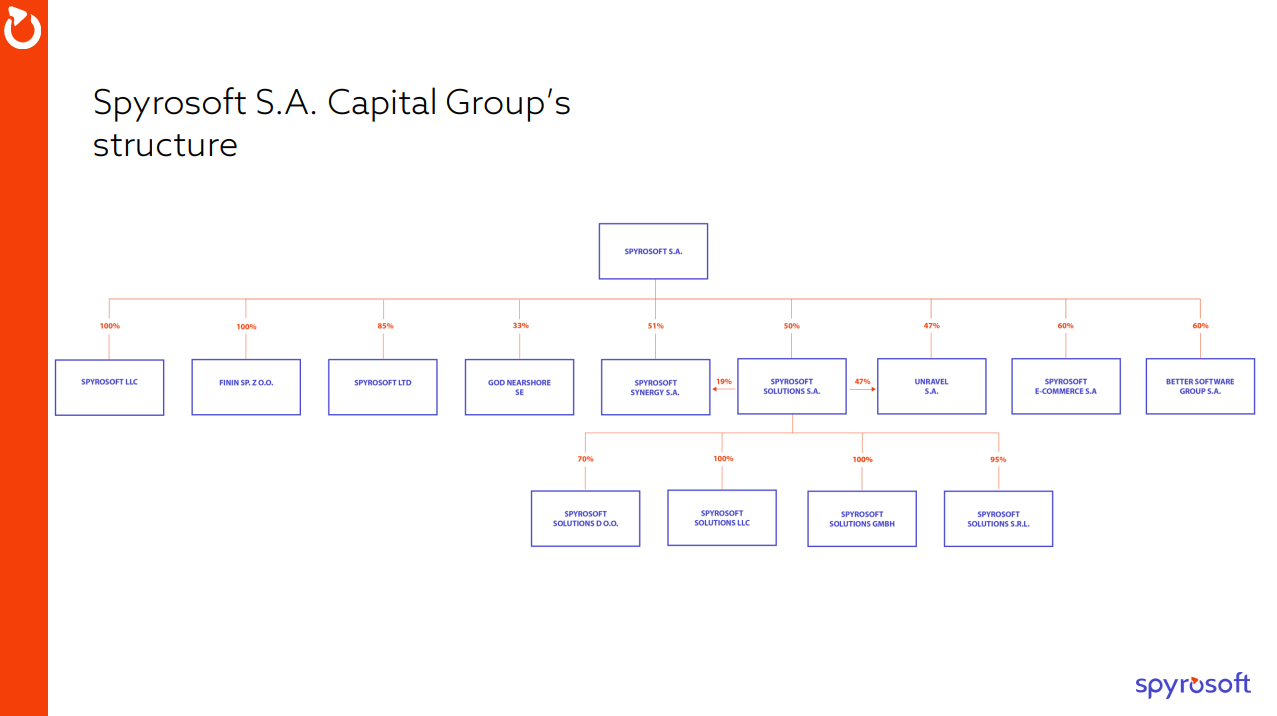

“This is not actually a company. We are a group of companies. What we have created is a plug and play platform, to which we connect new companies and new people who want to do something we are not already doing. The goal is to provide complementary services to serve our customers end to end”. - MicroCap Leadership Summit

Great description. However, it does sound like a bunch of buzz words, which can’t be trusted. Therefore, what I’m going to do is the following:

Break down the current structure of the business and dissect Konrad’s description

Draw implications and parallels in strategy. This will be italicized.

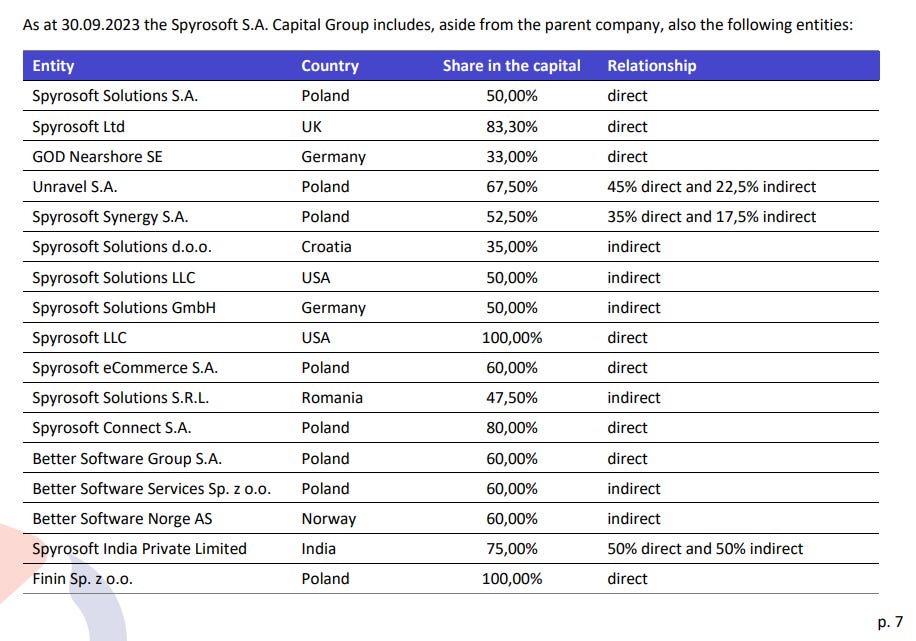

The current “business” of Spyrosoft S.A. is broken down with the following corporate structure with majority or 100% equity positions in all the subsidiaries below. Ensure to pay attention to the number of partial equity positions. This is what Konrad means when he describes his business as a “platform”.

Now, I go down in the weeds on some microcap stocks and it is not often you see a 7-year old company with this developed of a corporate structure. The next set of questions when finding out information like this… how does the “group of companies” interact? What is the vision for how these pieces fit together? How is this group managed? Incentive structures? Organic vs Inorganic Growth?

Let’s dive deeper to get more info. We can’t make bricks without clay.

So, Spyrosoft S.A. is a “group of companies” being run in a decentralized fashion with the parent company being a, “magnet for individuals mostly in their 40s who have been around the block a couple of times... and who know to attract customers and talent… But may be missing several resources, like capital, might not be familiar with marketing, HR, legal, and so on. What [Spyrosoft] offers them is back office services, including recruitment and our sales network. These people start companies with [Spyrosoft] being the majority shareholder and them being the minority” - MicroCap Leadership Summit (Konrad).

Smart. This creates alignment for the overall company to perform and retain talent in key positions at multiple managerial levels. When I saw this, it seemed similar to how Constellation Software aligns its incentives across a multi-tiered, decentralized organization. I like how this concept scales. It makes it where the “structure” can outgrow the founders and each layer of management is incentivized to grow the business like owners.

Spyrosoft S.A. has a number of offices around the globe now. All the Offices are in traditionally low cost of labor cities or countries. In addition, Spyrosoft S.A. now has global 24/7 coverage and can mix and match offices with time zones. Therefore, low-cost of labor Engineers from Argentina/Poland can now support the Michigan/UK offices on high value IT contracts.

I like to see this level of development at this early of a stage. It shows Management is looking to actually build the business. The rapid development into a global company shows me that this team isn’t looking at Q/Q developments and are looking to grow this into a global multi-national level business. Even more impressive is that the business was only started in 2016 and is already operating at this scale globally.

Projects & Sectors

Potential investors do need to understand the “current state” for where the company’s revenue is derived though so we can better understand where the company is going.

Now as you can read above, Spyrosoft S.A. serves a wide variety of industries. I like this because it does de-risk any individual sector slowdown hurting the company in the future. I would expect this to continue to diversify in the future.

Then, the company’s revenues are global to date. However, the United Kingdom does represent nearly 50% of the trailing revenues. Germany comes in at 25% and the United States at a measly 14%. Trailing country-based revenues are not as diversified as I would like today. However in the same way that this is currently a concentration risk, it also points to the level of whitespace the company is working with going forward!

Incentivized Growth

One of the key founding principles that I like about this company is the incentivized growth structure. Making sure the Professionals, who are leading their companies, are incentivized to grow their business effectively over the long-term is definitely a key factor in sustaining high growth rates.

Spyrosoft S.A. utilizes the following compensation/incentive plan:

Partial founding Equity positions with Spyrosoft as the Majority Shareholder and the key leader as the Minority Shareholder. This incentivizes these key individuals to growth THEIR business, since they have direct equity in the subsidiary.

Stock Option Plan: The Founders have approved a 5% dilution plan for key employees (not including the founders) to encourage employees to get aligned with the overall company’s strategy. As a shareholder, I like this alignment. Retaining those key heads internally makes all the difference in long-term vs short term growth mindsets, maintaining a quality culture, and producing quality work. In Konrad’s work, “We try harder, because it is ours”.

Key Growth KPI(s) & Growth Drivers

I’ll keep this section short. If you were monitoring the “growth” of the business though at a high level, I would monitor the following:

Employee Count: Consulting/Dev companies are billable by the hour. Therefore, your employees are the constraint to growing revenues for customers needing their services. The business currently has around 1600 employees and is targeting a minimum of 3000 by the end of 2026.

Utilization: Another key growth driver is the level of utilization of your employees. If the same employees bills 90% of the hours in a year versus 80%, that’s a large difference in revenue from a fixed cost output.

The Bench: Un-utilized employees (not on projects) are on what’s called “The bench”. Currently, Consulting firms are all cutting employees to maintain margins with the Post-Covid IT upgrade hangover. Currently,

Spyrosoft is maintaining a high bench to retain employees, hurting short-term margins. However, this will help the long-term growth as the company won’t need to rehire these employees before continuing growth. This is a good indicator of Outsider-level Management making decisions that’s best for 7-10 years out, not the next quarter.

Service Expansion: Another key factor I’ll monitor will be the services the company offers around the world. In the United States alone currently, the potential expansion of IT services has a large white space to work with.

Customer Retention: Konrad pointed out that the company hasn’t really lost a customer, besides some startups. What’s enabled this success is the following:

A Proper Audit: Finding what makes sense for the customer, not trying to sell more expensive work. This definitely makes more sense as you start to do maintenance work for recurring customers. “By finding the right solution, even if its cheaper, the customer will love you. Now, anyone can say that but to your point, we haven’t lost a major customer” - Konrad, MC Summit.

Consolidating Providers: The mid-sized customers do not have the resources to have multiple providers and much more prefer to buy from one entity. This helps Spyrosoft, as long as the company focuses on providing that initial quality of work and trust building.

Culture: With people being your input cost, it’s easy for consulting/development firms to focus on utilizing people as resources. In Konrad’s words, “The word resource is forbidden. They are not resources. They are human beings”. I will continue to monitor this for the future. As a current IT Consultant, this is definitely the reason why I’m looking to exit the Industry. The toxic cultures at most firms makes employee retention near possible for major players.

Now, all of this is super interesting but entirely theoretical to this point. Let’s get into the Public financials and see how the company has been doing, what assumptions we can make about forward growth, and what forward looking returns might look like.

Financials: “The Numbers”

For this section, I’m going to cover the basic financials: (1) revenue (2) bottom line margins (3) cash-conversion and (4) the balance sheet (5) per-share/efficiency metrics.

Revenue growth has been quite impressive over the past couple of years. The company grew revenues from $8.52M back in Dec 2018 to nearly $100M today (65% cagr). If you look at the revenue cagr over time, the company has been putting up consistent numbers.

For this company, the top-line is definitely the most important metric to look at in the Income Statement. The growth rate has been staggering thus far. I think this level of growth is definitely not sustainable going forward. However, I think the structure of the business will allow the company to hit its 33% topline goal set out by management.

Revenue Assumption: 25% forward revenue growth

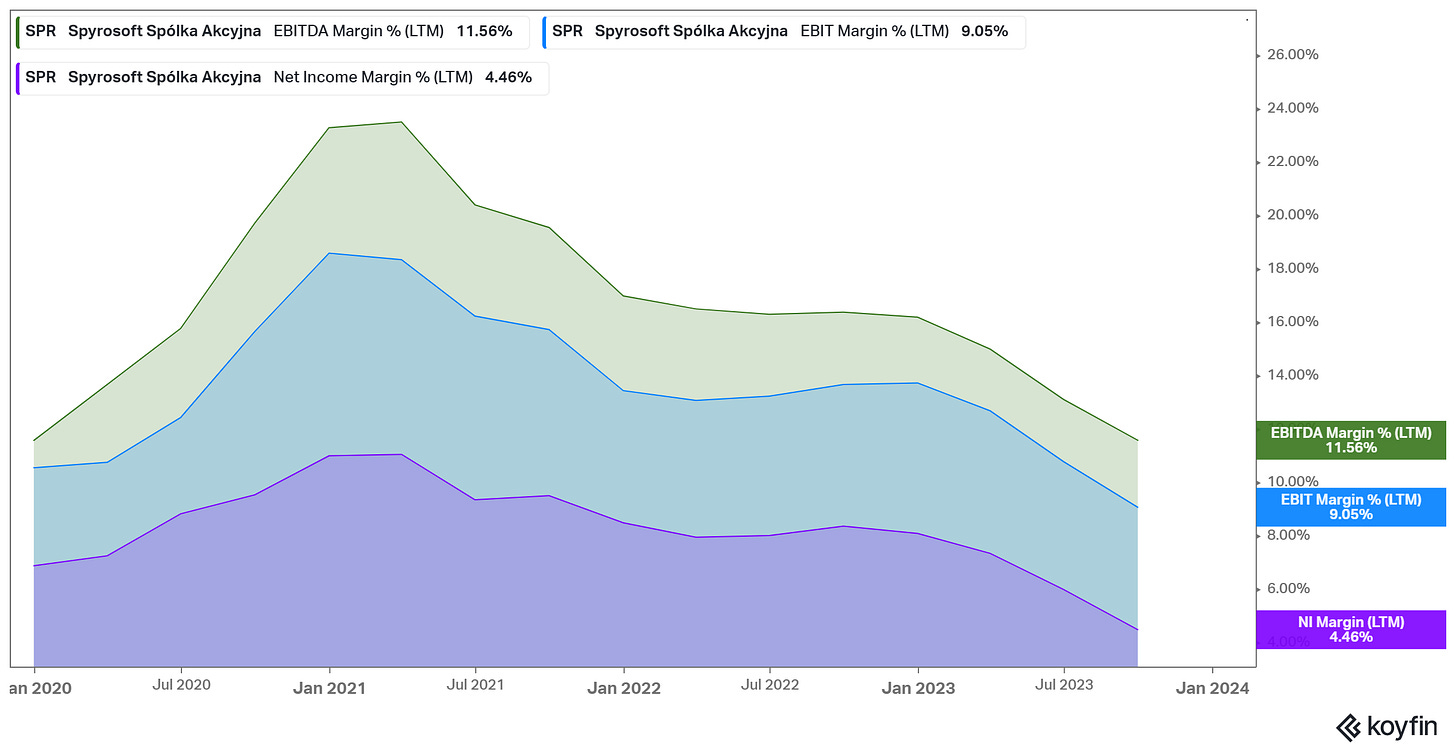

The bottom line margins are nothing to gawk at. The company has guided forward EBITDA margins to be between 11-14%, which is a realistic target. The Covid pull forward on margins was intense and most likely won’t be repeated. As covered earlier, the company is maintaining a high bench in the middle of the current IT upgrade slowdown.

To reiterate, this industry is not a “super-profitable” winner-takes-all market. I’m going to assume the company hits the low-end of the bottom line goal of 11-14% EBITDA target. This translates to a roughly 6% net income margin at maturity, which is respectable but not fantastic. Given the past performance, I do expect this to be a conservative estimate that the company can most likely outperform at maturity.

Bottom-Line Margin Assumption: 6%

Moving on, the cash conversion is pretty good. On average, the company is putting up around 78% free-cash-flow conversion from the diluted net income. This is always good to see from a small and growing company, because it’s hard to go under if cash is continuously coming in the door! Definitely helps for stability when a company is in growth mode.

I’m not going to go too in-depth on the balance sheet. It’s clean enough. No inventory issues, due to low physical asset requirements. Good cash and equivalents. Not too much debt. Below this first graph, I put the book value per share growth, which would impress even Buffett.

Now as all good investors know, book value growth with declining assets aren’t worth owning. Maintaining high Returns on Equity and Returns on Capital are paramount. Spyrosoft has managed to maintain high metrics, especially compared to its larger and more established peers with comparable balance sheet ratios of equity/debt.

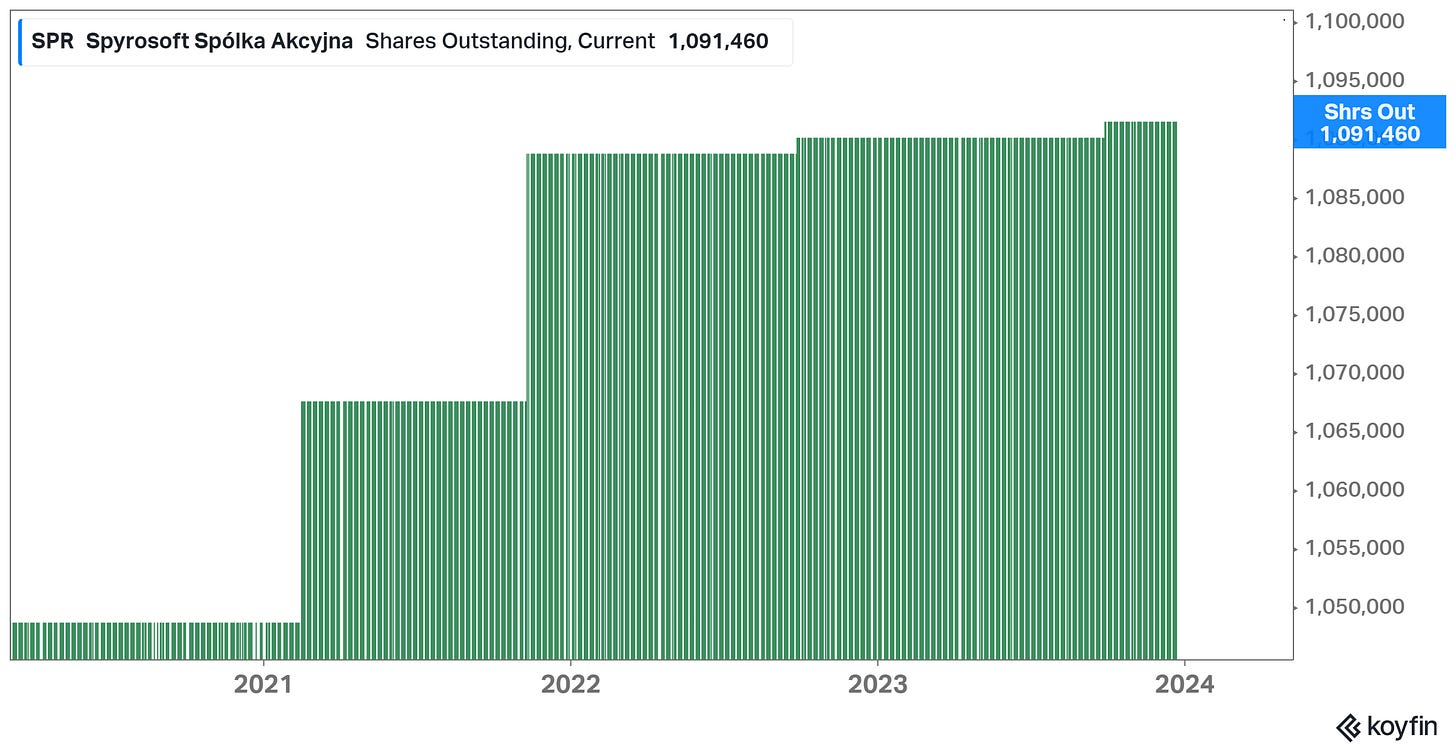

Per-share wise, Spyrosoft has done well to grow without utilizing excessive dilution. It does help that the management team has such a high equity stake and senses of integrity (Founders received no additional comp in the options package). I’m fine with the current rate of dilution as a shareholder because it feels methodical and seems to be a feature, not a bug.

Dilution Assumption: 10% dilution over next 10 years

And with that, we’ve concluded our financial metric coverage. If you want any additional information, feel free to leave a comment and I’ll get back to you! Let’s put all these assumptions together and figure out what our napkin math calculation gets us for expected forward returns.

Napkin Math Assumptions

As always, input your own assumptions based on the data covered. Here are my assumptions for the next 10 years that I’m going with:

Revenue CAGR: 25%

I ran a 20% revenue input and got a 14.9% cagr. However, I think this business model and team has legs. I’m putting my name on 25% over 10-years. Implies $875 million in revenue. Message me if you have questions here.

Bottom Line: 6% (4.46% LTM)

PE Exit Multiple: 20x (32.5x right now)

Capital Return / Dilution: 10% dilution, no capital return

ForEx Conversion: Lose 1-2% a year, will estimate 1.5%

Return Calculator: [ (1.25^10) * (6/4.46) * (20/32.5) * (1/1.10) * (.985) ^10 ] ^.1 = 19.7% cagr

*These return estimates are not meant to be 100% exact but are more meant to provide a rough mental framework to estimate comparable investment returns from investor expectations. Adjust any input as you see necessary for your framework.

Risks

There’s definitely a good number of risks for this investment. However, I think most of them are mild compared to other microcaps of this size:

Existential Environment: Obviously, the majority of the company’s developers are based in Poland. If Russia were to invade Poland tomorrow, that would negatively affect the company. I don’t see Poland itself being a large risk factor though.

Mismanaged Subsidiaries: As a group of companies, Spyrosoft S.A.’s main risk to be concerned on is that the individual operating groups do not work together in a cohesive manor. This will come into play if the Equity Owners destroy company culture, target the wrong long-term clients, or give the company a bad reputation within individual sectors or networks. This “risk” is hard to quantity on both the likelihood and magnitude. However, I like the incentive structure to mitigate this and the reporting of individual segments. This will definitely be the primary factor I monitor going forward though.

Governance: With nearly an 85% insider ownership, there is obviously a risk that insiders can make decisions that can’t be reversed by activist shareholders. This also provides the best alignment for long-term outperformance though, so it’s a double-edged sword.

New Competition: I figured I’d put this in. New entrants, especially Big 4s after untangling their Audit anchors, can enter the mid-size customer space and drive down contract values. I think this is unlikely though, due to those firm’s size and price range in comparison to their potential customers. It’s something to monitor though.

Summary

This will not be the most exciting name in your portfolio. However, it’s hard to find a company with all these following traits:

Good organic growth strategy, growing fast

Scalable business

Shareholder friendly management

Aligned management

Small starting point for a globally growing business

Finally, I hope this write-up finds you well and you made it to this point. If you haven’t already please subscribe now for FREE below and/or support my channel by pledging a subscription for as little as $5 per month! A subscription for future writeups will allow you to receive the writeup a week ahead of free subscribers.

Have a great day guys!

Hi William,

Looking at the 2023 annual report. Do you understand why "Cost of general management" has increase faster than sale? 150% (97 992/63 958) vs 125% (416 109/331 453). Note2 seems to implies it's salary increase related but that doesn't seem to explain all of it. It also contradict my experience that IT salaries are somehow stabilising this year with the many lay-off.