What is Roku?

Roku is one of the more misunderstood companies out there. On my financial Twitter feed, you can tell who’s actually researched the company and who thinks they simply sell a streaming stick. You get questions or statements such as:

Where’s the moat?

With Google/Amazon/Apple doing XYZ, they’ll crush Roku!

This is only a Covid stock play! This can’t do well going forward.

However, Roku has been killing the largest companies in the world, Apple, Amazon, and Google, since before Covid was even a twinkle in that bat’s eye. The real question they should be asking is this… how has this small tech company, Roku, been beating these tech giants in streaming??

A TV Operating System

Anthony Wood started Roku within Netflix in the early 2000s. He saw that the future of TV was streaming, not cable. Therefore, he started building “streaming sticks” that allowed individuals to turn their TV into a “smart TV”.

Netflix (stupidly) decided to spin the project off in 2008. Mr. Wood was given all the patents. Netflix took a part of the company, and they told him to kick rocks. In response, Wood created a custom Operating System (OS) for TV, perfecting his design. He started selling his streaming sticks that allowed regular TVs to access the internet and run on Roku’s OS.

If you’re fuzzy on the difference between operating systems and hardware, watch this video. To understand Roku, you need to understand this concept. This isn’t the best video but it gets the point across if you’re fuzzy. If you understand this dynamic already, let’s move on to the nuances!

Roku does not manufacture TVs. Their business revolves entirely around their OS and its distribution. They are not interested in taking on expensive manufacturing processes. With that in mind, how do we have “Roku TVs” then?

Anthony Wood realized earlier than his competitors, he needed to license his OS to TV original equipment manufacturers (OEMs). This allows TV manufacturers such as TCL, Hisense, Onn, and Sharp to have a quality OS for their users. It also allows Roku to spread its OS to more individuals, similar to how Android and Windows expanded. Why do the OEMs want Roku’s OS in the first place though?

What’s Special About Roku’s OS?

Roku’s OS is designed specifically for TV. Anthony Wood is an electrical engineer that understands both computer hardware and software. He knew that his OS needed to be simple and use the least amount of computer memory as possible. In turn, this allows Roku TVs to have less expensive computer chips because the software is less demanding. The OEMs love this too because it allows them to make cheaper, higher quality, TVs than their competitors. This means Roku has the least expensive option in nearly every market, with the same margins for the manufacturers. This was actually a large part of the YouTube/Roku dispute. Google was adding parts to the agreement for Roku to start using more expensive chips and Roku said no. This would cause Roku to give up the main aspect of their initial customer acquisition strategy.

On the flip side of this argument though, there are some wonderful other streaming OS options for CTV. I went very far down the YouTube rabbit hole looking at the pros and cons for each… here is a short summary of the major players!

Google TV’s OS (Android/Google TV) [Limited OEM partnerships]

Pros: Google TV is the most feature rich of any OS (imo). It has great recommendation technology, suggesting TV shows and movies right on the home screen. The Google assistant plug in is cool.

Cons: This device/OS will also have favoritism toward’s YouTube/Google products. It is not a “neutral” platform. This biggest thing about this OS is it was rebuilt from the pre-existing mobile Android OS and it was not built for TV. Also, this OS is known to be a bit more buggie and it will crash more often than other platforms. Read more here for one example: Link

Amazon TV’s OS (Firestick)

Pros: This OS was one of the first movers. It was adapted from the Android OS and it get’s the job done. It’s very good for existing Amazon subscribers. Also, Alexa plugs in.

Cons: Amazon is constantly self promoting their own products/services. Nothing is really “special” about this option though.

Apple’s OS (Apple TV)

Pros: This is probably the “cleanest” TV OS because Apple doesn’t do anything second rate. Also, it works well with your iPhone.

Cons: It’s super expensive (4x everyone else). They aren’t focused on OEM partnerships so no easy Apple CTV options.

TV Manufacturer OS Systems (Samsung, Vizio, LG)

All these options are okay. They’re unique in their own way and they have their distribution connections worked out already. None of them are too differentiated though. Samsung has a large lead in Europe for now though.

Roku

Pros: Purpose built for CTV. This means it’s the simplest option. It’s known as the most reliable option. It’s also monetarily the cheapest of any option (TVs and sticks). It is also known as the most neutral platform.

Cons: Some people think it’s too simple and there’s not enough features available. The main banner ad on the home screen has some complaints, but no one is too irritated because you don’t need to scroll over it, like Firestick and Google.

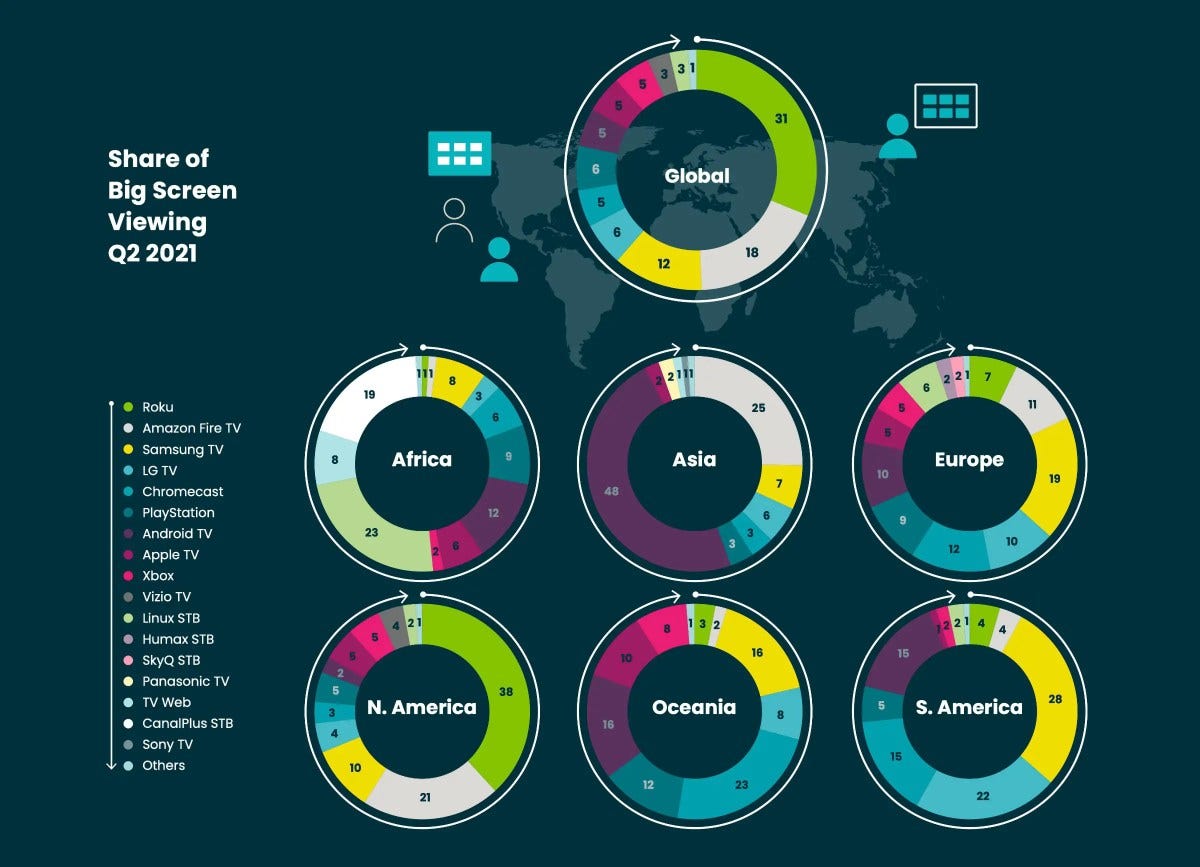

I’m going to put this image again. Now it makes sense why the Roku TV OS has gained such a dominant market share in the high ROI markets, such as North America!

Speaking of customer acquisition, if you’re liking what you read here consider subscribing to Fundasy Investor newsletters! We post at good valuation entries and attempt to post over unique business ideas.

Type your email…

Subscribe

Join 3,296 other subscribers

How Does Roku Make Money?

This is all nice to learn about cool tech, but this is an investing blog. Disruptive technology, without a real underlying business, is not useful. Therefore, the next question is how does Roku make money?? They seem to have consistent sales growth. What’s driving this machine?

Platform vs Player Revenue

Player Revenue: Player revenue is generated by selling the streaming sticks or players. These allow the user to connect their TV to the internet and use Roku’s OS. This segment includes other hardware, such as soundbars too. This segment is not profitable. In the past 12 months, Roku has been losing money in this area. This is because the real goal is to attract as many users to their platform as possible. Then, these users can be monetized through Platform revenues!

Platform Revenue: Platform revenue is how Roku monetizes the OS. This is done in primarily two ways, licensing and advertisements.

Advertisements: Roku’s OS distributes advertisements through primarily two ways: third-party inventory and first-party inventory. The third-party inventory involves selling ads through the publisher’s content. Publishers are apps like Hulu, Netflix, YouTube, Disney+, etc. If any of these publishers use ads to monetize their content, Roku gets a percentage of the advertisements within the content, similar to the cable industry. However, the larger and more “important” the publisher, the less favorable the terms will be for Roku.

The first-party inventory is the ads that Roku is displaying on their own content. This is through Roku’s own app, The Roku Channel, or on the home screen (Check the Disney+ ad in the image below). More on first-party ads in a second though.

Licensing: To distribute apps that make money on subscriptions, Roku signs a *distribution agreement* which allows Roku to receive a piece of the economics. This means Roku will make money by receiving portions of subscriptions or advertisements from the publishers. Again the more “important” the publisher the less favorable the terms will be to Roku. However, what happens when Roku, the OS, decides to become a publisher too?

The Roku Channel (TRC): This is the secret sauce of this investment opportunity for me. The Roku Channel is a free streaming app that makes its money on ads. Roku receives first-party advertising revenue, since it’s their own publisher, and they give a 50% cut to the content owner if it’s not original content.

The Roku Channel is an aggregator publisher, similar to 2000s Netflix, that provides monetization opportunities for small publishers like Discovery+, Peacock, or just some average publisher that can’t compete against Netflix/Disney/Amazon. Therefore, smaller publishers can license and monetize their content to Roku and make ad revenue on otherwise unmonetized content. In addition, Roku has started creating and acquiring its own content to make its platform more of a popular destination for users.

TRC’s original content has been growing quickly. In 2021, they’ve purchased Quibi, This Old House, and produced Zoey’s Extraordinary Christmas with Lionsgate. All this content is growing TRC as a publisher, which will allow them to monetize other publishers’ shows easier, charge more for ads, and create an effective flywheel.

On a side note, I love the original content strategy. Quibi was going bankrupt. This Old House has been on the air for 40+ years. Zoey’s Extraordinary Christmas had an existing fanbase and it will be a repeat holiday movie! Those are all high ROI content ideas.

Business to Financials

Understanding the business is important. However, translating the business and understanding what their financials mean in context is equally important.

Things to notice here:

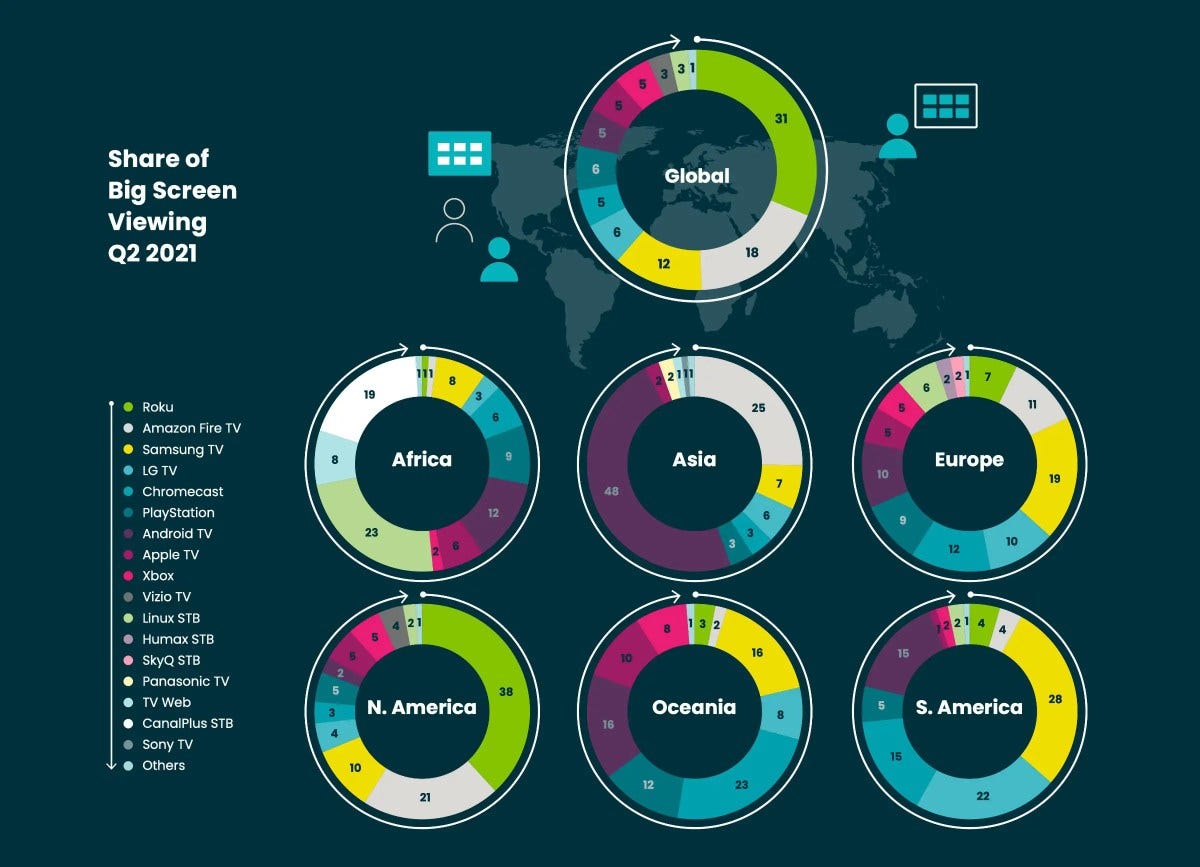

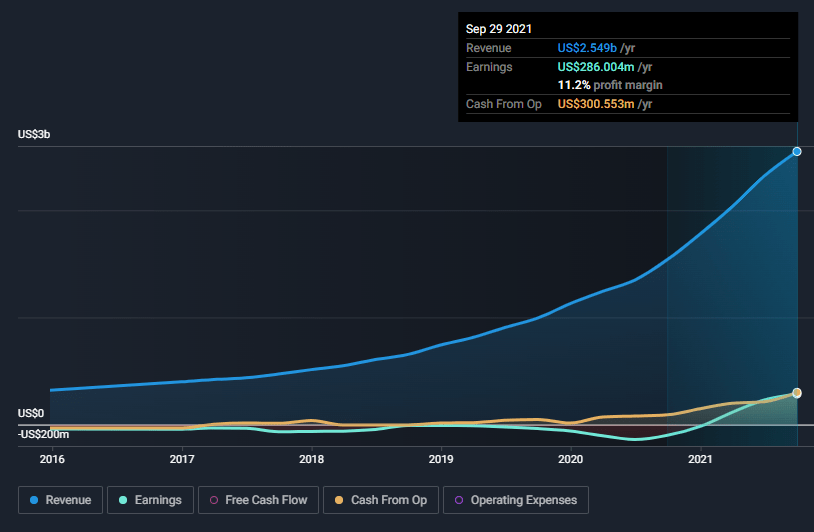

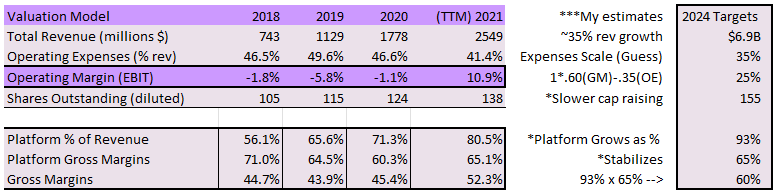

Consistent revenue growth: The company has had 40-50% revenue growth the past 4 years

Gross margins increasing (link for gross margin definition here, if you need it): The company has increased GMs from 28% to over 50%. This is due to the Platform revenues reaching scale and the inputs being more digital than physical. I think this is important, because it shows the business model is scaling well.

Operating margins increasing: In one year, the company went from losing money to having over a 10% net income margin. This is an inflection point for the Roku business here. Previously, they were raising outside capital to operate and grow. Now, Roku will be investing their profits to further their flywheel, creating better free ad supported content and growing their data advantage on their users.

Shares Outstanding (link again for definition here): The company has been diluting shareholders since its inception. However, the company was losing money until 2021. However, the company is finally making profits now. I don’t expect share dilution to stop, but I expect it to decrease as the company can start using its own profits to fund expansion.

Now, we know the company is growing revenue, growing margins (gross and operating), and is reaching scale. As investors, we need to look forward though. We need to do our best guess in predicting the future!

Business Model Implications

This is the hardest part of this thesis to convey curtly. Arguably, it’s the most important aspect though. What is the most universal trait that any human looks at when considering a purchase? Price. Nearly every human on this planet wants the best bang for their buck. There are studies where doctors making hundreds of thousands of dollars get excited and act irrationally over $5 Starbucks gift cards (Freakonomics).

First, Roku focused on the US, Canada, and Mexico. It is now the #1 streaming platform for all of these countries. Now, the company is focusing on its international expansion in the larger international markets first. This is a new strategy for the company because international expansion is not as high ROI as dominating the North American market.

Jan 20th, 2020: Roku arrives in Brazil

Apr 6th, 2020: Roku Launches The Roku Channel in the UK

Sep 17th, 2020: Roku Launches Roku Express in Brazil

Jan 14th 2020: Philco and Roku Launch TV Lineup in Brazil

Jun 16th 2021: TCL Launches Roku TV models in UK

Sep 5th 2021: Roku to Launch Streaming Players in Germany

Sep 30th, 2021: SEMP TCL announces partnership with Roku in Brazil

Roku has relatively cheap distribution and expansion with its partnership model. I think the company will continue to win market share outside of North America. Price is a universal incentive that every consumer considers. There’s no way to “prove” this will happen. However, when Roku gains a minority market share in any market, the flywheel starts to take effect. Then, it can slowly start to build the largest market position.

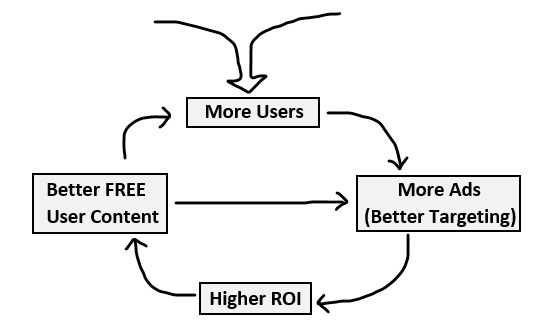

There are two large parts to focus on with this business model. (1) The top funnel: This flywheel is useless if the Roku can’t get users initially into the flywheel. Roku’s distribution model and value proposition allow the company to at least gain some market share, even if it’s starting from nothing (Mexico, Brazil, the UK, Germany show this). (2) Then, the flywheel takes effect because the Roku Channel/Platform ads are providing FREE ad-supported content, not subscription-based. With free content/platform ads, every user can further the flywheel in some way.

This flywheel can be seen by the platform revenues and the annual revenue per user data (ARPU). Notice how it seems to keep building on itself, growing steadily, and creates an exponential effect.

That ARPU pic.twitter.com/ADifsLsSgB

— Alex Morris (TSOH Investment Research) (@TSOH_Investing) December 16, 2021

If you can understand these two parts, you can understand why Roku is inevitably going to do well, even with competition from Google, Amazon, and Apple.

Valuation/Projections

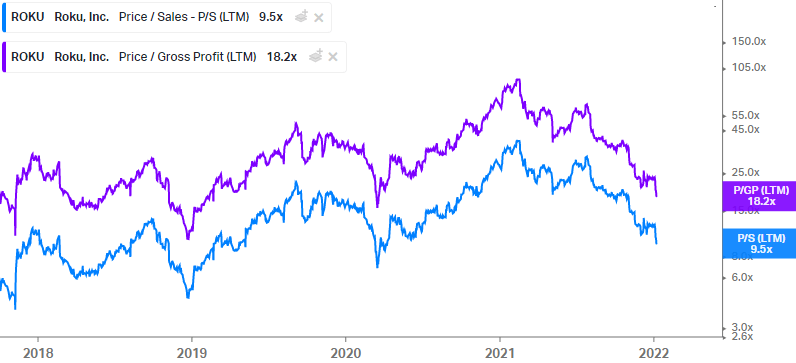

This is all very cool. However, we still need to consider the investment opportunity. This is a fantastic business but if we pay too much, it can still turn into a bad investment. Below you can see the trailing valuations!

What’s interesting about Roku’s stock action is that investors tend to get really optimistic on upcycles and then really pessimistic on down cycles. As you can very clearly see, we are in a down cycle.

Currently, you’ll hear that Roku’s business model doesn’t work; [Insert Big Tech Name Here] will clearly crush Roku, due to Roku being the underdog (Roku is the #1 CTV OS in high ROI N. America); Roku is simply a fancy USB; Why would I pay top dollar for this? Etc, etc, etc.

Now, if we’re being realistic, Roku will face tougher competition going forward. I don’t think that it’s something that will inhibit the company from growing though. It simply might make the company a little slower. With all disclosure, I think the company will scale very well. In the past two years, it’s spent a lot of money building out its Ad Platform, OneView, that allows easy ad campaigns with transparent ROI information. I think with these fixed assets in place, the future will be bright.

This next part is very subjective. If you have different assumptions, adjust this model as you see fit. This is my simple baseline model though.

This model has tons of assumptions.

Roku could grow faster or slower than 35% per year. However, from 2018 to the end of 2021, it will have a revenue CAGR of 55% with platform revenues growing faster than that rate. Therefore, this should be reasonable.

I did not count Player revenue for or against gross profit. With new products, like sound bars, being introduced, we don’t know what the gross margins will look like.

I also assume that Roku’s business will scale slightly with operating expenses to drop to 35% of revenue. Honestly, this could be lower. I think realistically you see 25-30% operating expenses at that scale, but I’m staying conservative.

This implies operating income/share in the Fiscal Year of 2024 of $11, on conservative projections. From a conceptual check, with 75 million subs (60M most likely after Q4 this year) that would be $92 ARPU, which is not conceptually outlandish ($40 ARPU this past Q3). I think Roku, by the end of FY 24, will most likely have more than 75 million active users, and that will make the ARPU goal much more achievable.

If you put a 25x trailing operating income multiple (80x today) on the nearly $11/share, you end up with a $275 share price by the end of 2024. That’s a 15% conservative compounded return over the next 3 years with a good scalable model going forward! I think that Roku will continue to grow much faster than 15% per year after 2024 though. The longer your time horizon, the better the compounded return will be!

In the end, you can insert your own projections into the spreadsheet and see what you come out with though! I think these are conservative enough and the investment still appears to have a good 3-year return. I find this name to be a good secular investment for the next decade as cable eventually dies and streaming dominates until well past the year 2024!

If you liked this post, consider subscribing for content over great businesses at good entries! Thank you for reading my thoughts over what I consider a fantastic business and potential investment.

Type your email…

Subscribe

Join 3,296 other subscribers

The post Roku: An Underappreciated Flywheel appeared first on Fundasy Investor.

Very nice content, William! Thanks for sharing!

Slightly two years after your post, what do you think of Roku's current situation and potential performance? I see positive results in almost every area except in:

-Annual revenue per user stagnated for the past couple of years, despite increasing both revenue and active accounts. Reason? A substantial revenue drop these last 2 years. When looking at their MD&A, on the one hand they blame recent business and Macro factors, which impact both advertising spend and consumer discretionary spend. On the other hand they say "The decrease in ARPU is due to an increasing share of Active Accounts in international markets where we are currently focused on growing scale and engagement, rather than monetization of our streaming platform". Not sure what to think about this ambiguity.

-SG&A has also increased. Managers have addressed this and are determined to bring it down. However, a large part of this increase comes from a larger stock-based compensation, which is included here. Stock-based compensation-to-revenue ratio has jumped 55%-70% from previous years. This obviously affects the bottom line. Might we have here a bad corporate governance example?

-Restructuring costs. This should be a one-time 2023 expense though (and most of them are impairments, not lay-offs).

-Insider selling. Except a very recent stock purchase buy one director in the open market, it's not possible to trace a similar action back in time. Insiders are selling like madmen. They were selling when the share price was at the top and at this current price. Not a very promising omen.

Any different insights on this?