My Earned Secret

The term “earned secret” was coined by Mark Leonard, one of the most successful CEO’s in history. It is defined as “knowledge of an opportunity in their industry that isn’t obvious and will allow them to be an early mover, parlaying their secret into a sustainable competitive advantage.” I like to think I have an earned secret and here is my earned secret regarding the Pool industry, free for you.

In college, I was looking for a flexible part-time job. I found a pool cleaning route for a local company and showed up for work one day. With an hour of training, I was on my own running my own route. This hour I “learned” how to balance chemicals (pH and chlorine only), operate the filter/pump, map the piping to figure out which valves to shut off, and clean the pool. Needless to say, this training was not very thorough.

I took pride in my work there. However as I soon found out, all the parts (pumps, filters, heaters, chlorinators, o-rings, connection valves, brushes, nets, poles, tiling on edge of the pool etc.) needed constant repairing, due to being left to the whims of mother nature. I’d be telling the owner to get maintenance out to a pool for weeks and in the mean time to keep it blue, I’d be dumping in hundreds of dollars of chemicals. As you can imagine, I felt pretty horrible about how the industry took advantage of people.

In addition, “shocking” the pool was the norm at this job, instead of a having a working chlorinator that allowed you to use chlorine tablets, which are MUCH CHEAPER. However, the pool company gets to mark up what they sell you, so they didn’t care too much about fixing the parts to make the pool operate better.

I quit this job, due to my qualms with the owner and practices. I found another pool cleaning job with a hyper-ethical owner (had commercial customers for 20+ years). He trained me for months and I learned everything the other company had been missing, due to negligence or malpractice. He also owned some bars in our college bar district and I got 50% off my tab every trip, so that was sweet!

I learned a few interesting lessons though!

The pool industry has constant wear, tear, and replacement: Parts in this area don’t last long. They are getting rained on, exposed to summer heat, have ineffective operators working on them, are being constantly exposed to water/chlorine/salt, and are left on for 8-12 hours of the day out of necessity.

The chemicals are recurring: In a small apartment pool (15k gal), which was smaller than the average residential, I put in 4 chlorine tabs per trip (twice per week) to maintain chlorine levels. Each pool would go through at least 4-5 of these containers per year ($200-250 each container). Each pool would also need on average one to two containers of muriatic acid per trip ($15 per bottle). These are simply the regular chemicals… extra chemicals like clarifier, yellow treat (bad algae), would be $50 per individual bottle. Cal Hypo or “shock” goes for about twice the amount of chlorine tablets and you’d go through 2-3 per year.

The customers just want problems fixed: This is a big one. The customers don’t care about the brand of pump, filter, chemical, etc. They simply want the problem fixed by the people they “pay to take care of it”. This is highly differentiated from other industries like automobiles, recreational vehicles, boats, etc, where customers tend to care about what’s being done.

Now, this is an investing blog. If you were interested in investing in the pool industry based on this information… what would you buy? The Wholesale Distributor.

Pool Corp

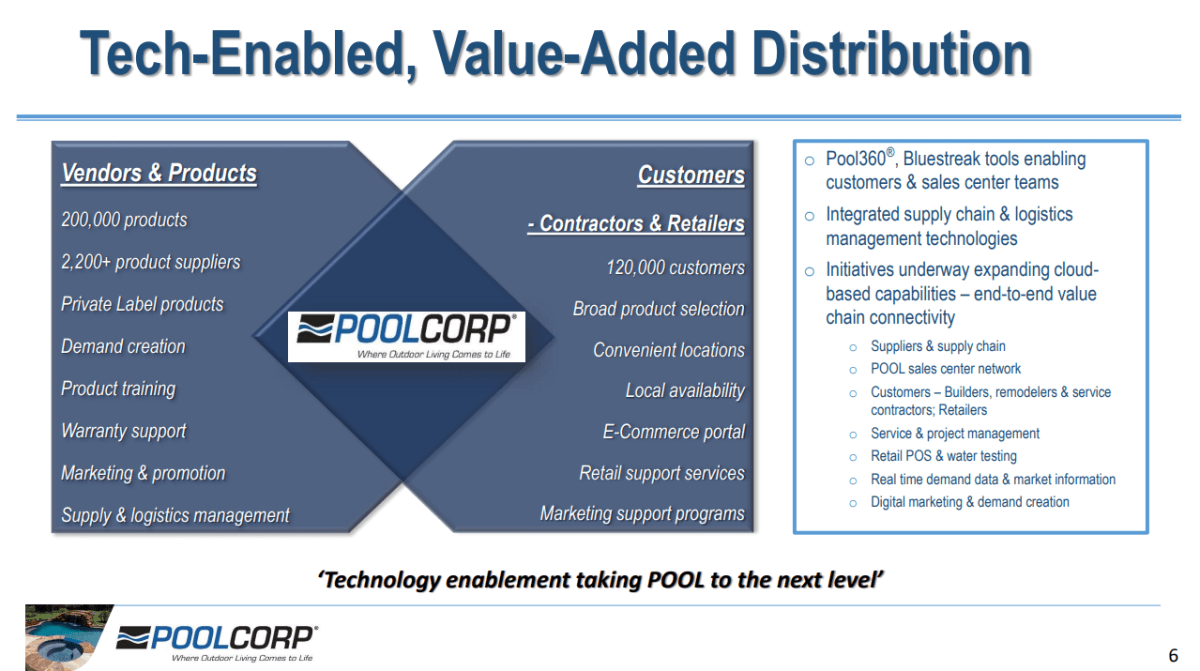

“Pool Corp distributes swimming pool supplies and related products. It sells national-brand and private-label products to approximately 120000 customers. The products include non-discretionary pool-maintenance products, like chemicals and replacement parts, as well as pool equipment, like packaged pools (kits to build swimming pools), cleaners, filters, heaters, pumps, and lights. Customers include pool builders and remodelers, independent retail stores, and pool repair and service companies.” – Morningstar

Big thanks to @justvalue2 for creating this graphic! Good follow on Twitter, if you’re not already.

With all my information, I think independent professionals have a very difficult job. The manufacturers will do well, but they don’t have that intangible customer facing value. Therefore, I chose to invest in the company that buys from unappreciated manufacturers to professionals with low bargaining power, resulting in a healthy margin and a large competitive advantage in the supply chain. This competitive advantage, with an unappreciated consistent industry, produces some excellent investment results!

Up 1650% since 2010 and 6700% since 2000, not including dividends.

My Thesis

Here is a summary of my thesis points:

Competitive Advantage: They are in the best point in the supply chain for an underappreciated consistent industry. They are also the largest player and continuing to take market share.

Recurring revenues: These are not “recurring” like software sales. They are recurring in the fact that things continuously break and even dirt poor customers can’t stand the sight of a green pool. When Pool Corp says “80% of their revenue are recurring or semi-discretionary”, believe them.

Pricing Power: In addition, Pool Corp has pricing power over both its suppliers and customers. This being due to the manufactures having little leverage and the professionals negotiating among 120k other customers. The professionals will simply mark up the price higher anyways because anyone with a pool and a service tends to bite the bullet on pricing, per my experience.

Growth: This part is two-fold. (1) The pool industry is gaining technology and complication. Pools have more automation, lighting, and fancy decorations now. These are simply extra growth vehicles for Pool Corp to wholesale distribute. (2) Pool Corp is continuing to acquire sales centers and new product lines. The Pinch-A-Penny acquisition last year came with a franchise customer facing business (like Leslies) and a chlorine manufacturing plant… you can already probably guess my thoughts on that. Therefore the growth is a good mix between: pricing power, new acquisitions, expansions, and new products. This creates a consistent growth machine.

Increasing Margins: Pool Corp had some terrific Operating Margins during the Covid times, being the distributor that had the most supply, in a supply constrained world. However, their business by nature is capital light in expansions. They don’t need massive infrastructure in or depreciating assets. Therefore, operating margins keep climbing over the long term.

Capital Allocation: Pool Corp has a clear allocation strategy, splitting capital between capital expenditures, acquisitions, dividends, and repurchases.

In Summary

Told you this would be short! In summary, you have a consistent operator in a niche industry, with the most valuable section of the supply chain. That will have continued operating leverage, pricing power, consistent revenue, share repurchases, and dividend growth.

This is not a flashy investment. Pool Corp does have historically high margins and is at a cyclical high. This is resulting in a historical low in valuation, based on profits.

However, I’ve got an earned secret… only 20% of revenue is from new construction. 80% are from things that I experienced on the day to day. Therefore, unless those owners want a green pool or a run down pool, they’ll pay a contractor to replace what needs to be fixed, regardless of the housing industry. That’s why this company outperforms and will continue to.

Hope you enjoy! Feel free to subscribe for free for new articles like this.

Type your email…

Subscribe

Join 3,296 other subscribers

The post Pool Corp: My Earned Secret appeared first on Fundasy Investor.