Opinion Piece: Why Founders Disproportionately Win Big

P.S. Spirit Airlines, I hate you

So, last weekend I visited Costa Rica, which was an absolute fantastic trip! I got to visit a number of hanging bridges, an active volcano, went surfing, and stayed at a fantastic AirBnb. Here’s a picture from one of our hikes!

I also got to fly on everyone’s favorite airline, Spirit SAVE 0.00%↑ .

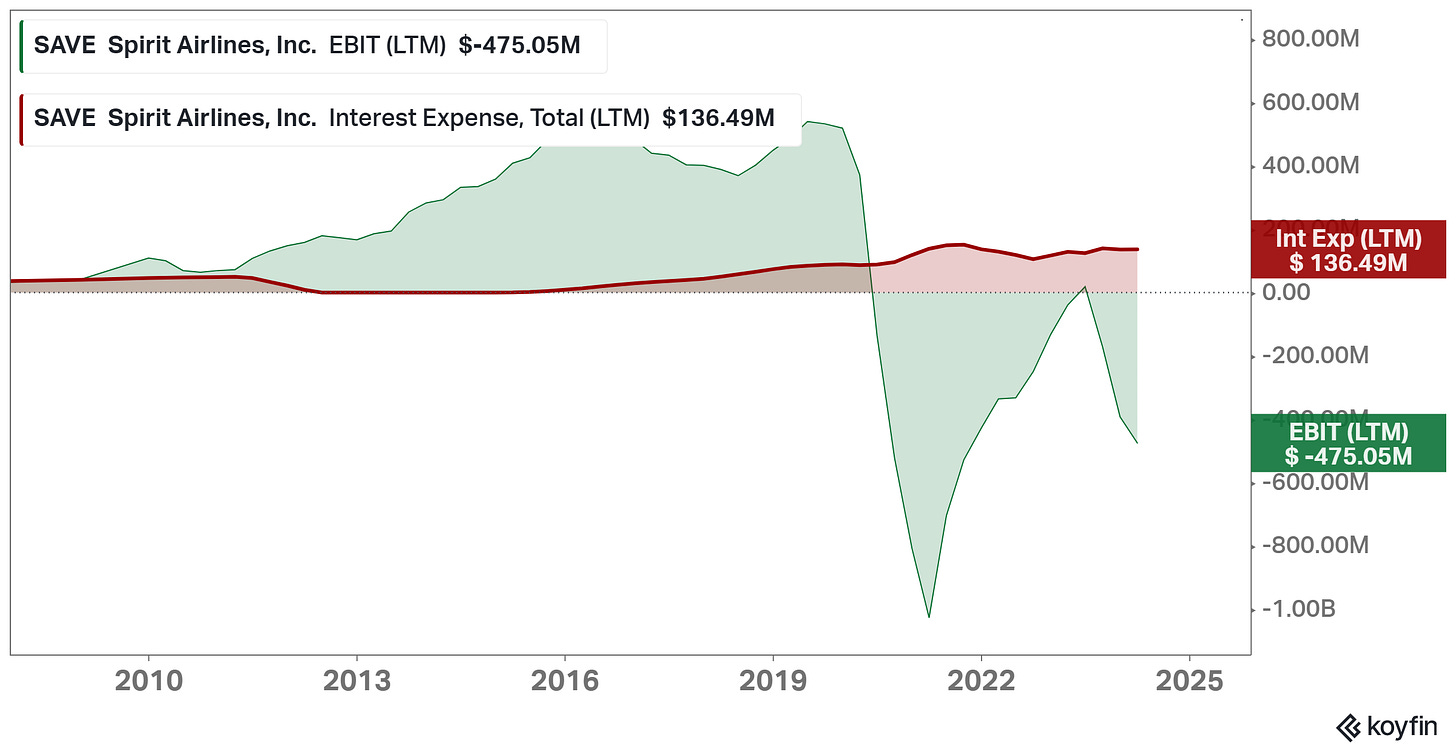

However, it went so incredibly horribly getting home, ON A DIRECT FLIGHT, that it will also be the last time I fly Spirit Airlines. Short that stock. Joking… kind of. You always need to make the best of a given situation though!!

So, on the way home, I listened to a ton of episodes of the Founder’s Podcast. Shoutout Founders and David Senra for creating such good business and entrepreneurial content that the Spirit Airlines experience wasn’t as horrible.

Here’s a link to their latest show if you’re interested!

It might have been the 12 hours on the 3 hour flight. It might have been the great podcasts I listened to. I was inspired to write this little piece though and dive down into a qualitative idea about… Why do Founders Disproportionately Win Big? First, I suppose I should define what winning big means in my book.

Defining Disproportionately Winning Big Clarification

Now, Private and family companies aren’t included in defining big winner’s track record, because there’s not as quality of public data regarding the topic. For Public companies though, there are tons of resources on why and by how much founders outperform. High-quality supporting evidence can be found everywhere out there. A few examples are below. In short though… betting on a Founder is usually a better chance than a “Gun For Hire” management team:

“The recent waning of the founder-CEO premium… but why I’m still bullish in the long-run” -

[Substack]“Founder-Led Companies Outperform the Rest — Here’s Why” - Harvard Business Review

To illustrate this point, here’s a quote from this last article:

“• Founder-led companies on average have grown revenue faster than their peers over the last five years, and have 31% more patents.

• A 2010 University of Pennsylvania study showed that small cap company founder CEOs consistently beat professional CEOs on a broad range of metrics, including return on investment.

• Finally, in one of the most comprehensive studies on the subject, Bain and Company found that over a 25-year period from 1990 to 2014, founder-led public companies performed four times better than all other public companies over that time period.” - Founder Led Companies, Page 1

The evidence is out there that founders outperform and I knew this well having written in the financial sphere for a few years now. But as I sat there… on that SAVE 0.00%↑ airplane… for 12 hours… on a 3 hour direct flight…

I listened to a ton of Founders episodes and kept coming back to the same conclusion on why founders win and outperform. It’s simple. They love what they do.

What Motivates Founders?

What’s funny is that I wasn’t even listening to finance individuals on Founders. I listened to two different episodes.

The first episode was on Quentin Tarantino who has directed some of the best movies of all time: Reservoir Dogs, Pulp Fiction, Kill Bill 1 & 2, Inglorious Bastards, Hateful Eight, Django Unchained, and Once Upon A Time in Hollywood. If you haven’t watched any of these, they’re fantastic. He’s a director with his own unique style. He’s uncompromising and won’t let someone, who doesn’t love the art as much as he does, influence his vision.

The second episode was on the undisputed basketball “Greatest Of All Time” (G.O.A.T.), Michael Jordan. Jordan’s reputation clearly precedes itself but the one line stood out to me from the Founder’s episode that I’d like to paraphrase:

“[Michael] I was motivated everyday because I was playing a game. I couldn’t have worked that hard going to a 9-5 job everyday.”

After I heard this line… it jogged my memory back to the Quentin Tarantino episode that I listed to first. Tarantino recounts that before each take, he chants with his entire cast and crew, [Quentin] “Why do we do this? [Everyone]: “BECAUSE WE LOVE MAKING MOVIES”.

It all clicked honestly in a super simple way. Founders simply love what they do and are willing to do the work that non-founders don’t want to do.

The study mentioned earlier, “Founder Led Companies” goes into all the depths of technical reasons on why founders win:

The Founder’s Mentality

An Extraordinary Sense of Urgency

A Frontline Obsession

An Owners Mindset

Better Aligned Management Incentives

Top Down Culture

Irreplaceable Knowledge and Moral Authority

Purpose and Long Term Commitment

Pride

Social Capital

Frugality

Healthy Paranoia

Smarter Capital Allocation Decisions

Innovation

However, all of these reasons seem to me to be effects of a unified cause: founders care and love what they do more. It’s not that they’re better at any of these individual aspects of business, sports, life, or anything (although some clearly are!).

They simply do care and are willing to do the work that others won’t because of that fact. They will take a pay cut or work for less when times are tight when a “gun for hire” CEO wouldn’t. They will do the hard innovations when a “gun for hire” will maintain status quo without being aggressive. They will have some pride, lead by example (because they want to), and will make better long term decisions on average than someone who’s worried more about their 3-5 year timeline.

Fundasy Investor - My Hobby

Now, I’ve talked a ton about other founders. I might not be as successful just yet as other big content creators out there. However, I will consistently put material out there that I enjoy writing.

In my DM’s from an anonymous account, someone messaged me that I felt relevant to this conversation. By the way, please do that. I enjoy connecting with everyone! The individual messaged though with a simple question:

That’s as simple as it is. I do think that I will outpace many writers because I genuinely love what I do. It’s not about making more money blogging to me. Money is fantastic but it’s not what drives me to write each day!

In this blog alone, I’ve been able to construct an entire post about all my passions that I love to talk about: sports, movies, and finance. That means that after an entire day of stressful work, I will have written this blog post in an hour or two and it hasn’t felt laborious in any way.

People might sit there and ask me one day, “How did you manage to keep putting out material?” And the answer will be simple… I love doing this and it doesn’t feel like work. Founders in businesses work the same way. Listen to the way founders speak on calls, write in their letters, and the track records they leave behind.

They’ll let you know if they love what they do or if they just love money. Bet on the people that love what they do.

I write this blog for my own enjoyment and I love having people read my work more than anything! Not to say that one day I wouldn’t build out an extra Paid tier offering. I love writing but I don’t love riding Spirit Airlines. However, I will always have FREE blog post coming out because I simply love doing this.

Also, shoutout Koyfin, my finance Business Intelligence tool. I use this tool all the time to research financials and do more with it than just make fun of SAVE 0.00%↑ . Affiliate link on my Home Page for 20% off a Premium Membership!

On that note, please subscribe for free below, share, like, leave a comment, message me, maybe donate $5/month to assist me in bringing the best content to as many people as I can, or maybe visit my Koyfin link on my Homepage for 20% off a subscription!

Nothing is expected, everything is appreciated.

Appreciate you guys!

"Because they love what they do"

Based on my observations in the workforce, I'd like to phrase it as (combining it with your other points):

"Because they have the courage to do what's right for the company, not what's optimal for their career prospects."

(And that's, of course, because they love what they do more than they are concerned about their career prospects.)

Buffett has also been consistently voicing a similar thesis. He says that they look for CEOs/founders who build and manage their businesses because they love what they do, not because they love money.

By the way, I stumbled upon some funds that tried to use "founder-led" as the main criteria for selecting stocks, but I have not seen any particularly successful ones. Could this be due to a relatively minor impact of this factor alone compared to other factors?