This will be a new style of Post today! Recently when analyzing another Microcap in Poland (which will most likely be a future post), I started thinking about how I liked how the Corporate Structure matched the Management’s strategy for growth.

The following week I remarked the same idea about a few of my other holdings in my portfolio. Then, I started thinking about specific Corporate Structures that bugged the shit out of me! So… I decided to write a Post about it.

Defining A Corporate Structure

Understanding Corporate Structures is an Accounting topic but I will say I want to talk about Corporate Structure Operational implications for the business and its efficiency to grow. Now, the simple concept of a Corporate Structure is easy:

“A typical corporate structure consists of various departments that contribute to the company's overall mission and goals. Common departments include Marketing, Finance, Operations management, Human Resource, and IT.” - Wikipedia (Judge me)

However, there is much more to Corporate Structures. This definition didn’t even include the concept of a subsidiary, which is a company controlled by a holding company. Understanding subsidiaries and how they fit in with the overall corporate functions (IT, HR, Operations Managements, Finance, Marketing, etc.) is an important skill when identifying which companies will scale well in the future.

Now, there are two parts to the previous statement that I want to dissect a bit further:

Subsidiaries and Business Function Dynamics

What Concepts Scale Efficiently

Intercompany & Business Function Dynamics

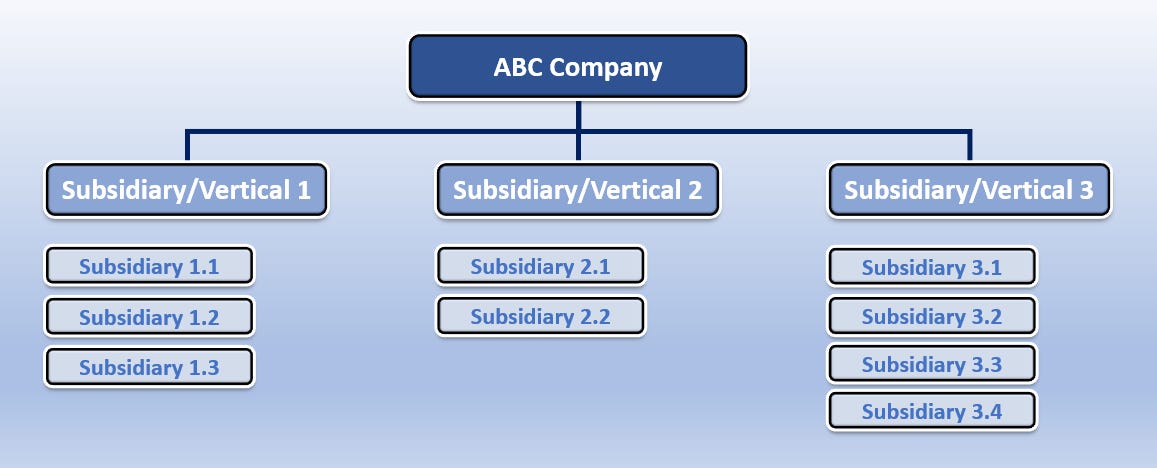

Now, there’s not a lot of materials within the blogging investing world talking about the nuts and bolts of a Consolidated business unit. So, I created this simple diagram to have an assisting visual in how modern businesses are constructed:

This is an example of a corporate business structure. In this diagram, you have the overall corporate entity, which is the name of the company. Below the parent company, you usually have multiple subsidiaries. In larger companies, you have subsidiaries below these subsidiaries as well.

In the meat of this post below, I will cover 2 main ideas or sections:

Corporate Structure & Business Functions

What Concepts Scale Well?

Corporate Structure & Business Functions

Now, a business can have a fairly simple structure or it can get more and more complex. Each business though with have certain implications on its Operations and how it scales by the structure that it decides to go with in any given point in its history. So, what are some things to consider when looking at a simple vs more complicated structure?

Corporate Structure & Business Function Dynamics

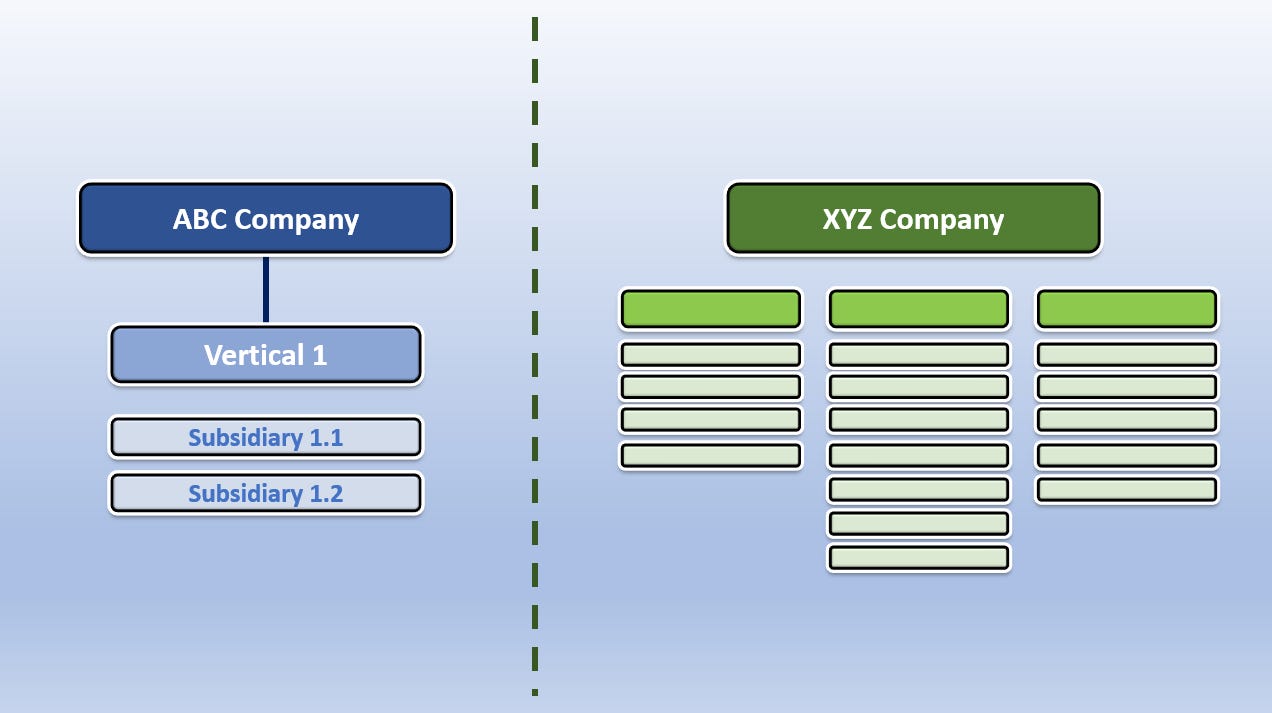

Simple Structure (ABC Corp)

This is the best place to start. For this simple organization, with maybe 2-4 main subsidiaries, this company will most likely have a relatively simple overhead. You will most likely have one Enterprise/Software application to track the following business functions:

Accounting / Financial Reporting

HR Management

Tax Management

Supply Chain - Procurement & Logistics

Ecommerce & Marketing

All the other areas needed to operate a business: Payments, Data Management, Manufacturing, etc.

The main idea is that the business will pay for applications and hire individuals to handle all these Operations. It’s already complicated to manage all these pieces with (1) seamless integrations (2) upgrade cycles (3) business expansion changing the requirements from the business. Considering this, how would running a larger organization differ from this “simple organizational structure” ?

Larger Structure (XYZ Corp)

A larger organizational structure is nothing more than a set of consolidated financials from a set of subsidiaries that all operate as their own businesses.

The larger organization typically allows subsidiaries to operate independently with their own brand, financial reporting/tracking, HR, Tax, etc.

A few applications can be centralized though:

Capital Allocation (not always)

Centralized Reporting (especially for Public Companies): Data and Reporting need to be consolidated and therefore this requires compatible systems across the entire organization

The subsidiaries below the Parent Organization are typically allowed to conduct M&A within their business, creating another corporate layer, and are able to operate their business as its own entity for the most part.

What Concepts Scale Effectively

What sucks about this section is that there is no effective way to answer this question for every business model. However, there are a ton of questions that I ask when evaluation businesses and looking at the corporate structure. I think going through some of these ideas will helps you evaluate businesses in the future:

Managing “Brands” at Scale: Decide on whether you want the Parent Company running a Decentralized or Centralized strategy. For an entities like Costco or Dino Polska (large scale-based economic business), a centralized and simple business will allow for effective operations at scale. Compare that to Kroger though! Kroger operates over 15 different supermarkets/grocery store chains. In a hard business already, Kroger has made their job that much harder by making it where every business or subsidiary needs to operate its own brand/business functions independently. This is a horrible strategy for a scale-based economics business. Kroger essentially destroyed the organization’s ability to become a better business over time by having a horrible corporate structure for their strategy.

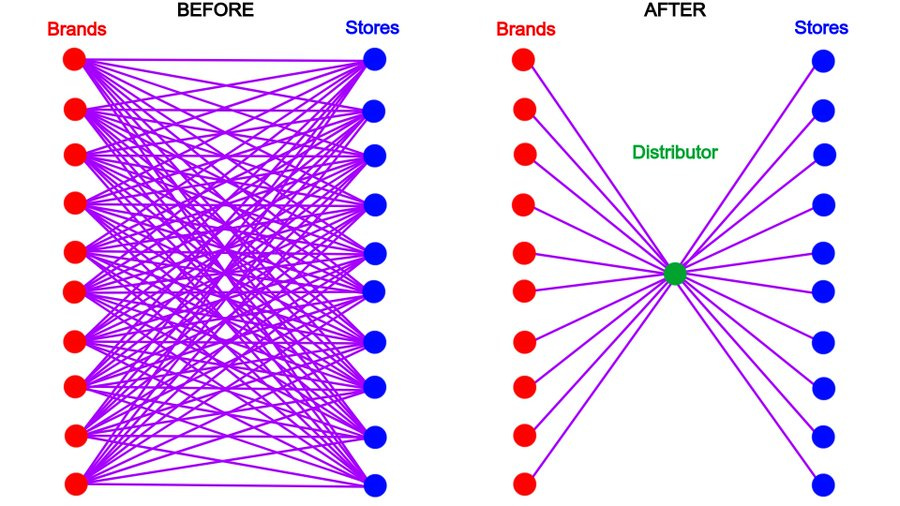

Supply Chain Scaling: This is an interesting subject. The best thing to do with this idea is to zoom out as far as you can and conceptually look at the business. H/T to @jayvas on Twitter for creating the image below! Basically, find whether the overall entity is becoming more efficient and creating more value for the system.

For a centralized organization like Costco/Dino Polska/Copart, as they build a larger network of stores, they can source more product, get better pricing, and add more value to consumers.

For marketing organizations that sell a “product” like Xpel and RedBull, they outsource manufacturing nearly always. This is because the manufacturing is not critical to the organization’s strategy. In reality, the parent organization would NOT be more efficient if a marketing company took over a manufacturing process. Instead, the “product” manufacturing is a commodity so negotiating with suppliers scales more effectively for the parent organization.

Multiple Verticals: For businesses with multiple verticals, these companies tend to run a decentralized strategy with each subsidiary/vertical individually attempting to run a scale-based economics business. Examples of this include LVMH, Lifco, Terravest, etc. Essentially, these businesses roll-up similar businesses within verticals. This allows the overall company to scale effectively and allows for another growth avenue by expanding into a new vertical, alongside growing each individual vertical. Integrated business functions can be as centralized or decentralized within each vertical as the organization sees fit. However as an investor, ensure the vertical’s operation management matches the overall corporate strategy.

Accounting/HR/Marketing: None of these functions scale too well in any decentralized organization sadly. In a centralized organization, most of these overhead expenses will scale well or at least better.

Essentially, there’s no right or wrong way to build a corporate structure to match an organization’s goals. However, there are definitely structures that are more flawed than others. When you’re analyzing businesses, ensure that the structure of the overall business is setup to scale well as the company becomes a larger organization.

That’s the key point though, “as the company becomes a larger organization”. This is especially true for small/microcap companies. Look at the design of the business to ensure that the structure will allow for effective future growth!

I’ve found $100-500M businesses that when I look at their corporate structure, I can tell that the company is going to be a multi-billion dollar business in the future. The corporate structure, strategy, and ability to execute are all there. Similar to a house, the foundation goes up first and can make or break the house in the future.

Ensure that the foundation for your investment is well constructed to meet the overall organization’s goals! If you found this post valuable, feel free to subscribe for free below or give a gift subscription to support my writing now and in the future. Nothing is expected, everything is appreciated.

Have a great day everyone!

Which smallcaps have you found which will multiple several times? :-)