Businesses are typically built to solve problems and meet the needs of customers. This is what drives their success and generate profits. However, it is important to note that not all businesses are primarily focused on maximizing shareholder value. There are businesses that solve problems, generate some profits, but are not worthy of investor’s attention or capital.

Investors are looking for businesses that have a tangible plan for generating profits and increasing shareholder value over time. This can be achieved through a variety of means, such as expanding into new markets, launching new products or services, or increasing efficiency and reducing costs.

Adopting a simple approach, which focuses on analyzing the underlying factors that drive the value of an asset, can often lead to better results compared to more speculative or complex strategies. With these ideas in mind, here is the outline for this writeup to analyze Floor & Decor:

The Problem: Industry Overview, Friction Points

The Business Model

The Growth Drivers

The Financials: Income and Cash Flows, Balance Sheet

The Return Estimates

The Risks

1. The Problem

Industry Overview

Starting with a wide view of the industry, the flooring industry includes products and materials such as: carpet, hardwood, ceramic tile, laminate, and vinyl. In recent years though, there has been a shift away from carpet and towards hardwood and other hard surface flooring options, as these materials are often seen as more durable and easier to maintain.

There are several different types of retailers in the flooring industry, including independent mom and pop shops, home improvement stores like Home Depot and Lowe’s, and specialty stores that focus on a particular type of flooring material or service.

Independent mom and pop shops may have a smaller selection of products, but they often offer personalized service and expertise. Home improvement stores like Home Depot and Lowe’s offer a wide range of flooring options, including both hard surface and carpet, but they may not have as much specialized knowledge as independent retailers. Specialty stores, on the other hand, may offer a more focused selection of flooring products and services, such as high-end or specialty wood flooring.

This industry, like any others though, has some problems.

Friction Points

Home Depot and Lowe’s, as large home improvement stores, generally carry a wide range of flooring and other products and in their stores. However, it is possible that they may not always have a large enough selection of a particular type of flooring in stock to meet the needs of contractors or DIY individuals who are looking for a specific product.

Additionally, because Home Depot and Lowe’s often source their flooring products from third party distributors, they may not have as much control over the selection and pricing of these products as they do for other items in their store. This can make it more difficult for contractors to find the products they need at a competitive price, as the store may not have the same level of purchasing power as a specialty flooring retailer or a direct supplier. This friction created opportunity for a specialty store, similarly to what Sherwin Williams did in the paint industry.

Enter: Floor & Decor.

2. The Business Model

We briefly covered the friction in the industry and what pain points existed. Much earlier to the party, the founder of Floor & Decor, Tom Taylor, opened the first store in the year 2000. His goal was to eliminate the friction and provide value to this niche home improvement industry.

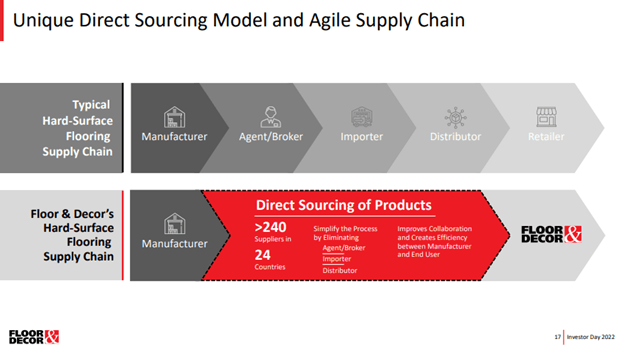

With this goal in mind, Floor & Decor built their own distribution centers and implemented a direct sourcing model, which means it sources its products directly from manufacturers, rather than through intermediaries. With the proper scale, this allows the company to achieve better pricing and add more value to the industry.

At the store level, Floor & Decor operates warehouse-style retail store. This allows customers to browse larger selections and purchase products on site the same day. For contractors and DIY individuals, who:

Want to see the product in person

Want large quantities of the product

Want a larger selection of options

Want to leave the same day with the product

Want to avoid shipping costs

This is a great option. Top of Form

The product-market fit is there, and there are scale economics at play. As Floor & Decor grows, it can order more directly from suppliers at cheaper prices and create more value. These get passed along to the consumer or generate higher profits over time, similar to the strategy Costco utilizes.

3. The Growth Drivers

This is going to be a short section. There are three main growth drivers:

1. Same Store Sales (SSS): Each store as it matures can sell more product year over year. Average tickets also increase over time with inflation and price increases.

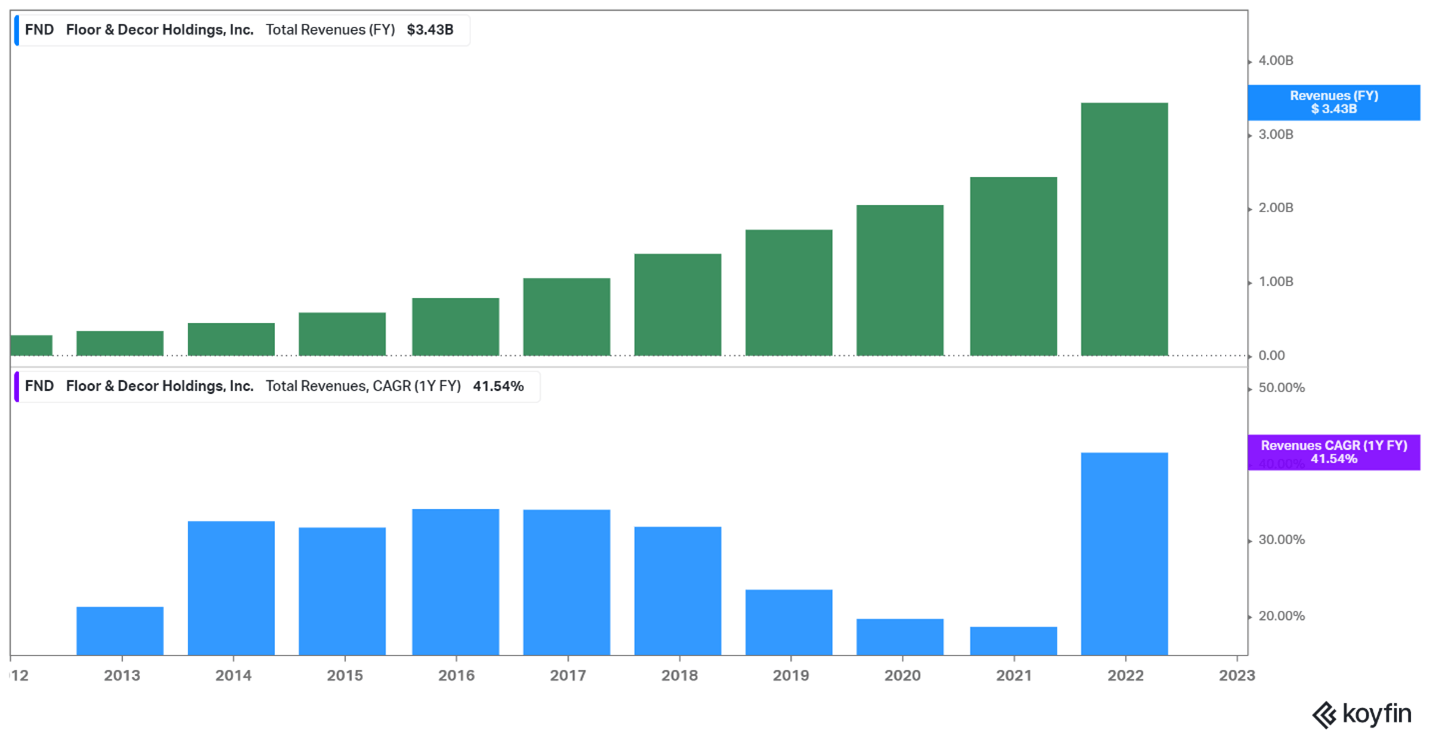

2. Store Count Growth: Add additional stores at good locations. The company has targeted a 15-20% store count growth per year with a 500-store count target in 8-10 years. The company has 178 stores today. These two factors allow the company to routinely put up 20-30% revenue growth numbers.

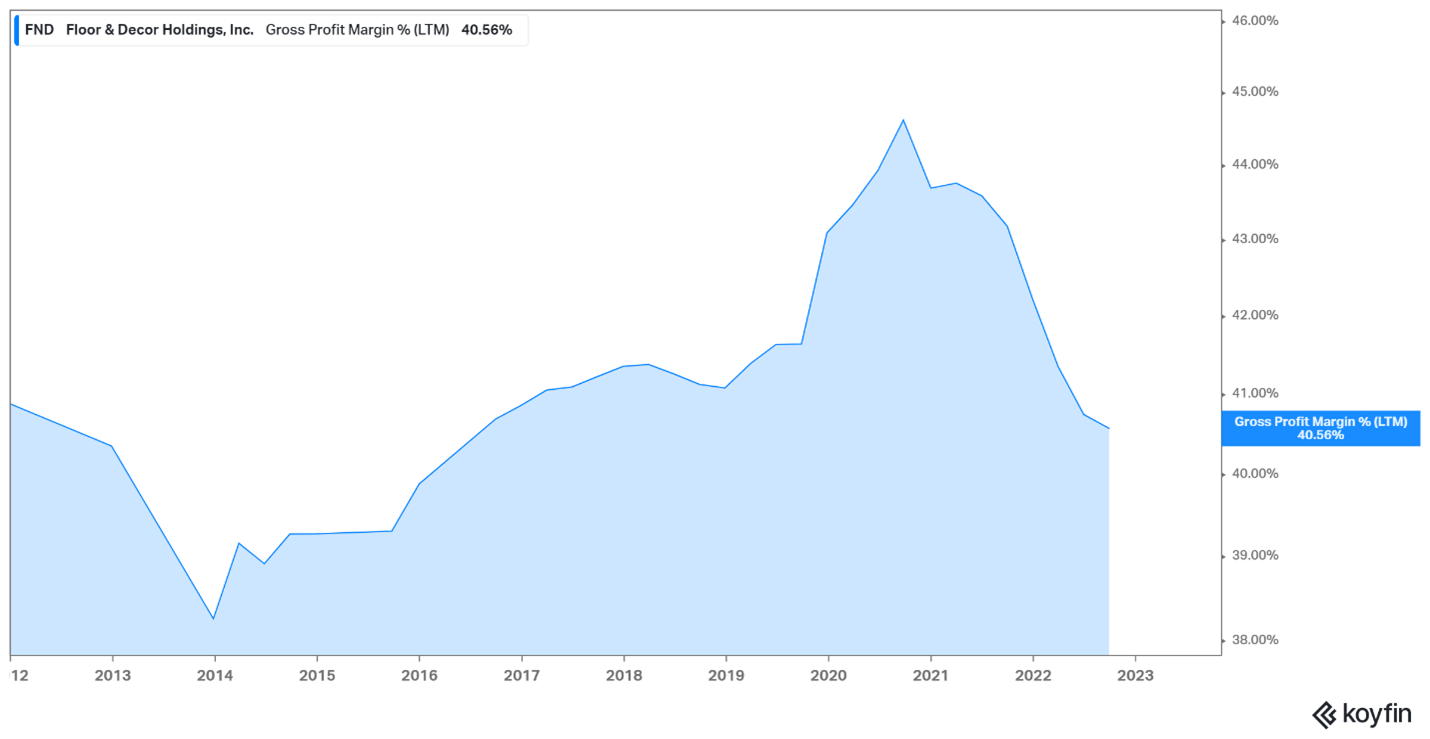

3. Cost Efficiency: As the company adds stores in the locations where existing distribution centers exist, there are cost efficiencies unlocked. This can be clearly seen by the Gross Profit and EBIT margins increasing and SG&A costs decreasing over time.

4. The Financials

Income and Cash Flow Statement

Floor & Decor has a relatively simple cash flow and income statement, so I will not be spending too much time here. There are a few things to note:

Operating cash flow is higher than net income margins, due to large depreciation costs of a physical footprint. It also has significantly decreased the past year, due to increasing the inventory. I wouldn’t be worried about this. Flooring is a durable, largely fad resistant, and does not expire like other retail names.

Free cash flow is much lower than operating cash flow, due to the capital expenditure of opening new stores. As store count matures and ROI decreases per store, this will most likely be returned to shareholders. Best personal guestimate: This starts to occur in 4-6 years as the store count is harder to grow at the 15-20% rate.

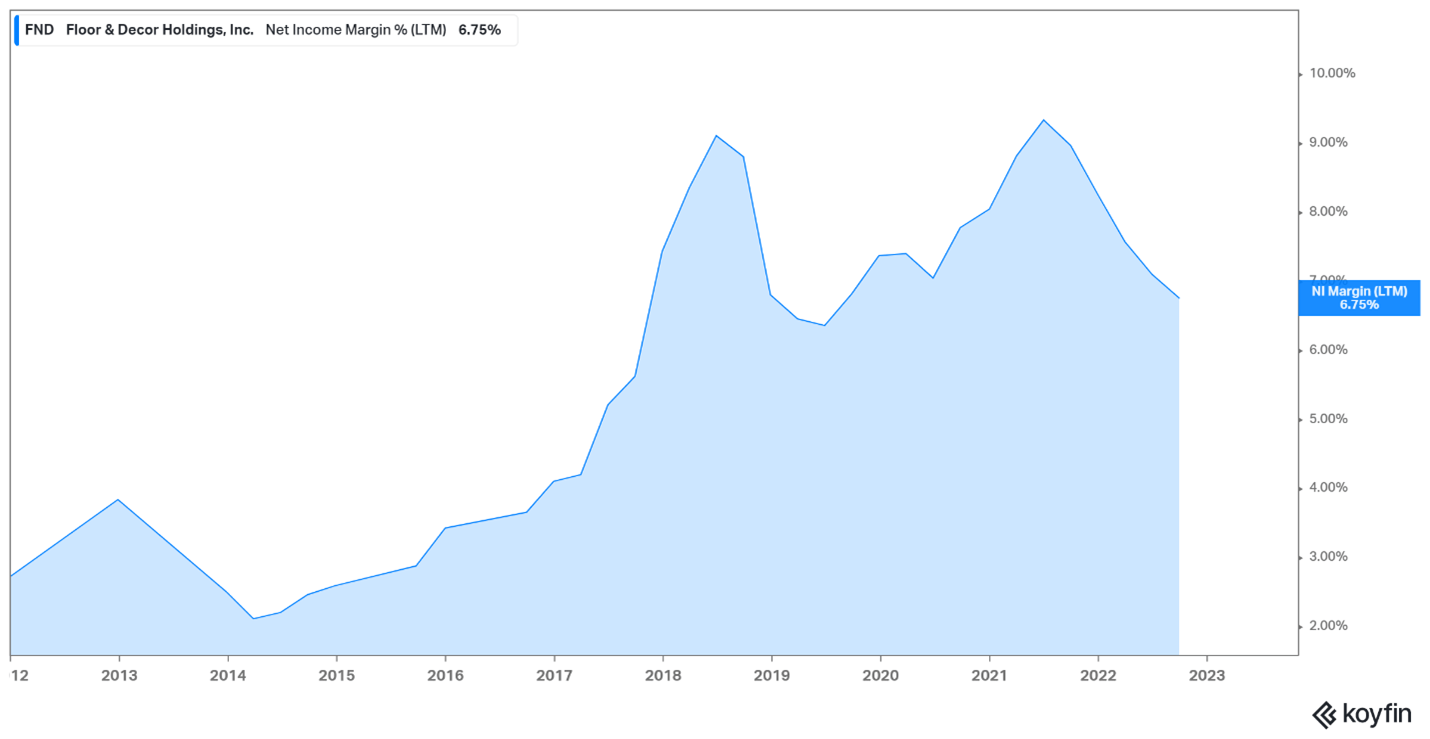

That’s about it. Simple enough. Net income margins for the last twelve-month period were 6.75%. As a shareholder, you love the fact that this trend is up and to the right. Gold star for management.

The Balance Sheet

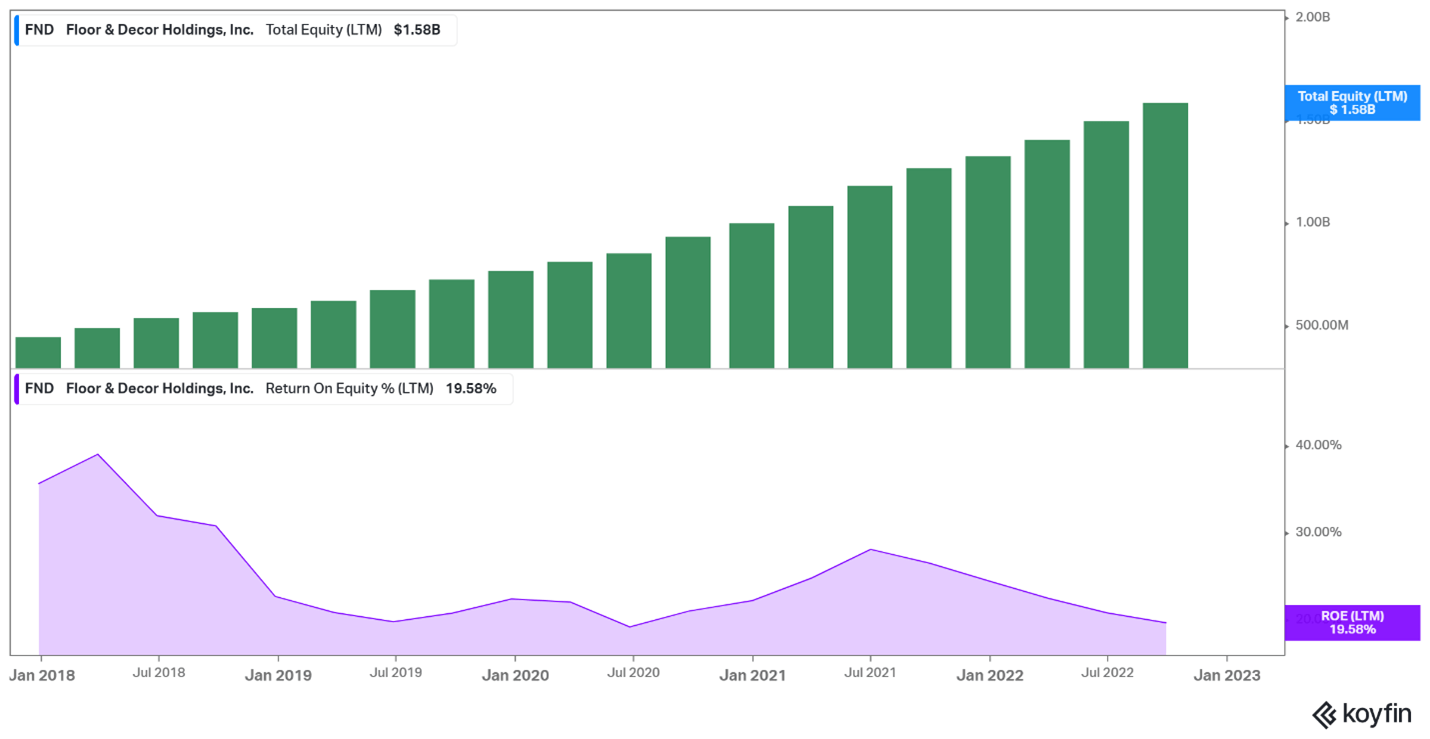

The balance sheet is conservative. There is not a lot of long-term debt, and equity has been ticking up quarter over quarter with attractive Return on Equity numbers. Another gold star for management.

Sadly, the company is not sitting on a lot of cash and equivalents. No gold star here but with so little long-term debt, I won’t knock them too hard.

5. The Return Estimates

These return estimates are from my napkin math calculator that I created to monitor holdings. The assumptions for a 10-year period are below:

Store Count Growth: 178 store count at the end of Q322. 500 expected in 8-10 years (500/178 = 2.8x revenue).

SSS: Conservative same store sales growth average of 3.5 percent (1.035^10 = 1.41x revenue).

5% dilution: I think this is conservative because I think the company will start returning capital but I’ll model for the worst case. Past 3 years, the company has diluted shareholders 6.5%. CapEx through existing store base will fund more expansion here on out (.95/1x results).

Net Income Margins: I think net income margins can come in at the end of the decade around a steady 10 percent. This being due to operating leverage on distribution centers, SG&A leverage, and gross profit margins rising with efficient procurement (10/6.75 = 1.5x).

Ending Valuation: Throw whatever you want here. I’ll put toss a 20x ending PE on it with international expansion, high return on capital new store opportunities, and a large percentage of capital being returned. The company sits at a 27x trailing PE today (20/27x on results).

The result comes out to -> (2.8 * 1.41 * (95/100) * 1.5 * (20/27)) ^ .1 = 15.3% CAGR expected over 10 years.

6. The Risks

I think besides the cyclical nature of the housing industry, I don’t see any massive risks. It is a definitely a cyclical name so do not expect it to be linearly up and to the right. This name will have massive swings that will provide opportunity to the retail investor that has time and perspective on their side.

I think there are not really any existential risks to this name either. Mom and Pops cannot compete at the corporate scale and the company has created its niche between Home Depot and Lowes. All around, I think it’s a very simple and boring investment. Find your rate of return hurdle and pounce on opportunity when it presents itself.

Sometimes, boring is best.

If you like this post, feel free to leave a comment, subscribe, or share this Post!