Welcome back recurring subs and welcome aboard new subscribers!

Today, I will be covering my largest position: Evolution Gaming ($EVO.ST / $EVVTY). My last post on Evolution, published in December 2020, did not adequately break down the dynamics within the industry properly or distinguish WHY Evolution Gaming even had an advantage within its industry’s supply chain. Since then, I’ve learned a ton about the company and probably rushed out an article back then.

Therefore, today I will be updating my analysis and thoroughly breaking down Evolution Gaming, its place within the growing iGaming industry, and why I believe it can continue winning within the space! As a hook, here’s just some interesting facts for you:

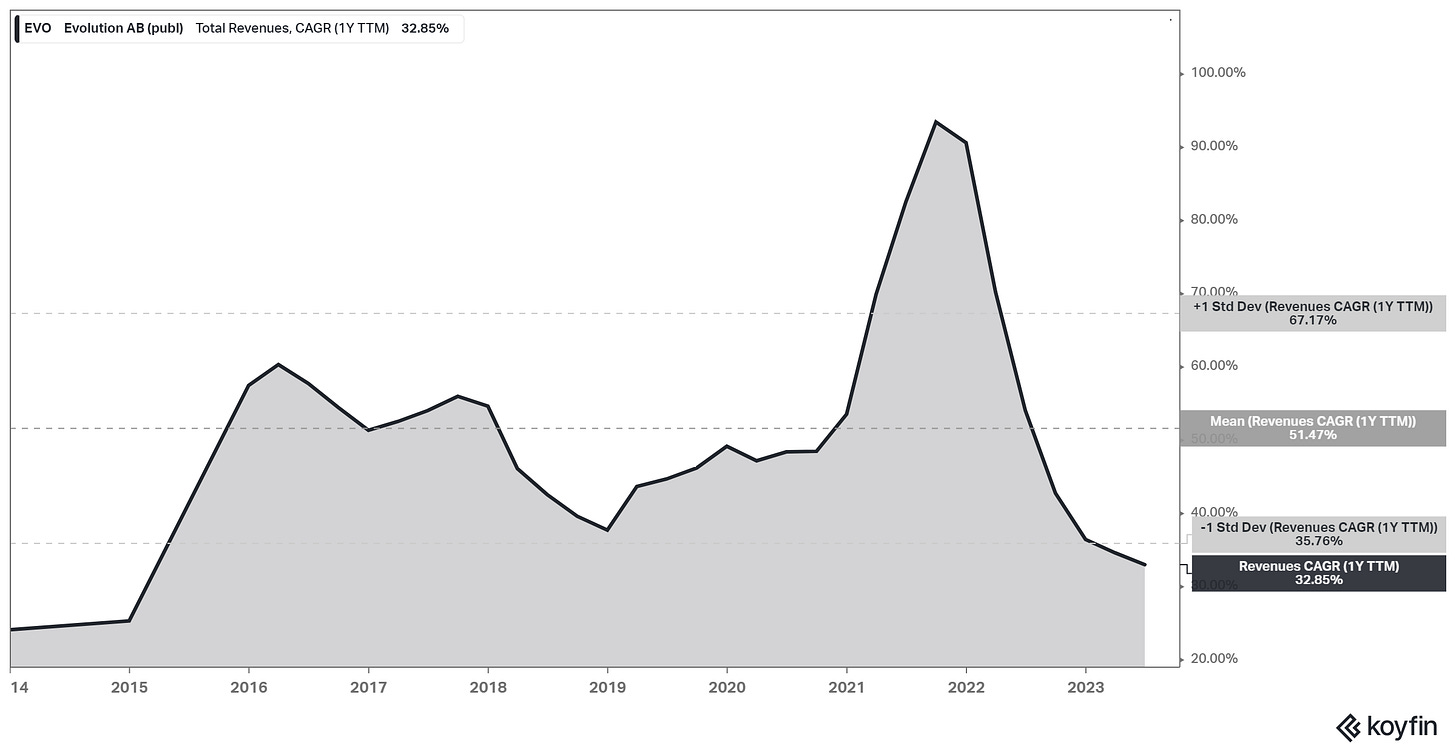

Since going public in 2015, Evolution Gaming has grown its revenues by an average of 51% per year. High growth without consistency doesn’t mean anything though. Good thing the -1, +1 Standard deviations covering 68% of past statistical growth rates are between 36% and 67%, implying a highly consistent and high average growth business!

The company trades at a 21.2x trailing PE, 17.4x NTM PE (per Koyfin - 21% forward revenue growth)

Returns 50% of profits via dividends to shareholders and only requires 4% of revenues for CapEx. From 2016 to today, dividends per share have grown from .06 EUR to 2.00 EUR (65% CAGR). Next year’s cash return yield will likely be above 2.5%, based on today’s prices.

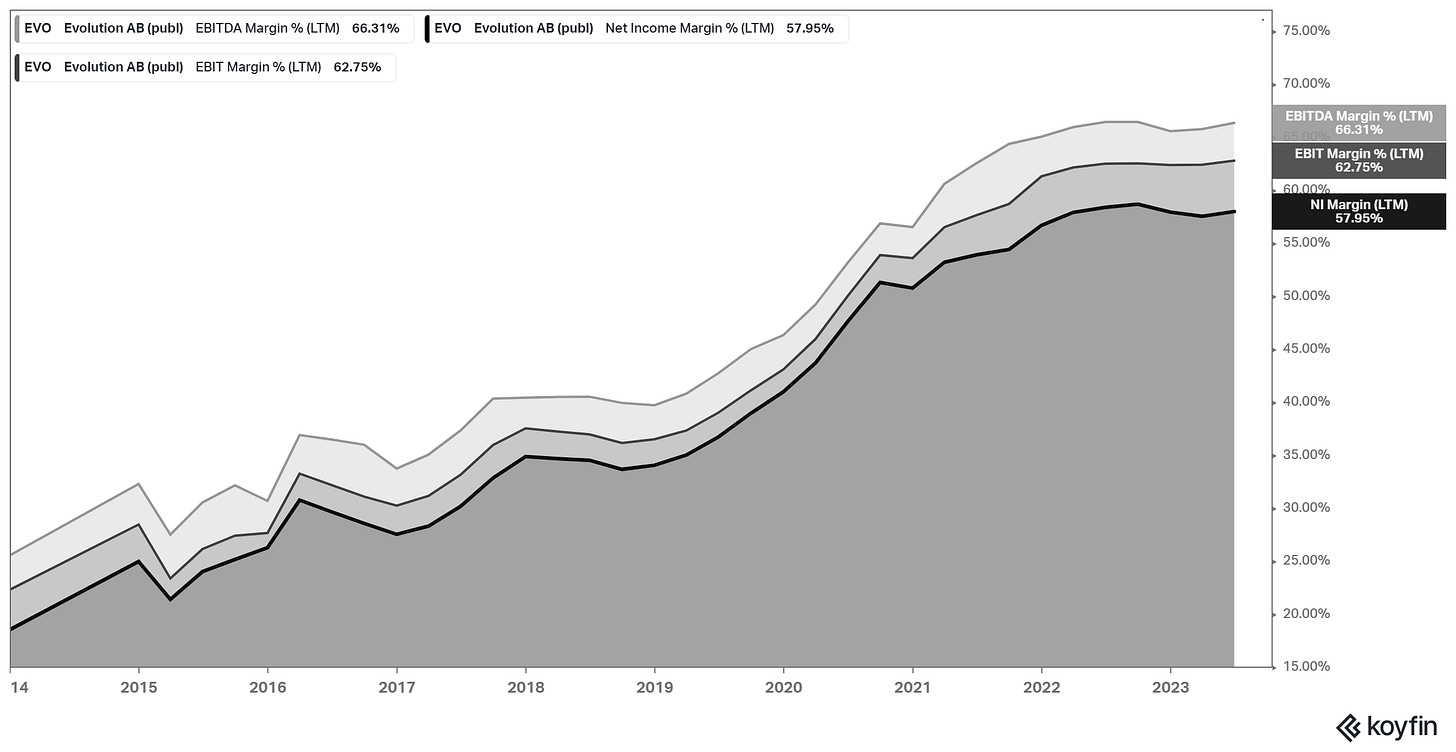

Generates 60%+ EBIT margins, a tad behind Visa but ahead of Mastercard, with toll-road style revenue dynamics.

If any of that interests you and you want to learn more about this company and its industry, read on below. Additionally, subscribe to Fundasy Investor if you want more free articles like this sent to your inbox!

Customers/Users

The place to start this story is with the end user. Imagine a typically slimy industry, such as gambling, and then picture the same industry within the digital space. As a user, it’s a unique world to enter into. Would you trust this medium? Would you be dealing with scams? Safe to enter your payment information?

Tons of questions and concerns. Things need to be PERFECT, else the consumers will not trust this medium to gamble.

In addition, you have casinos all offering promotions or “Pay to Plays” for you to enter their app or site. Games are unfamiliar and hard to learn. Real money is at stake. Then, once you finally get used to the games and the rules, a glitch can happen where the stream crashes once you have that perfect hand. Needless to say, you wouldn’t use that game provider anymore.

This is the world of online gambling, the iGaming Industry. Simple in concept. Difficult in execution. It draws many parallels to the E-commerce industry back in the early 2000s. The industry is a secular movement away from brick and mortar into an online world.

However, disruption via a new distribution channel is not always a silver bullet. Some recent examples for me come to mind:

Streaming: Netflix appears to be building a commanding lead, but the real takeaway was that streaming, in general, has poor unit economics, compared to its predecessor, Cable. The leader, Netflix, has kicked the snot out of its competitors such as Disney, Paramount, and Peacock to name a few. However, it does seem like all players struggle to produce cash from the revenues generated.

Music Streaming: I think it’s firm to say that Spotify is crushing this trend. They have thoroughly outpaced its competitors Apple, Amazon, and Google in the music distribution game. Their product is superior. However, unit economics are abysmal. The company is still massively unprofitable, even after generating over $13 BILLION in sales the past year.

Online Shopping: This one Amazon has taken a decisive lead in its target market. However, many players are all winning in their given area. The winners and losers in this area can be predicted but are not set in stone. Companies such as Mercado Libre, Shopify, Wix, InPost, Coupang, Sea Limited, Amazon, and many others are all playing in this field. Who knows what will happen in the future! However, if investors look at the elements within the supply chain that are the most difficult to replicate and have attractive unit economics, that’s a solid place to start!

My point with these examples though is that disruption is not a guaranteed success. Learning and understanding the unit economics, dynamics within the industry, and who holds the cards are questions with the utmost importance to generate positive shareholder returns. That is why in today’s post, I will be walking through the iGaming industry as I see it. To provide you readers with a concise overview of the industry, what Evolution Gaming’s place is within that dynamic, and why I believe their position will yield positive shareholder returns in the future!

Below is an assisting visual diagram that I created for this purpose. Don’t stress about not understanding it yet. I’ll be walking through it methodically throughout the post.

Customer-Operator Relationship

I think one of the most important dynamics at play in this iGaming system is the entry into the industry. The entrance to online gambling is through an Operator or Casino. These Operators fit into a few categories:

A Land-Based Casino: These operators are Casinos that operate in a brick-and-mortar location. They want to get into the online gambling scene but don’t have either the expertise or capital to do so. This category includes larger names such as MGM, Caesars, Casino Estoril, etc. However, it also is available to smaller operators that can go online and leverage their small but sometimes loyal customer base.

A Digitally-Native Casino: This is how I would describe the new entrants in the US such as DraftKings or Fanduel or the European players, such as Unibet or 888 Casino to name a few. They all operate their own sportsbooks. However, they figured out… why not offer iGaming options as well and outsource that functionality to monetize their experienced online gambling users?

A Gaming Aggregator: This final one is one that many have not heard of. A Gaming Aggregator is a one-stop shop software that combines thousands of games from different suppliers. More on this in the section below!

Below in the yellow-lined segment is the interaction between the users and operators. What do we as investors need to understand about this dynamic?

Customer Acquisition: This dynamic between operators and customers is probably the most familiar. Every viewer of sports in the past 24 months has been bombarded with gambling ads. Acquiring users is the name of the game for operators. It’s an expensive marketing ordeal. Just to highlight this fact, DraftKings ($DKNG) has never had a positive Operating Margin on record… it’s a knife fight out there to gain and retain users.

Promotions: To attain users, many Casinos offer promotions to get a user to gamble with their software. This can be free spins, a bonus sign-up, or referral codes. Users are also clever and tend to churn these rewards so it’s a constant battle in this dynamic. Brands to date have not appeared to have a significant effect on retaining users.

Types of Gambling: In addition to many choices for what platform to gamble on, users also have many options on how to gamble. Gamblers can choose Blackjack (primarily US), Roulette (primarily Europe), or Baccarat (primarily Asian markets). There are also other options such as slots, game shows with licensed materials, Poker, or variations of any of these games based on speed, payouts, or multipliers! The options are endless.

Aggregators: With so many different game options and integrations needed, Game Aggregators found a market to combine all these games from the B2B Suppliers into one API to integrate into smaller Casino’s tech stack. This is a great option for smaller operators for simplicity but larger Casinos will typically integrate directly for lower operating costs.

Regulations: As you can imagine, there are many many regulations across the entire gambling industry, online, and in-person. Operators/Aggregators must make sure that the users are not located in locations where gambling is illegal (many use a VPN to get around this). In the US specifically, it is federally illegal and only recently legal on a state-by-state basis.

It’s a tough industry. From a consumer’s perspective, it should be simple. Simply put an attractive individual in front of a camera, stream their dealing with one-to-many individuals, and collect online payments. Boom you have a Live Casino!

This raises questions though…

If online gambling was largely made legal in Europe from 2005-2012, why does Evolution Gaming have the largest online casinos in Europe (888 Holdings, Betsson AB, Entain) all as customers, not competitors? Why have none of them tried to in-house this service offering since it is just a camera and a dealer?

Why have some of the largest casinos in the US (MGM, Fanduel, DraftKings, Penn National) all partnered with Evolution Gaming as a supplier?

Las Vegas Sands announced they will build their own B2B Live Casino product this past summer. Will it be successful or bleed cash? After all… its just a camera and a stream. How hard could it be?

To answer these questions, we need to understand the B2B offering for Live Casino Suppliers and the relationship they have with the Casinos, denoted by the next section in yellow!

Operator-Supplier Relationship

This is the more complex dynamic at play. Land-based Casinos are legacy enterprises. Consider this, the first Casino was built in Italy during the 17th century! It’s an old industry. In addition, the owners of these casinos are good at what they do. They manage people. Drinks. Eating. Physical security! However, what happens when Casinos need to translate this very physical experience into a digital one?

Experience: Users in a game need to feel “entertained”.

The UI needs to be good. This will require a larger number of skilled developers to build the gambling experience within a phone screen. Also, the stream needs to be compatible with desktop, iOS, Android, and all updates/models of every device. The baseline needs there.

The games need to be good and have tons of options! This is similar to streaming how users got bored with streaming services that only have a few good shows. If an iGaming casino drops with only a few games, users won’t be interested. The games all need to be HD, have attractive people on screen, have the right speed of play, and replicate this across a few hundred games. Then, do the small task of managing this 24/7 across the globe in multiple languages.

Dealers:

The dealers all need to have experience interacting with live chats, creating a “personal” gambling experience for users.

Dealers all need to understand local/global regulations on situations that may occur: fire alarms, dropped cards, etc.

This all will require training and an in-house academy, another fixed cost.

There will also be high turnover, due to the need for younger dealers who will quit quickly after being in a dark studio all day interacting with just a camera. Evolution hires thousands of dealers a month for just the usual turnover rate.

Security:

Digital threats are real. In a land-based casino, if you use your phone to cheat, you go to jail. In a digital world, that’s the norm. Cheaters are playing heads-up with their entire ability versus the house. There’s a story Chris Mayer shared of a software noticing a slight tilt in the floor on a roulette wheel and the house got taken for millions before they figured it out.

In addition, the house needs to monitor the floor to meet regulations on whether dealers have a weak shuffle or if the roulette wheel doesn’t spin enough times before landing.

In summary, it’s a ton of fixed costs that all need to be made upfront. Otherwise, the house is going to either be hit by regulators, the churn of customers, or some malicious cheaters might take advantage of the inexperienced house entering the online gambling world.

Mathematics: This one I can’t take credit for but H/T to @W1NST0 on Twitter for sharing this. The mathematics behind operating a Live Casino require scale and player density, else you’ll be running a negative OpEx game with significant CapEx intensity discussed above. However, my only complaint here is that EVO averages 4-17% revenue share on net revenue depending on the (1) size of the casino and (2) type of game and if it requires licensing costs (Monopoly/Deal or No Deal).

Partnerships: In addition to hosting these games, the actual revenue is made through two main streams: Branded Services and Revenue Split

Services: Evolution offers dedicated branded tables for operators including outfits and UI branding. These all require an upfront cost, typically funded by the operators themselves, not the Supplier.

Revenue Split: This was covered earlier briefly. However, EVO is rewarded 4-17%, 10-12% on average, of the net revenue the games profit from. Casinos pay when the Suppliers run a profitable service. Compare this idea to operating yourself. For 4-17% of missed fees on net revenue, casinos can potentially lose millions and millions of dollars, take years to implement, and it might not even be profitable ever… a “Gun for Hire” CEO of a big Casino would have trouble risking 6-8 bad quarters in sunk costs to even have a shot at maybe breaking even. Human incentives at work! It’s hard for me to see a reality where a land-based Casino that makes money in its core operations can run a streamlined digital operation, starting from way behind the digitally native incumbent. Look at how it’s gone for Disney vs. Netflix… and that’s not even a business model where viewership directly relates to higher revenues.

To summarize these thoughts, read this transcript from @InPractice on Twitter where an iGaming Exec explains why no casinos in-house Evolution’s services. H/T Chris Mayer for sharing.

Now, all of the items discussed above are targeted at the Casino/B2B Partner dynamic. What is the dynamic like between B2B Suppliers though and why does EVO have s 60% market share in Europe and nearly 100% in Live Casino in the US??

B2B Competition

I believe we have thoroughly covered why in-housing a live casino is difficult. In addition, we also covered the reasoning behind why a live casino is just an all-around difficult operation to run effectively.

However, we have not thoroughly covered the dynamics between the B2B Suppliers! These companies provide the full end-to-end service for their partners. Each B2B company tends to have a niche of online games that it focuses on. The games broadly can be categorized as RNG Games (Random Number Generator - contains Slots), Live Casino (Poker, Blackjack, Baccarat, Roulette, Craps, etc.), and Game Shows (RNG/Live Mix in a game show format).

For the last 12 months Evolution, Playtech, and Pragmatic have had respective trailing revenues of 1.66B EUR, 1.67B EUR, and ~100M EUR (Private company so unconfirmed actual amount). Within the Live Casino market, the market shares respectively are approximately 60%, 15%, and 5%. The other remaining 20% is a knife fight among the smaller players. Playtech/Pragmatic do have a significant foothold within the slots/RNG segment though. However, slots/RNG are a more commoditized product due to no human operating expenses/training, easier-to-produce automated games, and generally a significantly less complicated product.

To illustrate the difference of RNG vs Live unit economics and market shares within Live Casino, below is a chart of the Evolution vs Playtech financials. Notice how the leader within the more difficult and fast-growing live casino market tends to have better unit economics and better growth.

Now, I would be remiss if I didn’t state that Evolution Gaming has tried relatively unsuccessfully to gain a foothold within the RNG supplier market. In 2020, Evolution purchased Swedish-based slots provider NetEnt for 1.9B EUR (23.5x EV/EBITDA). In addition, Evolution also acquired another slots provider, Big Time Gaming, that commanded 88% EBITDA margins for 450M EUR or 16x EBITDA.

Even with these two acquisitions, RNG as a percent of revenue is in the mid-teens and hasn’t grown as a business segment since the acquisitions. Evolution’s management has indicated they expect forward mid-teens revenue growth from this segment, planning out a large suite of games for this year. However, it appears largely unsuccessful thus far and many shareholders are not pleased with the capital allocation strategy in the past few years from the management team. These shareholders would much prefer buying back the company’s own stock since its own shares might have the best value compared to these acquisitions.

I would consider the RNG a “free-call” option for Evolution. With the company’s distribution and the segment’s high margins, it’s possible this could be an accreditive area but user retention among a commoditized product is a key issue.

B2B Comparison: Quality in Live Casino

This will be a short section. The main aspect I want to cover is game quality. There is a ton of first-person data out there but I can succinctly summarize all the analysis out there within a few points:

Between the big players, all the Dealers/UI/Streaming quality is comparable.

Evolution Gaming has the best games, comes up with them originally, and the others tend to rush out to “copy” the games the firm puts out.

Evolution does not have the most interesting dealers. However, it does offer the most variants of games for speed, risk, etc.

Evolution licenses the most “name brand” names like Monopoly/Deal or No Deal.

Now, that concludes the part of this post where the industry and wide dynamic are being covered. From this point on, I will be covering Evolution Gaming and why it will continue winning, the risks associated, and the financial implications for investors!

Evolution Gaming’s Advantage

Scale Scale Scale

Evolution Gaming is the dominant player within a good industry to be the leader. This industry has a situation where if you can retain more user attention, you make more money proportionally.

Compare that to Netflix’s business model which can just hope to hold enough attention to prevent churn and increase prices further. In iGaming, if the leader holds the user’s attention, there is no automatic subscription that can help the <1% market share holder. That competitor simply goes out of business because they never got the player density required to even cover the Operating Expenses for each game.

With its scale, Evolution can:

Spread its costs across its larger user base, investing more per game and taking longer to get the game “just right”. This allows for better game flow, better security, and more creative games.

Charge more than competitors in revenue split. Since Evolution makes 10-12% commissions on revenue, even if a competitor comes in and offers 5-6% then they would still need to make significantly more than Evolution per table for this to make a difference for the casino. If Evolution makes 25% more net revenue per table then paying 5% more commission per table is worth it. This in turn allows Evolution to be more profitable and spend more on games/capacity/quality.

Create more dedicated fix-fee tables for large customers! Evolution Gaming makes revenue from all its partners that have their own branded tables on its platform. This is a scale-based economics that pretty much only the larger players can enjoy.

Create its own lobby. You see after a user enters an Evolution Game, there is an “Exit to Lobby” button. That button doesn’t take you back to the Casino’s interface though. That Lobby is the Evolution Gaming lobby where a user can then play another Evolution game! This is why having a wide array of games is also a priority. It allows Evolution to retain its gamers within its own platform! This is why I put the circle-back icon within my industry diagram below the iGaming suppliers.

Evolution is in a feedback loop where the industry leader continues to get stronger. It’s a weird combination of business quality, along with a complementary industry that rewards only the leader with excellent unit economics.

Culture

Systematic and strategic insights are nice. However, every investor knows the phrase “culture eats strategy for breakfast”. It’s a nice coincidence that Evolution Gaming probably has the best team in the gambling business! With 15% insider ownership, this 20B EUR company is being run with the long-term mindset that I like to see in management teams.

Martin Carlesund (CEO): Carlesund seems to be a good CEO. He has experience in Computer Science, Law, and a Masters in Finance. He has a well-rounded education, which is useful in his current profession. Martin does not prioritize margins at all. He states repetitively on calls or to analysts that he will prioritize taking market share over EBITDA margins any day. Just a good operator and he’s on record stating he wants Evolution to be one of the best companies in the world, regardless of industry. Everything appears like he’s in for the long haul and isn’t a “gun for hire” CEO.

Todd Haushalter (CPO): Todd is undoubtedly the most important individual in Evolution’s C-suite. He’s pretty much the Steve Jobs of gambling. Obsessed with providing the best experience, he studies Apple/Amazon/Spotify and why consumers love them. He’s obsessed with not being disrupted. Starting out in Las Vegas, he’s been in gambling his entire career and made his way to Evolution Gaming in Sweden. Now, he gets to be creative and build the best games at the second-largest publicly traded gambling company in the world, and he’s on record stating, he does not want a CEO position and does not envy Martin’s job at all. He’s the biggest asset and probably the biggest potential liability for the company today.

I’m going to embed a set of his speeches below. I would highly recommend watching some if you haven’t already or want to “get to know the culture”. Long watches though.

Risks

This company has a ton of potential risks. There’s a reason it’s trading at half the value of the FANGs but has 2-3x the growth. Below are some risks in no particular order of significance:

Key Main Risk: Todd/Martin leaving are both big risks, mainly Todd. I think it’s unlikely given his age, relative freedom/importance in his current role, and is at already at the biggest online gaming company.

Different Gambling Modes: Cited by Todd himself, online gambling is also things like Robinhood/Coinbase. The actual mechanism to gamble might move to online video games, “investing in short-term options”, or whatever else might come down the road. It’s unclear what the horizon has to offer here.

Medium Change: Today, online gambling is conducted on phones, surfaces, or desktops. There’s a potential reality where online gambling is moved to a VR/AR environment and the platform owner is a POS, destroying the unit economics, similar to the App Store or Google Play Store. I think Evolution can move to a new medium easily, phones/desktops will still be utilized obviously, but new platforms do pose potential risks.

Competition: I think both the in-housing and B2B competition have been covered thoroughly thus far. Make your own opinion in this matter.

Regulatory: The best for last here. Regulatory is the elephant in the room for risk management with this company. Evolution being a B2B supplier, it luckily has no responsibility legally for who is on the platform (“KYC Requirement” - Know Your Customer), unlike the Aggregators/Casinos. This could be subject to change but that’s the reality today. Today, the Operators/Aggregators who allow entrance into the gaming environment are in charge of KYC due diligence. In addition, there are 3 classifications of markets for the legality of online gambling: White (all-legal), Black (illegal), and Grey (undisclosed either way). History has shown that grey markets tend to move to white. However, instances such as Australia in 2021 show that this isn’t always the case. The risk here is that Grey markets will move to black and cause a total loss of GGR (Gross Gaming Revenue). The entire situation is very akin to how Uber/Lyft operated for a number of years.

Investors see this as a 1 or 0 situation. I see it as defacto 1 until told otherwise. Countries all want gambling tax revenue to increase their budgets and incentives speak louder than words, especially for Politicians who tend to have no morals anyway.

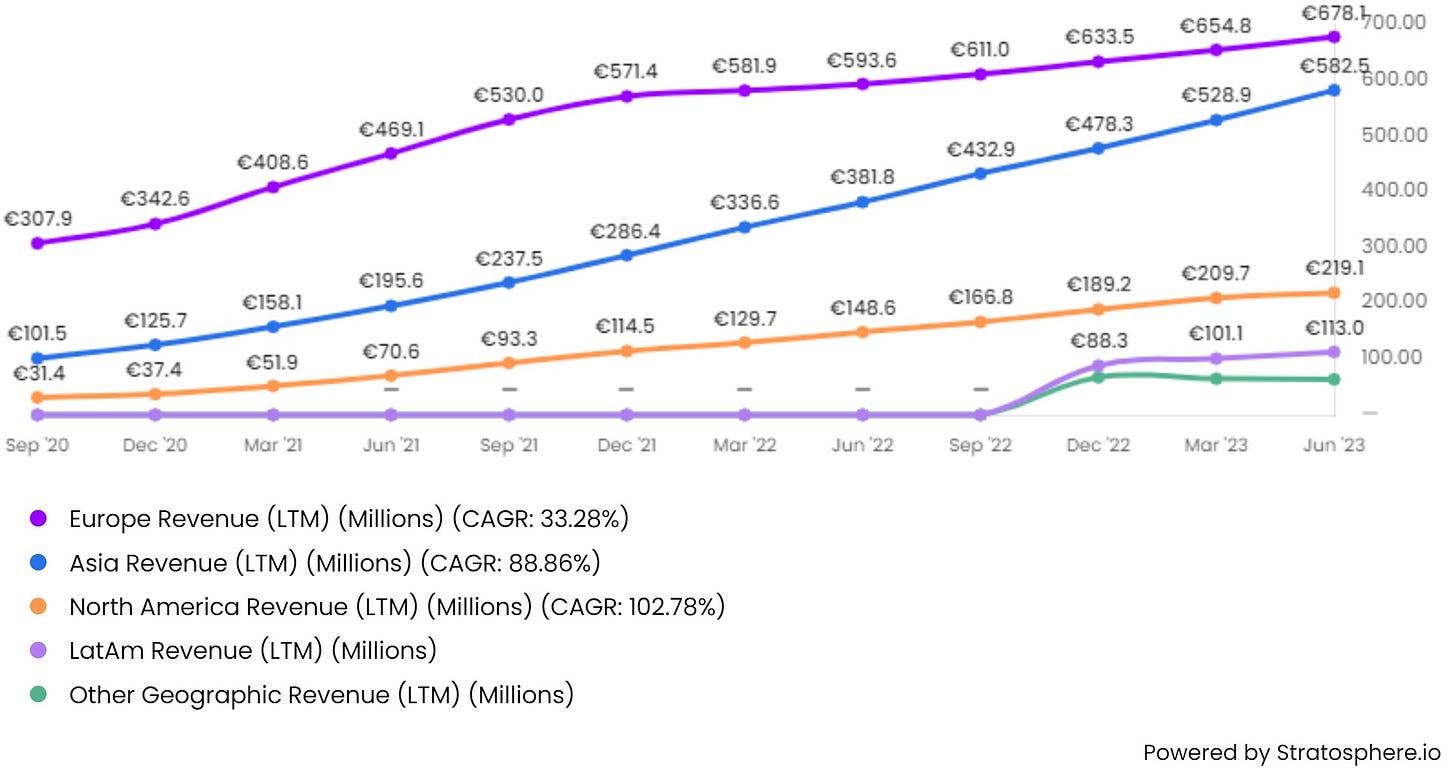

Geographic Revenues: The revenues for the organization are becoming concentrated within the Asian content. With so many people in Asia gaining access to the internet and online gambling, this is a major growth area for the company but also has the highest potential regulatory risk. Definitely a double-edged sword.

Anyway, I think knowing the risks is important.

Is the best person to follow to understand the risks at play in this company. Highly recommend you follow him on Twitter as well (@gnufs).The Financials & IRR Assumptions

Now, given I am already near 4000 words. I will make this section short. The real purpose of this write-up was to describe the competitive advantages that Evolution enjoys. I hope to have achieved that goal!

Let’s get to our inputs: (1) Revenue Growth, (2) Terminal Margins, (3) Terminal Multiple, and (4) Capital Return/dilution.

1. Revenue Growth

**Special Shoutout to my Sponsors: Koyfin & Stratosphere.io. If you want awesome charts like these and to support my writing, use my referral links on my home page for 10% off!

Revenue growth is great. It’s averaged 50%+ since 2016. The “mature” Europe market is growing mid-teens still. Asia/North America are growing 40/25%+ respectively. If I were being simple, I’d key in 20% growth for the next 5 years and 15% thereafter.

Input: Average revenue growth of 17.4% (what the math above comes out to).

2. Margins

Few comments here:

Gosh dang, that’s impressive.

The tax rate is expected to increase next year with the EU unanimously increasing the tax rate to 15%. To this point, Evolution Gaming largely operates in Malta where the tax rate is like 5%. Smart cookies looking for tax advantage. With an average 7.5% tax rate today, that lowers net income margins to around 53% once this increases to 15%. However, I’d expect some scale-based efficiencies to still be gained in the future. More on the EU legislation below.

Input: Even net income margins going forward. No change over the long term. Short-term hit in 2024.

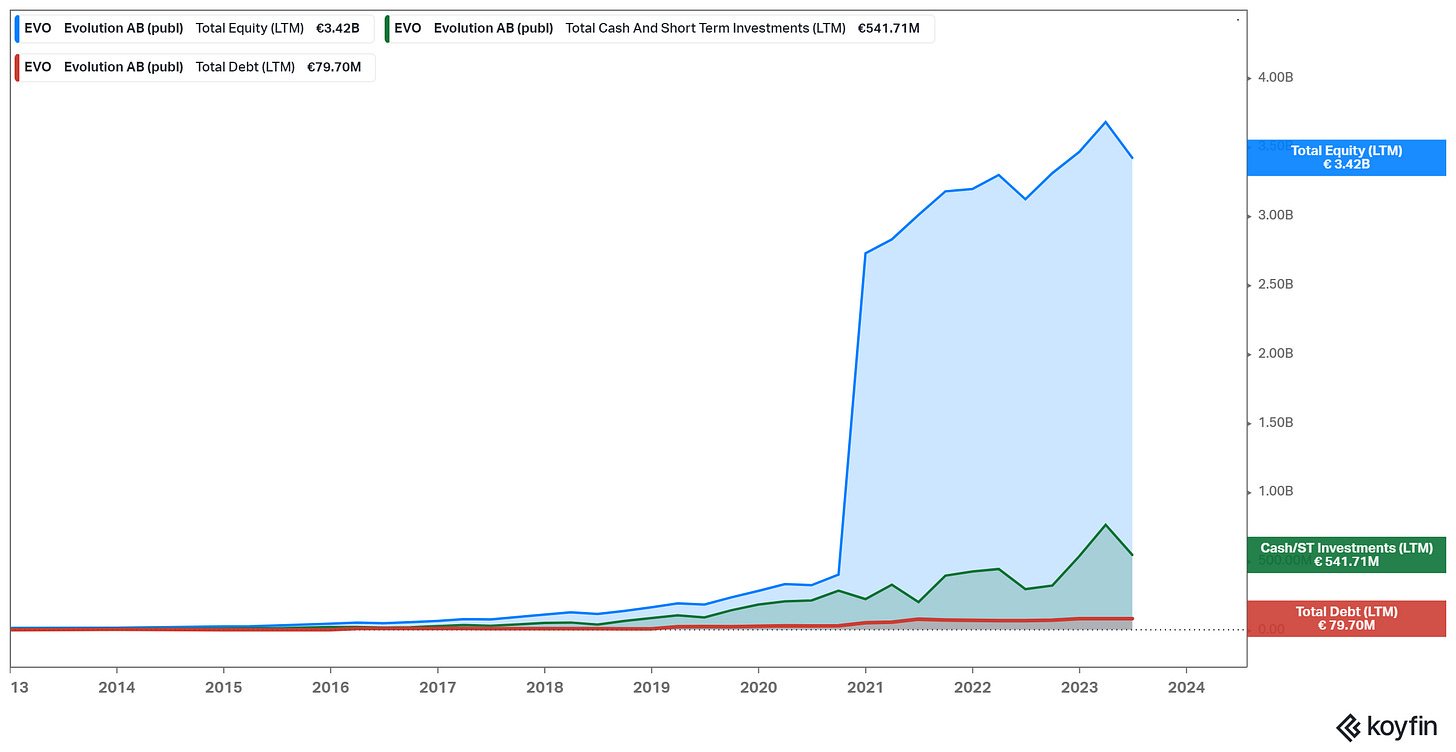

3. Capital Return / Dilution

Dilution: The company just approved an incentive plan for warrants that will increase the max dilution to 2.88% but the stock price needs to increase 30% for these to take effect. Again H/T

, he’s an absolute unit for information like this. The large bump in 2020 was to acquire NetEnt but I don’t foresee another massive acquisition such as this in the future.Dividends: The company pretty much only pays dividends. They have very minimal repurchases, unfortunately for investors. This would be the perfect share cannibal. It seems like this just aligns with Swedish culture though.

The company policy is to payout 50% of trailing profits via dividends though and it’s managed this so far (lower than 50% because earnings grow so fast and payout only once per year).

Input: With 1.2% dilution a year and 2.5% current dividend (20x PE → 50% profits to dividends, 2.5% yield), the capital return will be approximately 1.25% a year with the rest of the cash building up on the Balance Sheet, like it has to date.

4. Terminal Multiple

This one is weird. I think as time goes on, this company will be “de-risked” by investors… but today is not that day. Today, it is sitting at a cheap 17.4x NTM PE / 21.3 LTM PE.

Input: With a company on a commission revenue structure, 66% EBITDA margins, and 4% of CapEx as a percent of revenues… that’s Visa-level economics. I think putting this at a 20x PE terminal multiple for napkin math, the same as today, is fair for a “bond-like” yield with an inflation-resistant business model going forward. 20x PE multiple.

Napkin Math

Return: [ (1.175^10) * (1/1) * (1.0125^10) * (1/1) ] = 1.19 → 19% forward 10 year CAGR

Summary

The napkin math calculator is not meant to be exact. It is simply meant to be a means to see if a public investment is compelling based on reasonable assumptions! If an investor is highly conservative and wants a 12x terminal PE, that’s fine. The forward return is 13% with capital return being a much higher percentage. It’s not meant to be exact but more just to show how “obvious” the opportunity is.

In this case, I think you have a company that is entrenched within their industry by a moat with alligators, piranhas, and archers looking to snipe any newcomers not meeting initial requirements.

In addition to the competitive advantages enjoyed, Evolution Gaming also is early on its runway and can grow at a fast rate in the coming years as online gambling becomes more normalized, as E-commerce did nearly two decades ago.

Finally, I hope this write-up finds you well and you made it to this point. If you haven’t already please subscribe now for FREE below and/or support my channel by pledging a subscription for as little as $5 per month!

Have a great day guys!

What are your thoughts about a potential disruption via AI. I could imagine in the coming years an AI avatar become as realistic as a real human in combination with an LLM model. This could potentially reduce the cost to operate drastically and open up this market in such a way that scale is no longer an actual need in the igaming industry as it resides in the AI modelling world breaking the entry boundaries and allowing for massive competition. What moat would be left for this company?

As well as AI risks as mentioned by Jeroen, I would be interested to hear your thoughts on competition versus other live casino players, Playtech and Pragmatic. If they all have a similar core casino offering and the other two are making decent margins (which of course we don't know for Pragmatic), how can prices stay elevated enough for such a high margin and return on capital?