The Friendly Middlemen Concept

To start with, I’d like to provide some context into the Friendly Middleman concept, in an effort to add value to the business model of Digital Turbine.

A Friendly Middleman is a type of Business Model coined in the book “Quality Investing” by Laurence Cunningham, Torkell Eide, and Patrick Hargreaves. This type of business model is Business to Business (B2B), and it has a few defining features:

Customer: As with most B2B companies, the real “customers” (the partners) are not the end consumers. The real customers are the partners or businesses the middleman is selling to.

Aligned Incentives: The Friendly Middleman’s sales are usually directly correlated to the customer sales. This aligns incentives. If the partner does well, so will the friendly middleman. This incentives the Friendly Middleman to create and layer on quality products, and the partner will willingly use more products. This leads to easier cross-selling, lower marketing costs, and higher return on invested capital (ROIC).

An Edge: Usually, the Friendly Middleman has an “edge” over the partners. This is the reason they’re needed. It can be capital to spend what one partner can’t on developing a new product (scale), expertise in the area required, or a mix of both.

Scaling Expenses: In a successful Friendly Middleman model, expenses scale. This is due to a variety of reasons:

With a quality Friendly Middleman, the partners receive more value in the relationship than on their own, due to the middleman’s edge over the partners. This incentives the relationship to continue, add products, lower acquisition cost, and sell products at scale with lower expenses.

Also, the existing partners acquire the end consumers for the Friendly Middleman. This means the middleman gets to keep a portion of the profits and it doesn’t get involved in costly repetitive end consumer acquisition to grow.

The implications of this business model are powerful. The scaling expenses and keeping the majority of the cash flow means that the middleman can focus on adding new services, organically and through acquisitions. With existing businesses lines taking minimal effort to maintain and new products being sold across the network of existing relationships, this model leads to high returns on invested capital.

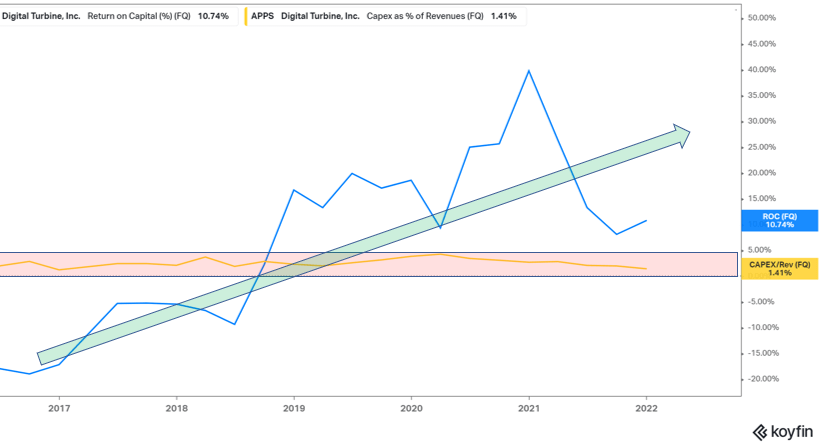

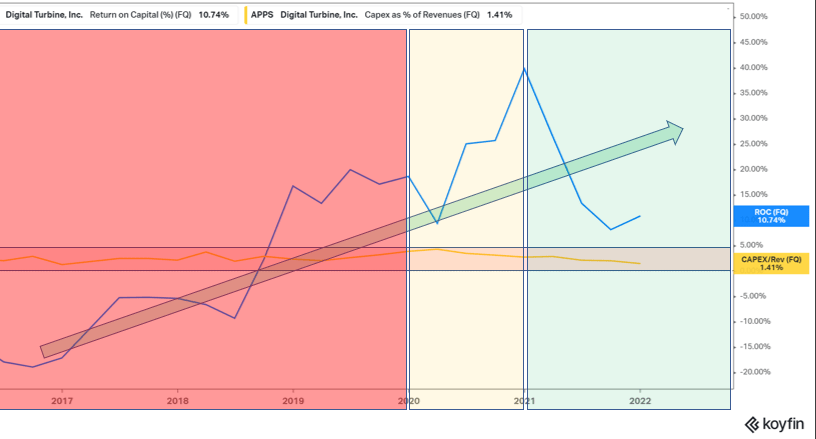

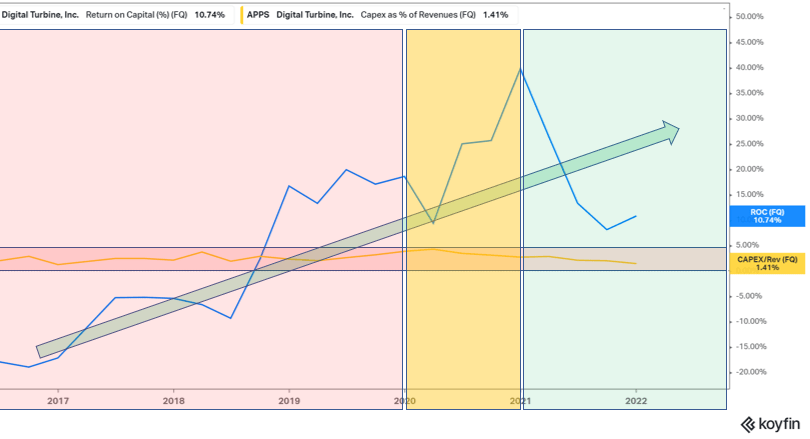

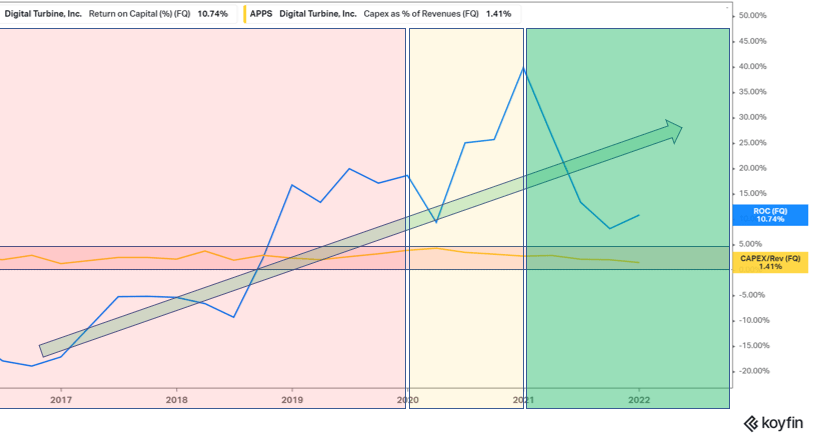

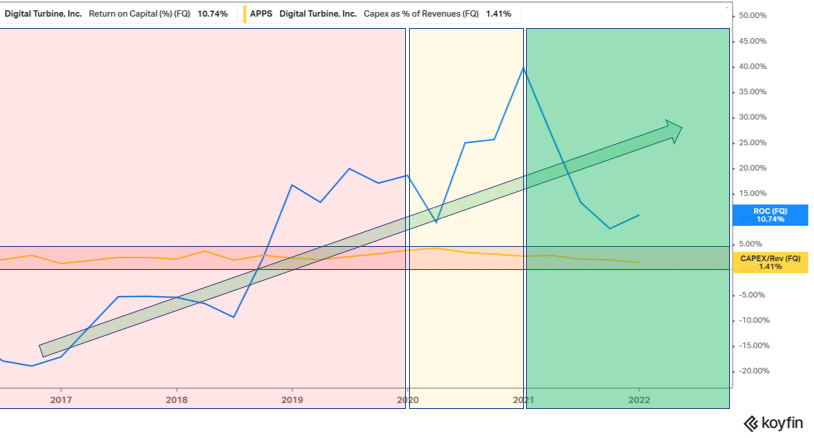

Now, I’m going to use this chart below to tell a story throughout this post in an effort to connect events in the company’s history to quantitative metrics! Let’s get into it.

Digital Turbine: The Android Friendly Middleman

I’m not going to waste too much time on this post explaining the Android ecosystem. Therefore, if you need a refresher or you want to learn about how Google’s mobile OS works, read here: Android Summary

In summary though, the Android eco-system, unlike Apple’s iOS Operating System, is an open-source platform. Google allows Original Equipment Manufacturers (OEMs) to utilize the Android OS for free, as long as the OEM ensures Google is the default search engine.

Since Android is open-source, Carriers/OEMs have been downloading their own apps and “malware” for years. However, none figured out a way to monetize the products in-house at scale and quality on their user’s devices. The Cell Carriers/OEMs needed a partner!

Part One: Building the Network

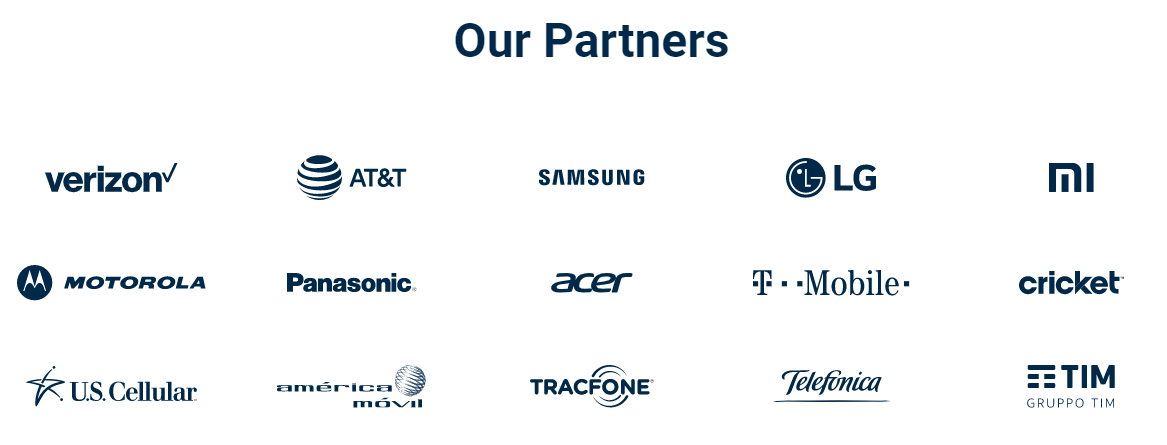

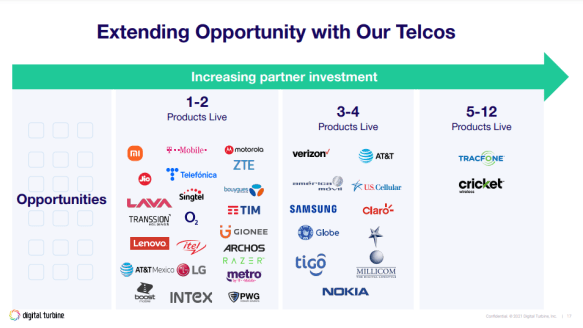

Being put simply, Digital Turbine’s business is assisting Cell Carriers (Verizon, AT&T, T-Mobile, Telefonica, etc.) and Original Equipment Manufacturers (OEMs: Samsung, LG, etc.) to monetize the Android devices that they sell. In return, Digital Turbine receives revenue share for the monetization services they provide. Now, that was a mouthful, let’s break it down:

Digital Turbine’s (Friendly Middleman) Customers: OEMs and Carriers that sell Android phones. This is a large market. Nearly 75% of mobile devices sold worldwide are Android. To date, DT’s software is on over 750M devices.

Monetization: Digital Turbine started with a product, Dynamic Installs, that preinstalls apps on user’s phones when they first boot up the device. The OEM/Carrier gives Digital Turbine the profile of the user and Digital Turbine, based on this data, picks apps to install on the user’s phone when he or she initially boots up the device. This allowed each partner to make a few dollars per device when the user boots up the phone.

Aligned Incentives: Both Digital Turbine and the Partners want the devices to be monetized, to the furthest extent, with the highest quality products (easier to sell new monetization products).

Value Add ‘The Edge’: This is the largest part of this thesis. Digital Turbine took years to get to the scale they needed to succeed. Previously, Carriers and OEMs installed their own products (malware) that pissed off users, and each network had to go out to advertisers for only their own devices. Digital Turbine managed to aggregate this demand with a higher quality product.

Digital Turbine clawed and scratched for nearly a decade for its network of partners to become more powerful together than apart. I would argue late 2019 to early 2020, the company hit its inflection point. This is why Mike Ng, Digital Turbine’s CRO, described the company as “the longest startup in the world”.

After Digital Turbine built a sufficient customer base, it was about layering on additional products, which leads us to our next section!

Part Two: A ROIC Case Study and SingleTap

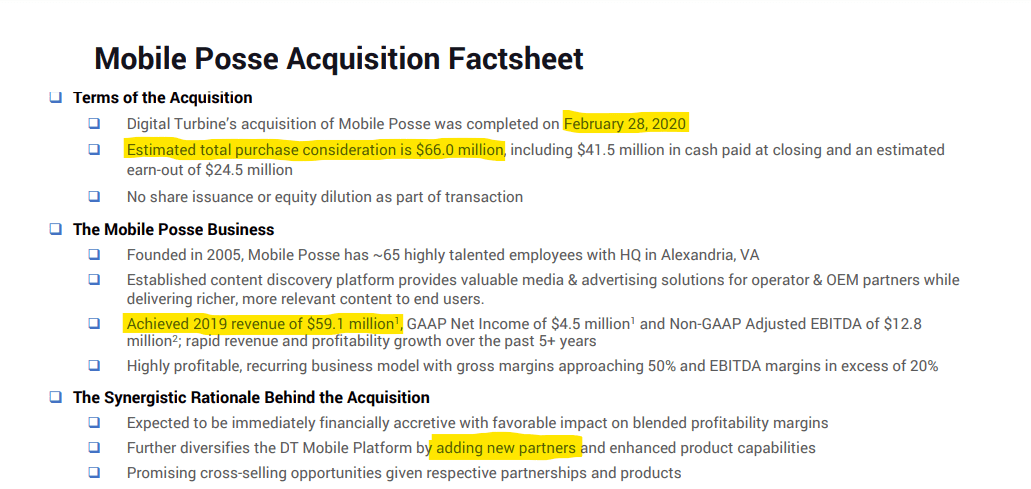

Mobile Posse (2020-2022): Digital Turbine acquired Mobile Posse 2/28/20 for $66 million.

The takeaways:

$66M acquisition price

Content Media (think Apple News but for Android and with ads): This product allows the OEM/Carrier to provide their own “News” (e.g. Kardashians, financial news, elections) widgets with a high quality user interface and aggregate advertising demand.

Added new partners (T-Mobile): We’ve already talked about how valuable this is.

2019 Metrics: $59M in revenue; 50% GMs; 20% EBITDA margins.

Mobile Posse’s one large customer was T-Mobile, DT’s last major player remaining unpartnered in North America. Nearly two years later, Digital Turbine increased Content revenues to north of $100M per year (remember $66M acquisition) on only T-Mobile’s devices! In addition, Digital Turbine this past quarter managed to cross sell this product to Verizon and AT&T.

Bill Stone, Digital Turbine’s CEO, had some words on the new product sales, “as far as the Verizon AT&T go, how we think about it conceptually is we just talked about $35 million in quarterly revenue in the Content Media business. The biggest driver of that is our relationship with T-Mobile. And if you think in rough terms that T-Mobile is 1/3 of the market, Verizon is 1/3 of the market and AT&T is 1/3 of the market. That’s how we probably think about the opportunity for us.” – Q2 2022 Earnings Call Transcript

Quick Math: $35M quarterly revenue * 4 quarters * 3 partners = $420M ->20% EBITDA margins = $84M in EBITDA

Turning a $66M investment into $84M in recurring EBITDA 3-4 years later with only selling the product to 3 of 40+ partners shows the ROIC potential with this business model! The ability to acquire/develop a product, have an OEM or carrier handle all the customer acquisition cost, and then realize a portion of the profits with little to no capital expenditures besides running ads, which have a relatively low fixed costs.

That’s a formula for an awesome ROIC machine!

Single-Tap

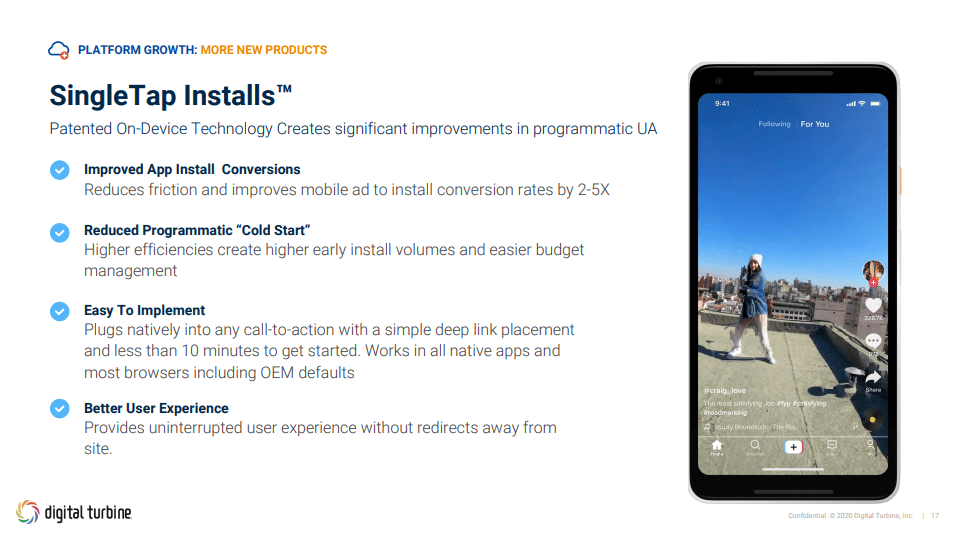

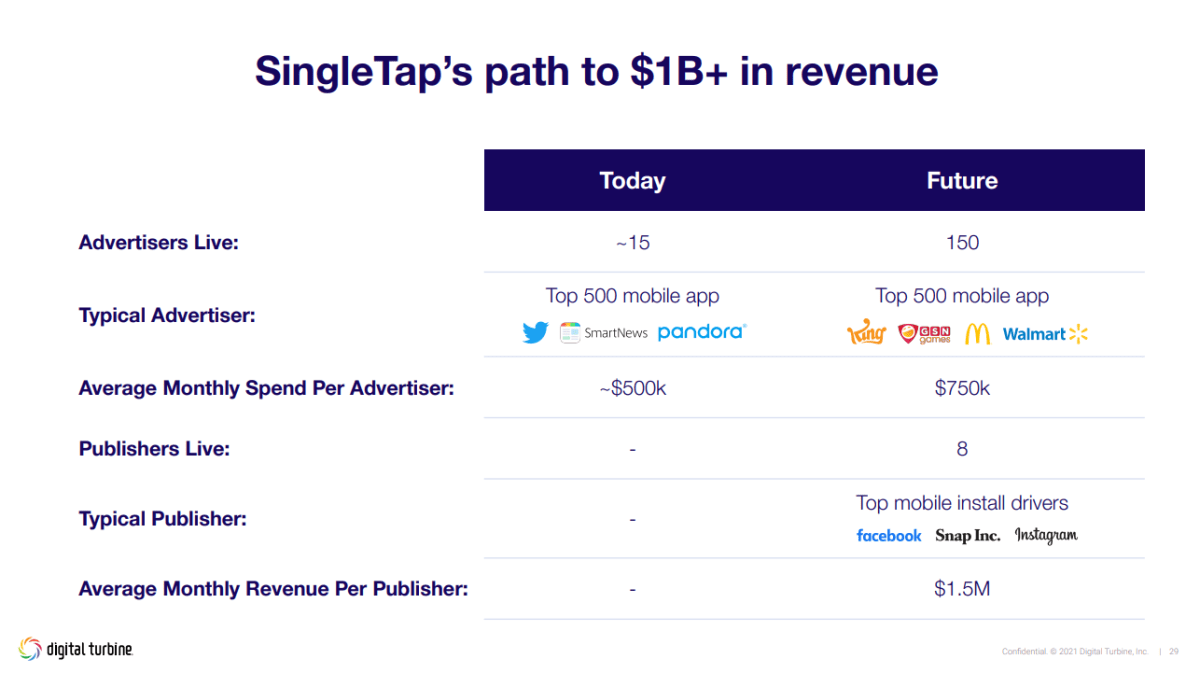

Modifying the Dynamic Install capability, Digital Turbine created a new product, SingleTap. This product allows a user to click on an ad (within an app) and the corresponding application will be downloaded on the background of the device with a *Single Tap*, and the user never has to leave the application to go to the Google Play store.

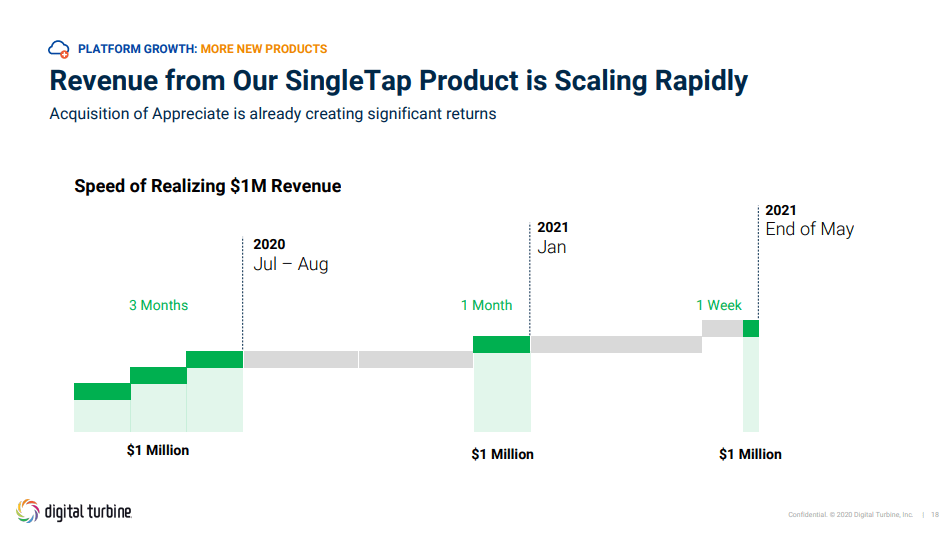

The two important aspects of this product are that it takes less clicks to download an application, increasing conversions, and it makes it so the user never has to leave the app. This is very important for publishers that want to retain user attention! This is why the product has taken off so rapidly, as shown by the second image below.

Digital Turbine up until this point had a small but relatively impressive product suite!

Dynamic Installs: App distribution (helping advertisers acquire users) and one-time revenue.

Mobile Posse: Traditional advertising (selling products) and outside the applications.

SingleTap: App distribution and can be inside the application or pop-up ads.

A few other miscellaneous products that aren’t worth going into detail about.

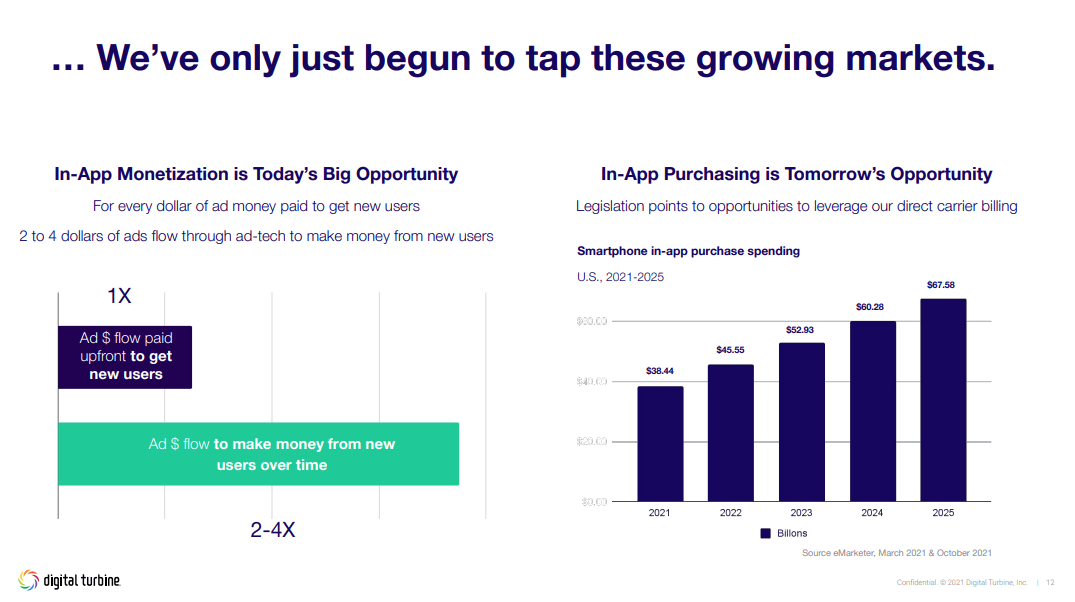

The problem being with these products is that Digital Turbine did not have a strong presence advertising within the apps themselves. However, good management teams see complimentary businesses and expand accordingly into high ROI areas. Digital Turbine did just this in March 2021, expanding their product suite yet again to a much larger market.

Part 3: The In-App Advertising Expansion

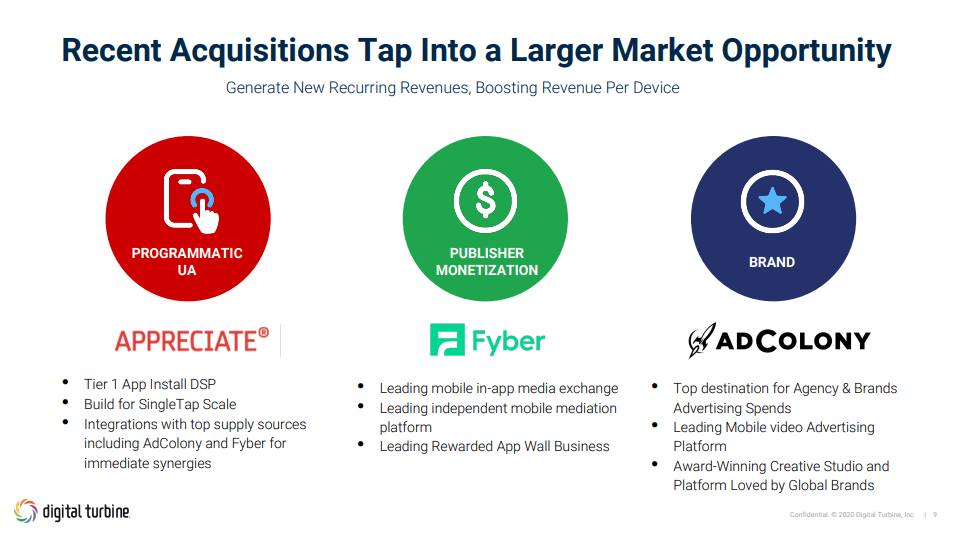

Between 2/21 and 4/21, Digital Turbine acquired 3 companies: Fyber, AdColony, and Appreciate.

Appreciate: This DSP was working with AdColony, Fyber, and Digital Turbine. Digital Turbine was leasing their services enough where it made sense to acquire the company. The main reason to acquire this DSP was to allow SingleTap the ability to scale this product at scale.

Fyber: This company provides the “in-app” monetization services, such as ad-walls and an in-app exchange (Supply Side Partner – SSP).

AdColony: This Platform allows Digital Turbine the ability to connect directly to advertisers, provide video/creative services, and complete their End-to-End network.

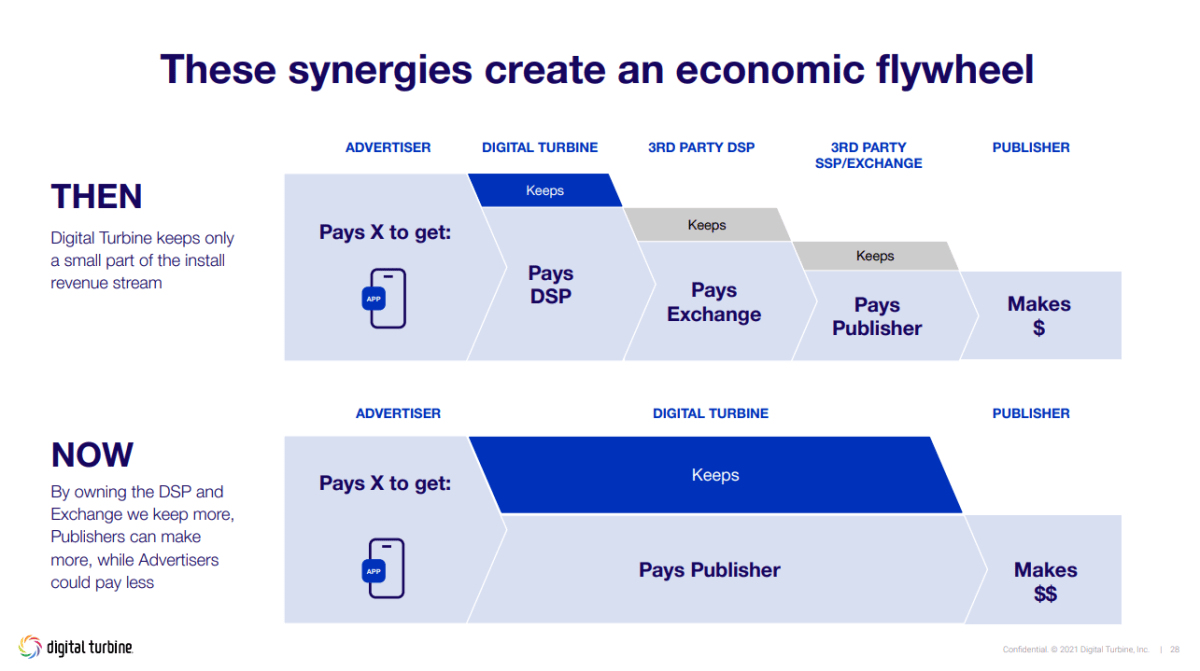

After these acquisitions, Digital Turbine now as an End-to-End Ad-tech stack all the way from advertisers to the user being advertised to. This is unique within the Ad-Tech universe! Digital Turbine is one of the few independent companies (not associated with a publisher) that has aggregated the DSP and SSP services and has convenient tools for advertisers all the way to the end users.

SingleTap as a Service

During the Investor Analyst Day (November 2021), Digital Turbine stated that they were “actively in testing” with Meta (Facebook) to provide SingleTap as a service to the Publisher. This deal is still up in the air, but licensing a conversion tool to 2-5x conversions to two of the largest apps (Instagram and Facebook) would be a large opportunity.

Management’s vision for taking SingleTap to a $1B run-rate in 12-18 months from the Analyst Day is shown below. A thread that I posted on my Twitter page is listed below that going further into the potential of this deal.

(1/n)$APPS People don't understand how large this SingleTap opportunity licensing with $FB / $MVRS is going to be

This will change the way billions of people are advertised to!

Here's a very short thread— Fundasy (@FundasyInvestor) December 17, 2021

Other Publishers that would be potentially interested in this service, besides Facebook/Instagram, would be:

TikTok (already partnered for Dynamic Installs)

Twitter

Snapchat

Strategic Rationale

Now, purchasing inorganic revenue is easy to do but creating value is another thing entirely.

Mobile Posse made 100% sense. It allowed Digital Turbine a connection to get in the door with T-Mobile and talk about Dynamic Installs. In addition, Mobile Posse’s content product can be cross-sold to all of Digital Turbine’s partners and create enormous value.

Appreciate made 100% sense. SingleTap needed a DSP to complete more auctions at scale with their product that increased conversions between 2-5x on each individual ad.

Fyber and AdColony are still up in the air. Creating an End-to-End product suite does makes sense though to make advertising as seamless and transparent as possible.

Digital Turbine can also cross sell all its existing and new products now too. Dynamic Install/SingleTap customers can be sold in-app monetization services, and current in-app monetization service customers can be sold Dynamic Installs/SingleTap (licensing or distribution).

In addition, Digital Turbine can layer on existing products with these base level product suite. They can incorporate in-app payments (have a Partnership with Bango already, read HERE), offer alternative app-stores to the OEMs/Carriers, and license SingleTap to nearly every Publisher that they offer in-app monetization services for.

Finally, the company also has a data advantage. Digital Turbine receives its customer identification straight from the OEM/Carrier. This means that even when Google bans tracking, Digital Turbine will have an advantage over other SSP services on Android, not to mention Digital Turbine’s Distribution offerings or conversion tools (SingleTap).

This is all good in theory. However, a good example of all the pieces coming together would be from the AccuWeather partnership that was just signed the other day to scale their operations globally.

This weather app has 1.2M and 2.5M reviews on iOS and Android respectively, and now Digital Turbine has partnered to monetize their free version’s advertising services and their app distribution needs. I think this is a good case study for how all these products make sense together. Digital Turbine distributes the app with higher conversions than traditional tools and then receives recurring value, via in-app monetization services. It’s a great business model, everyone is happy! Even Google receives their cut of in-app payments currently, so they love Digital Turbine putting more apps on user’s devices.

Financial Outlook

However cool the product suite might be though, the business model does not matter if it can not make money and make that ROIC trend upwards. This next section I will go through:

Margin Profile

Acquisition Payment Strategy

Forward Financials

The Investment: ROIC Mental Framework

Margin Profile

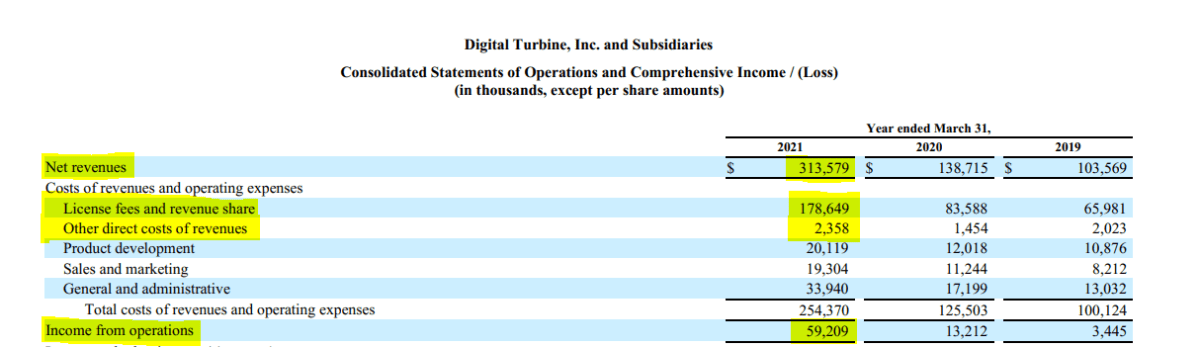

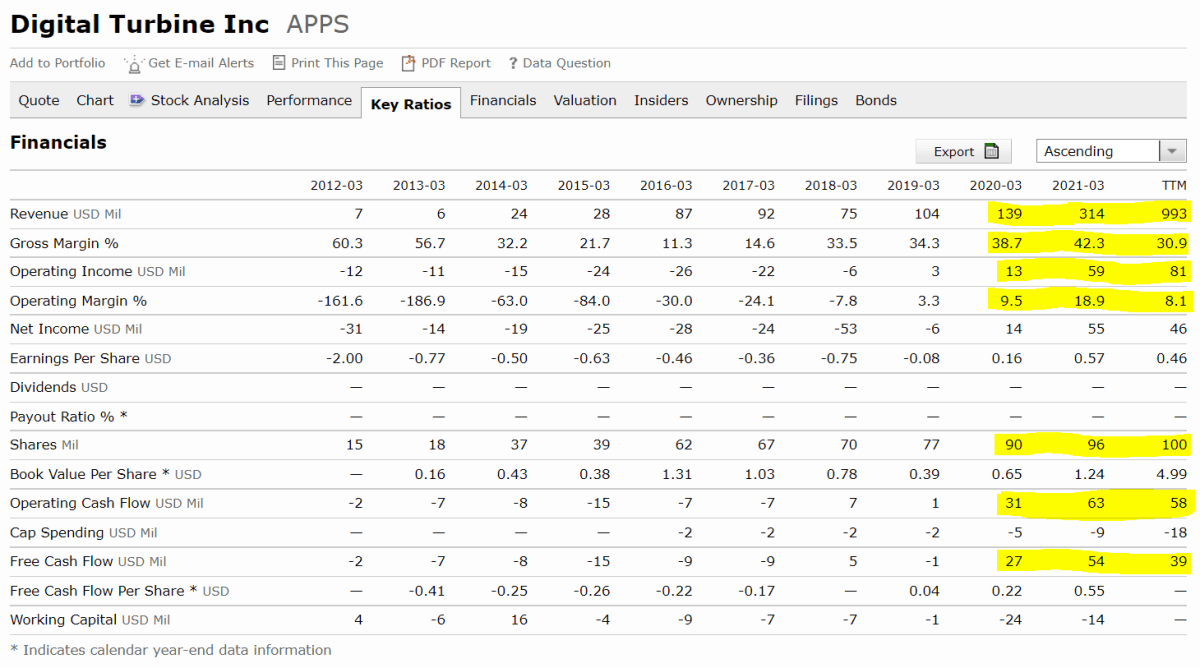

The big thing about Digital Turbine is that they report their revenue before sharing with their partners. This makes their Gross Margins, that are around 30%, look terrible for a software company. This image from the 10k filed on June 10th, 2021 (before Fyber, AdColony, Appreciate started reporting) shows that the Gross Margins after revenue share and direct costs of revenue was around 42%.

Although these numbers are outdated, there are two ways of looking at this expense breakdown, before revenue share and after.

Expense as % RevenueBefore Revenue ShareAfter Revenue ShareGross Margins42.2%98%Product Development6.4%14.9%Sales and Marketing6.2%14.3%General and Administrative10.8%25.1%EBIT Margin18.9%43.9%

In FY2021, there was also heavy investment into integrating Mobile Posse in the later half of the year and closing costs at the end of the year acquiring Fyber, AdColony, and Appreciate. Even considering this, Digital Turbine scaling to an effective 44% EBIT margin is one of the highest among any Ad-Tech names. However, many investors don’t break down the revenue after licensing/revenue share to see this unique effect!

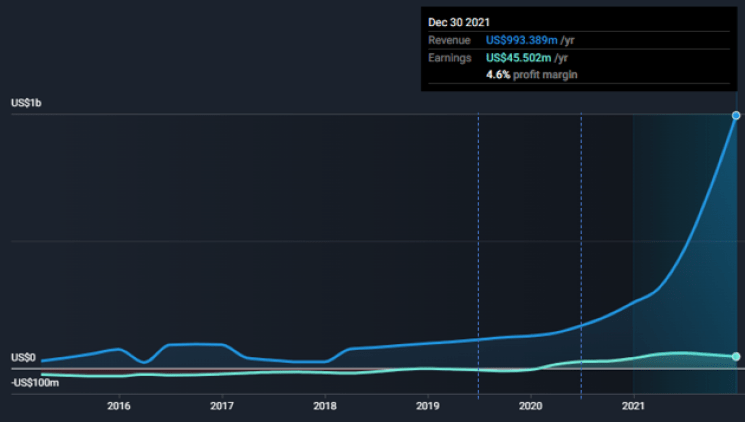

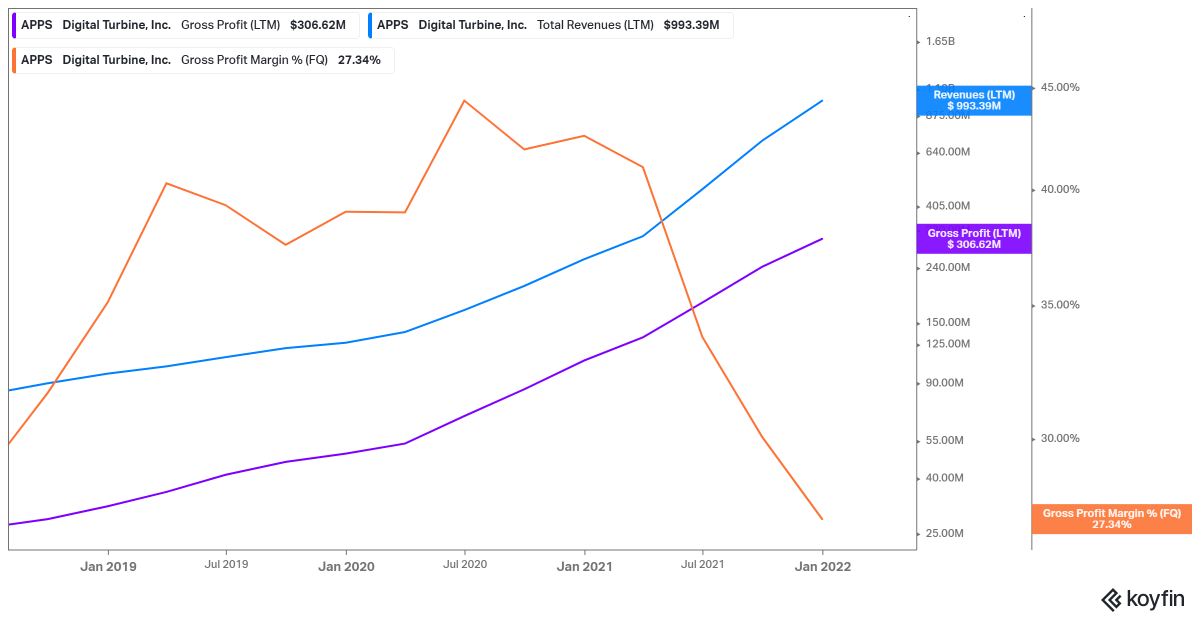

However, that $313M in revenue had the acquisition costs for the new acquisitions, but none of the companies reported revenue for that fiscal year. Below, look what happened to the revenue/margin profile after the acquisitions!

The Q4 for this Fiscal Year has not been reported yet, but look at the effect the new acquisitions have had:

Revenue: Has 3x’d

Gross Margins: Decreased 11%

Operating Margins: Decreased 11% (same as GMs, even with integrating costs!)

Shares Outstanding: Increased 11%, due to Fyber acquisition

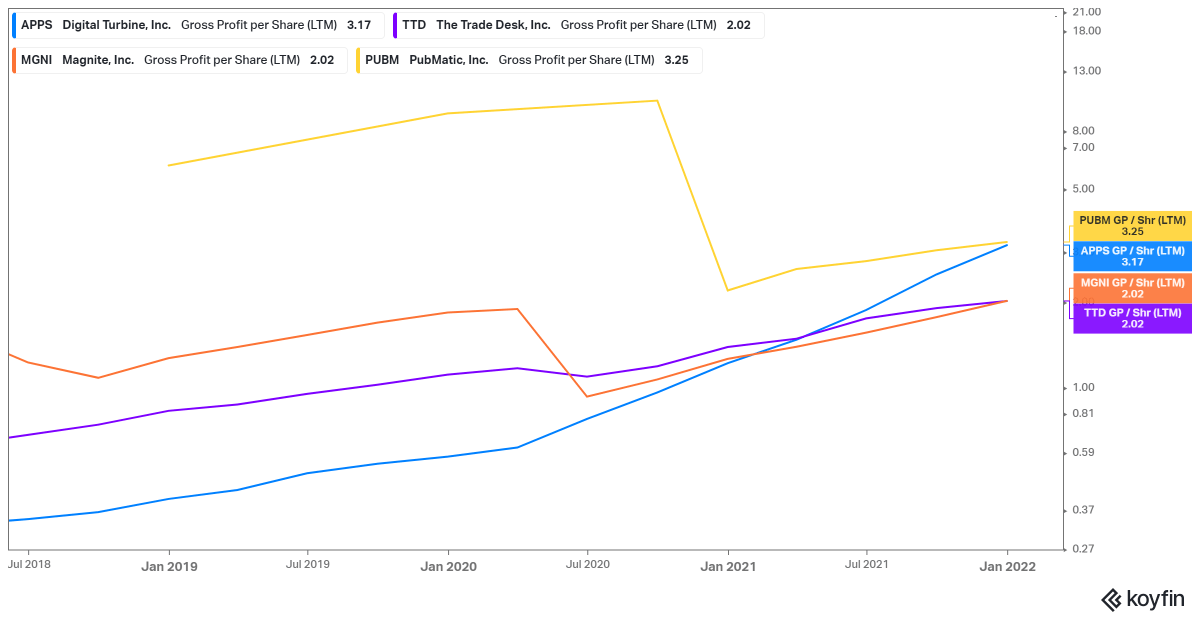

Now, investors get hung up on efficiency and lose track of the “Big Picture” in my opinion. To show what I mean, look at this chart showing how fast and efficient Digital Turbine has managed to grow. I will use Gross Profit per share to take away the gross margin effects and share dilution.

Since mid-2018, Digital Turbine managed to grow their Gross Profit per share over 1000% (82% CAGR). Compare this to Ad-Tech darling, The Trade Desk (DSP), which “only” grew around 250% (37% CAGR). The craziest part is that after breaking down post-revenue split, Digital Turbine also has the best bottom line profit margins, while simultaneously growing the fastest.

Acquisition Payment Strategy

Digital Turbine has received a lot of criticism for their Fyber, AdColony, and Appreciate acquisitions. However, investors that have been with the company since early 2020, knew exactly what the company was doing. The net income margin rapidly dropping was completely expected. Let me explain further.

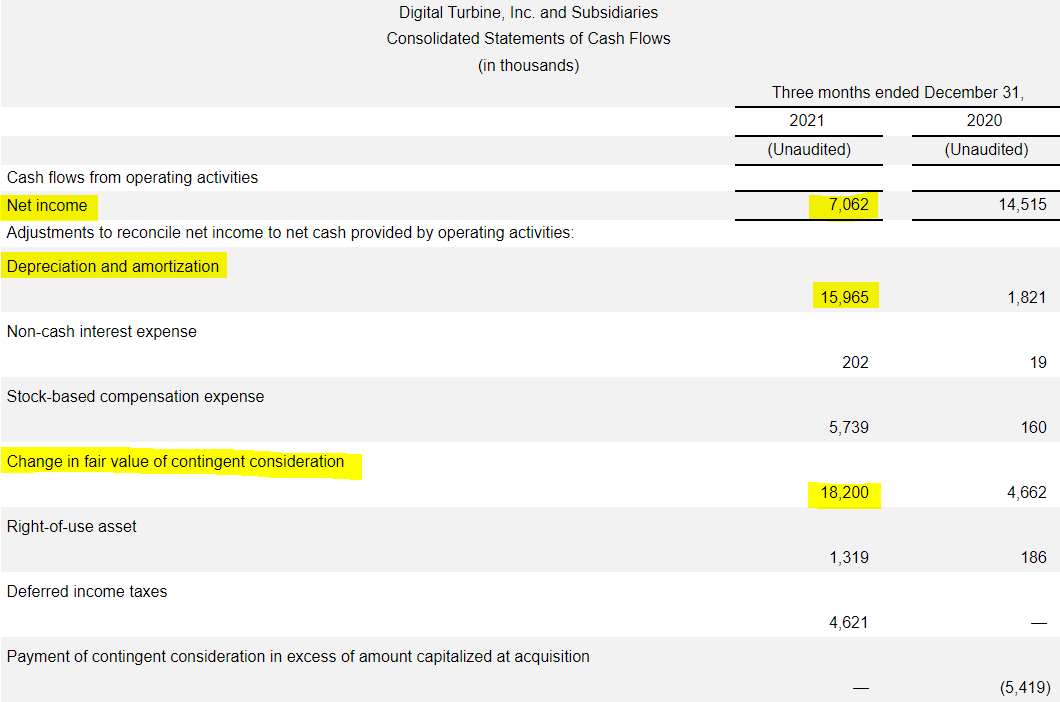

When Digital Turbine acquired Mobile Posse for $66M back in 2020, the company paid $41M in cash upfront and then paid $25M in earn-out payments based on Mobile Posse’s performance. In essence, Digital Turbine decreased its net income post-acquisition, while simultaneously increasing cash flow! This decreases taxes each quarter (very efficient), increases cash flow, and gives Digital Turbine time to cover the acquisitions more with operating cash flow, rather than issuing more shares.

Digital Turbine utilized this same strategy when it acquired AdColony, Fyber, and Appreciate. Digital Turbine utilized the following:

Appreciate: $22.5M in upfront cash

AdColony: $350-375M total cost. The breakdown being $100M in upfront cash, $100M in 6-months after closing, and $150-175M in earn outs ending December 31st, 2021 (last quarter).

Fyber: $600M total cost. The breakdown being $150M in upfront cash, $400M in newly issued stock (at extremely high valuations, very smart capital allocation), and $50M in earn outs ending March 31st, 2022.

These acquisition costs do a number on the short term results. On the surface, they have destroyed Digital Turbine’s net income statement. Then, you look at the cash flows for last quarter and it starts to make sense…

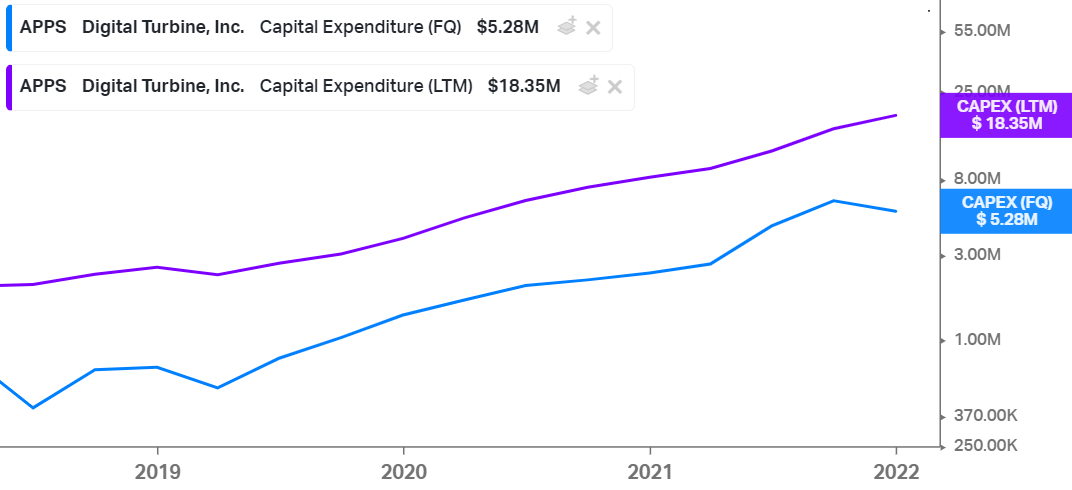

The $18.2M in Fair Value Considerations are the earn-out payments and the Depreciation and Amortization is stated to $16M. Even with paying out the acquisition costs each quarter, Digital Turbine has managed to put out profitable quarters. Then, (it is my opinion) the amortization/depreciation costs are overstated to decrease net income and taxes. This is especially evident since CapEx actually dropped last quarter and the company reported $18M in CapEx for the entire last trailing 12 months.

Essentially, the GAAP accounting is overstating the company’s Amortization costs, saying the acquisitions are “losing value”. This is a common strategy for management teams that genuinely care about capital allocation and aren’t worried about short term results.

These acquisitions were highly aggressive. In the end though, Digital Turbine has a history of successful integrating acquisitions, look at the Mobile Posse Case Study. Conceptually, these companies make more sense together than apart, and the acquisitions were made in a shareholder friendly efficient manner with long-term debt, earn-outs, and minimal share issuance.

Forward Financials

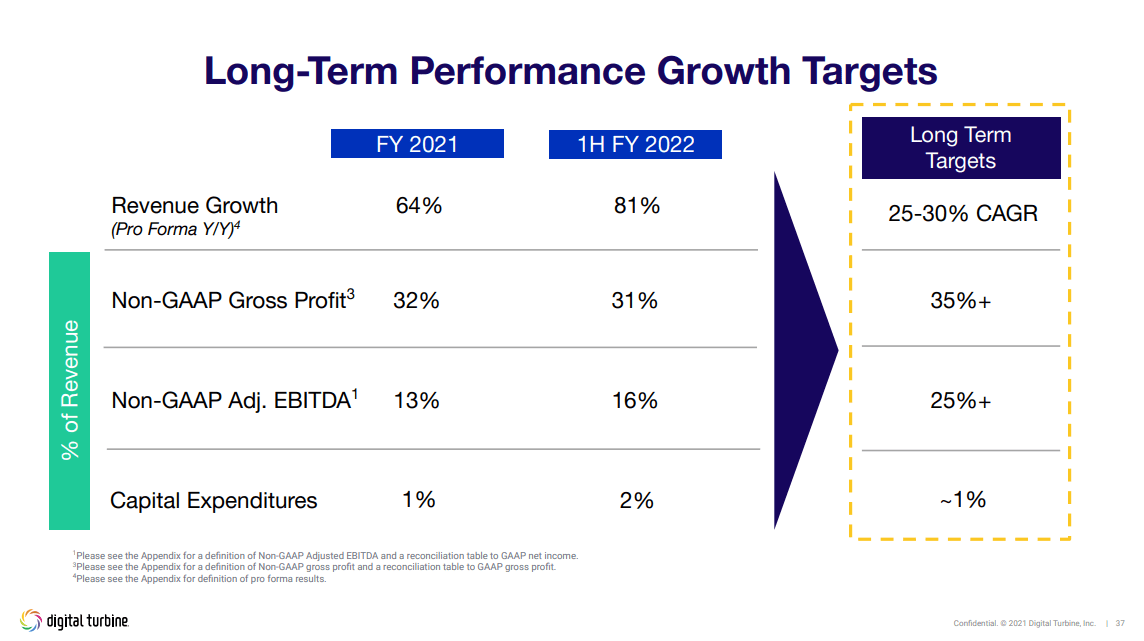

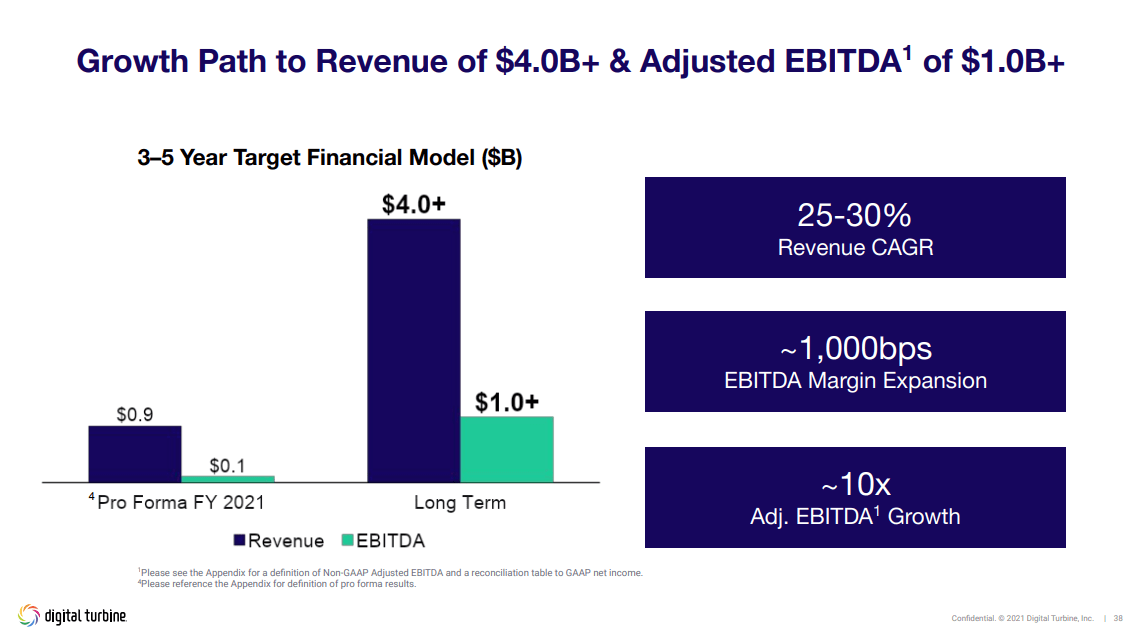

I’m going to keep this section simple and verify these numbers are reasonable. At the 2021 Analyst Day, Digital Turbine’s management guided to the following numbers in the next 3-5 years (vague).

These slides definitely present some ambitious goals! After this past Q3 was reported on February 8th, Digital Turbine has massively increased revenue and gross profit. However, the Gross Profit margin has continued dropping ever since the company acquire the lower margin AdColony and Fyber.

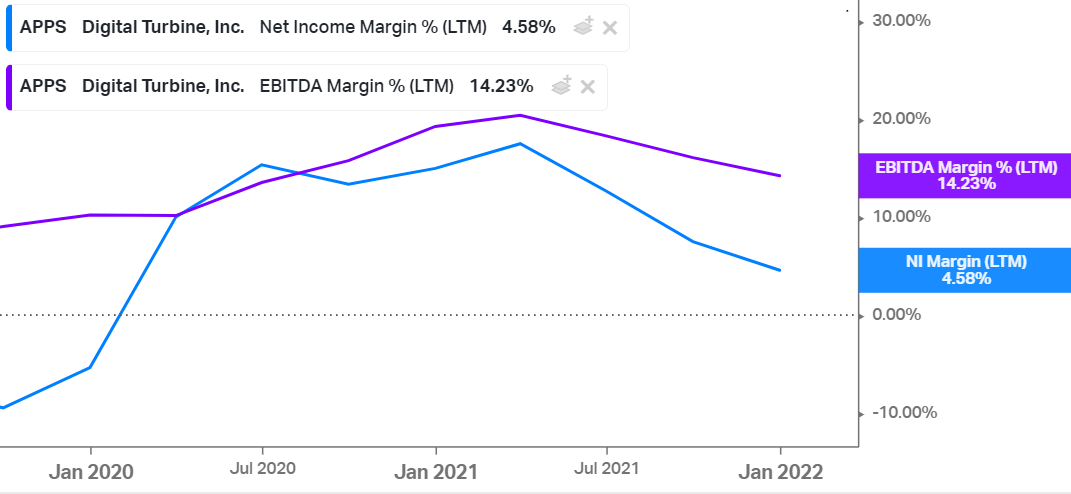

The past 24 months, Digital Turbine had a lot to integrate between Mobile Posse, Appreciate, AdColony, and Fyber. Gross margins on the original business (SingleTap, Mobile Posse, and Dynamic Installs) are mid-40s for their Gross Profit margins. Fyber and AdColony are still very much being integrated and are maturing within their own individual segments themselves. Taking all these factors into account, I can see the business reporting 35% Gross Margins in the next 3-5 years. Now, to the 25% adjusted EBITDA margin!

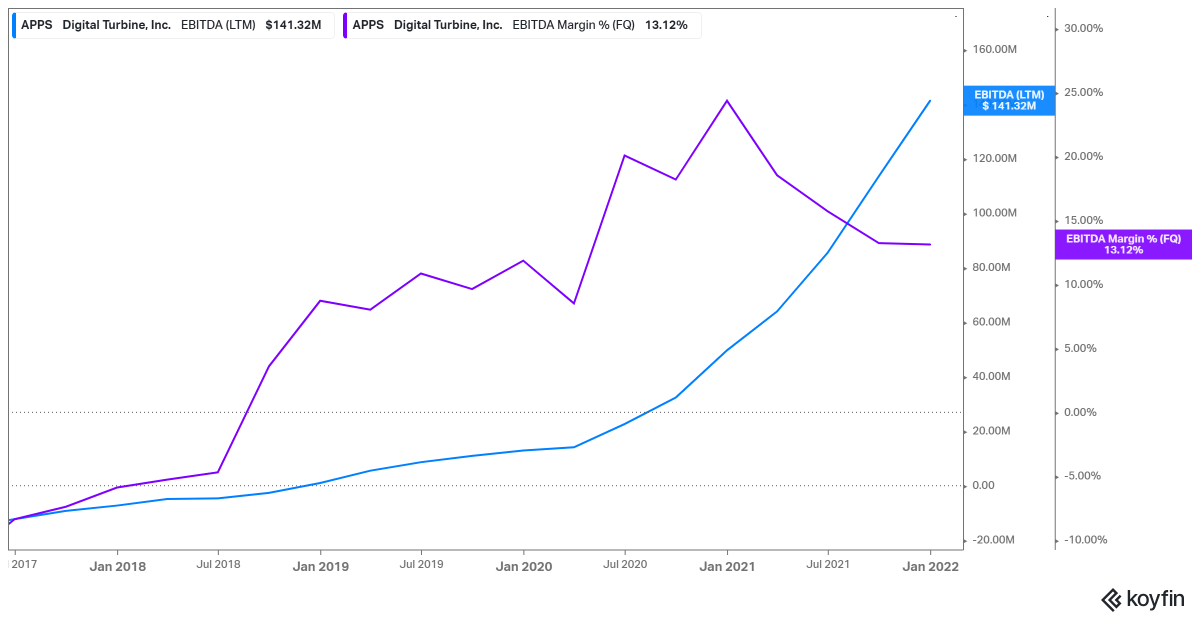

Currently, Digital Turbine is rocking a steady 13% real EBITDA margin. Assuming the gross margins actually climb the 8%, that means that EBITDA margins would be 21%. I think the company will continue to heavily invest in R&D and Sales and Marking with large stock based compensation. Therefore, I personally think it’s not unreasonable to see EBITDA margins increase another 2-3%. I think you will still see 1-2% SBC dilution per year though.

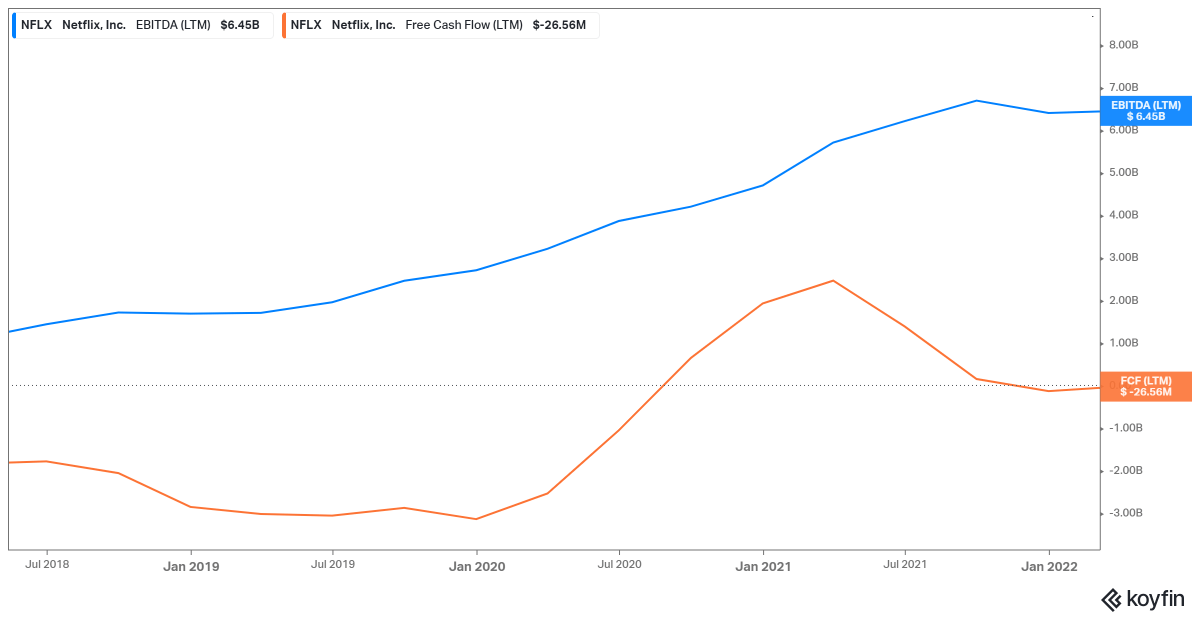

However, as we’ve also experienced EBITDA doesn’t matter if the company can’t convert to FCF. Not to dog on them too much but let’s use… Netflix as an example.

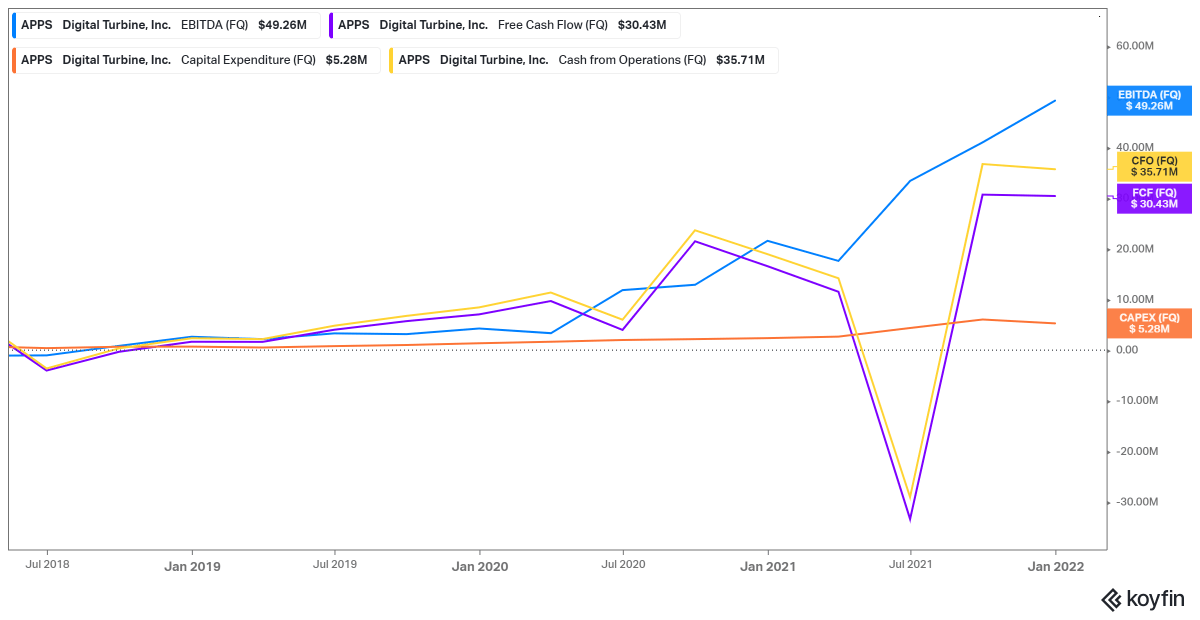

Luckily, Digital Turbine tends to convert EBITDA to FCF. The big drop in 2021 being the AdColony, Appreciate, and Fyber acquisitions. This past quarter though, the company converted 60% of EBITDA to FCF. Also, this is promising because the large hits on the net income statement last quarter were from amortization (doesn’t affect FCF) and earn-out payments (do affect FCF), so the actual conversion could be higher at a more mature business state (covered earlier).

Valuation

The company at its current $3.5B fully diluted valuation, $35 per share, :

12x Gross Profit

26x EBITDA

89x FCF

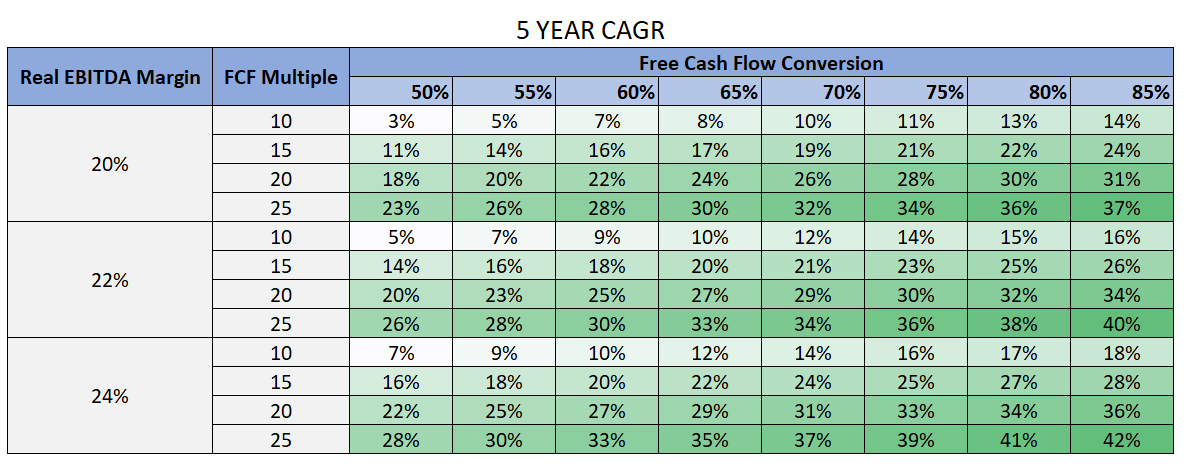

To complete a possible forward outlook is difficult with so many uncertainties:

Revenue/EBITDA can grow slower than expected

Margins might be higher or lower

It can take 3 to 5 years to achieve these results

The terminal value is uncertain

The EBITDA to Free Cash Flow (FCF) conversion is uncertain in the company’s end state

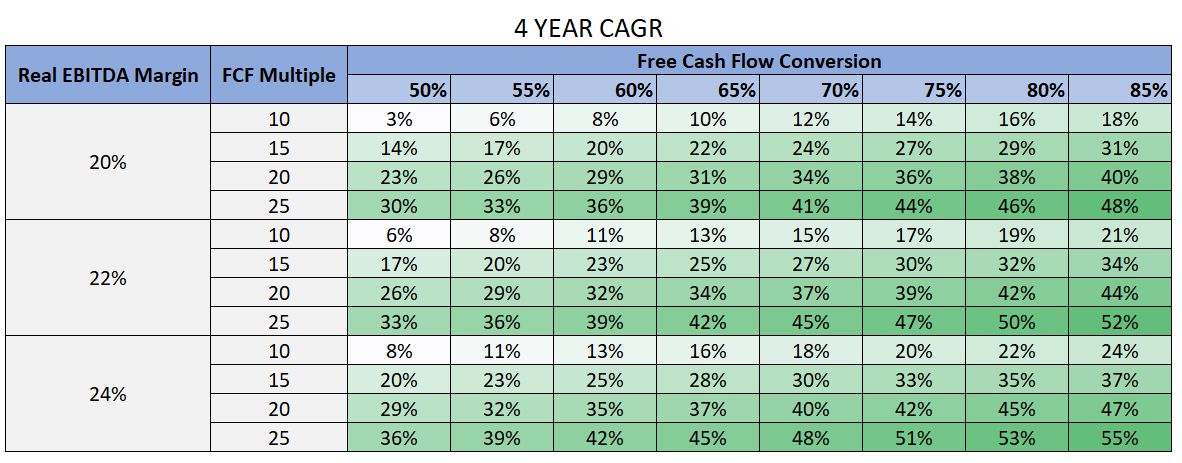

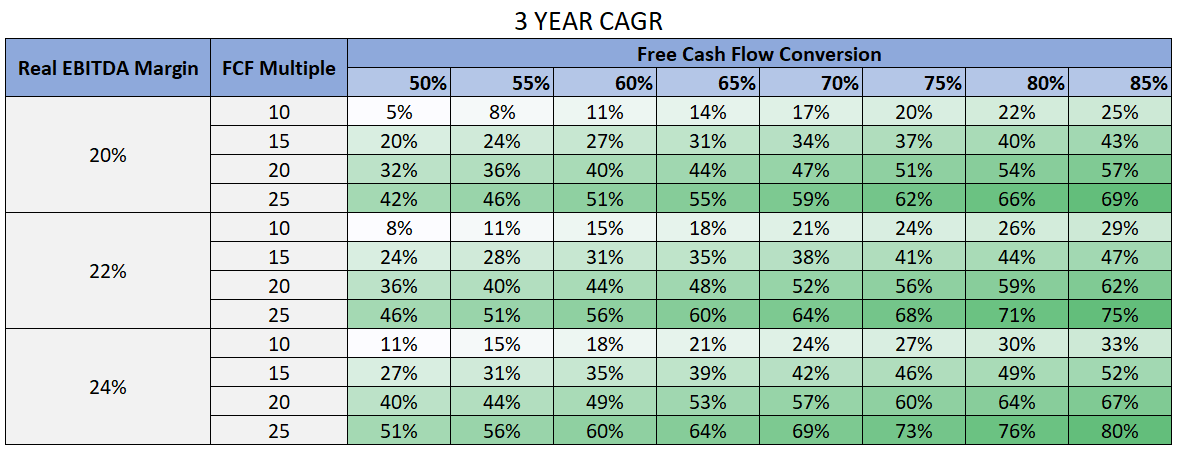

This part is tricky. We have a very large variation of outcomes. To account for all of this, I created a set of tables from worst case to best case on the timeline. Each cell contains the stock’s potential CAGR from today’s valuation with the given inputs and timeframe in the title!

Worst Case: $4B Revenue in 5 years

Base Case: $4B in 4 years

Best Case: $4B Revenue in 3 years

When looking at these graphics, choose your terminal multiple that you feel is fair, keep in mind last quarter’s FCF conversion was 60% with earn-outs, and think about how long it will take the business to achieve its ambitious goals.

In Summary

In summary, you have a company that has:

Rapidly growing both the top and real bottom line

Areas for further ROIC on top of existing business

Low capital expenditures, due to no end customer acquisition costs and software gross margins

A defensible network of OEM/Carriers that are stronger together

A stable end market, smartphones and the Android OS aren’t going anywhere

An astute management team that prioritizes growing shareholder value

A good forward looking valuation

If you enjoyed this write-up, feel free to subscribe to my newsletter or share this post. As of this writing, I’m currently at 99 subscribers so please help me get to 100!

Type your email…

Subscribe

Join 3,296 other subscribers

I love writing these Newsletters and write them for free, but if you enjoyed this Digital Turbine post and wish to buy me a coffee, you can do so below! Thank you all for reading!

Your contribution is appreciated.

The post Digital Turbine: A ROIC Framework appeared first on Fundasy Investor.