CanadaBis Capital (CANB.V): A Nanocap Analysis

A Canadian Cannabis Company with Best-in-class Unit Economics

Today’s write-up is an investment that I am really excited about and actually took a long position within my own portfolio! I’ve been hesitant to write about this nanocap because it resides in the Cannabis Sector, which has been a pretty horrendously performing sector of the markets since its inception.

The Marijuana ETFs all tend to look like MJ below. The pick and shovel supplier, Grow Generation, hasn’t done much better, appreciating a measly 14% since 2017. The only real winner has been the Cannabis REIT loan shark, Innovative Industrial Properties, which focuses on capital-starved multi-state operators that can’t get funding through bank loans, due to the limited Interstate transactions allowed!

All in all, it’s been a tough sector.

So believe me, I get the hesitancy of investing in the industry… but for today’s Long Idea, we have a unique and disciplined Canadian cannabis operator that I looked into and it actually managed to surprise me! This company:

IPO’d March 2017 on the TSX Venture Exchange, as a pre-revenue Cannabis startup building their sole manufacturing facility in Alberta, Canada.

In the past 4 years, has scaled revenue from $0 to $16M USD ($18M current run-rate), with a $29M USD market capitalization… but appears to be still ramping up.

Has gone from unprofitable to generating high-teen operating margins.

Since becoming EBITDA-positive (TTM) in July 2022, the company has decreased its Debt/EBITDA ratio from 5.4x to 1.8x, with 91% of the long-term debt being the mortgage to the cannabis manufacturing facility.

Slightly interested? If so, read on and enjoy the rest of this article, and subscribe to Fundasy Investor for more unique globally sourced Long Ideas in the public markets!

Last introduction touchpoint, Fundasy Investor is a free Substack. If you want to support my writing, you can give a gift subscription below. Nothing is expected but everything is appreciated. If that isn’t in the cards though, no pressure. I genuinely just appreciate people caring about what I have to write about!

With that being said, let’s get into this write-up over the nanocap, CanadaBis Capital!

CanadaBis Capital Inc.

Founded and run by the current CEO, Travis McIntyre, who beforehand had experience as:

The President/CEO of SS Pipelines, steel pipe manufacturing

The President/CEO of The Septic & Civil Solutions, a Construction Company servicing the Upstream O&G market

Travis is an operator who knows how to build “a 100-year manufacturing building” (as he puts it) and run a complex manufacturing process with high-quality and efficient outputs. Looking into his background, it appears that he’s a multi-faceted entrepreneur and I find it interesting he founded a venture in the cannabis space. However, with his company producing tremendous operating margins only three years after its first quarter of revenue, it appears he saw and capitalized on an opportunity in the space!

What was the opportunity that Travis saw though? Concentrates.

Product Line & Manufacturing Process

CanadaBis Capital is a company targeting the manufacture and sale of concentrates in Canada. Operating through two subsidiaries, Stigma Grow and a Retail arm (one location for “on the ground” product feedback). The company sells a variety of concentrate products. Below is a corporate structure diagram from the company’s presentation deck and documented product lines for each of the company’s 4 brands, which each have their own product line.

DAB-BODS: Focused on male consumers

HIGH PRIESTESS: Focused on female consumers, nicer packaging. More expensive

Black/White NGL: Gender agnostic. Differentiated by cannabis to elicit a more mellow (Indica/removing pain or insomnia) or energetic (Sativa/daytime usage) response

Although the company has many concentrate products: infused pre-rolls, vapes, live resin, etc. The core theme is that the company wanted to sell more premium products than the conventional flower that many Multi-state operators utilize, which has not exactly had great pricing dynamics over the past few years. Notice how most spot price graphs tend to find a home on the bottom right of the pricing chart…

I know these aren’t organized and all-encompassing charts, but if you google “Cannabis Spot prices per pound”, you’ll see nearly every chart goes down and to the right. Which is definitely the opposite of what you would want to see as an investor in the space.

That is unless your main input to your manufacturing process is flower and you sell 100% in Canada… enter CanadaBis Capital!

The general process for creating concentrates involves using a solvent to break down the cannabis into its cannabinoids/terpenes from the actual plant itself. Once this process occurs, the extracts are considered more “refined” but the texture tends to vary depending on the process. From the extract, the product can be fashioned into a vape pin, single-usage infused joints, or a variety of other variations. The main “customers” for CanadaBis Capital are the cannabis retail stores.

Now that you understand what products are sold and the dynamics of the supply chain, what can we figure out about the margins and unit economic dynamics in the concentrate business?

Unit Economic Dynamics

Travis’ main goal (per an interview with Paul Andreola, Twitter profile @PaulAndreola or @SmallCapDisc) was to build a profitable business that someone might want to buy one day. His strategy is to utilize cheap flower production from in-house or excess inventory from other operators and produce a more high-dollar product using those raw inputs! This manages COGs in a tough competitive industry by focusing solely on higher dollar concentrates. Through this strategy, the company has managed to become a very efficient business with high returns on capital, assets, and margins! Below, are a few of the efficiency metrics I like to look at.

ROA (top) / ROE (bottom):

EBIT Margins:

Few observations:

Increasing: I like how the efficiency metrics are still increasing. I don’t think the company is at its ceiling for its return on assets. I like this metric being high and steadily improving. This implies that the company will be able to grow with less extreme asset investments going forward.

Examples: For reference, Buffett’s beloved Coca-Cola makes 8% ROA with such high intangible value and goodwill on its balance sheet.

The company definitely has great unit economics and efficiently utilizes capital but what about the runway? Because high returns on capital are only half the equation. A company also needs to grow its revenue to enjoy a rapidly increasing stock price!

Runway and Growth Drivers

To date, the company has been doing quite well with its revenue growth. Below is a set of charts with the revenue growth by Quarter (first chart) and Trailing Trailing Twelve months revenue (second chart), along with a Revenue CAGR calculator.

Eliminating the initial skew growing from $0 in revenue, the company still has an average Revenue CAGR of 67% the past two years, even accelerating the past few quarters! Below are a few observations that I’m seeing though:

Higher Variance: Revenue growth appears to be consistent but a bit more lumpy. Not every quarter will have high Q/Q growth. However, from a Y/Y perspective, the company is executing on growing its sales channels. Per the interview with Travis/Paul, the CEO stated that the company is not trying to grow as fast as possible. He’s actively attempting to stay stocked in the areas they expand to. He doesn’t want consumers to see their product on the shelves one week and not the next. This definitely seems like a prudent strategy not not get over your skis and let expenses bloat in a cyclical and changing industry!

Explosive Growth: We will get to valuation in a bit but it is really appealing to see average revenue growth for the past two years to be north of a 65% average CAGR. For a company at a sub-10x PE, you don’t need that high of revenue growth but dang is that combination appealing!

With those observations out of the way, I want to cover the main growth drivers for the company: Distribution and Brands.

Distribution & Brands

I know CanadaBis is not your typical CPG company. However, for all intents and purposes, it is essentially a CPG company with a “sin” product. Following that business model and looking at the best-performing companies, you find companies like PepsiCo, Coca-Cola, and many others.

These companies all follow the same general strategy:

Sell unhealthy dopamine-releasing products with high margins (Check)

Build out the distribution of these products (In-Progress)

Layer on more brands to get more shelf space on the same distribution channels (In-Progress)

So to determine the runway, how big is CanadaBis’ current distribution channel from its Alberta facility?

With Alberta providing 47% of the company’s TTM sales and Ontario being 19% when it is 40% of the cannabis market in Canada, the answer appears to be that there is definitely some runway left! What I will say though, the company’s brand, Dab-Bod, is the #2 brand for infused pre-rolls in both British Columbia and Alberta. So there is market share available for stealing, especially from the smaller players, but the company is definitely already a bigger player in the Provinces that it operates in!

Another comment though is the fact that the company calls out that concentrates are approximately 2% of the country’s sales when California has approximately 7x that amount, nearly 14% of industry sales. Now, unlike Travis, I don’t expect the 2% to get to 14%. I think concentrates are utilized higher in the US, due to the illegal nature of the products. They are definitely utilized to be a more “discrete” product among users. I still do see the company’s concentrates becoming a higher percentage of revenues going forward though! This will undoubtedly be a nice tailwind as the company gets more shelf space at dispensaries and consumers become interested in these products.

And with the Canadian Cannabis revenue being north of $11 billion, there is definitely an opportunity for a company with $16M in USD trailing revenue to keep growing for a number of years. That’s before you even get to the current valuation or valuation of the Owner’s Earnings!

Valuation

This will be slightly different than the napkin math I have done on my previous writeups. For this one, I will simply list the financial inputs and let the merits of the investment case speak for themself with maybe a hypothetical example at the bottom.

Owner’s Earnings / Distribution Income

The cash flows for the business are pretty clean. The company has generated positive cash from operations every quarter since becoming cash flow positive. It does appear like there are some times thus far when the company has needed to focus on building inventory, thus decreasing cash from operations. However, with the past two quarters delivering returns on capital of 29% and 19% respectively, I think the returns on that cash are being deployed well!

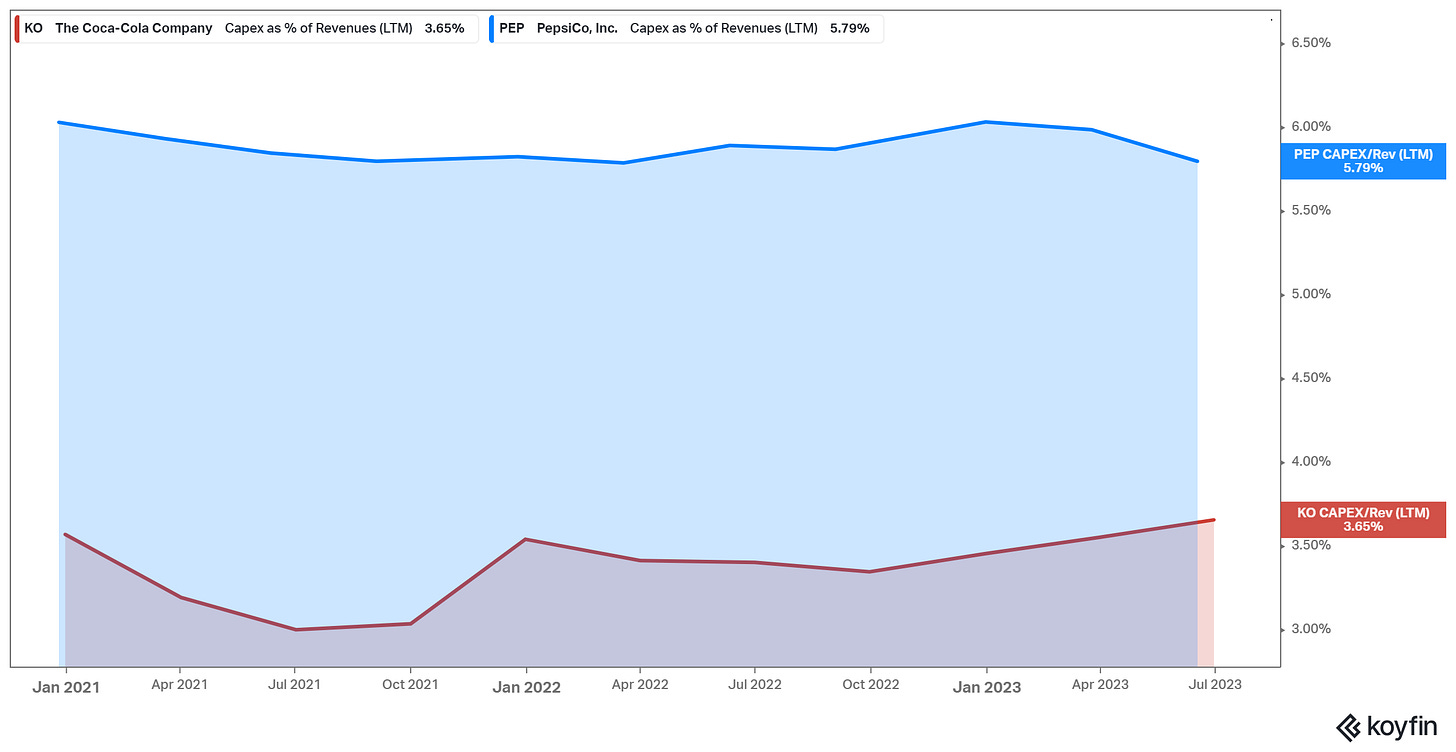

One highlight is that the Capital Expenditures are very light. As a percent of revenue, CapEx is sitting below 4% today! For a new company in growth mode, this is staggering to have this low of expenditures and maintain 60%+ revenue growth. As an investor, that’s definitely something you like to see from a physical-based distribution CPG brand. For reference, this is pretty much in line with PepsiCo/Coke already!

On top of minimal maintenance capital expenditure needs, the company is actively paying down its debt each quarter, growing its equity Q/Q (mainly from cash on hand), and deleveraging its balance sheet!

With such an improving balance sheet, a good question is what the company will do with the cash. Travis McIntyre has mentioned that M&A is on the table. He does want to continue deleveraging though by paying down the mortgage for the manufacturing facility (90% of the long-term debt). From his perspective, he thinks the M&A field is filled with companies with bad debt and are strapped for cash though.

Given the first part of this article discussing the horrors of the cannabis sector, I definitely appreciated hearing this candor! That being said though, I like that the company has high enough owner’s discretionary earnings, aligned management, and cash on the balance sheet to have M&A on the table if the right opportunity presents itself!

Valuation Multiple

There’s not too much to say here. Few observations:

EV/EBIT > PE: This is due to the debt on the balance sheet increasing the Enterprise Value. With the current run-rate EBIT being over 50% of the total debt though, I don’t think this is an issue.

At a near single-digit PE, the company is very cheap. This is definitely due to the size of the company ($38M CAD/$28M USD) and illiquid trading. This is not something that’s worrisome in my opinion. It’s just the nature of the situation with publicly traded companies of this size.

Hypothetical Returns

This is different than my other writeups so far where we had much more clean data and KPIs to make our estimates. For this one, I’ll just leave you with a hypothetical 5-year timeline:

Revenues: Conservatively, CanadaBis Capital expands across Canada, growing its brand count/distribution, and triples its TRAILING revenues over the next 5 years (24% CAGR, WELL below past averages).

Margins: Conservatively, the company only increases its EBIT margin to 20%, which is below last Q2’s 22.50% margin. The company has moderate scale-based economics, increasing the trailing 17% EBIT margin to 20%. With LTM Interest payments being 2% of revenues and a 25% Canadian tax rate, you end up with a 13% net income margin from the 17% today. This assumes no scale-based economics improving the Gross Profit margin or OpEx operating leverage, which are both in actuality very likely to occur, especially SG&A operating leverage.

Multiple: Give the company a “fair” 12x PE multiple for a “higher risk” 8% earnings yield from the 10x today.

Dilution/Capital Return: With the company diluting shareholders 1-2% a year in the past few years, factor in a conservative 1.5% dilution rate with no capital being returned. The cash just builds up on the balance sheet and investors don’t value it in, due to it never being returned before. Again, I see this as unlikely but let’s give ourselves some baseline assumptions.

Now, I know a lot of these inputs are silly/unrealistic but it really is just to build the case for how cheap this company is trading today.

With those inputs, you get the following:

Total Return = [ (1.24^5) * (13/17) * (12/10) * (1 - .015*5) ] ^ .2 = 20.00% CAGR

Anyway, I hope that I made my point pretty clear about how dirt cheap this company is trading currently. Investors really don’t need much to go right to make a good amount of money on the stock.

Summary

Similar to the greats, investors should look to see if they’d want to purchase this company outright. For a company with the following traits:

Skilled operation-focused management team. Smart capital allocator, Paul Andreola as a large shareholder

Strong forward revenue growth

Strong margins that could increase further as OpEx scales

Low but reasonable starting valuation multiple

Low Cap-Ex business

Would you buy the whole company with existing management in place? If so, you should look further and do your due diligence on CanadaBis Capital (Disc: Long)!

Thanks for reading! If you enjoyed this article or found it useful, please like/retweet/subscribe/tell your friends!

Have a great day guys!

Enjoyed the writeup. I did work on the company earlier in the year and really wanted to buy, but couldn’t get over one thing - cannabis is a commodity (in my opinion). Even brands that have positioned themselves as premium (Stiizy, Cookies, etc) have seen prices come down over time. Though some brands do carry a little bit of weight, pricing is both decreasing and becoming increasingly homogeneous. As much as I like management and am impressed by the positive cash flow I couldn’t get over this. Obviously you disagree - would love to hear why

Great writeup as usual!. Thank you