Auto Partner (APR.WA): The Polish Auto Distributor

A Reposted Article from Fundasy Investor - Now on Substack

Originally Published: February 21st, 2023 - Some metrics with trailing valuations will be outdated but not significantly changed.

1. The Distribution Business Model

Distribution businesses are a fantastic business model. Acting as an intermediary between suppliers and service providers, these B2B business models provide service providers (customers) with a wider selection of products, cheaper prices through scale-based purchasing power, and providing ease of access for a one-stop-shop. Adding value to the entire ecosystem.

On the supplier’s side, they have a difficult task in getting their products in customer’s hands cost-effectively. They just want to manufacture their products efficiently! On the customer’s side, they want (1) a wide selection (2) fast deliveries and (3) a cheap price. Usually in that order.

The distributor is the intermediary that solves these problems for the suppliers and service providers. It’s a simple business model. Hard to get to scale though. The distributor has a small markup on procured goods. Then, the distribution needs to be built out and managing the working capital put into inventory requires precise cash flow management. However, through scale based economics in purchasing power, more efficient logistics, and leveraging fixed SG&A costs, the margins have a tendency to improve over time!

Now that the exposition is out of the way, let’s turn our focus to the star of this article, the underdog $500M Market cap, Polish auto parts distributor: Auto Partner!! The format for this analysis will be as follows:

The Distribution Business Model (Covered! One down)

Auto Partner: Founding and Industry Overview

Business Model

Growth Drivers

Financials: Overview and ROI Estimates

Risks

Summary

2. Auto Partner (APR / APR.WA)

The Founding and Short Industry Overview

Founded in 1993 by Aleksander Górecki, CEO/Chairman/46% shareholder owner (including the shares held by his wife), Auto Partner today is the second largest auto parts distributor in Poland, doing over $500M in sales in the last 12 months.

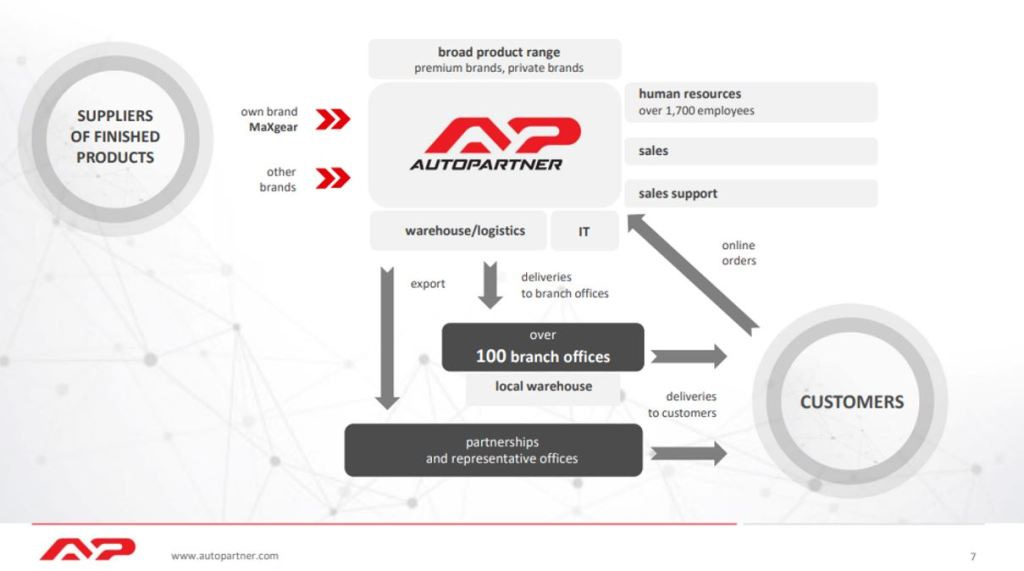

On the supplier’s side of this equation, the company has over 350 suppliers of aftermarket spare parts and global OEM distributors, supplying a catalog of over 250,000 reference items for cars, light commercial vehicles, and motorcycles. It sells these products from brands such as Bosch, Castrol, Continental, Febi, along with their own private brand – MaXgear.

Turning to the customer’s side of the equation, Auto Partner primarily supplies independent mechanic shops of which 99% are low bargaining power Mom and Pop operations. Sophra Peak Capital Partners has a fantastic writeup going over the customer base, linked HERE.

TLDR: 90% of Polish individuals opt for repairing their car at a mechanic, rather than the 40% in the US that opt to DIY for car repair (Mix is POLAND – 90/10 vs US – 60/40). The customers primarily order online with 62% of orders occurring digitally. These customers prioritize in order of significance (1) large SKU selection that’s in stock (2) speed of delivery (3) cheapest price.

Now, that’s a lot of fun information but how does all this translate into the company’s business mode

3. The Business Model

Personally, I’m not a fan of the way this Business Model slide looks like. It doesn’t properly distinguish the differences between how the company supplies parts Internationally vs Domestically. So here’s my version:

Even added some little car graphics for you all.

Anyways, the key parts of this diagram are as follows:

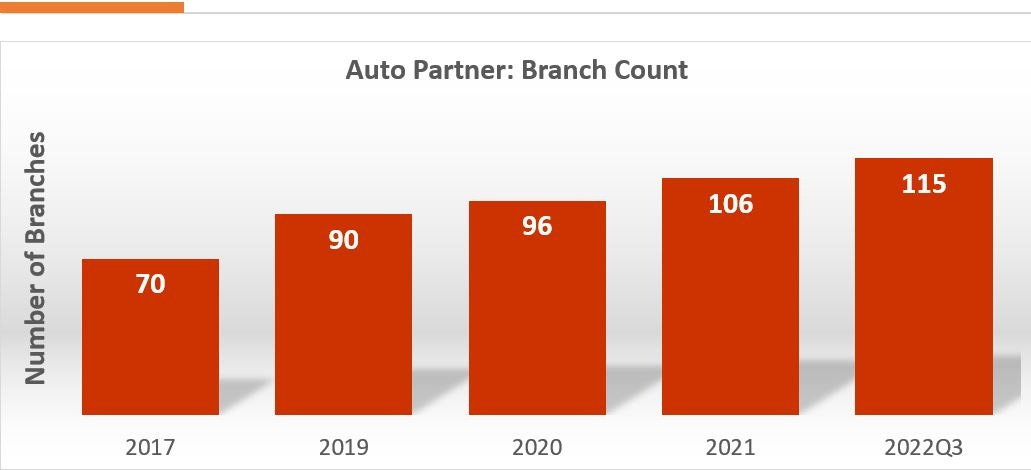

Warehouses/Branches: Orders come in online from customers (International B2B or Polish Auto Shops). For domestic Polish orders, these items are sent to the company’s branch locations. The company currently has 115 branch locations located throughout Poland. For International orders (B2B), the shipments are sent directly from the warehouse to the equivalent of a branch location Internationally.

Margin Breakdown: A key part of the International growth is that the shipments go directly to other shops with lower SG&A costs. This means these orders have lower Gross Profit margins but have higher EBIT margins. This also helps because this is the part of the business growing the quickest, as we will cover in the next section in our Growth Drivers!

4. Growth Drivers

I feel like up until this point, I’ve been giving mostly exposition. These next two to three sections are definitely the part that I feel most excited about. Using what we know from the previous section, we’ll make some assumptions about the growth drivers for the business, overlay these ideas on the financial metrics, and then create our future ROI estimates!

Now, these are my assumptions. In your blog post, you can make whatever assumptions you want but here are mine about the growth drivers:

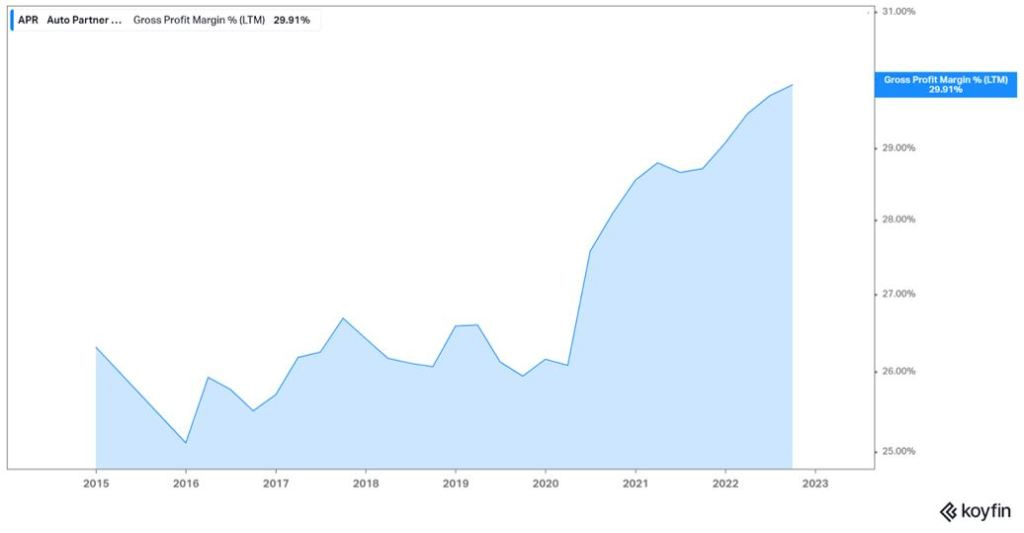

Scale / Purchasing Power: A key part of distribution business models is purchasing power. These distributor intermediaries, as they grow, can purchase in higher quantities, driving down costs per unit. This in turn will increase gross profit margins over time, or the company will keep gross profit margins stable, selling cheaper products, and growing market share. Both are great approaches. Most of the recent margin improvement is due to the supply chain problems, but the margins were still improving over time.

Branch Growth: In the domestic Polish distribution, Auto Partner utilizes its branches as the final leg of the supply chain. Online orders come in and the SKU is either (1) at the branch or (2) at the warehouse. If the branch is holding the inventory, the parts are distributed to the mechanic shops. From the company website and the Sophra Peak letter, these deliveries can go out 3-8 times per day per mechanic customer.

This means that building a dense branch network will assist in winning customers in new geographies and reducing logistics last-mile costs. Luckily, management appears to feel the same way. This is definitely a KPI to keep track of for Polish sales and will correlate to market share growth and bottom-line margin improvement.

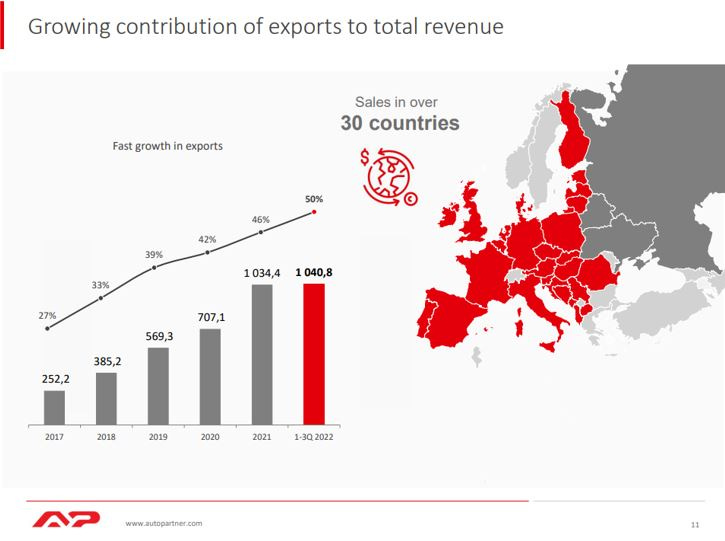

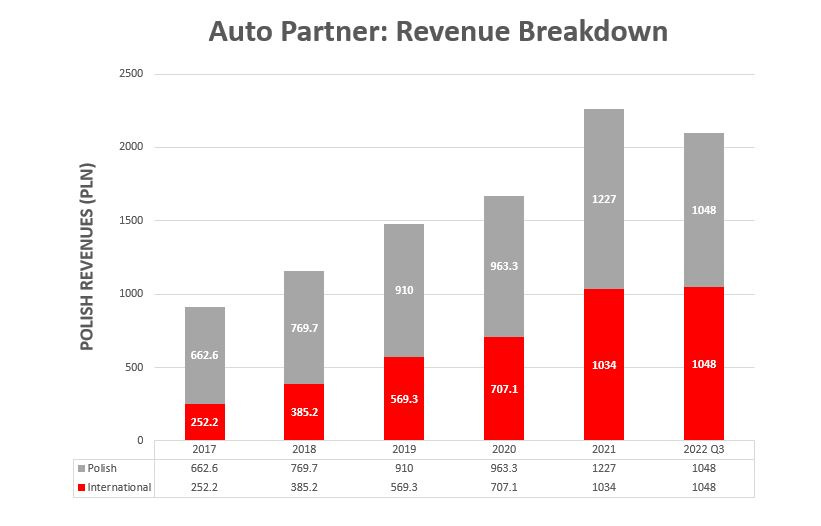

International: The international playbook is much more simple. These are B2B style transactions, due to Auto Partner not having Branches in other countries. As stated previously, these orders have lower Gross Profit margins but higher Operating margins.

This area is definitely a higher growth opportunity, with revenue compounding at a 42% annualized growth rate from 2017 to 2021. In addition, the International revenues just passed the 50% share of revenues and has been steadily growing over time.

Also, to aid the International distribution to Western Europe, Auto Partner has announced it has a new Warehouse under construction in Zgorzelec, Poland that will be completed in 2025. This facility is on the edge of Germany and Poland, is 30k sqm, and will reduce transportation times by nearly 3 hours to Western Europe customers.

These were all of my growth drivers and what I conceptually see going forward. However, the company under their strategy section echos these same ideas with focus points on (1) Increasing Scale of Operations – Branches/Warehouses (2) Product Diversification (3) Further increase of Profitability (4) Expansion of Sales in Foreign Markets – International Growth.

Personally, I like to see that the company’s growth strategy seems to align pretty heavily with what I would conceptually like and expect to see! That definitely helps an investment case when the business is aligned with long-term shareholders on smart capital allocation policies.

5. Financials

Overview

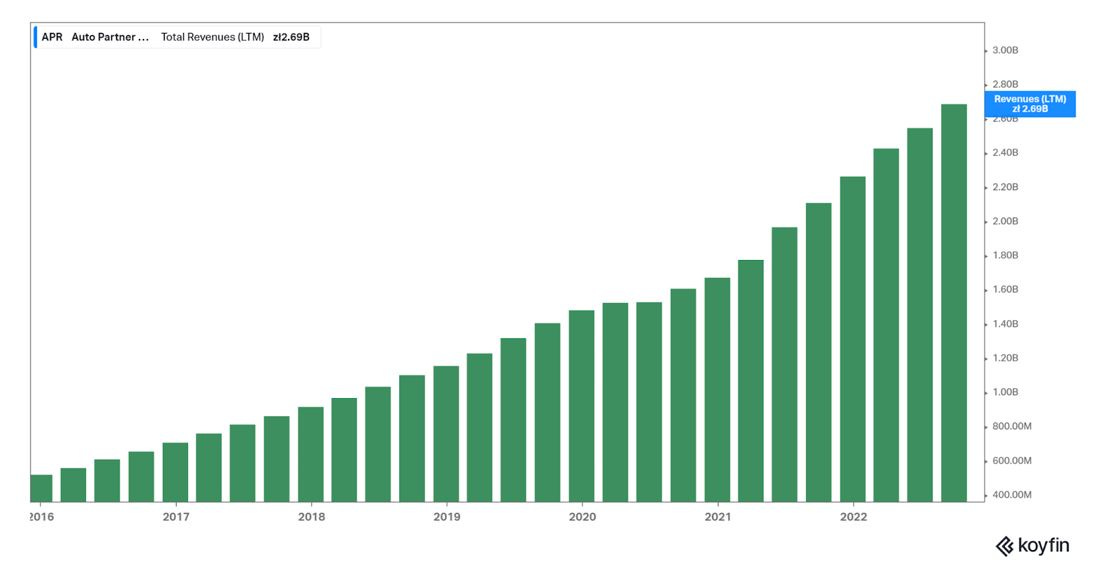

The financials here are relatively easy to understand. I would say the conceptually important part of this business is to realize one fact, it takes a lot of capital. The company is continuously investing more working capital in new inventory, especially when the topline is growing nearly 30 percent a year. In addition, the company also is investing in expanding its logistics network with new branches and warehouses, as shown earlier. All this contributes to a quickly growing top-line:

Domestic Polish Revenues: From 2017 to 2021, have an annualized 16.7% cagr.

International Revenues: From 2017 to 2021, have an annualized 42.3% cagr.

Total Revenues: From 2017 to 2021, have an annualized 23% cagr.

Preliminary January numbers have come out already and had about 34% Y/Y growth on the top-line. Definitely showing the company is keeping up the growth pace.

Turning the cash flows and net income, you will naturally expect that cash flows are going to be much lower than net income or operating income. This is because the unit economics themselves are good but all these profits are going to be reinvested on the cash flow statement to Working Capital and expanding the logistics network.

The final input that we need for our ROI estimates though will be the bottom-line net income margin.

This definitely appears to be rolling over after the peak supply shortage during 2020-2021. Short term, the bottom line will most likely normalize in the 5-6%. However, looking at other distribution businesses, the bottom-line does tend to increase over time as the distribution can procure at scale and enjoy better unit economics. Therefore, I would expect the net income margin to eventually rise with time a bit higher.

Now that we have all the information for the company’s business model, its financial make-up, and what will drive that growth moving forward… let’s figure out how much money we can make on an investment today!

ROI Estimates

This is going to be super simple. If you want a detailed breakdown, check out @LukeWolgram on Twitter. His pinned tweet shows his model he’s built. Me… I’m lazy. I’m going to simply use a napkin math calculator.

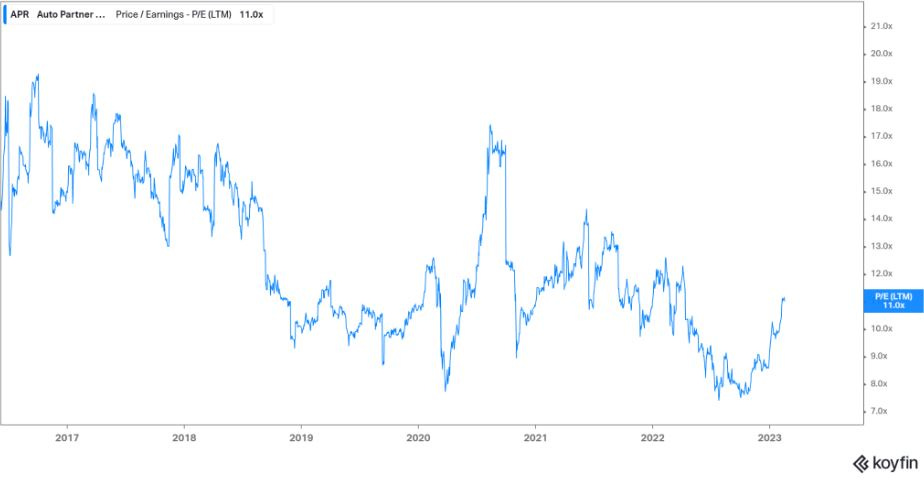

Today, the company is trading at a ridiculously cheap 11x PE today. Utilizing this information and our other inputs, let’s find a guess-timate on our expected ROI.

Total Revenues: This is the toughest part. The company is still putting up 30%+ growth rates and International just overtook domestic sales and appears to not be slowing down any time soon. To account for this, I’m going to simply do a base case and everything on top is upside. I’ll do 15% for the base case over the next 10 years, meaning sales in 10 years would still be under $3B USD. Not a horrendous assumption [ 1.15 ^ 10 ].

Gross Profit Margin: I’d expect these to stay level over 10 years. Decrease initially and then increase again to around the 29-30% range [ 1:1 ].

Net Income Margin: This is an iffy one. It’s clearly inflated now but where does it go down the line? I think you’ll see an initial drop off then it could totally rise to the 9-10% eventually as the company slows down its investments [ 9 / 7.4 ].

Terminal PE: Call me crazy, I think this will trade at least a 15x PE as it becomes discovered from the 11x today [ 15 / 11 ].

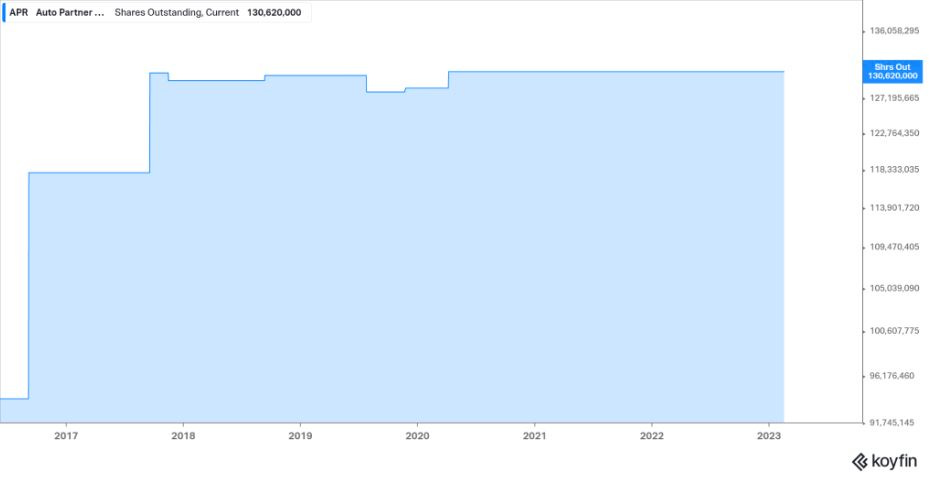

Capital Return/Dilution: The company today has a measly 1% dividend. I would assume this is a way for Aleksander Górecki to get paid for his stake in the company without selling stock at an undervalued price though!. Let’s say for our purposes that all the dividends will off-set any future dilution though. Maybe even factor in a capital raise eventually with 10% dilution [ 1 / 1.10 ].

Put this together, you get:

(1.15^10) * (1/1) * (9/7.4) * (15/11) * (1/1.1) = 6.1 ^ .1 = 19.8% cagr.

6. Risks

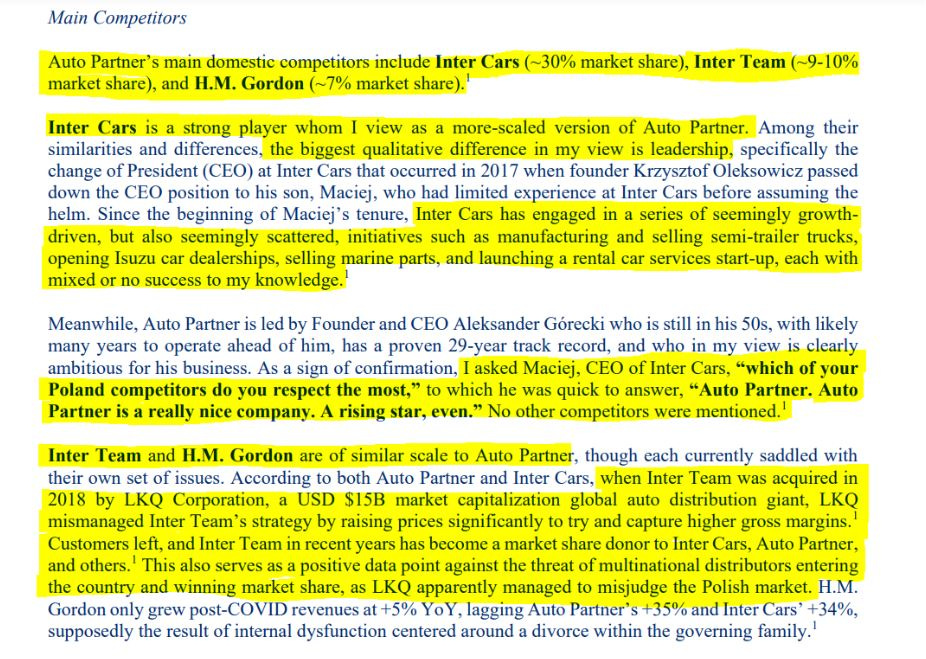

There are most definitely risks to this thesis. The Polish currency could fall off a cliff. However, with the US dollar being so strong currently, there could even be upside from that situation. Then, there’s competitors. The Investor Letter referenced earlier by John Cukewar gave a terrific breakdown of the competitive landscape.

Sorry for highlighting the entire page.

Finally, there’s the Russian threat with Poland being located firmly in Eastern Europe. This is a tough threat to put a definite label on. To give any point of view on this subject would embarrass me, so each investor needs to at least be comfortable with this possibility.

7. Summary

To summarize all this in a sentence… you have a well run distribution business in a large TAM, stealing market share, trading at a good price, and can deploy lots of capital at high rates of return for many years to come.

Hope you all enjoy! If you found this write-up useful please share, retweet, like, and subscribe below to get more articles like this.

Thank you for reading! If you enjoyed this post, please like/subscribe/share/comment for this new writing channel for me.