American Coastal Insurance Company $ACIC: The Niche Florida Catastrophe Insurer

A Special Situation with an Underlying Quality Company and has... Uniquely Strong Growth Drivers

Now, this is one of those writeups that I’m thankful that I finally get a chance to release! It has been nearly a year and a half since I initiated the position, and the stock since this initial purchase has appreciated 82% since I initiated last August.

My bad on not getting my own writeup out around that time… However, the stock price has finally consolidated after its runup and I feel the stock is again worth recommending to Subscribers at the current price.

With this goal in mind, I want to provide an overview of one of the best investments I think exists in the market today, American Coastal Insurance Company ($ACIC) and for Paid Subscribers an estimate on future results.

Key Figures:

Market Cap: $580M

Price to Earnings (LTM): 6.9x

Price to Book (LTM): 2.2x

Return on Equity (LTM): 45%

Sector/Industry: Wind-Cat Insurance in Florida, US.

A Word from our Sponsor: Me

This past year, I launched a Paid Membership on Substack with no real strategy on monetization. I simply knew three things:

I wanted to create quality work and be rewarded for that output; However, I needed to pick a method that is less time consuming than traditional “Earnings Updates”, “Quarterly Reviews”, etc. that are more “time-filler articles” than actionable investing content.

Paid Subs want quality work and to pay a reasonable price for the service. However, you all want to know that I am giving you my best ideas and I’m not creating content simply to justify a Paid Subscription.

I want my own portfolio returns to benefit from my Substack writing, assisting everyone involved in the process.

Newsletter construction needs to align the interests of #1, #2, and #3.

Diagnosis of my Newsletter Design:

Free Tier: These are my regular stock pick articles that I put out each year. You will receive the notification of my research when I have the time between my job and life. The Free Tier does not receive the access to view my Return Assumptions at the bottom of my articles. Essentially, the quality research you will receive for free is the advertisement for my Paid Subscription.

Paid Tier Issues: This was the harder Tier to construct. I only want to write quality research, and you want to make money on quality research. However, good research, writing, and design takes time (~20-30 hours per article). In essence, I want to cut the fat off the offering, simplify, and align my portfolio methodology with the Newsletter.

My Solution: As I’ve mentioned, I don’t always get the timing right on releasing articles. However, I do know my expectations on returns when I choose to release an article. With my articles each year, you will be able to pay approximately essentially $1-2 for each hour of my labor to view the output. I also notify subscribers when I buy a position myself to bridge the gap of timing issues with article releases. NOTE: In an effort to align our interests further, I do not write about companies that I do not own or never plan to own. That also limits the ideas in your inbox. Therefore if you’re looking for weekly reading material, this Newsletter is not for you.

An example of a Paid Subscriber note is a message I put out last November to subs on November 21st over my newest position. It’s up 31% since then and I’m continuing my research on the stock, planning material, and waiting until the stock is at a good time to release for Subscribers!

***Please message me if you’re a student and the Paid Tier is outside your current monetary status. I have granted free Paid Subscriptions in the past to view my Research to pay it forward.

American Coastal Insurance Company

A Strange Timeline of Events

I tend to enjoy diagnosing business models and summarizing key events. However in contrast, this post requires significant exposition to even set the scene! Let me tell you though… you’re in for a crazy corporate story on this investment.

The Rise of our Main Character

For this story, it’s good to start with the founder, an individual named Dan Peed. Graduated from Undergrad in 1985, Petroleum Engineer by Education out of Texas A&M University (Whoop!!!), my Alma mater. He then worked as a Loss Prevention Consultant for 6 years at an insurance consulting firm that dealt with Insurers to minimize and reduce risks in their underwriting process. This broad experience of an Engineering degree, experience across a variety of clients/risk areas, and the financial acumen acquired through his simultaneous MBA enrollment in 1987-1991, created a uniquely capable founder.

Upon graduating, he’d had enough of the Consultant work. He managed to land a prestigious role as the VP of a Reinsurance agency until around the dotcom bubble in 2000. He decided to do something different…. him and his Engineering buddies decided to go into business together to build an Managing General Agent (MGA) insurance company. The function of this type of insurance business is similar to an insurance agency/broker. However, an MGA has ability to underwrite risk for insurance carriers for a fee, as an additional service. This policy distribution system is a self contained segment of the sales channel that maps customers to insurers.

Now, Peed and his nerdy structural engineering friends from school spent significant time understanding the mechanics behind more structurally sound commercial buildings. This expertise allowed them to build an effective policy sales channel with quality underwriting within the Florida Catastrophe Commercial Garden-Style Condominium segment. The founded company was known as AmRisc and it became the largest Cat-focused MGA in the United States today, processing approximately $2 billion of Gross Written Premiums last year.

It is important to understand the function of an MGA. This specialty Agent type functions as an underwriter/agent quasi-entity. The value it provides is the access to bid on policies by carriers looking for premiums to grow their book, along with the expertise on the risk management from AmRisc. This service helps carriers grow their business and reach more customers while having hired expertise in the loss ratios expected from policies.

Many would be satisfied with this achievement. Peed didn’t stop there though. Like all from his alma mater, Dan is a sharp and opportunistic individual. Come 2005-2007, a system of horrific hurricanes came through year after year and decimated the Florida coastline. Peed saw that the traditional insurer market was undercapitalized, reliant on Florida’s state run insurance service (“Citizens”), and there was a gap in his customer segment to sell these well-performing policies to. With this in mind in 2007, he founded an insurer named American Coastal Insurance Company. From 2007 to 2013, American Coastal fueled by quality underwriting, an efficient vertically integrated distribution channel via the partnership with AmRisc, and good management grew premiums from $3 million to $303 million.

The Fall and Way Back

In 2016, Peed announced a merger that closed in 2017 with a promising publicly-traded personal lines insurer, UPC Insurance, that traded under the holding company United Insurance Holding Corporation. All stock deal. This granted Dan Peed 49% of the total company’s shares outstanding.

By 2022, the parent company United Insurance Holding Company’s personal lines division suffered from a combination of extreme litigations in the Florida and a terrible set of hurricane years. The Insurance Information Institute released the following curt but telling statement:

“With its overabundance of unneeded new roofs on homes, and flashy lawyer billboards at every turn claiming massive settlements on claims, Florida’s insurance market is on the verge of failure. Even more, this man-made catastrophe is causing financial strain on resident consumers, as the annual cost of an average Florida homeowners insurance policy will skyrocket to $4,231 in 2022, nearly three times more than the U.S. annual average of $1,544, according to an Insurance Information Institute (Triple-I) analysis.

“Floridians pay the highest homeowners insurance premiums in the nation for reasons having little to do with their exposure to hurricanes,” said Sean Kevelighan, CEO, Triple-I. “Floridians are seeing homeowners insurance become costlier and scarcer because for years the state has been the home of too much litigation and too many fraudulent roof replacement schemes. These two factors contributed enormously to the net underwriting losses Florida’s homeowners insurers cumulatively incurred between 2016 and 2021.”

Two major hurricanes made landfall in the state since 2016: 2017’s Irma and 2018’s Michael. No direct hits occurred in Florida over the past three hurricane seasons (2019-2021). Florida, however, is the site of 79 percent of all homeowners insurance lawsuits over claims filed nationwide while Florida’s insurers receive only 9 percent of all U.S. homeowners insurance claims” - Link to Article

Now, that’s the context for this historical price (Green/Red stock line) and book value/share (Blue Line) in the chart above. You might be wondering though what the BD/AD indicate on the graph above? Simple: Before Dan (BD) and After Dan (AD).

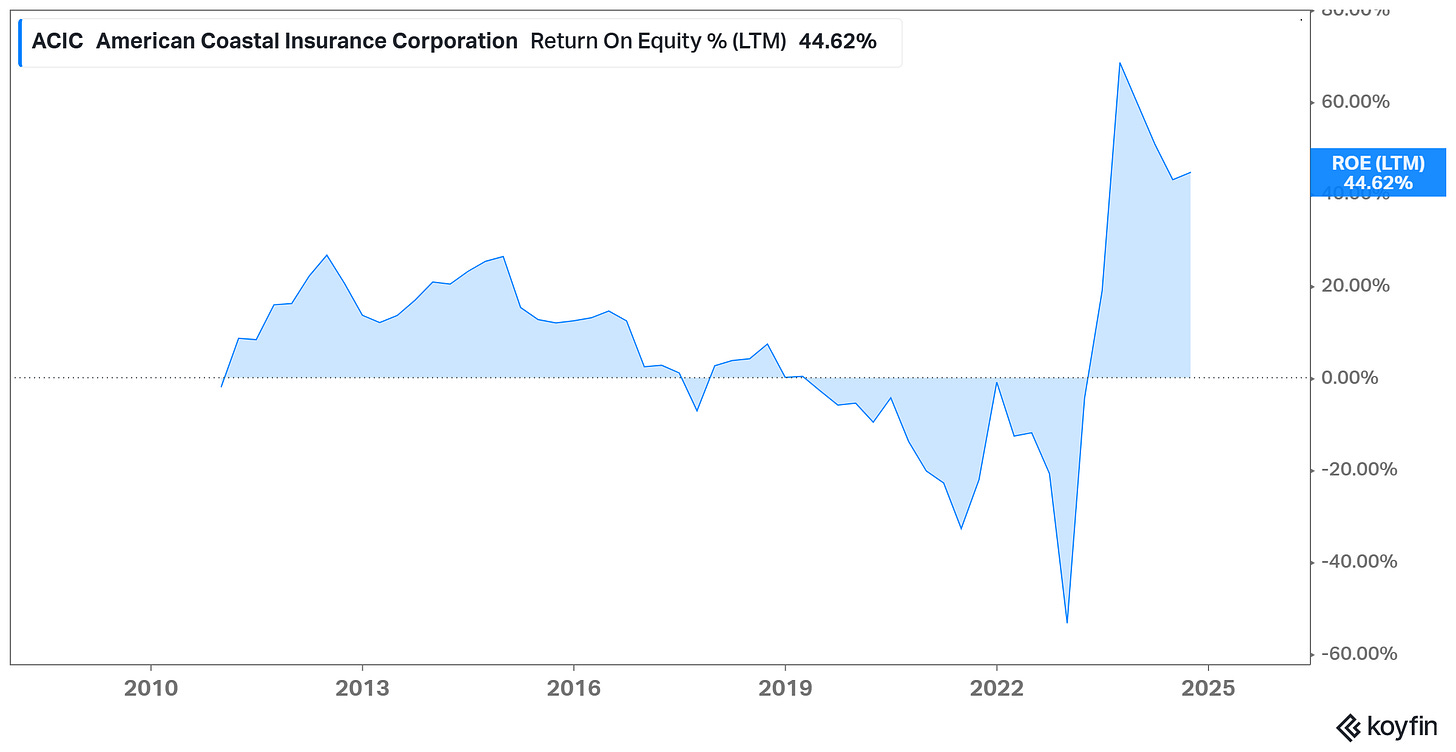

Taking back operational control in June of 2020, Dan needed to try to right the ship. American Coastal Insurance Company (ACIC) was a highly profitable subsidiary, as shown below by Sohra Peak’s diagram (writeups by Jon Cukierwar, a hedge fund manager I hold in high regard). However, UPC/Interboro were increasing their losses each year.

(*Link Sohra Peak Writeup: HERE ; 5-Star Research, highly recommend)

In an effort to right the ship, Dan Peed moved nearly $100 million in Equity from ACIC to UPC to attempt to save the company. However, the move ended up being too little too late and the subsidiary went into receivership in 2022.

Luckily for the team though, American Coastal Insurance Company that went to $300M in premiums in 6 years was a really good business. It was also an insurer that routinely puts up combined ratios in the 55-70% range with the “worst” hurricane years around an 86% combined ratio.

Luckily, the state of Florida ended up allowing the unprofitable subsidiary, UPC, go into receivership and allow ACIC to continue to operate without repercussions to operations. Since the 2022 timeframe, Dan Peed and team have restored the balance sheet, sold off another unprofitable subsidiary Interboro Insurance Company (IIC), and are setting up for further future growth.

The question though is… what is the opportunity today for the company?

Financials/Operational Analysis

Lucky for us, the financials of the business largely drive the operational updates. So this section will allow us to identify the few main drivers that affect both the P&L, Balance Sheet, and Operations/Strategy: (1) Revenue - gross written premiums (GWP), net written premium (NWP), and investment income (2) underwriting income and combined ratio (3) balance sheet & capital allocation and the (4) new MGU initiative.

My thesis is that with a general napkin math approach going through these 4-Drivers, we can easily identify American Coastal Insurance Company as a spectacular investment opportunity at today’s price of approximately $12 per share.

1. Revenue: Gross/Net Written Premiums & Investment Income

Financials are an interesting Public Equities to analyze. In particular, insurance stocks are equities that similar to their underwriting models, contain a probabilistic set of outcomes that require underwriting. For instance, consider a probabilistic chart that graphs the probability of each discrete number of hurricanes hitting a coast.

At 1-4 hurricanes in a year, the bulk of the probabilities lie. Meaning that 1 hurricane might have 15%, 2-30%, 3-20%, 4-10%, leaving (>4 with a 20% cumulative chance).

In this instance, an insurer needs to charge enough to make sure that in 1 of 5 expected years… the company has enough Equity to cover any short fall in its coverages. However, this means that a set of humans in a risky Balance Sheet position will have to (1) analyze the risk properly and (2) make the conservative choice and forego new business, if the balance sheet doesn’t allow it.

As it turns out, humans are not very good at either of these skills or risk management in general.

The result is that Florida insurance for Catastrophe (Hurricanes) got hit in 2005-2007 bad for 3 years in a row, a statistical possibility. This left a gap in the balance sheets of the insurers, especially in the wind coverage for Cat-focused Florida insurance. Dan Peed, who worked in risk analysis in his early years, decided to fill this gap. His insurance company is notoriously profitable, due to their accurate risk assumptions and conservative heavy reinsurance programs. For instance, this year even with 3 named storms hitting the region… American Coastal Insurance Company will still post a profitable quarter that contained the bulk of the hurricane season. Competitors will not be this lucky and will inevitable increase rates further in coming years (to customer’s dread) to make up the difference.

ACIC is in a unique position though:

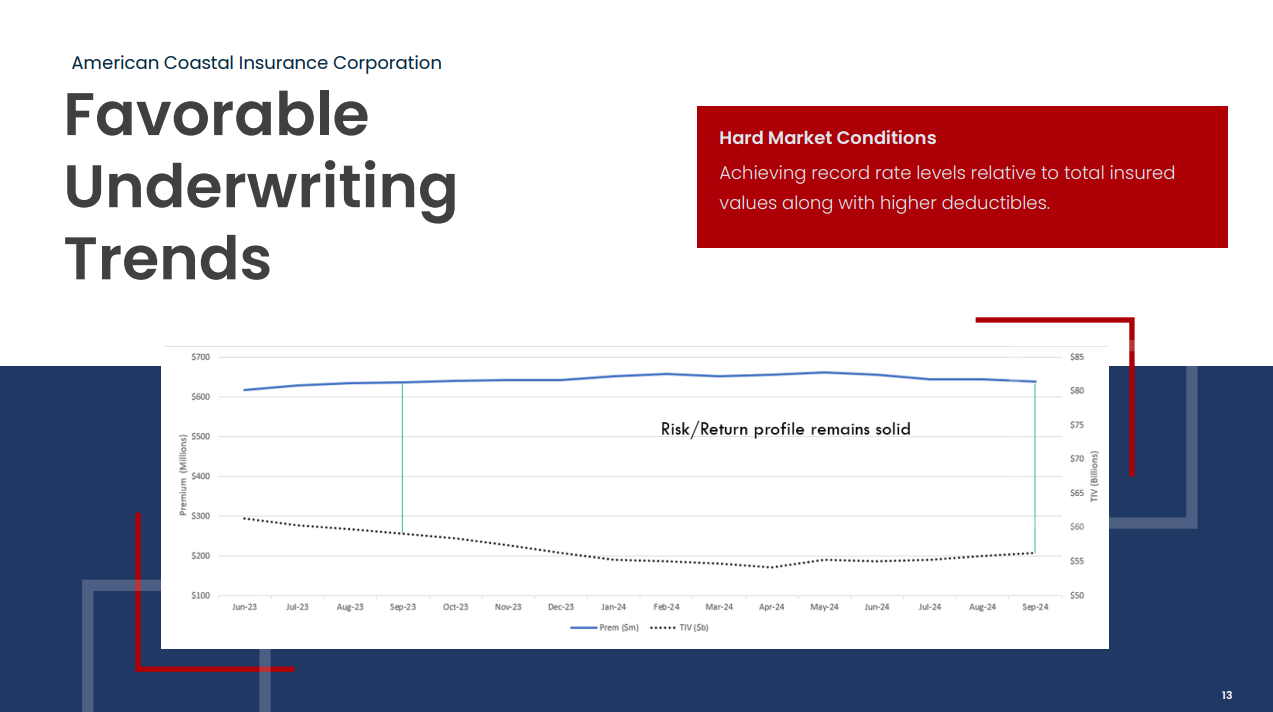

In the first picture, you will notice that the Total Insured Value (TIV) is historically low vs the Premiums collected. You see, ACIC maintained its Gross Written Premiums (GWP) the past few years and made it where customers continued to buy insurance through them, maintaining customer relationships. This is largely due to to the lower variance in quotes ACIC provides, along with the exclusive partnership with AmRisc.

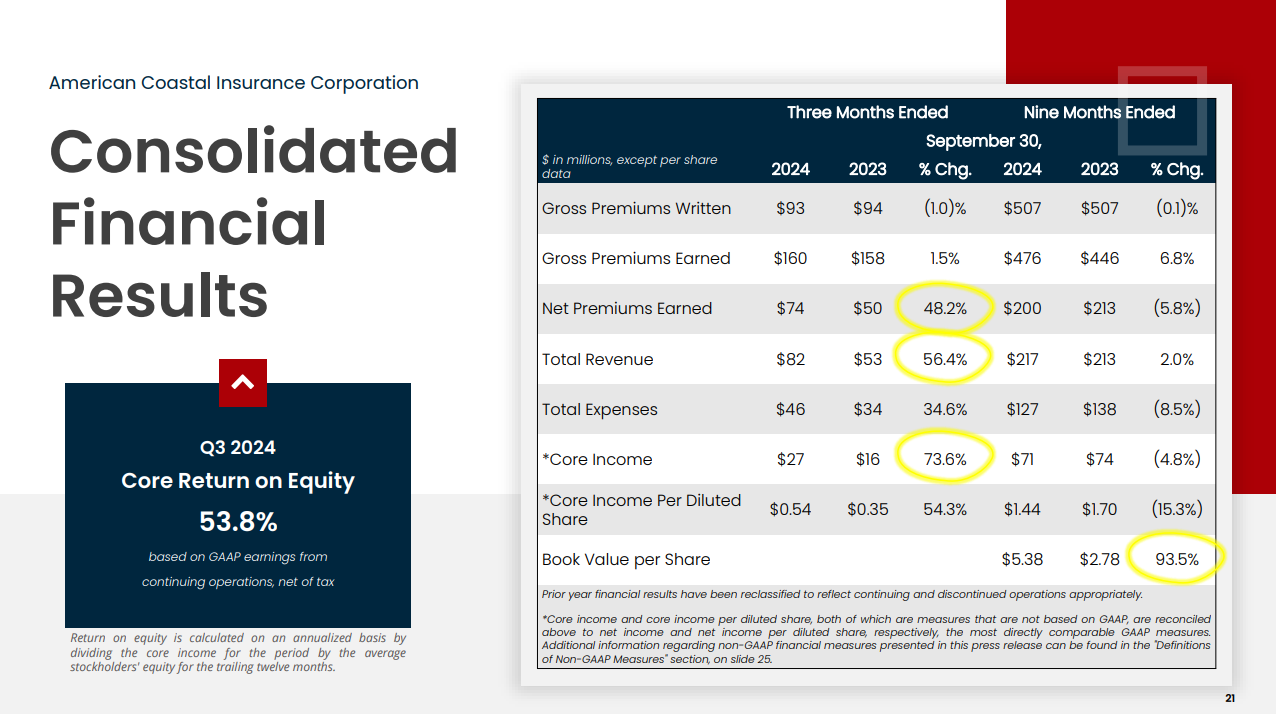

However, ACIC with its obliterated balance sheet in 2021-2023 could not hold these premiums itself. The company had to cede the premiums to reinsurers for high-margin fee revenue instead. In 2022, with UPC going into receivership, the ship had been righted and profitability ensued again. The balance sheet got restored, the risk profile became attractive again, as shown by Graph #1. Therefore on 6.1.24, ACIC revised its reinsurance agreements to insurer these premiums again, reducing the quota share from 40% of GWP to 20% of GWP. This makes sense then why NWP (Underwriting Revenues) grew 48% the next quarter with the revised reinsurance agreement (80%/60%=1.33%) and taking on some additional business. This is all mind you while Gross Written Premiums (GWP) actually shrank year over year.

The company has guided to a modest 5-16% of NWP growth this next year and a -9-16% Net Income from Operations.

I will be honest with you. I look at these numbers and I see some sand bagging conservative insurance managers. With another stair step in reduced ceded premiums on 6.1.25, I don’t really see how NWP can come in lower than 20% growth in 2025 in all honesty. This past quarter the company provided 48% NWP growth this past Q3, due to the reduction of ceded premiums from 40% to 20% in June (80%/60%=1.33%, 33% growth in NWP). Q4 will be a similar step up for FY2024. Q1/Q2 have the same comparable and Q3/Q4 will face tougher comps but will assisted by the new reinsurance agreement 6.1.25.

There also is a fun nugget within this line as well… Investment Income from a restored balance sheet, up 200% Y/Y.

The company’s Investment portfolio skyrocketed in value at the end of the last fiscal year as the Reserves moved on the balance sheet to Investments. I foresee a similar event occurring this year as well. What’s interesting now is that going forward, you will have the ability to:

Go after new business and grow GWP

Take more profitable policies onto the company’s own Balance Sheet and increase NWP

Grow the investment income with today’s increased rates vs the 2010-2015 timeframe

All in all, I see the core business being able to sustain high growth rates by simply enjoying the benefits of its profitable core benefits, while not being used as a cash cow to fund unprofitable other business lines.

However… I keep talking about it. How profitable will American Coastal be?

2. Operating Income & Combined Ratio

For the Operating Income margins, we have to consider two main factors (1) how intrinsically profitable the core business is and (2) how market conditions will be affected in the future.

The Core Combined Ratio has been fantastic in recent years. The Combined Ratio last quarter was a record low 57%, producing a trailing ROE of 45% for the past 12 months.

The Florida Insurance market in 2021-2023 was in a notorious hard market as well. This means the premiums were high, due to an undercapitalized insurer/reinsurer base. Therefore, the premiums were increased to equalized for the outsized risk in the region. This will be a headwind for the future. However, due to ACIC’s unique distribution channel (AmRisc), along with being entrenched as the leading player with the largest market share percentage, I don’t see the company losing its edge within its niche.

I think it is highly likely that the company will receive less profitable underwriting rates in the future, increasing the Combined Ratio from the modest… 58% today.

Going back to our original hurricane example, 80% of years are really good. In 20% of years, you find out who was cutting corners. ACIC holds up in bad years exceptionally and tends to build higher customer retention by not aggressively adjusting rates, allowing for a sustainable competitive advantage.

In 2019, Hurricane Ian hit the Florida coast and was the costliest hurricane on record. American Coastal ended the year with an 86% combined ratio.

3. Balance Sheet & Capital Allocation

The Equity growth following UPC going into Receivership has been rapid. Luckily, this past year Assets grew 8%, while Liabilities decreased 1%. This created a favorable Equity growth of 54% through only 9 months in the year.

Now, we have already discussed how a larger Equity base will allow the company to increase its Net Written Premiums and likely its underwriting income via taking more Premiums onto its own Balance Sheet. What will the company do with the additional income though?

Answer: Opportunistic buybacks and Special Dividends

I don’t think these policies have any crazy effect on growth but they do set the floor on valuation, due to a high percentage of earnings able to be used as distributable shareholder income.

All the growth avenues for the company thus far have been focused on the Balance Sheet and what the ins and outs represent. Only if there were a way for the insurer to grow where it could use its expertise but not take on additional excessive risk on its balance sheet…

4. Skyway Underwriters: The New MGU Initiative

The management team knew that the core business had limits to the ability to grow without taking on potential existential risk with a set of statistically bad hurricane seasons. Limitations do have a habit of breeding creativity.

The management team has created a subsidiary called Skyway Underwriters that operates as an Managing General Underwriter (MGU), which differentiates from an MGA by the functions. MGAs are more administrative in nature; MGUs simply underwrite the policies and has administrative overhead. This differentiation is important, due to the fact that Skyway Underwriters will distribute these policies through wholesale broker partners and not to insurers directly. The premiums that this new entity will be targeting is Apartment Style complexes that are similar in construction and risk profile to the existing Garden Style Condos business line. According to management, it’s similar to Condos but just different tenants.

This new business line is already incorporated, has a completed custom low-cost tech platform, and is targeting $100-200 million in annual premiums by Year 5.

Essentially, MGU/MGA’s make a percentage of the premiums as service revenues with no Equity requirements. The benefit of this arrangement will be that after vetting how the new policies are performing, American Coastal will eventually be able to become the insurer on some policies. This creates a situation where American Coastal becomes vertically integrated, allowing for additional growth channels or adjacencies.

Now, typical service fees from the broker/wholesale broker network in total range between 10-25% of the total premiums in a given policy. ACIC operates in the specialty admitted market within Cat-focused wind policies in Florida. That’s pretty niche. For that, I would say 18-22% of premiums would be a fair and maybe even conservative confidence interval. Of that, 5-10% will be taken by the Wholesale Brokers. This leaves around 8-17% of premiums for Skyway Underwriters.

This would obviously be decreased a bit further if the company is assuming policies from other entities, as premium service revenue agreements would be required. Therefore, I’m assuming 8-12% of premiums Skyway Underwriters assumes will be translated to high-margin service fee revenue. This equates a broad range of outcomes on percentages of $100M to $200M in premiums within 5-years, especially as the company has already assumed $10M in premiums a few months in…

Essentially, it’s hard to come to a defined number on the opportunity, especially as Brad Martz (President of ACIC) briefly remarked that the company will likely hit the $100-200M goal within the next 2-3 years. With a $150M mid-point and a 10% take-rate, that would equate to $15M in additional annualized high-margin revenue. Then, add ACIC as the eventual insurer and you have a solid new growth driver.

Competitive Advantages & Risks

This is not a fun section to write in all honesty, because the nature of this investment is making higher margin off of higher volatility. The outcome of a 0 or 1 in a good year versus a bad hurricane year makes any prediction naturally uncertain.

Therefore, I’d like to simply state what we know and let you decide the level of risk assigned by this investment with the understanding each year contains it’s own independent risk analysis on the hurricane season between August and October in Florida:

Competitive Advantages:

Vertically integrated with AmRisc and the new MGU business unit providing SG&A efficient policy distribution, creating a structurally higher margin structure

Leading Market Share holder within its niche and is increasing prices to actually reduce retention from 87% today

Ability to grow the next 2-3 years on its own Balance Sheet alone, allowing for simple high return on capital decisions for management. Longer growth goals of 4-5 years have already been established by Skyway Underwriters and eventually insuring insuring some of these premiums.

Due to structurally higher ROE due to business advantages and market share leadership, high amounts of capital can be returned to shareholders as a percentage of Seller’s Discretionary Earnings (SDE) in good years

Proprietary Technology Stack custom built in the past year to manage Skyway Underwriters. The team of seven individuals implemented a no-code platform, Unqork, and named this policy administration system internally: Compass. Then, the team integrated this with their listing and underwriting platform, Mosaic, to have a fully functioning tech stack that could be expanded into new niches, eventually. The more important aspect is that the custom tech stack has the low-cost service fee of an owned software tech stack, instead of outsourcing the software and losing 100-150 bps of premium on “revenue sharing agreements” that are customary for the industry. This additional margin in and of itself is a massive cost of sales competitive advantage.

Risks

Hurricane and Catastrophe does scare away investors, naturally. However, this management team has been profitable every year since 2007. Hurricane Milton that hit this year won’t even have ACIC have a single unprofitable quarter. Even in 2019 with Hurricane Ian (the costliest hurricane on record), ACIC put up an 86% combined ratio that year. This company is formidable in its profitability. Hurricanes cause risk in the year to year with earnings and opportunity cost though and a 2 year fantastic return could become 3-4 years. This in turn would cause a harder market though, favoring the incumbent.

Speaking of insurance market cycles, a prolonged soft market is the biggest risk in my opinion. Currently, Florida insurance markets are in some of the hardest markets in history. This has been a boon as of late, but keep in mind ACIC is bringing policies back to the Specialty Admitted market, instead of the more expensive Excess & Surplus. I do see more general competition within the region moving forward. Who will benefit or increase their exposure is unknown.

Luckily for once, valuation is not a risk. With the company currently trading at a trailing 7x EPS and with the underlying growth expected in coming years, the company is trading at an attractive low single digits forward PE with a high percentage of distributable SDE. Even with a soft market, this is an attractive entry in my opinion.

Now for my free subscribers, I appreciate it if you made it this far! From this point on, I will give what I think the stock will appreciate in my realistic point of view. If you would like to support my work and become my partner this coming year, please join me with an annual subscription for 3-5+ quality actionable ideas like this!

Thank you for reading, let’s move on!